Case Studies

Colwill Road, Auckland

4.82% gross yield

Case Studies

1 min read

Author: Andrew Nicol

Managing Director, 20+ Years' Experience Investing In Property, Author & Host

Here’s an example of a development I recently recommended to investors. It’s in Mt Roskill, Auckland.

Please note that this property is not currently available and has already been recommended to an investor. The statistics provided were accurate at that time, but may now be outdated.

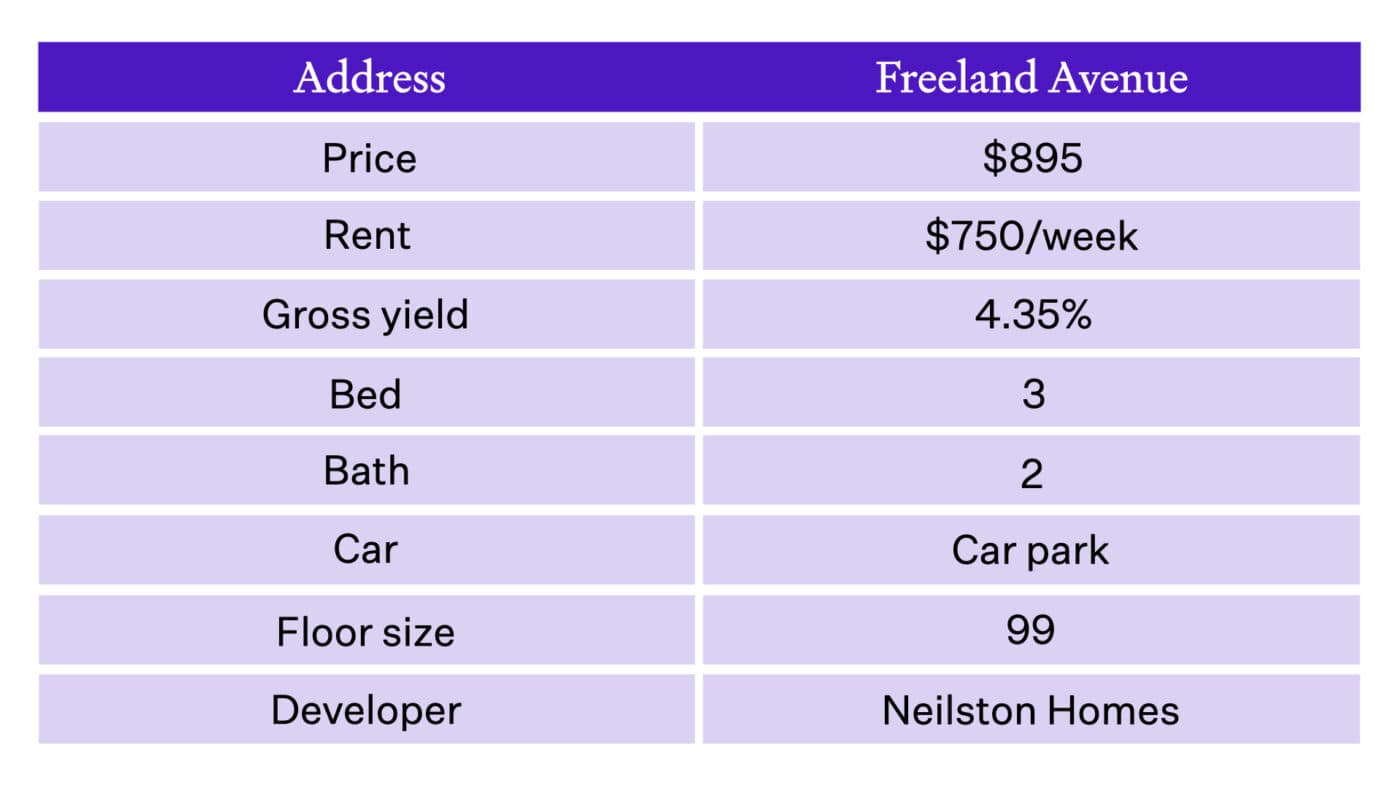

The most crucial factor when investing is price. This unit, priced at $895,000, is competitively placed in the market.

Comparable properties in the area range from $895,000 to $1,125,000, making some up to $230,000 more expensive.

However, this property stands out with a larger section than other new builds and includes a car park, which some more expensive options lack.

When it comes to property investment, understanding the cash flow and return on investment is essential for long-term viability.

By current forecasts, an investor would need to top up 25 Freeland Ave by $500 a week in the first year, likely to decrease as interest rates fall and rents rise.

The projected cash flow is about $298 per week better than comparable properties.

This means for every dollar you invest, you’ll get an estimated $3.64 back (as well as your initial investment).

For every dollar you put into:

Managing Director, 20+ Years' Experience Investing In Property, Author & Host

Andrew Nicol, Managing Director at Opes Partners, is a seasoned financial adviser and property investment expert with 20+ years of experience. With 40 investment properties, he hosts the Property Academy Podcast, co-authored 'Wealth Plan' with Ed Mcknight, and has helped 1,894 Kiwis achieve financial security through property investment.

This article is for your general information. It’s not financial advice. See here for details about our Financial Advice Provider Disclosure. So Opes isn’t telling you what to do with your own money.

We’ve made every effort to make sure the information is accurate. But we occasionally get the odd fact wrong. Make sure you do your own research or talk to a financial adviser before making any investment decisions.

You might like to use us or another financial adviser