Case Studies

Colwill Road, Auckland

4.82% gross yield

Case Studies

1 min read

Author: Andrew Nicol

Managing Director, 20+ Years' Experience Investing In Property, Author & Host

Here’s a case study of a development I recently recommended to investors in Spreydon, Christchurch.

Please note that this property is not currently available and has already been recommended to an investor. The statistics provided were accurate at that time, but may now be outdated.

When it comes to property investment, the first question is always about price: “Is it a good price compared to other properties on the market?”

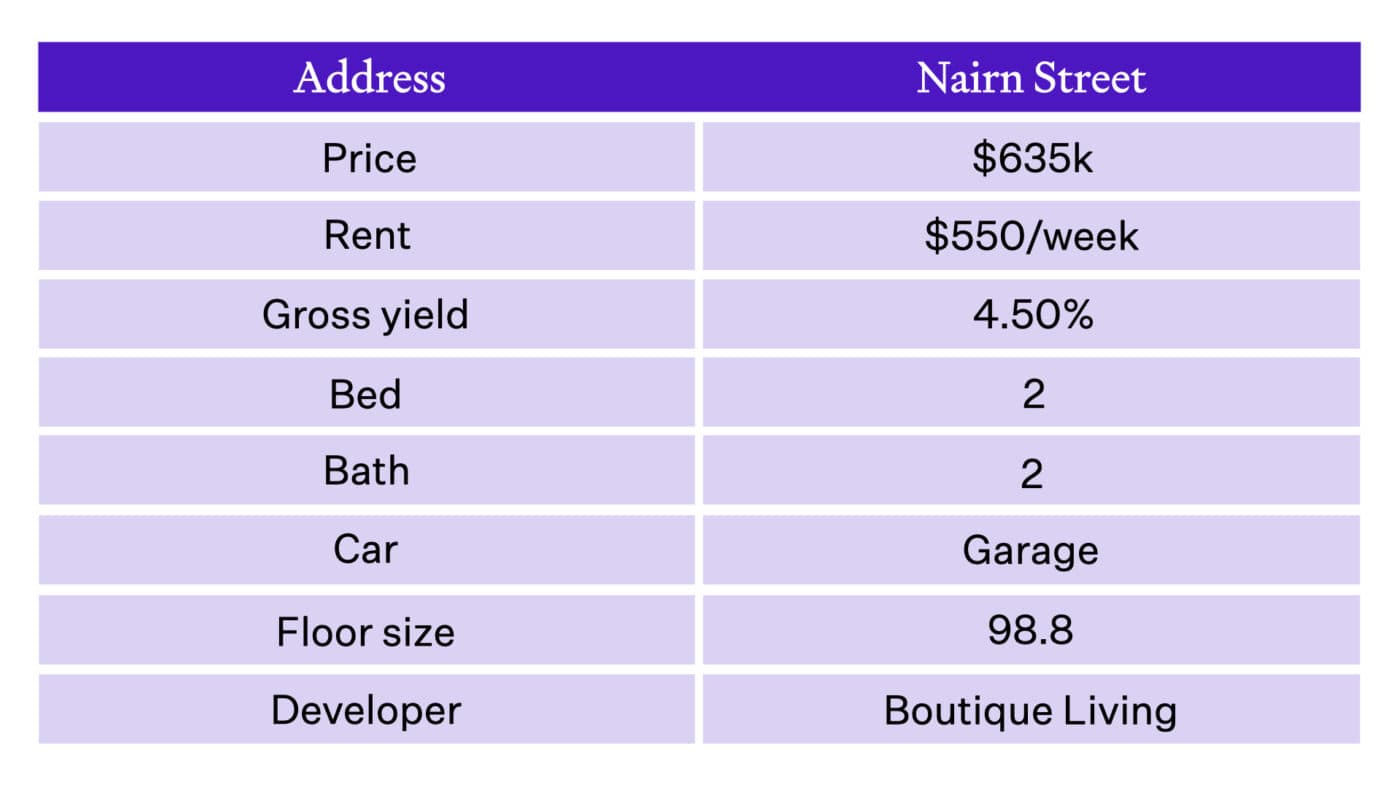

The table below shows how Nairn Street properties stack up against two other similar developments in Spreydon, all within a 2km radius.

For instance, the most affordable property (Evesham Cres) is $10,000 cheaper than Nairn Street but lacks a garage.

Meanwhile, Mountfort St, despite having the same floor area and an additional garage like Nairn St, is $50,000 more expensive and Nairn St has an extra bathroom.

Beyond price, the true measure of a good investment is value. In this case, Nairn Street leads with the highest gross yield of 4.5%, followed by Evesham Cres at 4.28%.

Gross yield, calculated as the annual rent divided by the purchase price, is a simple but effective tool to gauge investment value.

Interestingly, the most expensive property, Mountfort St, despite its higher cost, does not get higher rent, resulting in the lowest gross yield of 4.18%.

This indicates that a higher price does not always equate to more value for an investor.

Having a garage significantly affects the price of new builds in Spreydon, often adding $40 - $50k to the cost.

However, the lack of off-street parking in the area makes a garage a desirable feature, potentially affecting tenant retention.

In this context, investing in a townhouse with a garage in Spreydon could be a justifiable expense.

Managing Director, 20+ Years' Experience Investing In Property, Author & Host

Andrew Nicol, Managing Director at Opes Partners, is a seasoned financial adviser and property investment expert with 20+ years of experience. With 40 investment properties, he hosts the Property Academy Podcast, co-authored 'Wealth Plan' with Ed Mcknight, and has helped 1,894 Kiwis achieve financial security through property investment.

This article is for your general information. It’s not financial advice. See here for details about our Financial Advice Provider Disclosure. So Opes isn’t telling you what to do with your own money.

We’ve made every effort to make sure the information is accurate. But we occasionally get the odd fact wrong. Make sure you do your own research or talk to a financial adviser before making any investment decisions.

You might like to use us or another financial adviser