Developers

The developers Opes recommends (and the ones we don't)

Who are all the developers you work with? Well, we counted them. In total there are 123 developers that we have had a relationship with over the last 3 years.

Property Investment

6 min read

Author: Stevie Waring

Financial Adviser with 7 years of experience. Property investor in Wellington and Christchurch

Reviewed by: Nefe Teare

Financial adviser at Opes. Formerly a senior adviser at one of NZ largest investment firms. Owned 3 properties by 30.

Here at Opes Partners, we help investors grow their wealth through New Build investment properties.

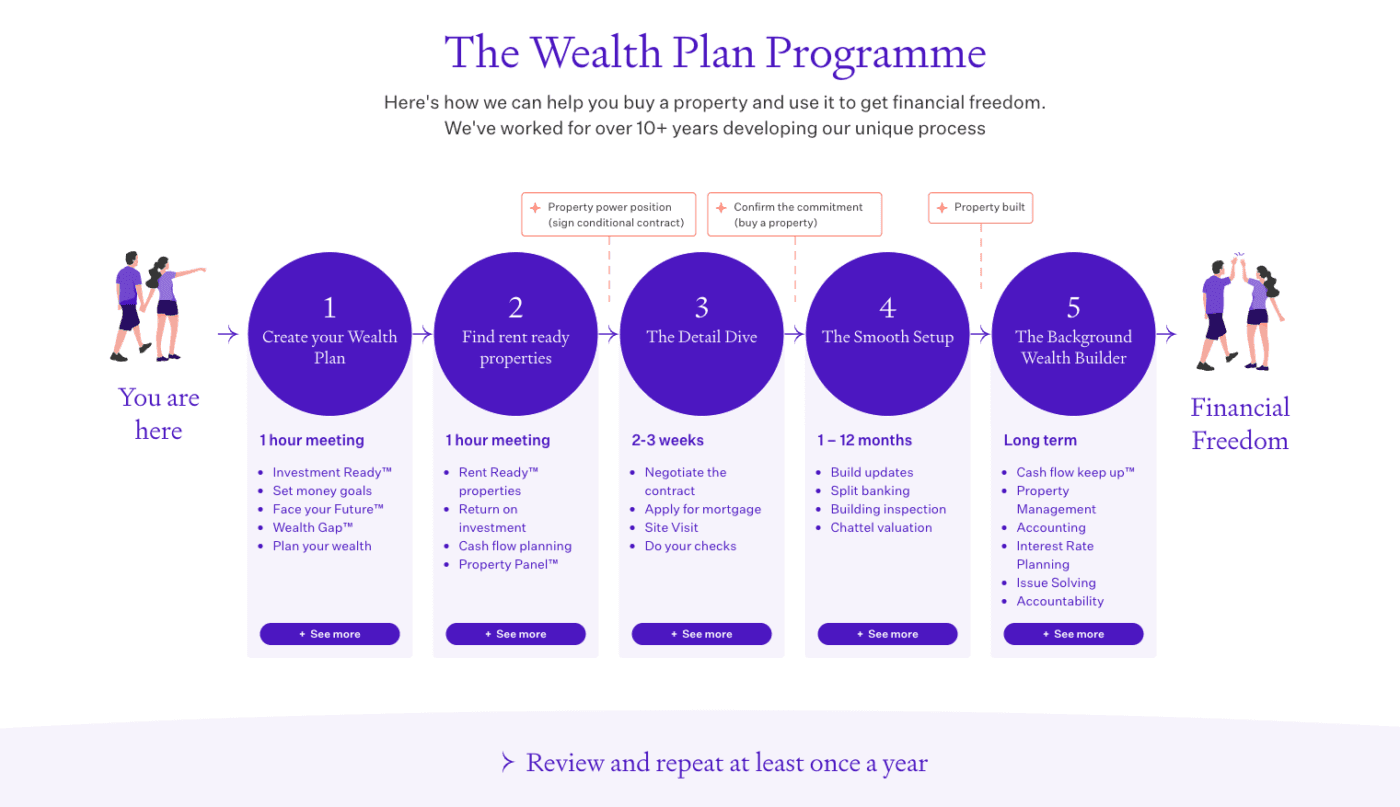

We do this through our Wealth Plan framework. This is our 5-step process for how to buy and then manage your properties over the long term.

