Property Investment

What’s a good investment property?

You might like a property… but is it actually a good investment? There’s now a tool to check👇

Property Investment

2 min read

Author: Andrew Nicol

Managing Director, 20+ Years' Experience Investing In Property, Author & Host

Property values technically bottomed out over 2 years ago (and have gone sideways since).

But, since then, properties have actually gotten cheaper.

Here’s why (and the data pointing to when they’ll be the most affordable).

Property prices peaked in November 2021 and then fell 17.8%.

It is the worst property downturn since the records began.

Property values fell more than in the Asian Financial Crisis (late 90s). And more than during the GFC (mid-2000s).

To underscore just how large the fall was. If you bought a house for $800k at the peak of the market, 18 months later, your house value could have dropped $140,000.

In some parts of Wellington, property prices dropped 30%. That’s like buying a $1 million property with a $200k deposit.

And then having the deposit completely wiped out. And still being $100k underwater.

Of course, since May, property prices are up about 3.2% (depending on which data you look at).

But house prices have gone up by less than incomes and the cost of living (inflation).

So real house prices, which are inflation-adjusted, are 7% cheaper than they were 2.5 years ago.

So, while it looks like May 2023 was the cheapest time to buy a house.

In actual fact, houses have become more affordable since then.

It might surprise you, but houses are now more affordable than before the Covid property boom even happened (by some measures).

Since December 2019, house prices are up 24%. But incomes are up 33%.

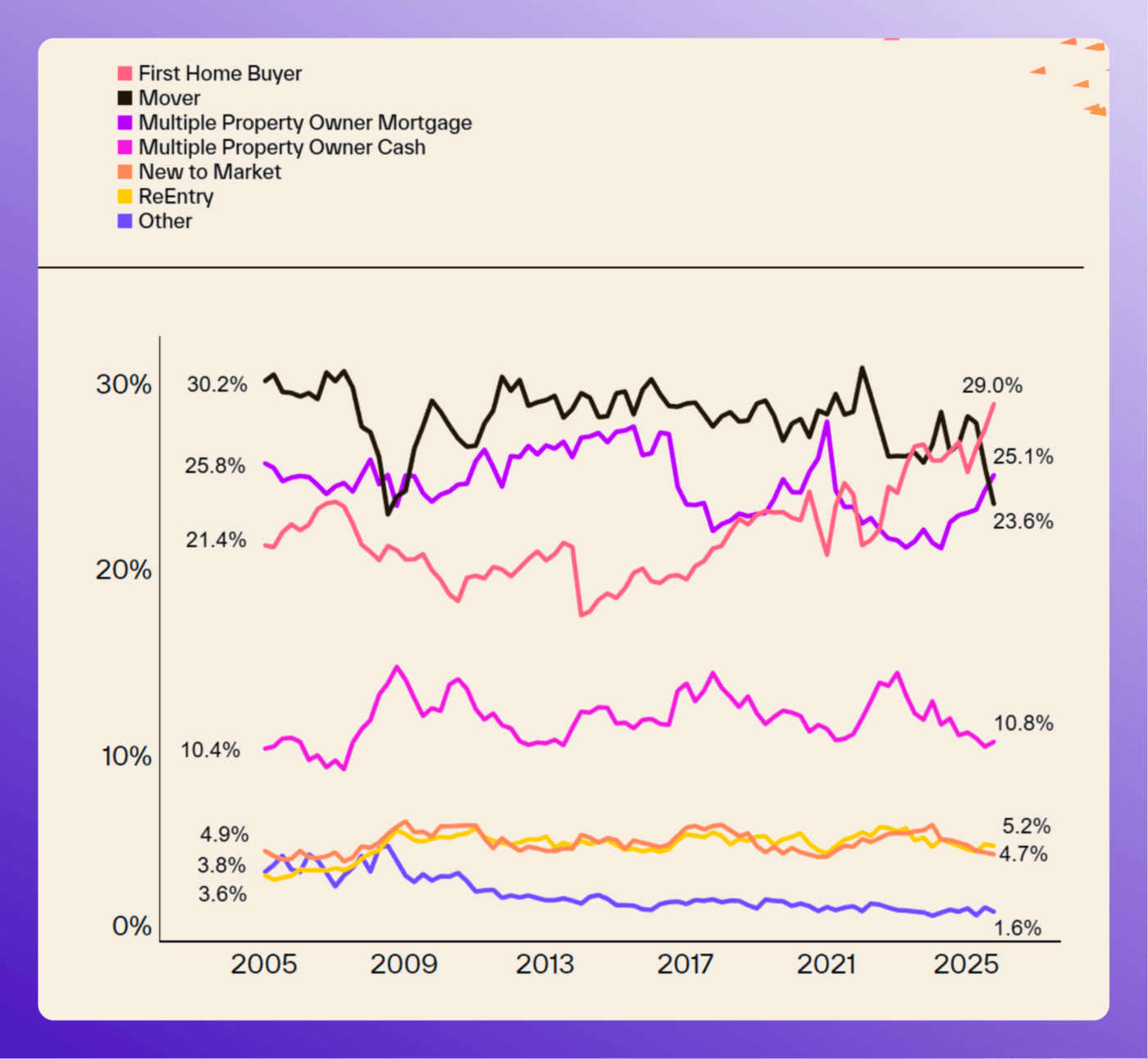

And that is the reason why First Home Buyers are screaming back into the market.

