Property Investment

What is Akahu – and is it safe?

Akahu is the secure “middle man” that lets budgeting apps and tools like Opes+ connect to your bank accounts without sharing your bank password.

Property Investment

5 min read

Author: Ed McKnight

Resident Economist, with a GradDipEcon and over five years at Opes Partners, is a trusted contributor to NZ Property Investor, Informed Investor, Stuff, Business Desk, and OneRoof.

Reviewed by: Laine Moger

Journalist and Property Educator, holds a Bachelor of Communication (Honours) from Massey University.

It’s often difficult to figure out how much to offer for a house. That’s especially true when so many properties sell at auction … it’s hard to know what the seller will accept.

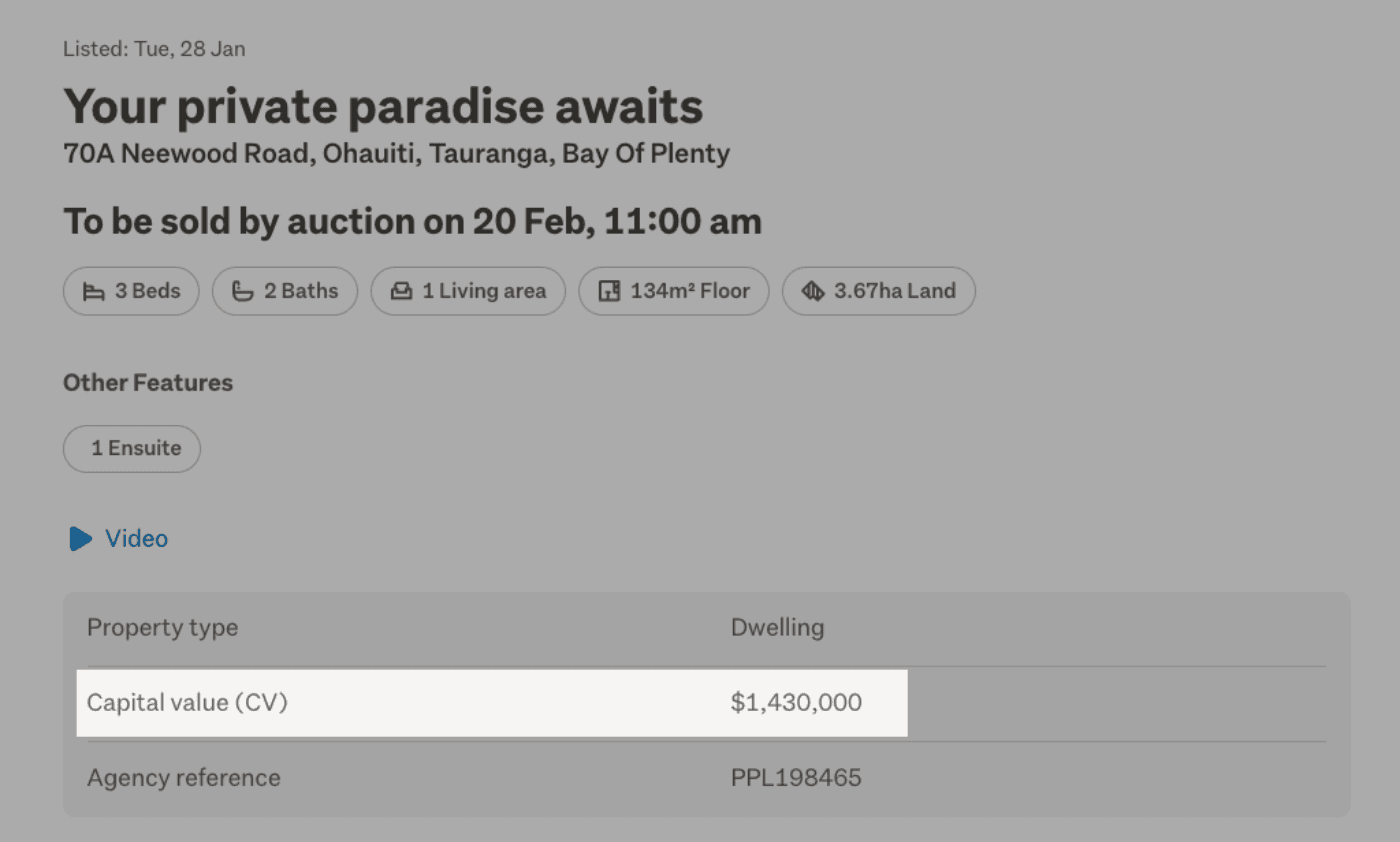

That’s why many New Zealanders look at the Capital Value (CV) or Rateable Value (RV). These are the estimates of house values councils use when setting your rates and are often shown on property listings.

