Opes

Are the properties Opes recommends more expensive?

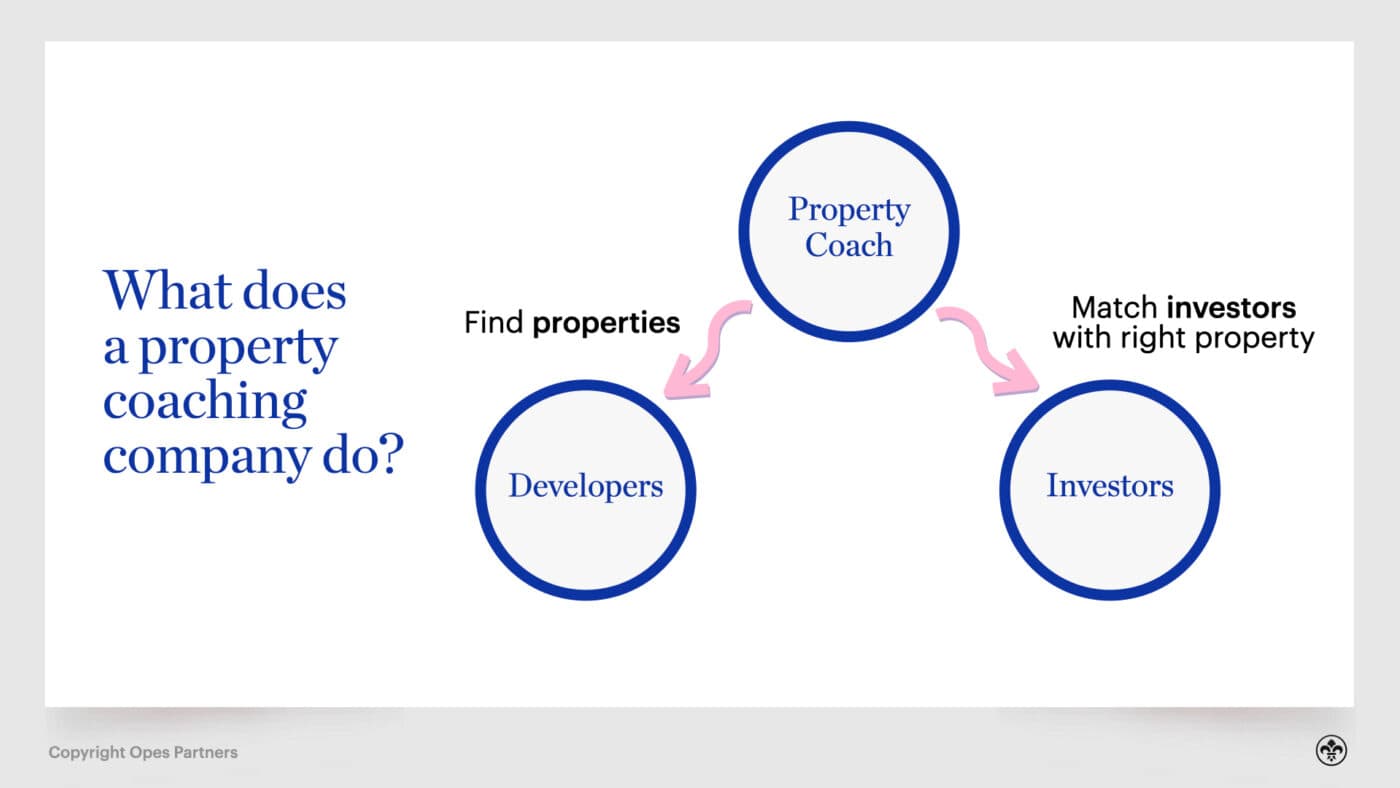

In this article you’ll learn why properties can sometimes appear to be more expensive when bought through a property coaching company like Opes.

