Property Investment

What happens at the end of the Nest Egg strategy

How do property investors turn equity into income? This guide explains what happens at the end of the Nest Egg strategy, step by step.

Property Investment

1 min read

Author: Andrew Nicol

Managing Director, 20+ Years' Experience Investing In Property, Author & Host

If you’ve been waiting for the market to move, you’re not alone.

But here’s the surprise—it’s not. And that’s the real story.

Could I write a salacious update that makes a big song and dance about minor jiggles in the data?

You bet. But I’d rather let the data speak for itself.

Property prices are up 0.1% since last year. Nothing at all. Just a rounding error.

There are a lot of listings on the market.

But sales have picked up too — 76,988 properties sold over the last year.

That’s up 15% on last year’s number. And just under the long-term average.

So, although we have a lot of property listings online, people are still buying properties.

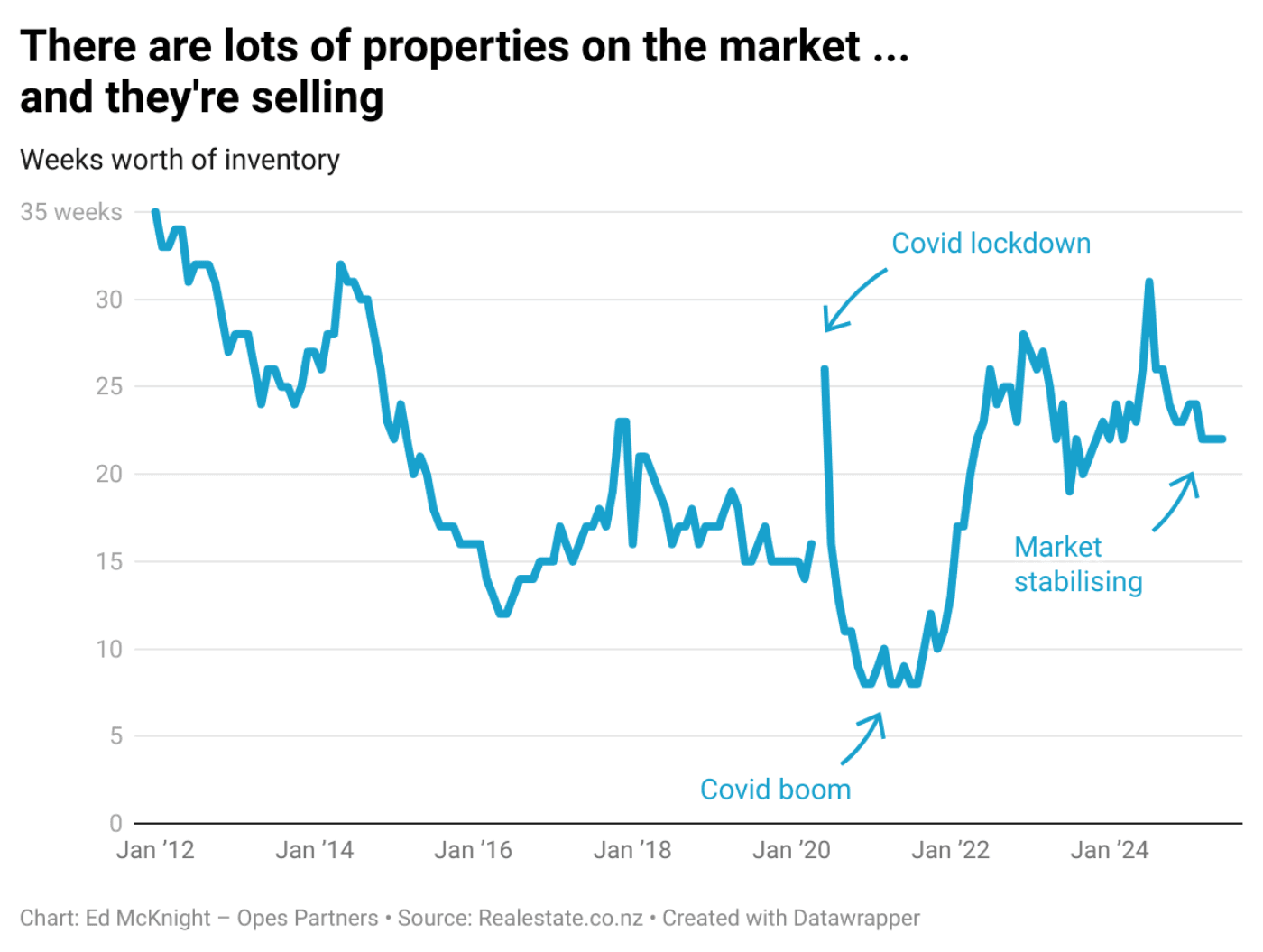

One way to measure that supply vs demand balance is by looking at how many weeks it would take to sell every property listed for sale online (if no others were listed).

There are currently 22 weeks of stock on the market.

That compares to 26 weeks in June last year.

That’s high compared to the boom times of 2021.

But take a look at this graph 👇 we’ve been here before.

