Property Investment

What type of property investor should I be? Property pathways

I’ll honestly explain the pros and cons of each strategy. Then I’ll take a step back and you can decide which is the right strategy for you.

Property Investment

4 min read

Author: Marc Lemaire-Sicre

Chartered accountant, specialising in investment property structure and accounting.

Reviewed by: Andrew Nicol

Managing Director, 20+ Years' Experience Investing In Property, Author & Host

There’s a lot going on when you own rental properties.

Before you know it, you’re juggling rates bills, insurance payments, property management fees. On top of that you've still got your rent and mortgage payments to manage.

And then your accountant emails you asking for all kinds of information.

As a property accountant, I see this every day. And investors often find it stressful if they haven’t set up their bank accounts properly.

In this article, you’ll learn how I recommend you set up your bank accounts as a property investor so your property finances run smoothly.

Some investors think the best way to stay organised is to have one bank account per property.

That way you can keep track of how much rent is coming in per property.

On the surface, this sounds logical. Everything for that property is in one place.

But that can become a hassle as your portfolio grows.

You’re forever shuffling money around, topping up accounts here and there, and logging into half a dozen bank accounts to see what’s going on.

So I find it better if you have:

And I generally find it better if all the rent goes in to that one account. Then all the bills come out from the same account.

This approach keeps things streamlined. It also makes it easier at tax time. Because your accountant will ask for an export of each of your accounts.

If you have one main account, you only have one export to do. If you have 10 accounts, that’s 10 exports.

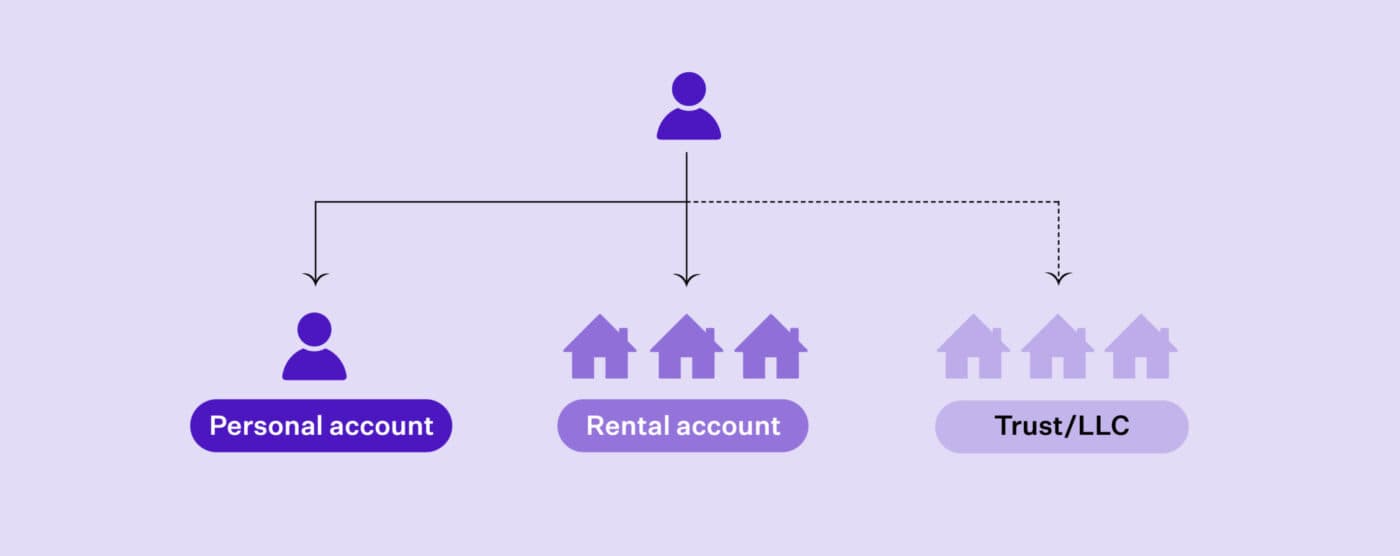

Now, that said, the “one rental account” approach only applies to properties owned in the same way.

So, if you own properties under different entities. So if you and your partner own 3 investment properties together, you have one account for those 3 properties.

But if you own:

Then in that case you’d have 3 bank account. One for the trust, another for the company, and another for the property with your family friend.

That’s because you’ll need to file a tax return for each of those entities.

Don’t mix the rental income and expenses between all the different entities. Why? Because then your accountant will need to call you at tax time to untangle what expense belongs to what property.

Here are my three top tips to manage your money better as a property investor.

Don’t pay your rates quarterly. You’ll likely forget about the payment. And it could become a “cash flow surprise”.

The best way to avoid that is to pay your rates both automatically and monthly.

Here’s what to do:

1. Check your annual rates amount

2. Divide it by 12

3. Set up an automatic payment that goes directly to the council each month.

So, if rates are $3,600 per year, your rates bill (divided by 12 months) is $300 per month. Easy.

You then set up an automatic payment to send $300 a month to the appropriate council.

You can do the same for insurance.

The rent may not cover all the cost of owning a rental property. In that case you need to top-up the rental property with some of your own money.

Use Opes+ to figure out how much your top-up is. That’s our property investment app that lets you forecast the cashflow of your rental properties.

For example, your property might require a $150 a week top-up. You then set up an automatic payment that goes from your personal bank account into your rental account.

Remember, don’t take money out of this account for personal spending unless it’s absolutely necessary.

If you do dip into it, repay it so the account reflects the true rental cash flow. It’ll save headaches when you send statements to your accountant.

You need to send your bank statements to your accountant at tax time.

They’ll ask for an export. And when you go to do an export you’ll see … there are a lot of options.

Should you do a CSV export? What about a PDF export?

Always use a CSV export (unless asked otherwise).

A CSV (Comma-Separated Value) file is just a spreadsheet with no formatting. It’s a plain text document … for spreadsheets.

PDFs, on the other hand mean your accountant has to copy the data out of the PDF. And this often leads to formatting issues.

It’s easier if you just send them a CSV.

Some accountants will ask you to use Xero (or similar software). This often costs $35+GST per month.

In my view, it’s not always necessary.

If you have a large portfolio, it might be worth it.

But for most small-to-medium investors, it’s not worth the expense.

Just set up your bank accounts the right way and save $483 a year.

Don’t set up your bank accounts this way just to make your accountant happy.

Do it to take control of your cash flow. That way you’re never caught off guard by a rates bill or scrambling to top up an account at the last minute.

One account per entity, automated payments, clean records, and a simple system – that’s all you need.

With the right setup, you can spend less time on admin and more time growing your portfolio (or just enjoying life).

This article is for your general information. It’s not financial advice. See here for details about our Financial Advice Provider Disclosure. So Opes isn’t telling you what to do with your own money.

We’ve made every effort to make sure the information is accurate. But we occasionally get the odd fact wrong. Make sure you do your own research or talk to a financial adviser before making any investment decisions.

You might like to use us or another financial adviser