Opes

8 min read

Author: Laine Moger

Journalist and Property Educator, holds a Bachelor of Communication (Honours) from Massey University.

Reviewed by: Ed McKnight

Resident Economist, with a GradDipEcon and over five years at Opes Partners, is a trusted contributor to NZ Property Investor, Informed Investor, Stuff, Business Desk, and OneRoof.

Deciding to invest in property is a big decision. So, when embarking on this exciting journey you might decide on enlisting some expert help.

Using a dedicated property investment company can be a way to reduce the risk for emerging property investors. But a quick Google search will render a whole bunch of would-be candidates, all seemingly offering similar expertise.

So, what should investors look for when weeding the good from the maybe not-so-good. How can you tell?

There are a few questions you can ask yourself to help your decision:

Some of this is going to come down to a bit of a judgment call, because you can’t do a back-of-the-label comparison for financial advice, like you can for Cornflakes.

In this article we’ll take you through an honest review of 4 property investment companies, and compare and contrast their services, values and ethos.

Disclaimer: We will be including ourselves, Opes Partners. Generally speaking, we don’t like to include ourselves in any of these articles because we try to avoid bias. But we wanted to cover this off since investors often ask what the differences are between us and other property investment companies.

We have also contacted all the companies on this list for comment and to fact check the article. We will update it with any additional facts as we receive them.

You’re a keen, but green, property investor and you’re looking to see what companies are out there offering help. But which one do you choose?

All the companies on this list will help you find a suitable investment. Some will offer coaching or mentoring services, a few will offer some sort of accompanying services such as mortgages or property management.

Just a note, these companies tend to specialise in finding New Builds. If you’re looking for renovations-focussed property coaching, check out our other reviews.

Here are 4 companies you might consider.

