New Builds

What happens if my new build property falls in value during construction?

Find out what to do if your new build property decreases in value during construction.

Mortgages

5 min read

Author: Peter Norris

Mortgage broker for over 10 years, property investor and Managing Director at Opes Mortgages

Reviewed by: Ed McKnight

Resident Economist, with a GradDipEcon and over five years at Opes Partners, is a trusted contributor to NZ Property Investor, Informed Investor, Stuff, Business Desk, and OneRoof.

New Builds have some great benefits, but they have a few extra risks as well.

One of the risks is that you sign up for a property, but then the property’s value may fall while it’s being built.

That can make it harder to get a mortgage. In the worst-case scenario, investors lose their deposits and are tens of thousands of dollars worse off.

But there is a way to deal with this risk. You get a valuation done upfront before the property is built. Then you get a completion certificate once the builder is finished.

Some investors ask: “Why the extra cost? Why not take the cheaper option?”

In this article, you’ll learn how a $400 completion certificate can lower your risk (and save you thousands).

The bank requires you to get a registered valuation when you apply for a mortgage. Some banks require you to do this upfront to make their approval valid for 12 months.

This is done by a registered valuer, who is the eyes and ears of the bank. They confirm that a property is worth X amount.

When you buy a property off-the-plans you get to choose when to get the valuation:

Option #1 – You get a valuation once the property is built. This is a one-off cost.

Option #2 – You order an upfront valuation when you sign for the property. This is when a registered valuer just looks at the plans.

They’ll go to view the section, take photos and look at the slope, and anything interesting about the area.

Under both options the valuer will create a report about what the property is worth once built. This report is based off the last 6 months of sales from properties like it. That’s called the valuation report.

If you’ve gone with Option 2, you will also need to order a Completion Certificate at settlement time.

That’s where the valuer returns to the now-built property. But they don’t revalue the property. They simply confirm that: “Yes, the developer built the property that I valued at the start.”