Through these 5 steps, you’ll assemble your Property Panel. This is your team of advisers who can help you make the right decisions along the way.

If you’ve ever listened to the Property Academy Podcast and wondered: “What do these guys actually do?” This is the article for you. Because we’re here to break it down.

We’re going to pull back the covers and tell you exactly what happens when you work with us. Here are the 5 steps of the Wealth Plan framework. Click here to check it out in more detail.

The first step is to forget about property – just for a moment.

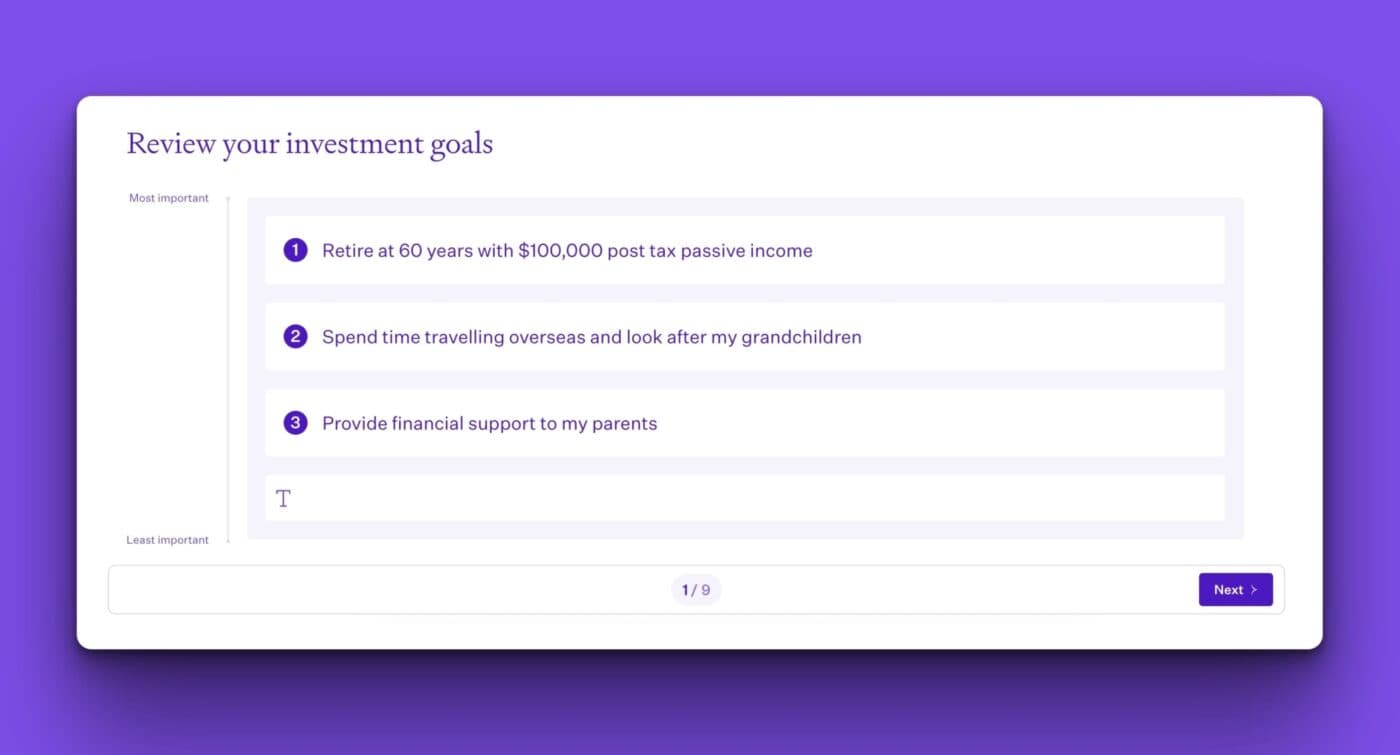

Instead, you’ll sit down for a 1-hour session with a financial adviser to focus on your big-picture goals. Together, you’ll answer questions like:

This might be one of the most valuable hours you ever spend. But it’s not just fluffy goal-setting or daydreaming.