Looking at rents and tenants.

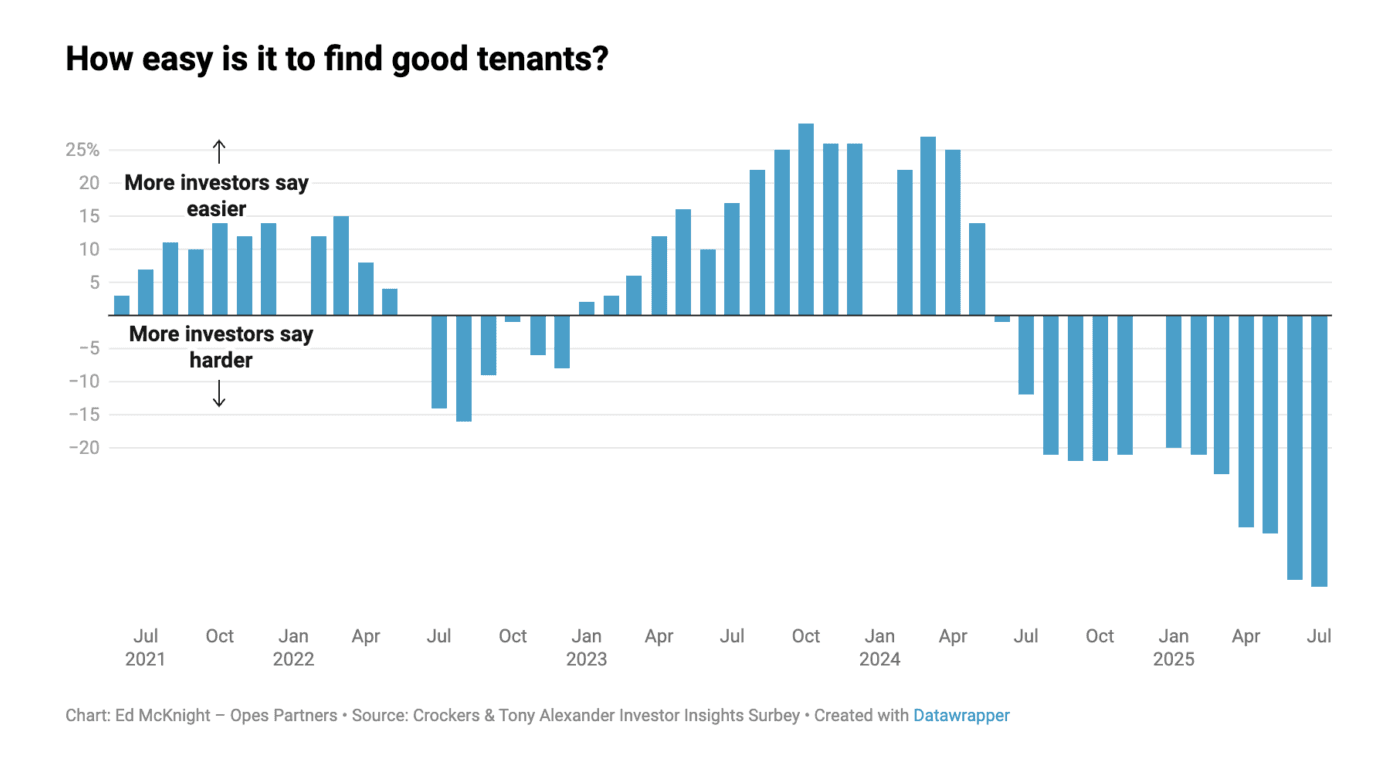

It’s true that property investors are finding it tougher to find good tenants.

A net 41% of property investors say it’s harder to find a tenant than usual.

I put that down to Kiwis moving overseas and renting out their houses.

That adds to the number of rental listings available.

But rents are broadly flat and have been for the last year or two.

The median rent is down in Auckland.

That’s only because rents briefly spiked $20/week last year, then dropped back.

So, today’s figures look like a dip – but in reality, rents are flat.

I could write an update that made a big deal over one change or another.

But the truth is that the market is trucking along.

Most things are … flat.

And that’s ok for now. For long-term investors I see this as a time for patience rather than panic.

Two years ago, prices were falling.

Today, we’re flat.

Eventually, the market will recover.

That’s the cycle.

But each part of the country is slightly different.

So here is the latest data you’ve signed up to get.

Managing Director, 20+ Years' Experience Investing In Property, Author & Host

Andrew Nicol, Managing Director at Opes Partners, is a seasoned financial adviser and property investment expert with 20+ years of experience. With 40 investment properties, he hosts the Property Academy Podcast, co-authored 'Wealth Plan' with Ed Mcknight, and has helped 1,894 Kiwis achieve financial security through property investment.

This article is for your general information. It’s not financial advice. See here for details about our Financial Advice Provider Disclosure. So Opes isn’t telling you what to do with your own money.

We’ve made every effort to make sure the information is accurate. But we occasionally get the odd fact wrong. Make sure you do your own research or talk to a financial adviser before making any investment decisions.

You might like to use us or another financial adviser