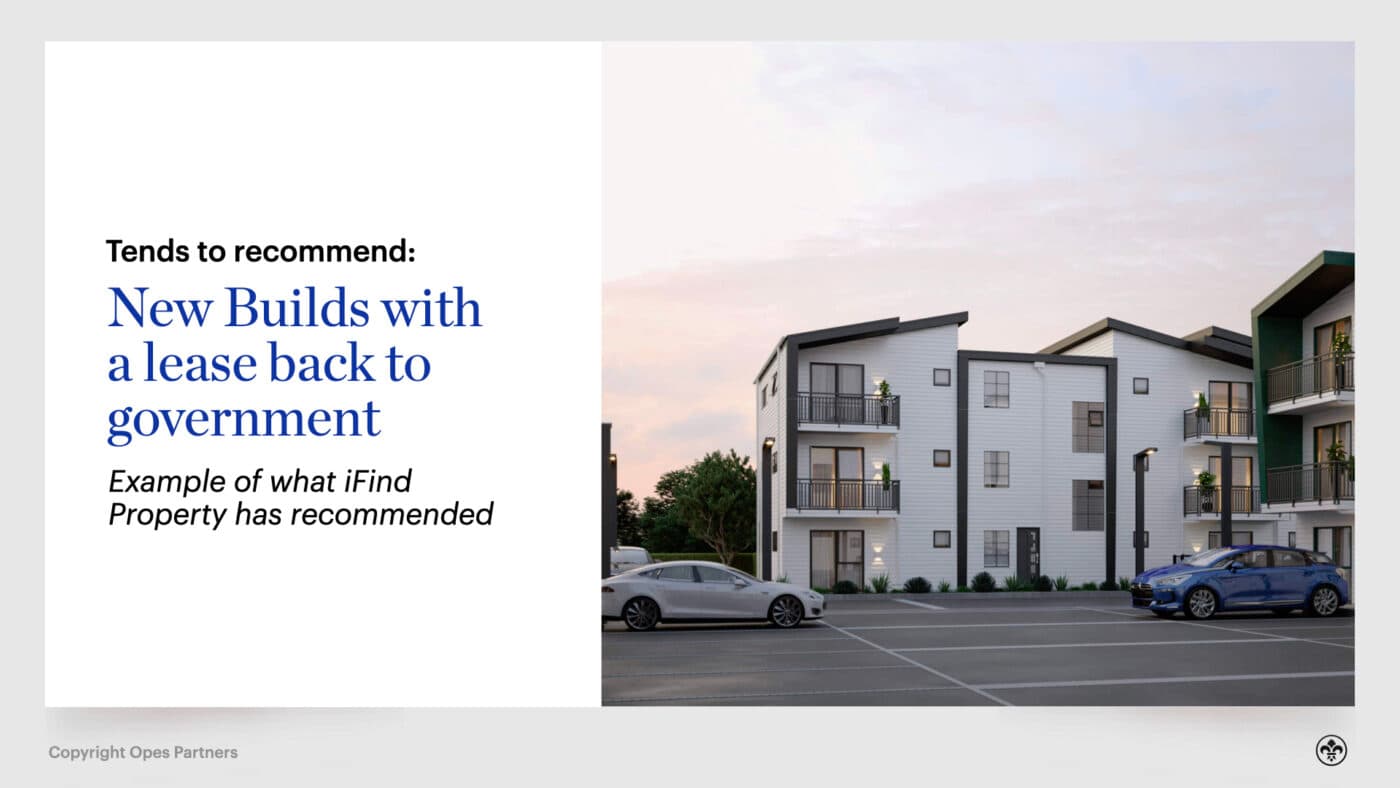

iFind Property is a Real Estate Agency that specialises in finding investment properties. Unlike the other companies on this list, iFind Property does not provide an investment coaching service – they (as the name says) find properties to suit investors.

The company started in 2005 with Rotorua origins and has grown to become an NZ-wide organisation.

There are two directors. One of whom, Nick Gentle, is also a moderator for the popular Facebook group, Property Investors Chat Group NZ.

Its team of 10 licenced salespersons are based in cities up and down the country. The team call themselves, “property finders” or “buyers’ agents” and operate under the Real Estate Agents Act 2008.

The organisation has received positive reviews from other investors, who tend to like iFind Property’s end-to-end approach, from helping you buy the property through to selling a property at the end.

Unlike some other companies on this list, iFind Property does also charge a “Success Fee” when it finds a New Build property for you.

For its premium service there is a $2,500 deposit, which is refunded once there has been a successful purchase of a recommended property.

The price also depends on how expensive the property is, as iFind charges in bands. For example, it charges $9000 + GST for the first $200K, then from $201 -$800K, it is 2% of the remaining purchase price +GST. For properties $801K plus, this falls to 1.6%.

This means if you're buying a $400,000 property the cost of the service is: $9,000 (for the first $200K) + 2% (for the next $200K) = $13,000 + GST.

Whereas a $700,000 property would be $19,000 + GST.

Just a wee note: the buyer’s agents are not financial advisors but are active and experienced investors who have clear connections in the industry.

One key difference between iFind Property and most others on this list is that they also offer to sell properties to other investors. For example, if you want to sell your property to another investor, iFind Property can sell your investment and potentially have your tenants stay on for the next owner. This may also suit if you don’t want an “open home” sign up and prefer a more subtle affair.

However, because iFind Property only deals with investors they may not be the right fit to sell every property.

Why? Well, if your property is suitable for an owner-occupier you may get more bang for your buck if you sell on the open market.