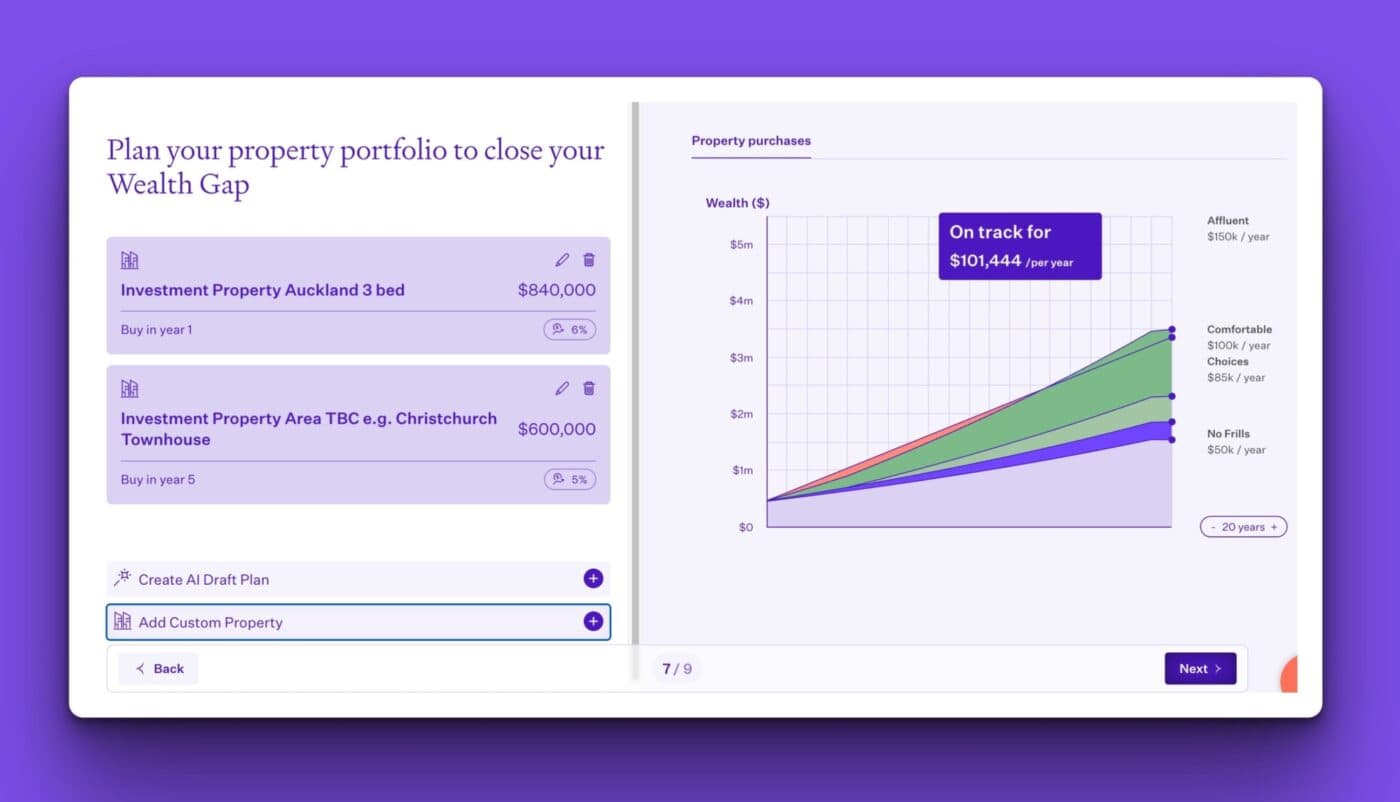

Instead, you then run the numbers to make those goals happen using My Wealth Plan. This is the software we created specifically to form financial plans for property investors.

By the end of the session you’ll walk away knowing:

For many investors this meeting is incredibly reassuring – they finally see a clear pathway to a comfortable, passive income.

