Property Investment

Case Studies

1 min read

Author: Andrew Nicol

Managing Director, 20+ Years' Experience Investing In Property, Author & Host

Reviewed by: Ed McKnight

Resident Economist, with a GradDipEcon and over five years at Opes Partners, is a trusted contributor to NZ Property Investor, Informed Investor, Stuff, Business Desk, and OneRoof.

Thinking about working with Opes? You’re probably wondering: “How much money have your investors made?”

That’s a fair question. And an important one, too.

After all, a good property investment company should be able to pick a good investment.

Here’s an example of a 2-bed townhouse an investor bought in 2020. It made $220,000 in the first 2 years and still did better than the average investment despite a fall in property prices.

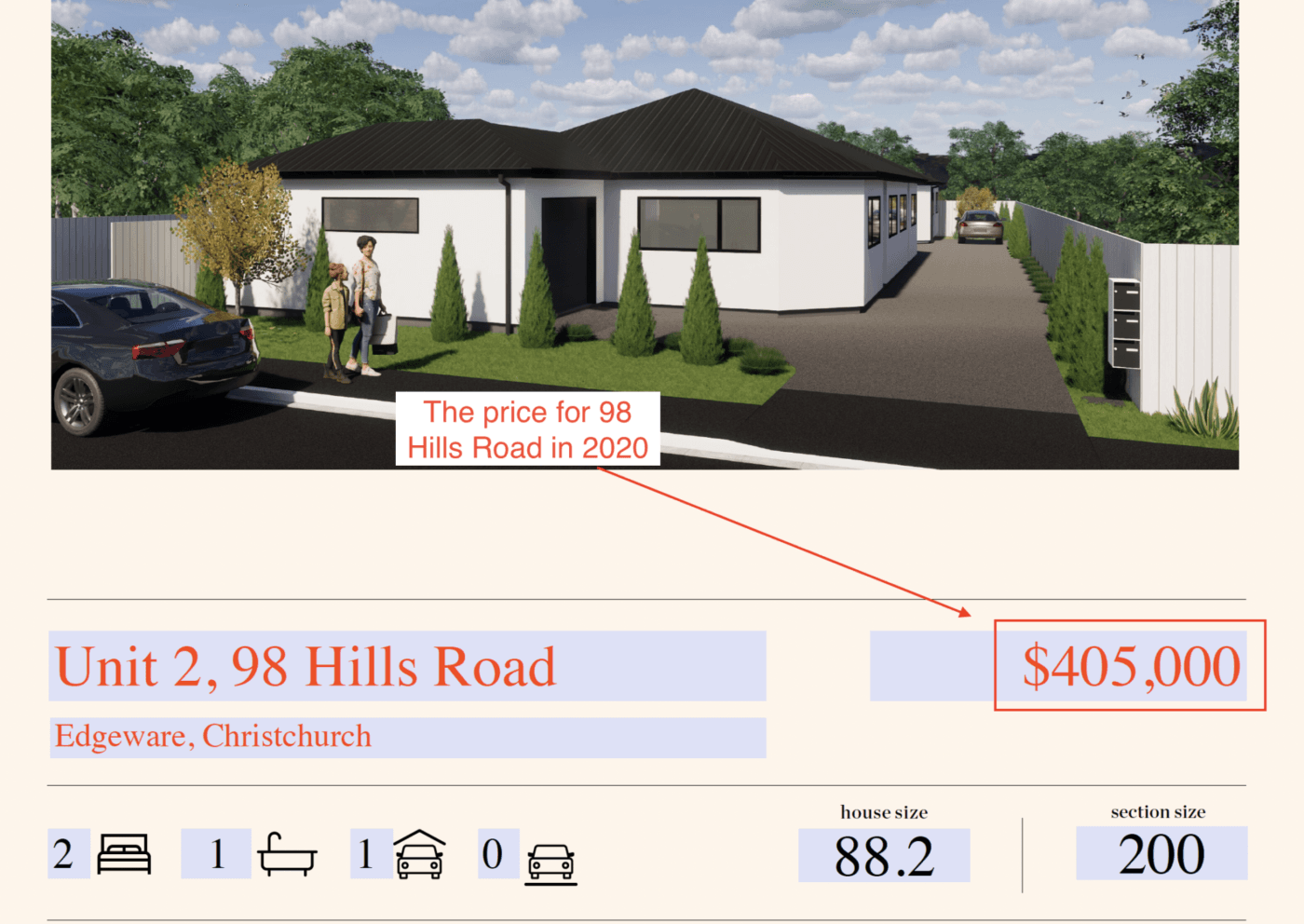

This property was 98 Hills Road, Edgeware, Christchurch. It’s a 2-bed townhouse and has a single garage.

