New Builds

New builds - The ultimate guide for every property investor

Explore the essentials of investing in new builds. Our guide covers key strategies, benefits, and tips to navigate the market and maximise your investment.

Opes

7 min read

Author: Stevie Waring

Financial Adviser with 7 years of experience. Property investor in Wellington and Christchurch

Reviewed by: Ed McKnight

Resident Economist, with a GradDipEcon and over five years at Opes Partners, is a trusted contributor to NZ Property Investor, Informed Investor, Stuff, Business Desk, and OneRoof.

Looking to buy your first investment property, but not sure where to start?

You could either:

Both approaches have pros and cons, and the right choice matters. You don’t want to spend hundreds of thousands of dollars on a property … then realise you made the wrong decision.

In this article, you’ll learn the 7 key differences between buying an investment property through Trade Me and using Opes Partners.

You’ll see how the two approaches differ in terms of:

Now, keep in mind that you’re reading this on the Opes Partners website, so we have an incentive to say: “Just use us. We’re amazing!”

But the truth is … we’re not right for everyone. In fact, Trade Me could be the right option for you.

So here’s our approach. We’ll outline these 7 differences as honestly as possible.

Then we’ll take a step back so you can decide which is the right choice for you.

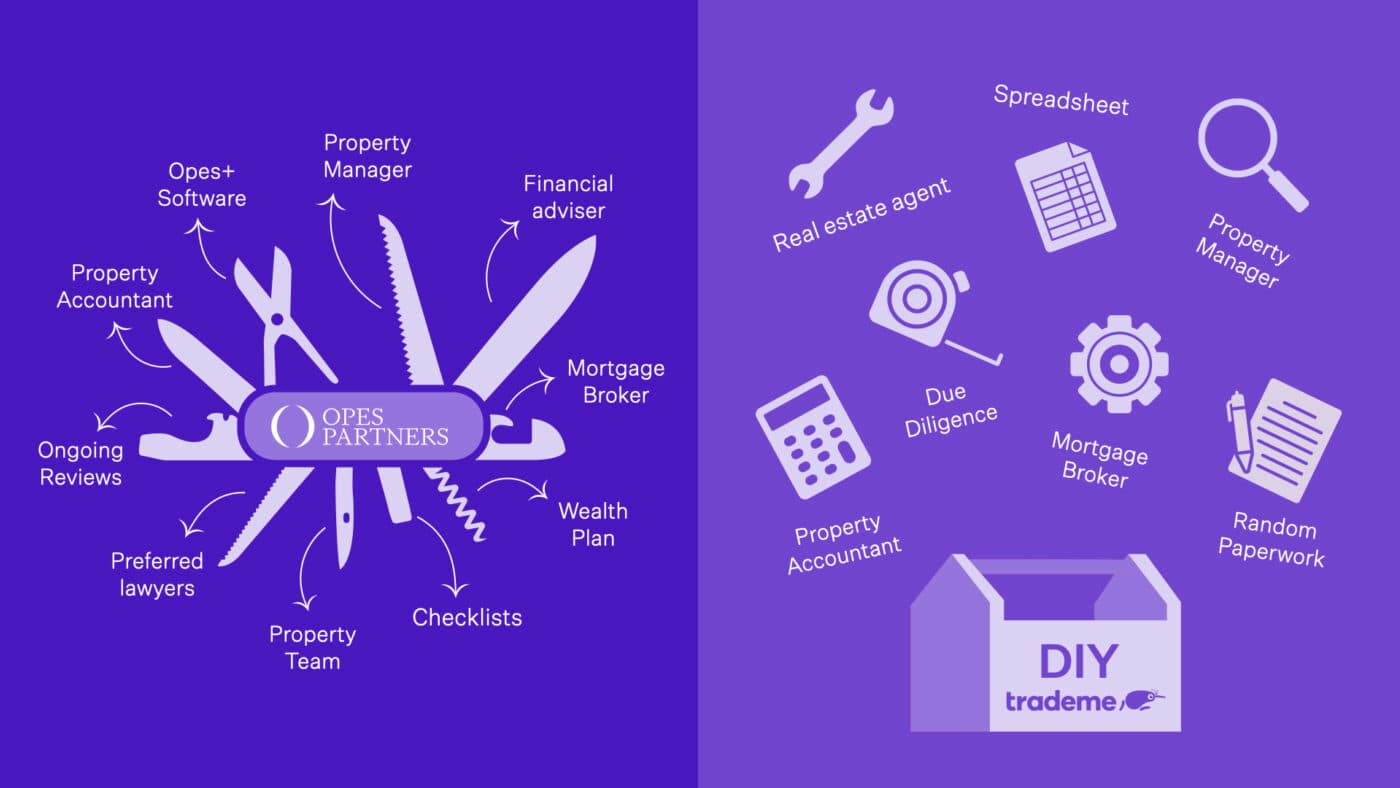

Using a property investment company (like Opes) is like carrying a Swiss Army knife (stick with me on this). Everything you need is built into one system.

Trade Me, on the other hand, is like building your own toolbox. You choose each part yourself – the wrench, the hammer, the drill – but you’ve got to source and assemble it yourself.

At Opes, you get:

That’s all in one place. And all your professionals (like a mortgage adviser and accountant) work together.