First Home Buyers, for the first time ever, are buying up the largest share of houses.

You won’t read about it in the papers, but 29% of houses are being bought by first home buyers (and the investors are back too).

The records began in 2005. Back then, houses were 65% cheaper, but a smaller share of properties were being bought by First Home Buyers.

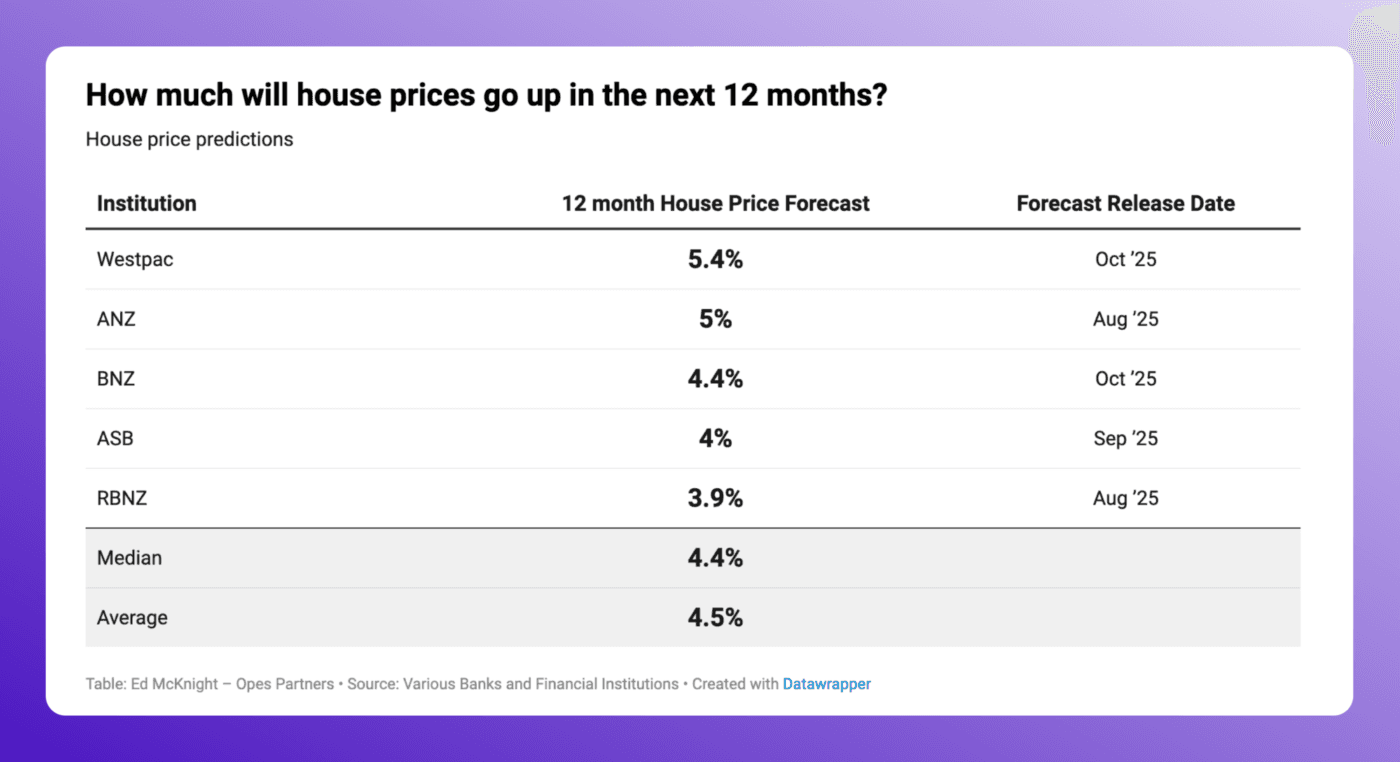

And that’s the reason that all of the big banks are predicting that house prices will go up in 2026.

Some are predicting more house price growth than others. But the average bank is predicting that house prices will rise 4.4% next year.