For others, it’s a bit of a wake-up call.

Once your Wealth Plan is in place it’s time to start looking at properties.

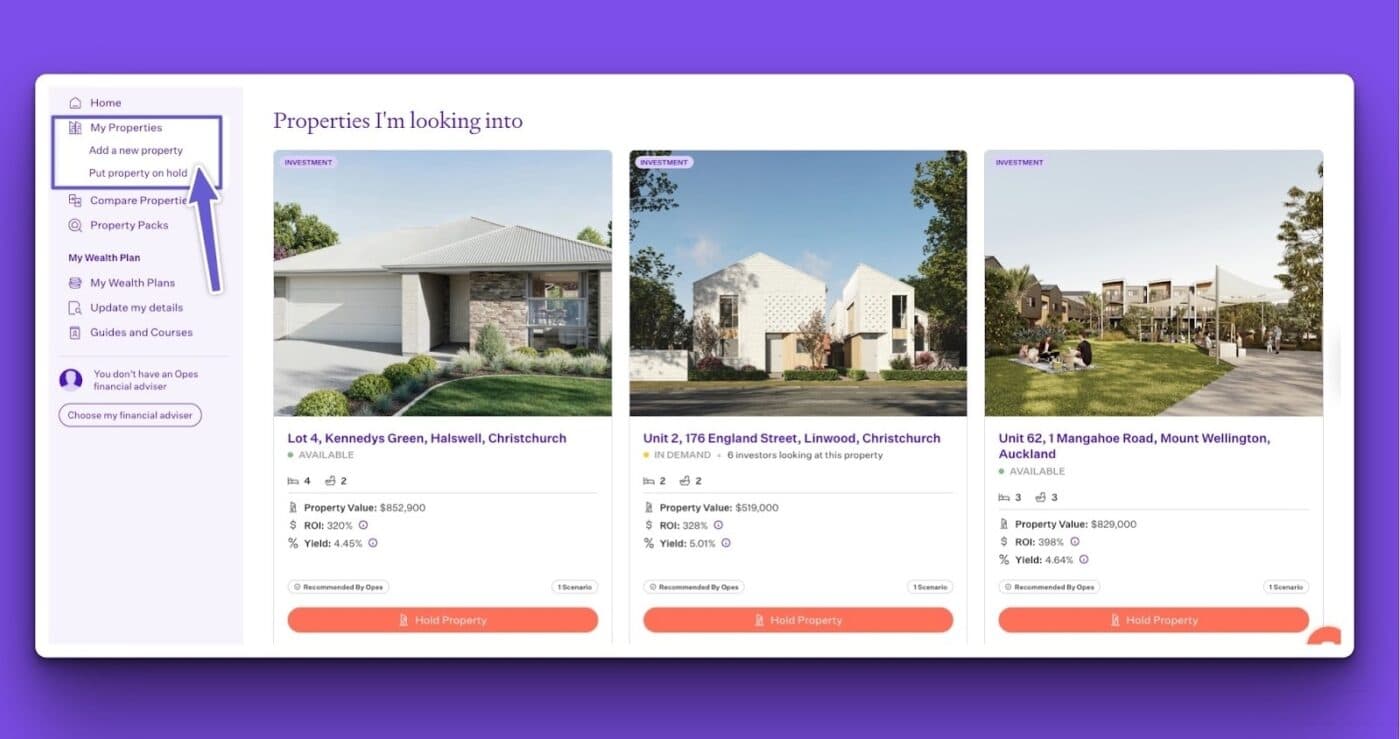

So, the second step is a one-hour session called the Property Selection Meeting.

Your financial adviser will present you with 3–4 Rent Ready properties that match your strategy.