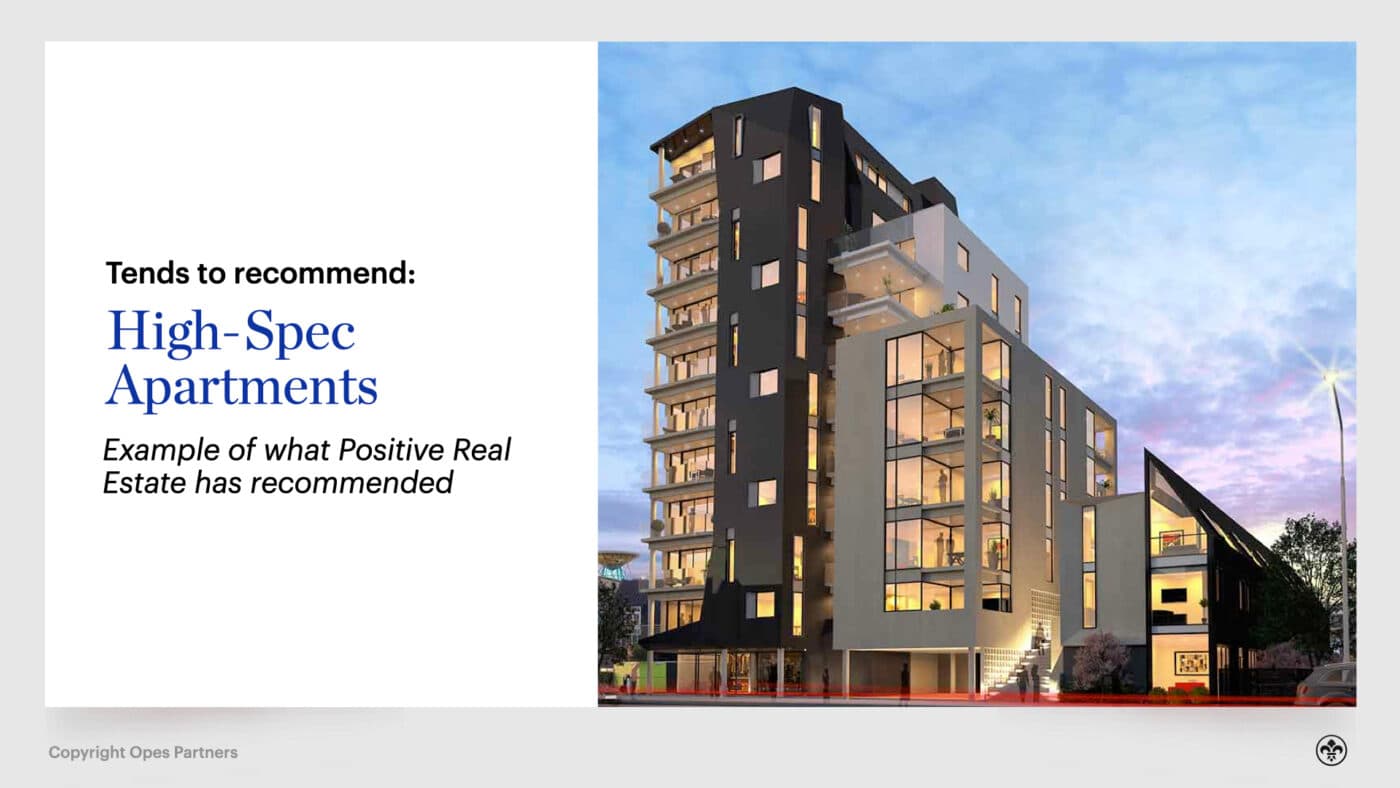

Positive Real Estate has coached over 6,000 investors in Australia and New Zealand during its 15-year life.

The company started in Australia and has a sizeable presence across the Tasman.

The Positive Group of companies has almost 100 people. But the New Zealand arm, run by director Sue Irons, is more compact - made up of 15 people spread between its offices in Auckland, Wellington, Queenstown, Tauranga and Christchurch.

The way Positive structures its service is different from other companies on this list.

Investors pay a fee to go through a property coaching course through the company before being shown potential investment opportunities.

From speaking with current members it’s understood the membership costs $10,000 (incl. GST), and provides lifetime access to Positive’s services.

While Positive Real Estate does find New Builds for investors, their services are exclusively for their mentoring program clients.