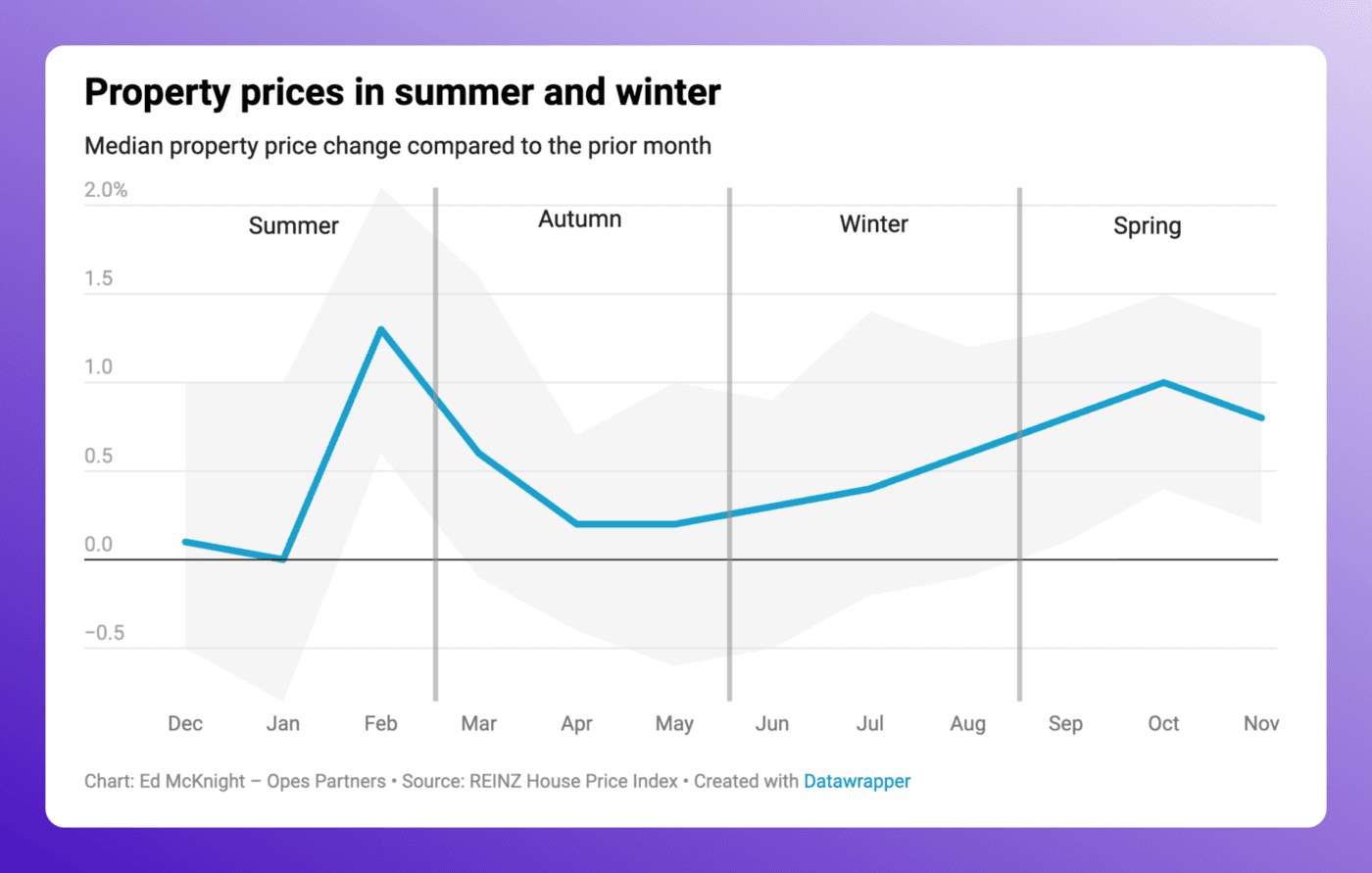

Property prices are a tiny bit more predictable than many people think.

They are most likely to fall in December and January, when the country shuts down for the Christmas break.

They then rocket back in February. Heat up in the late Summer, before cooling in Autumn, and gradually coming back to life in Winter.

This is why most of our property market downturns tend to bottom out in either December or May.

And if we look at a standard property market cycle in New Zealand.

A boom lasts for 6-8 years. A downturn lasts about 18 months. And then property prices stay in a trough for about 2.5 years.

So if I say “what’s 2.5 years after May 2023?” It’s December 2025.

So if I had to say when the property prices will be their most affordable, my guess is December 2025.

Managing Director, 20+ Years' Experience Investing In Property, Author & Host

Andrew Nicol, Managing Director at Opes Partners, is a seasoned financial adviser and property investment expert with 20+ years of experience. With 40 investment properties, he hosts the Property Academy Podcast, co-authored 'Wealth Plan' with Ed Mcknight, and has helped 1,894 Kiwis achieve financial security through property investment.

This article is for your general information. It’s not financial advice. See here for details about our Financial Advice Provider Disclosure. So Opes isn’t telling you what to do with your own money.

We’ve made every effort to make sure the information is accurate. But we occasionally get the odd fact wrong. Make sure you do your own research or talk to a financial adviser before making any investment decisions.

You might like to use us or another financial adviser