These properties are:

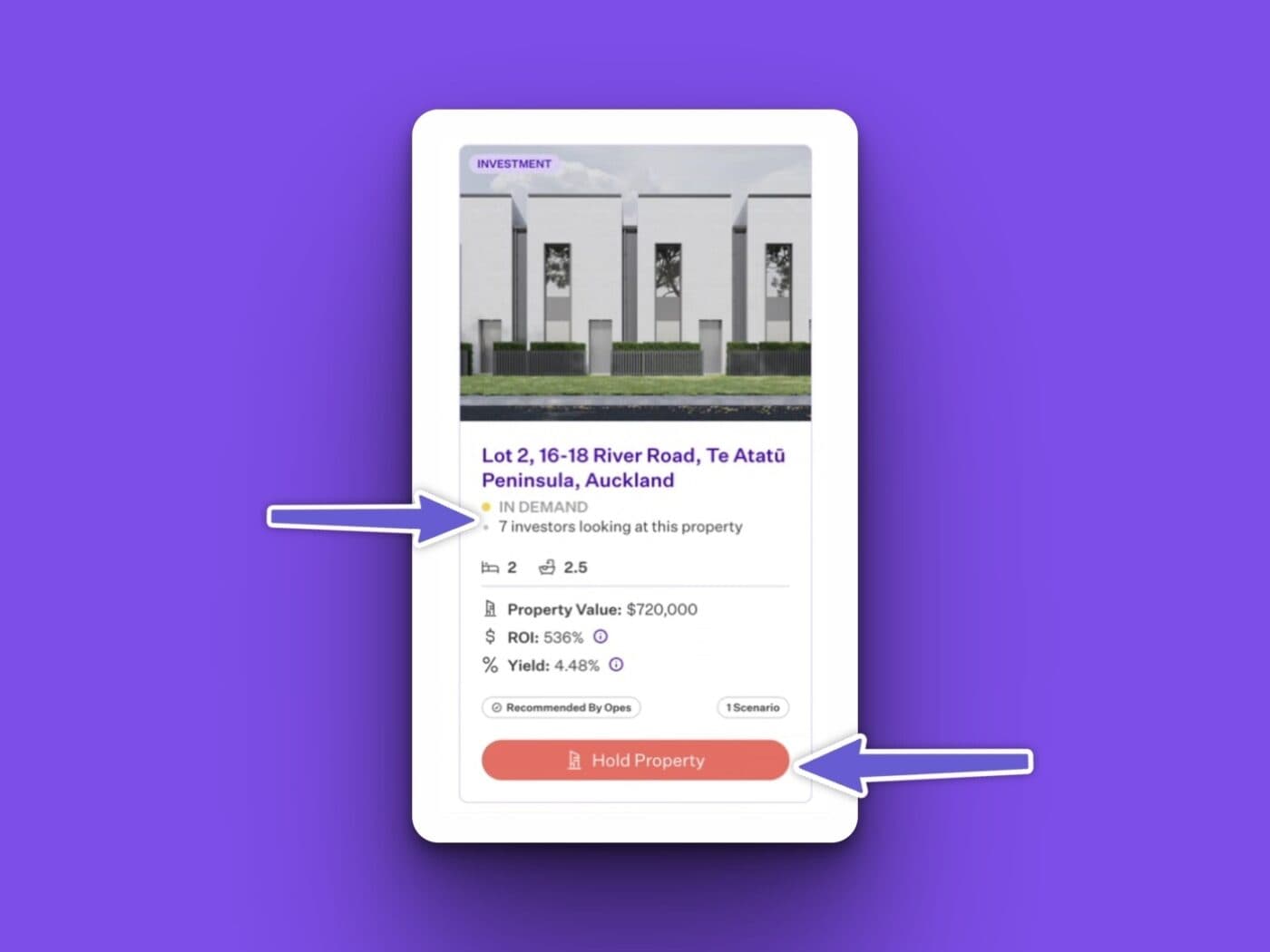

Before your meeting your financial adviser will load these properties into Opes+. This is the tool we built to help you analyse investment properties.

In that property selection meeting you’ll analyse the potential returns of each property to fund the best one for you.

You’ll also have access to each property’s information pack.

After the meeting you’ll usually have a few days to decide which property (or properties) are right for you. You can then click the button and put the property on hold (if it’s still available).

From there, you’ll sign a conditional contract – which gives you time to move into the next phase (the Detail Dive) while securing the property.

Don’t worry: this contract is conditional, so you can still change your mind.

After you sign a contract for a property you like, it's time to dig into the details.