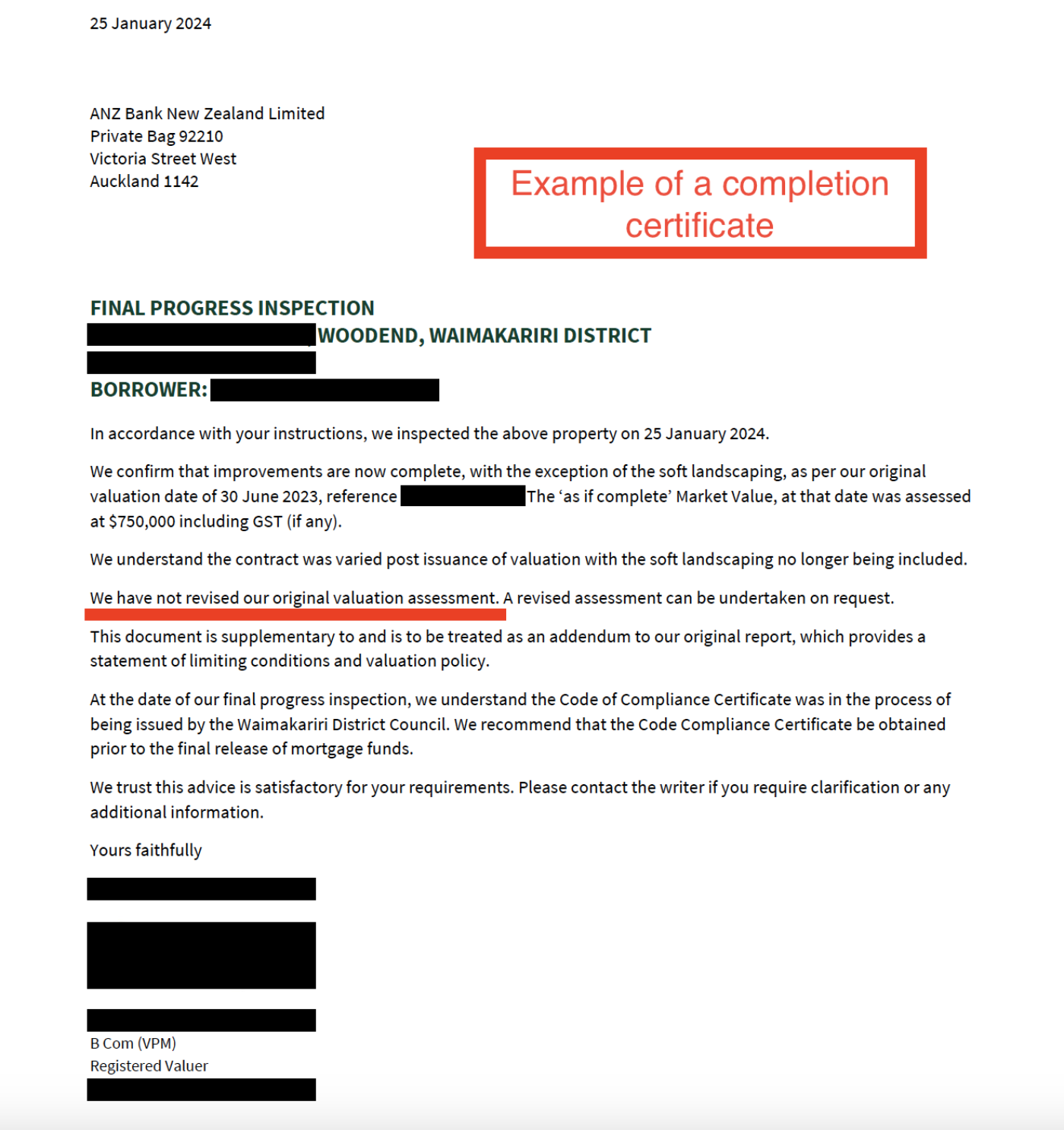

This is what a completion certificate looks like:

A valuation costs around $950, depending on house type and location.

Christchurch valuations are slightly lower, around $850, whereas in Auckland you’ll likely pay more than $1,000.

A completion certificate costs about $400. So, if you decide to get your valuation done upfront, there is an extra cost.

The bank won’t often let you choose your own valuer. They want it to be someone truly impartial, which is why they will want it through a ‘portal’.

This portal chooses a random valuer that’s accredited with that bank.

Your broker or bank will send you a link where you order the valuation. This either happens through

‘Valocity or ‘CoreLogic’

Generally, one of the benefits of a New Build is you “lock in” the price at the time of signing the contract.

By the time the property is built, your house may have gone up in value before you’ve paid for it.

But what happens when property prices fall? You have to pay for a property that is worth less than the price you’re paying.

This can cause issues with the bank.

You could lose the deposit you paid the developer, which often amounts to tens of thousands of dollars.

That’s why I prefer that investors order the valuation when they first sign the contract (Option 2).

That way, even if the property falls in value, the bank will use the original valuation you received at the start.

It comes at an extra cost, but it limits your risk and means you don’t have to come up with more money.

This is something unique that Opes Mortgages recommends. Not every mortgage adviser does this.

Here are a few scenarios of what can happen if you get (or don’t get) a valuation upfront.

Sam and Sandra signed a contract for an $800k townhouse in Auckland.

They didn’t get a valuation upfront, because their mortgage broker didn’t suggest it.

But during construction the market went down.

The bank asked Sam and Sandra to get a valuation before they approved the mortgage. The valuer said the property was now worth $750k.

That meant the bank wouldn’t lend them as much money for the property. So Sam and Sandra had to come up with an extra $40,000 in deposit.

This put Sam and Sandra under a lot of stress.

If they can’t come up with the extra $40,000 they might not be able to pay for the property. In the worst-case scenario, they may even lose their $80,000 deposit.

Tim and Toni had a different experience. They bought the neighbouring property to our couple from above.

Tim and Toni got a valuation of their Auckland townhouse before the property was built. The valuer confirmed the property was worth $800k.

During construction, the market fell.

When it came to settlement, the property was worth $750k (the same as our other couple).

But the bank didn’t ask Tim and Toni to get a new valuation. They already had one. All Tim and Toni had to do was pay $400 for a completion certificate.

The valuer returned to the property and confirmed the property in their original valuation had been built, but they didn’t revalue the property.

The bank used the original valuation, and there were no issues with getting a mortgage.

Now, getting a completion certificate cost Tim and Toni an extra $400. But if they didn’t take that option, it could have cost them an extra $40,000 like it did for Sam and Sandra.

You don’t have to get a valuation upfront. It’s only really a risk if your property falls in value during construction.

If the market goes up, there’s no problem.

But here at Opes Mortgages, we specialise in New Builds. So we think it’s worth it to minimise the risk of:

You decrease a lot of risk for the small extra cost.

Mortgage broker for over 10 years, property investor and Managing Director at Opes Mortgages

Peter Norris, a certified mortgage adviser with 10+ years of experience, serves as the Managing Director at Opes Mortgages. Having facilitated over $1.2 billion in lending for 2000+ clients, Peter is a respected authority in property financing. He's a frequent writer for Informed Investor Magazine and Property Investor Magazine, while also being recognized as BNZ Mortgage Adviser of the Year in 2018 and listed among NZ Adviser's top advisers in 2022, showcasing his expertise.

This article is for your general information. It’s not financial advice. See here for details about our Financial Advice Provider Disclosure. So Opes isn’t telling you what to do with your own money.

We’ve made every effort to make sure the information is accurate. But we occasionally get the odd fact wrong. Make sure you do your own research or talk to a financial adviser before making any investment decisions.

You might like to use us or another financial adviser