Their website states: “We do this for two reasons – firstly, so we can provide guidance and ensure the best chance of success.

Secondly – so we know the real estate investor is serious about achieving that success.”

Positive tends to source and promote a range of property types, which includes: houses, townhouses, apartments and dual-keys.

While prices range from $479,000 to $1,200,000, the bulk of properties sits in the $600K to $850K range.

While the company says they recommend all types of properties (houses, townhouses and apartments), the majority of photos on their website are of higher-spec apartments.

That does suggest that investors working with Positive are more likely to be shown apartments, compared to other companies on this list. But, bare in mind, that doesn’t mean they only have access to apartments.

Like most other companies, Positive has a few preferred partners.

The organisation works closely with Vantage NZ, who also appear on our list of top 10 mortgage brokers. They also tend to recommend Positive Asset Management – their in-house property managers.

Known as the “Queen of Property” Nikki Connors is the director and face of this Propellor Property Investments.

Propellor has been a property investment specialist since 2009. According to Nikki, her staff are experienced in property investment and are Registered Financial Advisers and Real Estate Agents.

Property investors who choose to use Propellor are assigned to a staff member who will pull together short, medium and long term strategies. Property is then used as the vehicle to investors get where they want to be, financially speaking. Propellor will then find properties that fit with that strategy.

As part of the service, investors receive cash-flow projections to consider as part of their due diligence.

From speaking with current and former Propellor Property Investment customers, our understanding is that the company does charge a fee when a property transaction successfully goes through.

One investor who had worked with the company over the last 12 months (as at November 2021) said they paid a $6k fee for the first property, and a $3k for the second property purchased through the company.

A good example of properties that Propellor has recommended in the past is the SugarTree apartments in Auckland.

According to the company’s Linkedin page, they have about 7 employees.

The final company on this list is Opes Partners – a property investment company that has been up-and-running for 8 years.

Now remember, this is us. So just keep any potential bias in mind, although we will genuinely try to explain the factual differences about our service.

Opes’ two directors, Andrew Nicol and Ollie McKenna, are both experienced property investors themselves. Andrew is also a host of the Property Academy podcasts.

Opes has a large-ish team of 70+ staff based primarily in Auckland and Christchurch, although staff are also based in Queenstown, Napier and Rotorua.