Property buyers pay attention to these numbers since they are shown prominently in online listings. That’s why you will often hear real estate agents try to set buyers’ expectations by saying whether properties are selling above or below CV. For instance, they might say properties are selling 5% above CV.

But CVs don’t always match sale prices. For example, as of December 2024, Wellington properties are selling 23% below their CVs. In contrast, Queenstown properties are selling 20% above. This shows how CVs can quickly become outdated and unreliable.

In this article, you'll learn why CVs don’t always reflect market value and how to use them when buying a house.

But there are massive extremes. Properties in some parts of the country are selling well above CV; properties in other parts are selling well below CV.

For instance, in December 2025 the average property in Grey District sold for 12% below CV.

So, if a property in Grey District has a rateable value of $1 million, there is a decent chance it will sell for around $880,000 ($120,000 less than the CV).

Other councils where properties are selling close to or below CV are Stratford District, where they are selling 8% below, and Lower Hutt City, where properties are selling 7% below CV.

However, in Westland District, the average property sold for 41% above CV.

Properties in Invercargill City and South Taranaki District are also selling 16% above and 14% above CV, respectively.

That doesn’t mean properties are undervalued in Grey District or overvalued in Westland District. It has more to do with how and when the CVs were set.

This map shows where houses are selling above and below their CV. Hover over the map to explore your area. Or, use the table at the end of this article to search for the data in your area.

CVs are often out of date – even on the day they are launched. But, even though that’s true, there are still pros and benefits to looking at the CV as a buyer.

So, let’s take an honest look at the pros and cons of using the CV as a buyer.

The first major pro is that it gives you an idea of what a property may sell for. Real estate agents often shoot themselves in the foot. They don’t want you to look at the CV and get the wrong expectation of what a property may sell for.

But, then they market their properties as ‘auction’, ‘price by negotiation’, 'deadline sale' or ‘tender’. That means they won’t say the price the seller wants on the listing.

Even if you call them, they might be cagey and not give you a clear idea of what the property will sell for. Even though you know they’ve talked about the price with the seller.

So what’s a buyer to do? Look at the CV, the Homes.co.nz estimate, and others online.

So, even though CVs are often out of date, at least you can get a ballpark for what a property might sell for.

You can also use CVs to negotiate. Buyers often say: “I don’t want to pay more than the CV.” Even though you and the agent know the CV is out of date, you can still use it as a reason you don’t want to pay more.

On the other hand, CVs can also mislead you as a buyer (and the seller).

Right now, a lot of properties sell below CV. So you might think: “Great, I am getting a good deal.” But you might actually still be paying more than a fair market price.

I often recommend buyers look at the CV, but use it as only the first step when analysing a property.

For instance, this property is currently for sale. The CV is $1.2 million, and that was set back in 2021.

But, 2021 was a long time ago.

So after looking at the CV, it's time to look at other estimates online. That’s because often a homes.co.nz estimate or OneRoof estimate will be more accurate and up to date than the CV.

For instance, while this property has a CV of $1.2 million. That was set over 3 years ago. The Homes.co.nz estimate suggests that the property might sell closer to $955,000.

However, even these online estimates are just a ballpark. And real estate agents can adapt them to make them higher (to try and make you pay more money).

So, after you quickly look at the CV and other online estimators, it’s time to get to work.