Our client, John, bought this property in May 2020 for $405,000. It was due to be completed in October 2020, and he settled the property in December that year.

It’s not the typical 2-storey, open-plan townhouse design we are used to today.

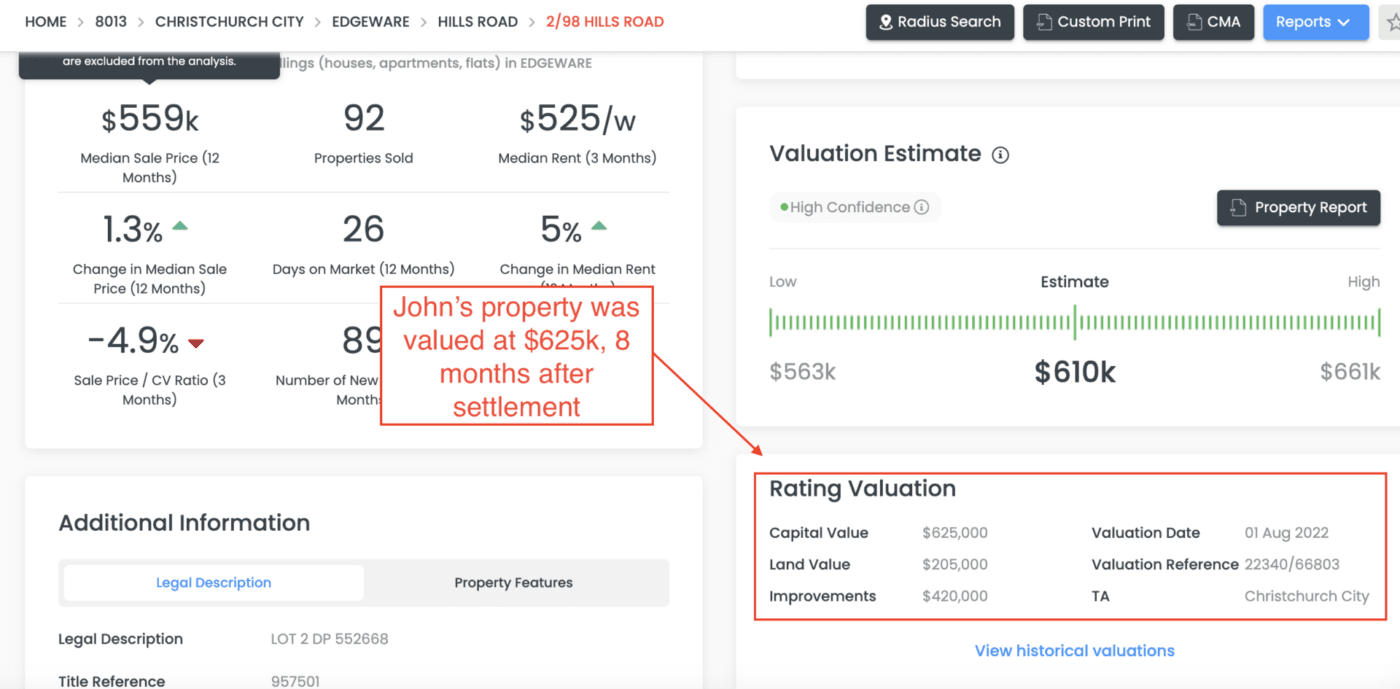

John’s property has a council valuation of $625,000 set in August 2022. That means he made an estimated $220,000 in a little over 18 months.

That’s an average gain of 21% per year ... 3% better per year than the Christchurch City market overall. He beat the market.

The market has turned and today property prices have fallen.