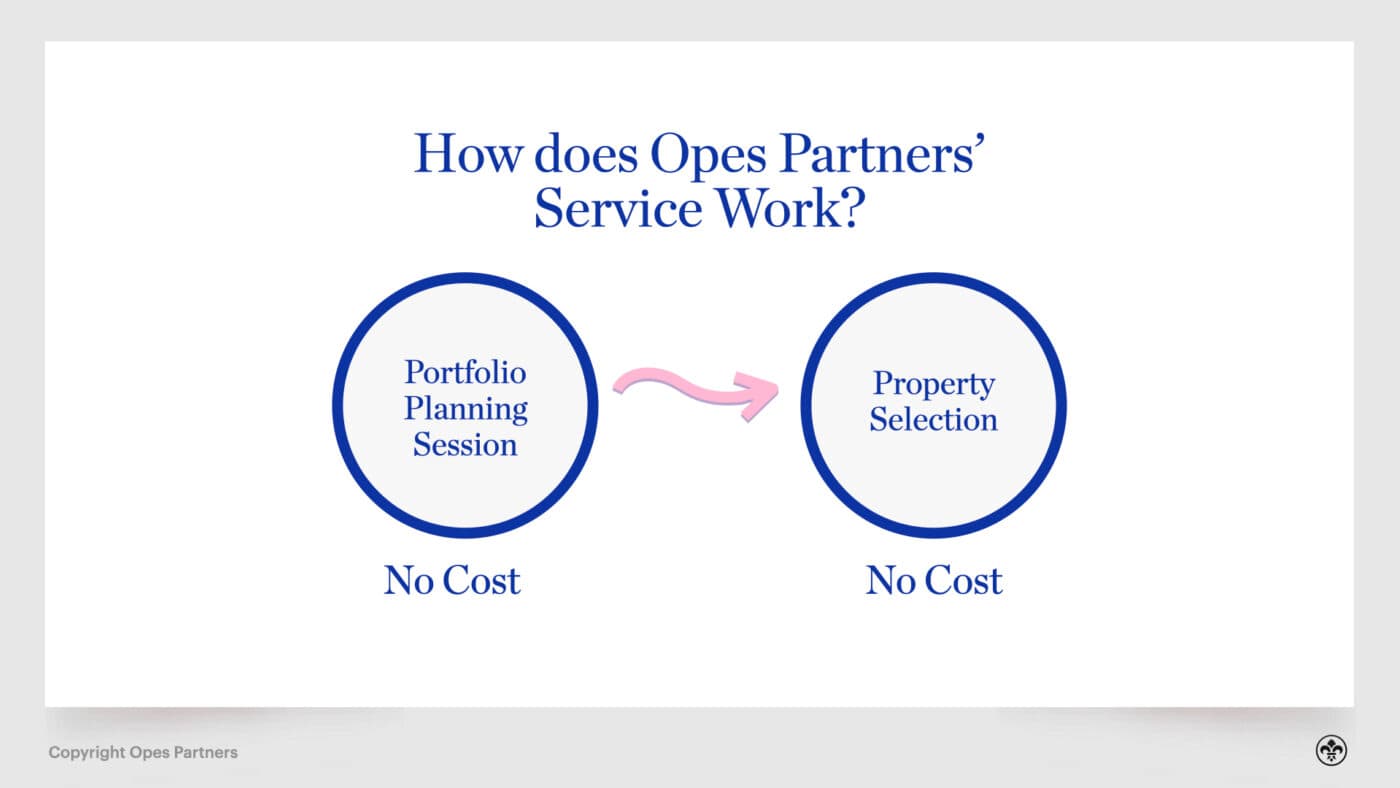

Unlike the other companies on this list, Opes is free for the investor to use, and doesn’t charge a coaching or compliance fee when it finds a New Build for an investor.

When investors work with an Opes Property Partner, who is also a qualified Financial Adviser, they’ll use our in-house software, MyWealth Plan, to create a written down property investment strategy.

Investors then use our Return-On-Investment spreadsheet to run a 15-year cashflow analysis on potential properties.

Once the final choice has been made, the investor is then guided and helped through the process of actually purchasing the property. This is helped through Opes’ sister companies:

Opes also has a media arm. The company owns and publishes NZ Property Investor magazine (the official mag of the NZ Property Investors’ Federation), and Informed Investor magazine.

The company also publishes the Property Academy Podcast, and The Deal – NZ’s first property investment TV show.

The main takeaway here is there are a lot of companies out there that investors can use when looking for a bit of expertise. The above 4 examples are by no means the only options out there for you.

So, have a shop around, do your own research and seek out advice from fellow investors.

Ultimately, your decision is going to be made by which one you think will work best for you … which one you feel you can trust.

And your plain gut-feeling.

Good luck.

Journalist and Property Educator, holds a Bachelor of Communication (Honours) from Massey University.

Laine Moger, a seasoned Journalist and Property Educator holds a Bachelor of Communications (Honours) from Massey University and a Diploma of Journalism from the London School of Journalism. She has been an integral part of the Opes team for four years, crafting content for our website, newsletter, and external columns, as well as contributing to Informed Investor and NZ Property Investor.

This article is for your general information. It’s not financial advice. See here for details about our Financial Advice Provider Disclosure. So Opes isn’t telling you what to do with your own money.

We’ve made every effort to make sure the information is accurate. But we occasionally get the odd fact wrong. Make sure you do your own research or talk to a financial adviser before making any investment decisions.

You might like to use us or another financial adviser