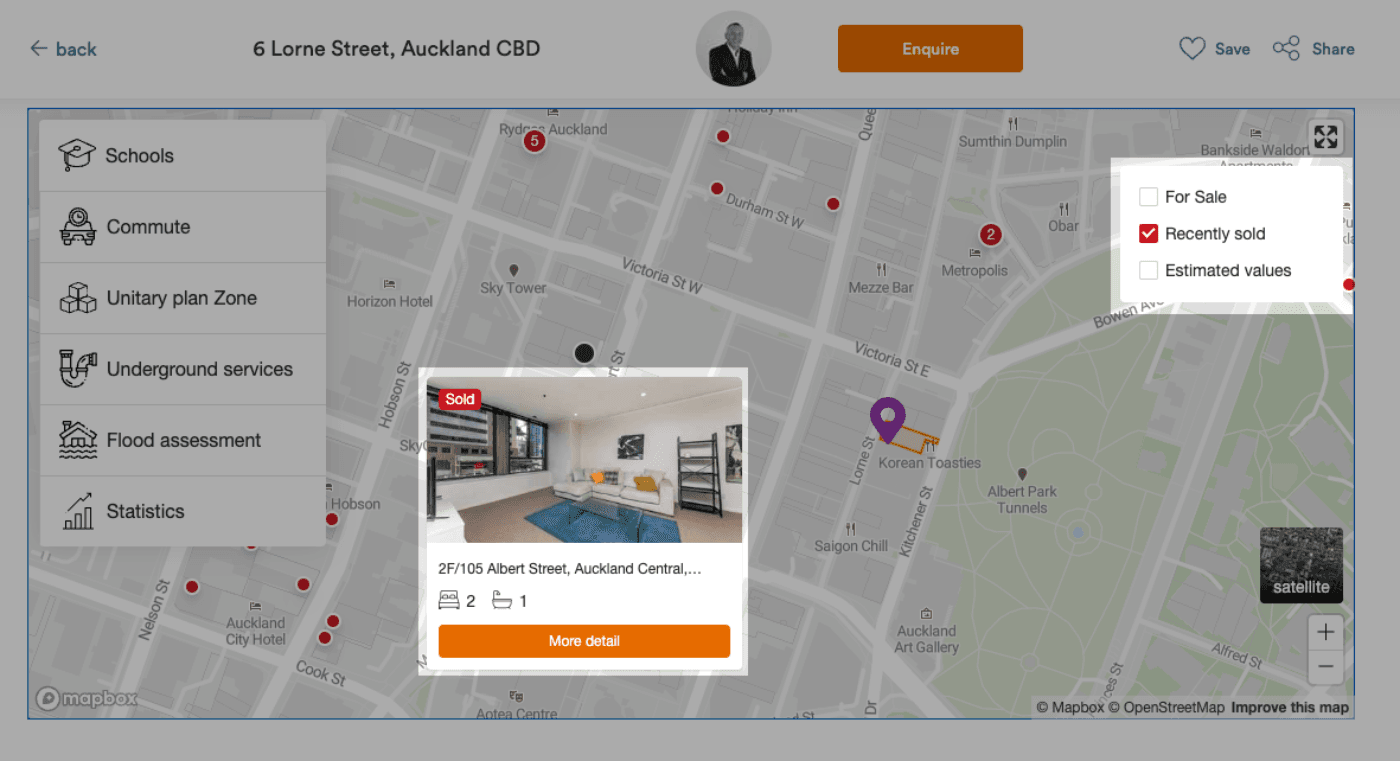

Look at what similar properties have sold for because that tells you what other buyers are actually paying.

You can see these on OneRoof and Homes.co.nz.

That allows you to compare properties that have actually sold to the property you are looking at buying.

Then you can say: “123 Smith Street sold for $900,000 down the road. This property isn’t as nice as 123 Smith Street. So, it should sell for less money.”

It takes time. But that’s how you become an educated buyer. Then, you will be more confident when you are making an offer.

Most councils update their property valuations around every 3 years. If a council only recently updated its valuations there’s a good chance these estimates are relatively accurate. The property market may not have moved much since the valuations were set.

But, if the valuations are very old, the market could have moved considerably, making those estimates very out of date.

Wellington City Council last updated its RVs in September 2021, near the peak of the property market. Since then, property values in the capital have fallen. So it’s not surprising the average property sells under CV.

It’s not that properties are cheap; it’s that the market has moved.

So, if properties are selling below CV, that doesn’t tell you that you’ve snagged a good deal. It just tells you that the council’s valuations are way out of date.

Councils don’t put a great deal of thought into their estimates. They use data firms like Quotable Value or Opteon to provide estimates.

These are similar to other online estimates that you’ll see on websites like OneRoof and Homes.co.nz. They are estimates generated by a computer. Home buyers know these online estimates are just a guide. And it’s common for those online estimates to be out by at least 5-10%.

So, it pays to treat CVs like any other online estimate, except that these estimates could be 2.5 years old and out of date.

You’d never go online and look at OneRoof’s estimated value from 2.5 years ago and use it as a guide for what to offer on a property in today’s market. So, it’s generally a mistake to get too hung up on the CV or RV.

Resident Economist, with a GradDipEcon and over five years at Opes Partners, is a trusted contributor to NZ Property Investor, Informed Investor, Stuff, Business Desk, and OneRoof.

Ed, our Resident Economist, is equipped with a GradDipEcon, a GradCertStratMgmt, BMus, and over five years of experience as Opes Partners' economist. His expertise in economics has led him to contribute articles to reputable publications like NZ Property Investor, Informed Investor, OneRoof, Stuff, and Business Desk. You might have also seen him share his insights on television programs such as The Project and Breakfast.

This article is for your general information. It’s not financial advice. See here for details about our Financial Advice Provider Disclosure. So Opes isn’t telling you what to do with your own money.

We’ve made every effort to make sure the information is accurate. But we occasionally get the odd fact wrong. Make sure you do your own research or talk to a financial adviser before making any investment decisions.

You might like to use us or another financial adviser