Case Studies

Colwill Road, Auckland

4.82% gross yield

Case Studies

2 min read

Author: Andrew Nicol

Managing Director, 20+ Years' Experience Investing In Property, Author & Host

Here’s a case study of a development I recently recommended to investors. It’s in Linwood, Christchurch.

In Linwood, 55% of rentals are 2-bed properties, according to Tenancy Services. This suggests that tenants want properties with 2 bedrooms in this area.

Please note that this property is not currently available and has already been recommended to an investor. The statistics provided were accurate at that time, but may now be outdated.

The most crucial factor when looking for New Builds is price. It needs to be a good deal compared with other properties on the market.

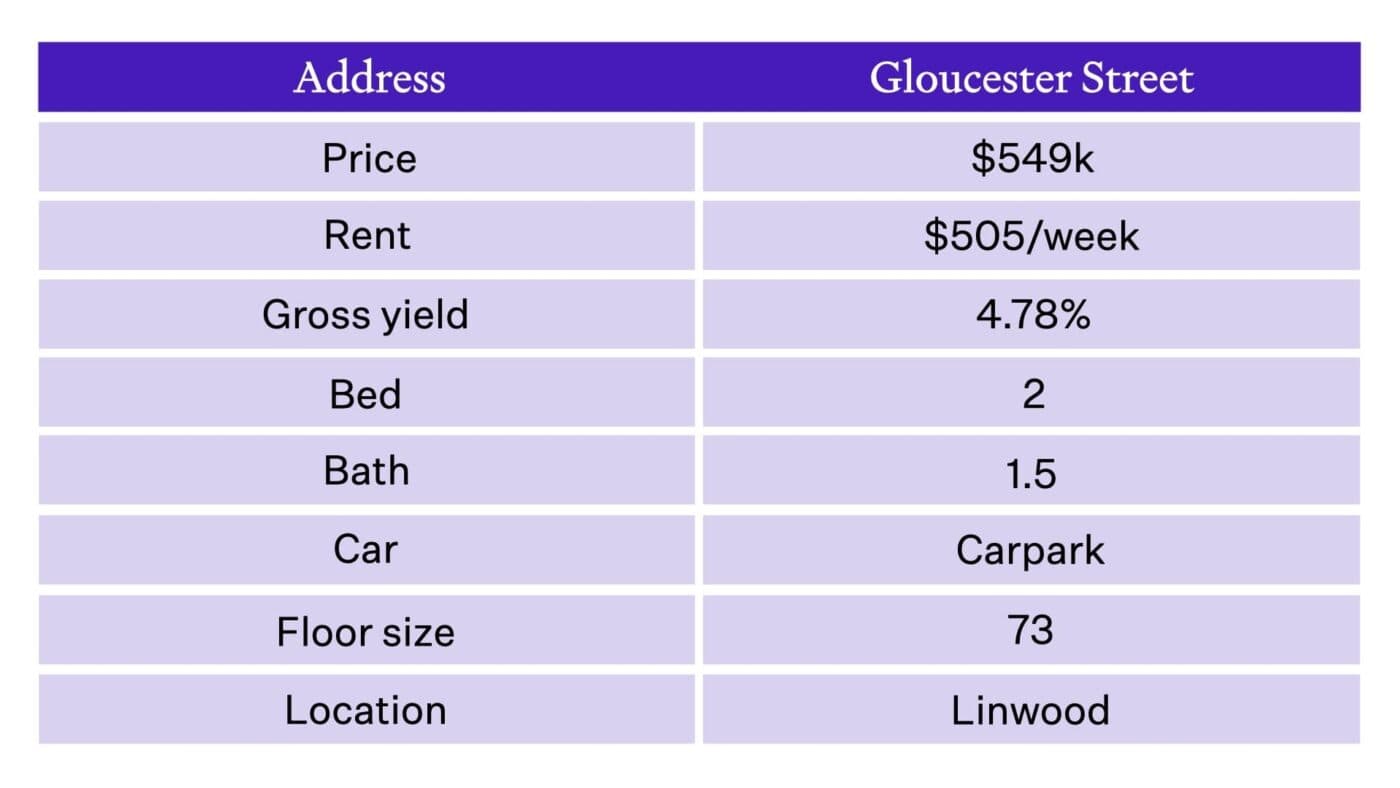

This table compares Gloucester Street with 2 almost identical developments at the time.

Gloucester Street is at least $30,000 more affordable than similar properties.

All 3 properties are 2-bedroom townhouses, spread over 73m2. They each come with a car park.

They are also within 700 metres of each other.

The only big difference is that Linwood Ave only has 1 bathroom, yet it is the most expensive property.

There are two main numbers you need to know when you invest in a property:

Let’s take a look at how Gloucester Street measures up.

Cashflow

In the world of New Build property investment, the key strategy is to hold onto the property for the long haul.

Property values usually go up, but to reap those gains, you need to keep the property.

In 2023, like many properties, the rent might not cover all the costs.

This means investors need to cover the gap, often called a "top-up" or referred to as negative gearing in property discussions.

For Gloucester Street, my forecasts suggest an initial top-up of $121 per week.

However, this amount is expected to gradually decrease as interest rates fall and rents go up.

In this context, Gloucester Street offers better cashflow compared to Tancred St and Linwood Ave.

Return on investment

Gloucester Street has an estimated return-on-investment of 260%.

This means for every dollar you invest, you’ll get an estimated $2.60 back (as well as your initial investment).

For every dollar you put into:

From this financial modelling, you’d say, “Gloucester St is the better investment.”

Managing Director, 20+ Years' Experience Investing In Property, Author & Host

Andrew Nicol, Managing Director at Opes Partners, is a seasoned financial adviser and property investment expert with 20+ years of experience. With 40 investment properties, he hosts the Property Academy Podcast, co-authored 'Wealth Plan' with Ed Mcknight, and has helped 1,894 Kiwis achieve financial security through property investment.

This article is for your general information. It’s not financial advice. See here for details about our Financial Advice Provider Disclosure. So Opes isn’t telling you what to do with your own money.

We’ve made every effort to make sure the information is accurate. But we occasionally get the odd fact wrong. Make sure you do your own research or talk to a financial adviser before making any investment decisions.

You might like to use us or another financial adviser