Some people call this due diligence. But we call it The Detail Dive.

That’s because you’ll follow a few additional steps we think you should take (that others often miss).

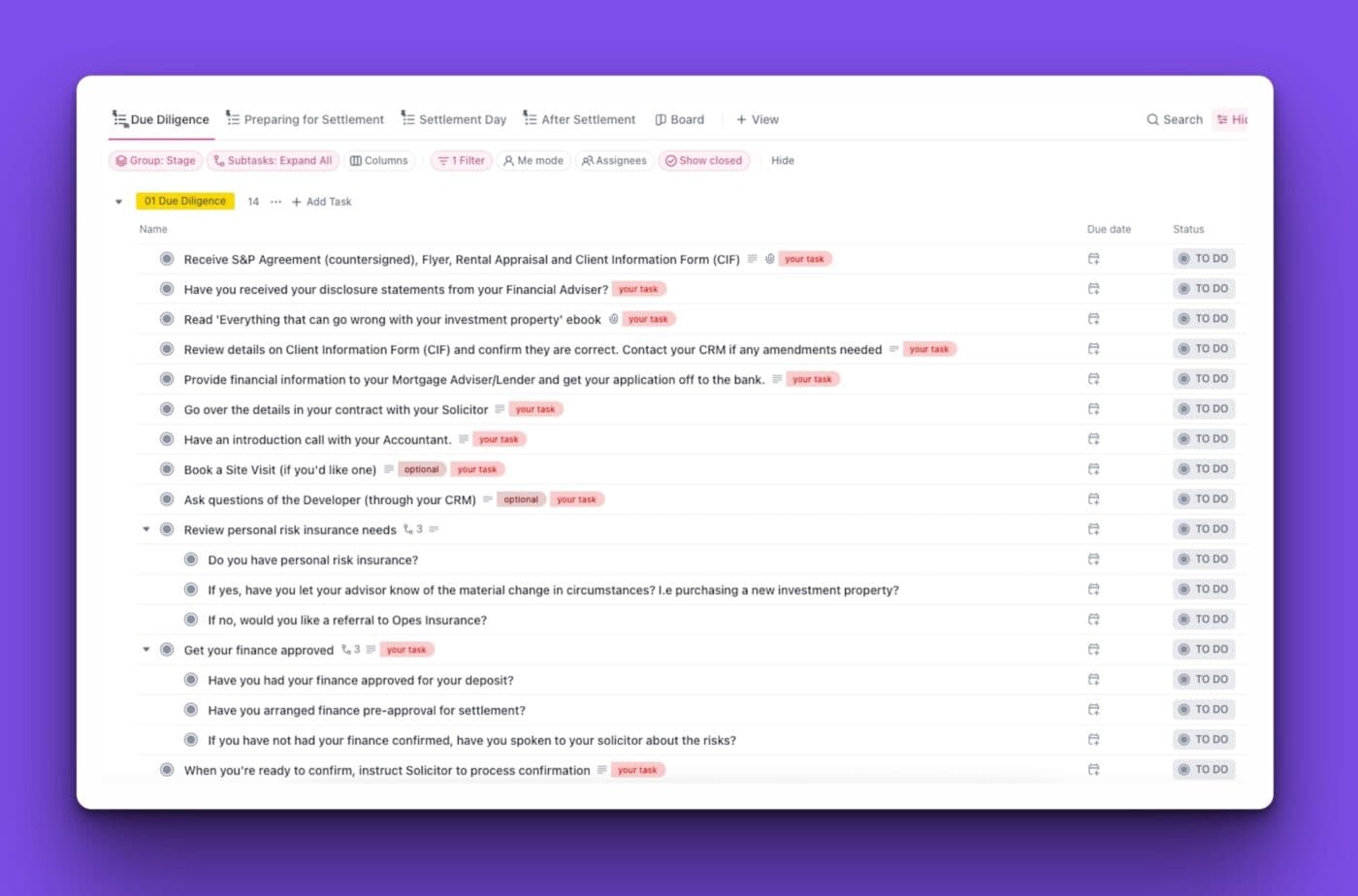

The Detail Dive is a 10-day period where you investigate the property. This is to make sure it stacks up as a worthy investment (and you can get the money to buy it).