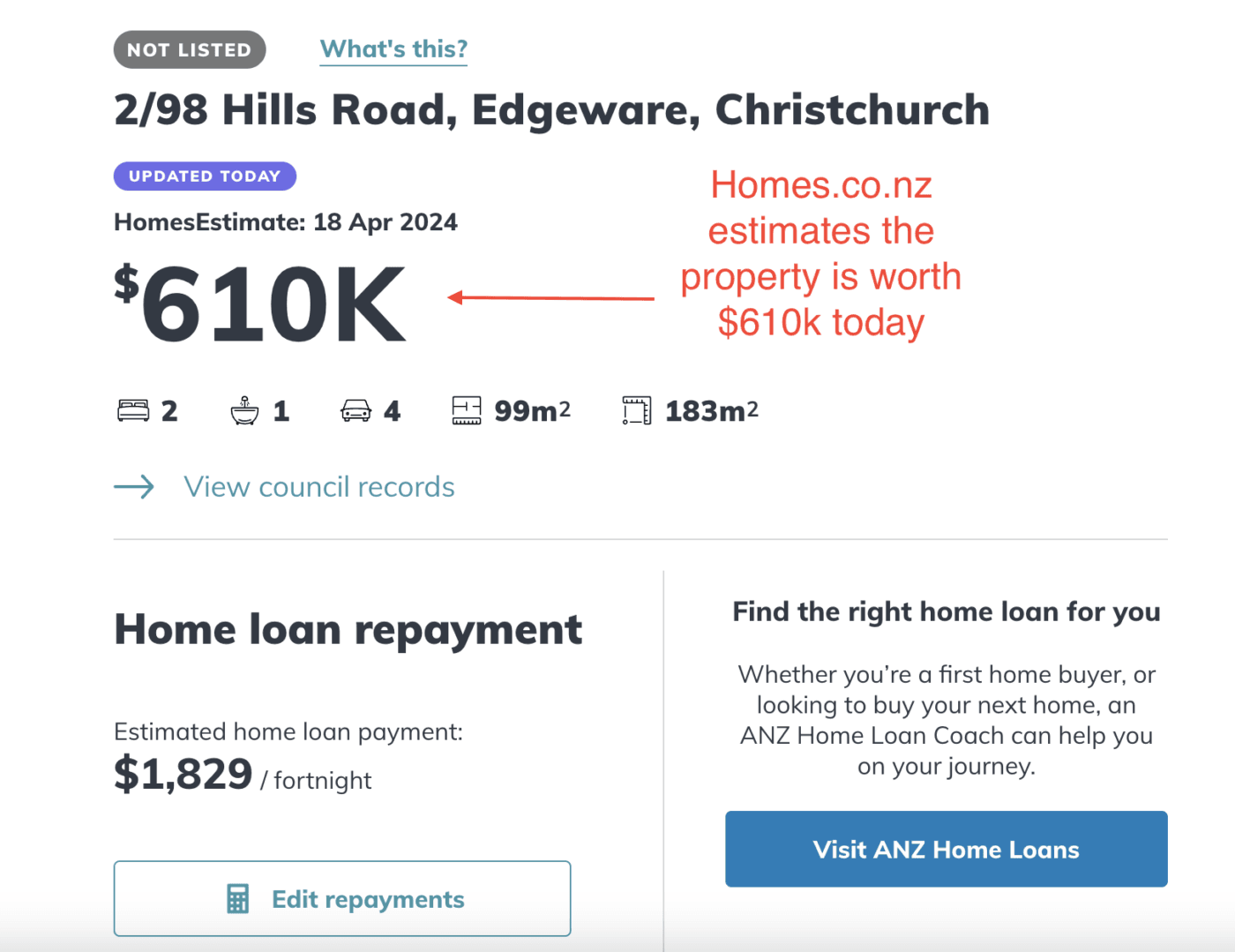

OneRoof now says his property is worth $585,000. Homes.co.nz says $610k.

If you take the middle of the two estimates, John’s property is in line with the market.

Even better, his property has increased in value by 12% per year. That is well above the 5% annual growth rate we use in our forecasting.

After reading this article, you might wonder ... “Do Opes investors always make more money than the rest of the market?”

The answer is “not always”.

(Sadly), we are not property investment oracles. We don’t have any special magic power to predict the market. Every. Single. Time.

But we do our best to try to get it right more often than not. That’s why we use data and number-crunching to inform our investment recommendations.

We aim to help you be a more successful property investor than if you found a property on your own.

But even after that number-crunching, high investment returns aren’t 100% guaranteed. They’re not locked in.

Investing comes with risk. The question then is how you manage it.

Managing Director, 20+ Years' Experience Investing In Property, Author & Host

Andrew Nicol, Managing Director at Opes Partners, is a seasoned financial adviser and property investment expert with 20+ years of experience. With 40 investment properties, he hosts the Property Academy Podcast, co-authored 'Wealth Plan' with Ed Mcknight, and has helped 1,894 Kiwis achieve financial security through property investment.

This article is for your general information. It’s not financial advice. See here for details about our Financial Advice Provider Disclosure. So Opes isn’t telling you what to do with your own money.

We’ve made every effort to make sure the information is accurate. But we occasionally get the odd fact wrong. Make sure you do your own research or talk to a financial adviser before making any investment decisions.

You might like to use us or another financial adviser