With Trade Me, you’re the project manager. You find the property, your mortgage adviser, accountant, solicitor and property manager. You decide what to look for and figure out how you’ll measure returns. You do the legwork.

Some investors thrive on taking the reins. They enjoy weighing options, vetting professionals, and making every decision themselves. If that’s you Trade Me is likely a better fit.

But others prefer a more guided (all-done-for-you) type service. If that’s you – you might consider using Opes.

With Trade Me, you can browse 40,000+ property listings. You’ve got every suburb, every property type, every seller in the country.

With Opes (or a similar investment company) your adviser will usually only show you 3–5 properties.

Now, that might sound limiting, but your financial adviser will hand-pick those properties based on what they think will fit your financial plan.

It’s also because the Opes Property team’s job is to find the most suitable investment properties. And they will only approve about 4 out of 1,000 properties available on the market.

So it depends on what you prefer:

Most property investment companies – including Opes – focus almost exclusively on New Builds.

These are the types of properties that often don’t make it to Trade Me. That’s because the Opes Property team will often do ‘off-market’ listings.

That means that rather than trying to find buyers through Trade Me, the developer makes the build (or part of the project) just available to investors using Opes.

Trade Me, however, is home to all sorts of properties, but primarily existing homes.

So if you’re an investor looking to do a BRRRR (Buy, Renovate, Rent, Refinance, Repeat) strategy, Trade Me is likely where you’ll find your property.

But if you’re after a New Build, then a property investment company may open doors not widely advertised on public platforms.

This one’s all about what goes on behind the scenes. Buying a property from Opes Partners and Trade Me might look the same on the surface.

At the end of the day … they’re both ways to find a property.

But behind that property … there’s a difference in the amount of work that gets done.

To get on Trade Me, a seller just needs to pay $599+ and the listing goes online.

With Opes Partners, a lot of work goes on behind the scenes before you even see the property.

That’s why we use this iceberg analogy – the property is what you see, but with Opes most of the heavy lifting happens below the surface:

With a property from Trade Me you get the property through a real estate agent, but you need to do a lot of the research yourself.

At Opes, most of that research is done for you (though, of course you’ll need to do a few of your own checks too).

So, if you’re confident in your ability to vet properties and spot hidden red flags, Trade Me may suit you.

With much of the due diligence done for you, you can save dozens of hours and avoid costly mistakes.

On Trade Me, prices are often listed as “Negotiation” or “Auction.” That can mean potential for a good deal – but also requires you to haggle or compete in a bidding war.

With a property investment company, prices are usually pre-negotiated. You’ll see the price upfront – no guesswork.

A common question we hear is: “Can I get a better deal by negotiating directly?”

If you’re buying an existing home or a do-up project, perhaps.

But with New Builds developers often give sharper prices to companies like us.

That’s because they can place multiple investors into a project.

If you buy through Trade Me, once the deal is done, you’re on your own.

You’ll need to:

At Opes, every investor gets a dedicated customer relationship manager.

You also get plugged into a professional-grade system (ClickUp) that tracks every task you need to do – that means fewer details fall through the cracks.

It’s a bit like having a checklist – with someone checking off the boxes alongside you.

Sometimes investors don’t realise how much work goes on in the background. We recently had an investor who bought their first investment property through Opes. Then, they decided to purchase their second through a real estate agent.

They were about to settle (pay for) this second property when they called us in a panic: “Who organises the Healthy Homes Assessment?”

Of course, when they bought through Opes, it was all sorted. So sometimes it’s not until after the purchase that buyers realise how work happens in the background when you use a property investment company.

Trade Me offers real estate listings. It’s up to you to figure out if a property will help you achieve your financial goals.

When you work with a property investment company, the conversation starts with your financial plan ... not the property.

At Opes, we use our MyWealth Plan software to:

So if you already know what you want, have a clear strategy, and just need the right house – Trade Me’s your go-to.

But if you want help figuring out what kind of property you need (and how many) then a property investment company is worth talking to.

Well, that comes down to who you are as an investor.

We recently had an investor come on the Property Academy Podcast for Case Study Sunday. He had bought a property on the West Coast.

It’s leasehold and he’s transformed it into a motel. He lives there and rents out rooms.

That’s the sort of investor who should absolutely use Trade Me.

If you want to flip, renovate, run a boutique business – Trade Me gives you that flexibility.

But if you’re serious about investing in New Builds, you might be working with us here at Opes.

The amount of expertise, support, and strategy you get – at no cost – makes it a bit of a no-brainer.

If you want to explore whether working with us is the right fit, start by booking a free Portfolio Planning Session.

Your next step is to book a portfolio planning session. This is where a financial adviser will create you a financial plan. They will then find properties that fit your plan.

Book your free sessionFinancial Adviser with 7 years of experience. Property investor in Wellington and Christchurch

Stevie Waring is a Financial Adviser with over 7 years of experience in property investment and a successful investor herself. Stevie has successfully guided over 200 Kiwis in their property investments, helping them move closer to achieving their financial goals.

This article is for your general information. It’s not financial advice. See here for details about our Financial Advice Provider Disclosure. So Opes isn’t telling you what to do with your own money.

We’ve made every effort to make sure the information is accurate. But we occasionally get the odd fact wrong. Make sure you do your own research or talk to a financial adviser before making any investment decisions.

You might like to use us or another financial adviser