Number Crunching

How much is my home worth?

A step-by-step guide on resources to help evaluate your home's market value in 2026.

Property Investment

4 min read

Author: Ed McKnight

Resident Economist, with a GradDipEcon and over five years at Opes Partners, is a trusted contributor to NZ Property Investor, Informed Investor, Stuff, Business Desk, and OneRoof.

Reviewed by: Laine Moger

Journalist and Property Educator, holds a Bachelor of Communication (Honours) from Massey University.

Are you obsessed with your online property valuation? Do you regularly check how much Homes.co.nz says your home is ‘worth’?

You’re not alone.

It’ll cost you at least $900 to get an actual valuer (a real person) to estimate what your property is worth.

That’s why most of us turn to free online tools like Homes.co.nz, OneRoof or QV.

And that one little number can stir up big emotions in us all.

Some people have called me in tears because their online value dropped $50k+ overnight.

That feels like a real loss, but do you really need to get that upset about it? And how accurate are those online valuations (really)?

The answer might surprise you. So, in this article, you’ll learn how accurate online valuations really are.

You’ll also discover what you can do if the number on your screen makes your stomach turn.

Property is usually the most expensive asset we own.

When your property value drops, it can feel like:

And if you are selling, those valuations are public, so there’s a fear buyers will only pay what the website says.

I once received an email from an investor who was extremely upset. Her 3-bedroom home in Te Atatū dropped from $945k to $760k overnight.

That’s seemingly $185,000 gone overnight … huge!

But I told her not to worry too much about it, and here’s why.

Online valuations are very loose ballparks at best.

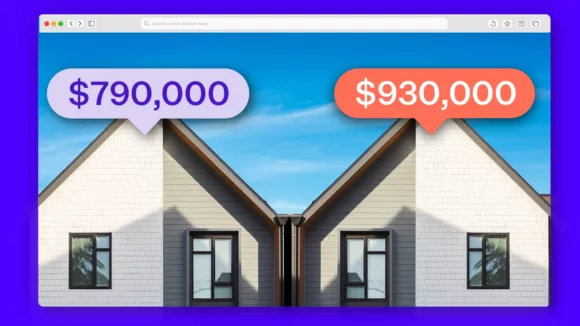

I own a property; an apartment in Christchurch. Just the other day I looked up the valuations across the main websites:

It’s the same property, but there’s almost a $100k difference of opinion between the leading property valuation websites.

And that’s not an exception: that’s the norm.

The online valuation providers use automated computer algorithms to estimate a home’s worth.

They look at what properties have recently sold and whatever public records they can get their hands on.

And since it’s just a computer estimate … it will be wrong.

They haven’t walked through your house. They haven’t done a drive-by. They may not even have an accurate understanding of how many bedrooms and bathrooms you have.

So the data they’ve based that estimate on could be wrong.

Let’s come back to that same Te Atatū investor I mentioned before; the one who’s property dropped $185k.

She pointed out that a nearby 1-bedroom home was valued for more than her 3-bedroom property.

“How can they be worth the same?” she asked.

Simple: the model doesn’t know, or it got it wrong, or both estimates are off (one higher, one lower).

That’s the thing – these tools apply formulas to every property in the country. No human is checking if the data is accurate for every single property.

That’s why you use a professional (in-person) valuer when you need them.

Inaccurate online valuations can be a hassle when you’re selling your property, so here’s what you can do:

More than half of Auckland listings don’t have a price. Instead, real estate agents list them as auctions, deadline sales, or “by negotiation.”

In the absence of real info, buyers will look at online valuations. If you don’t like what they see, take back control.

Tell them what you want. List your property with an asking price, or use “Buyers Enquiry Over $X”.

Real estate agents can input their appraisal into Homes.co.nz. That can shift the estimate upwards (or down).

Agents can’t control all the websites, but they can influence some of them.

If you want to buy another property you might need to get an in-person valuation to get the mortgage approved.

This costs money (about $900). But it’s more accurate – great if you’re selling, and even better if you need it for the bank.

Here’s the truth: online valuations aren’t real money, and they’re not gospel.

They can help you get a starting point (for buying or selling). But they are a directional tool. They give you a ballpark, but they aren’t precise.

So next time you see your number drop – breathe. Unless you’re selling, it doesn’t matter. And if you ares elling, the market will decide your home’s true worth, not a computer.

Resident Economist, with a GradDipEcon and over five years at Opes Partners, is a trusted contributor to NZ Property Investor, Informed Investor, Stuff, Business Desk, and OneRoof.

Ed, our Resident Economist, is equipped with a GradDipEcon, a GradCertStratMgmt, BMus, and over five years of experience as Opes Partners' economist. His expertise in economics has led him to contribute articles to reputable publications like NZ Property Investor, Informed Investor, OneRoof, Stuff, and Business Desk. You might have also seen him share his insights on television programs such as The Project and Breakfast.

This article is for your general information. It’s not financial advice. See here for details about our Financial Advice Provider Disclosure. So Opes isn’t telling you what to do with your own money.

We’ve made every effort to make sure the information is accurate. But we occasionally get the odd fact wrong. Make sure you do your own research or talk to a financial adviser before making any investment decisions.

You might like to use us or another financial adviser