To help you out, you’ll get access to ClickUp. This has all the tasks you need to do to see if the property stacks up.

That includes talking to a lawyer, a mortgage broker and the developer.

Over the years we’ve helped investors buy over 1,000 New Builds, so we’ve come up with processes to answer common questions and avoid the usual mistakes.

That’s why we use this tool; you’ve got our ideal process right there for you to follow.

But this can also be overwhelming. This is why you’ll work with a Client Relationship Manager (CRM). They’ll guide you through the process.

When you get to the end of the Detail Dive you can decide to Confirm the Commitment. That means deciding to invest in the property.

Or, you might decide to let the property go and look at other options.

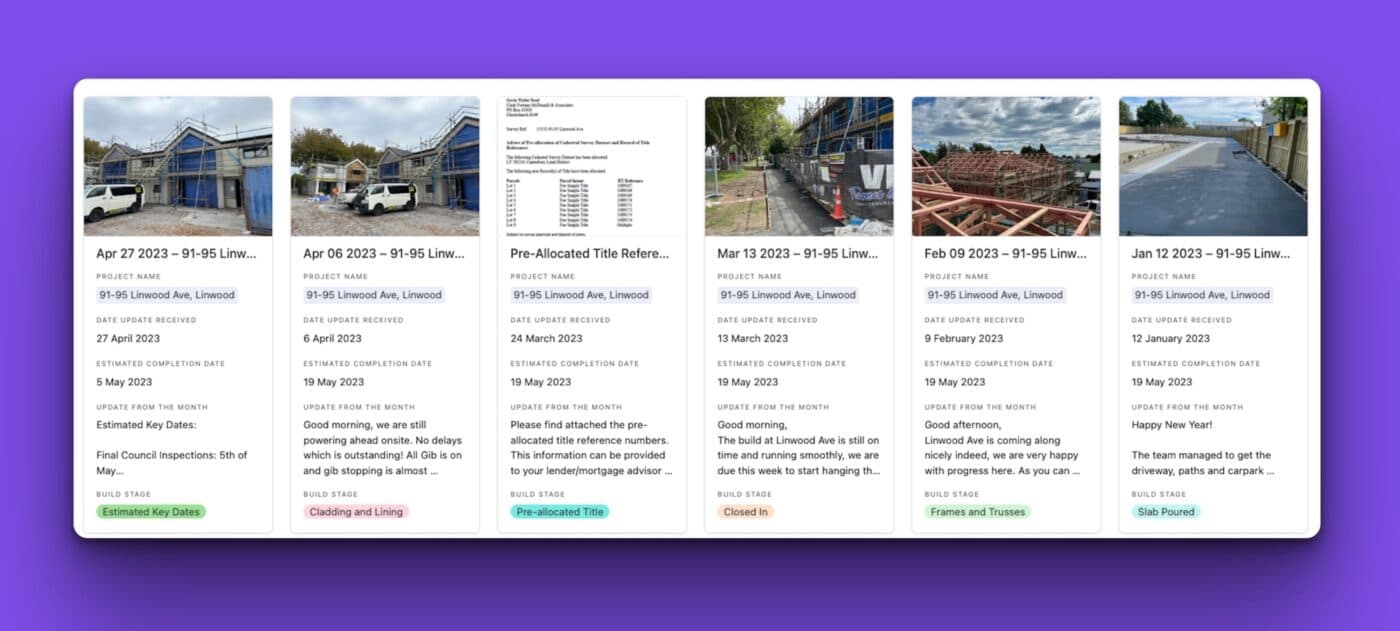

When you decide to Confirm the Commitment (and go unconditional) that’s when things kick into gear.

Your New Build property might not be built yet, so your Client Relationship Manager will send you build updates from the developer.

As your build progresses you’ll move into the Smooth Set Up. This is where you:

There’s a bit to do, and many investors struggle with this when they do it on their own.

Again, the process for what you need to do (and when) is all documented in ClickUp. These processes are only available for Opes Partners clients. We don’t release these publicly.

And your CRM will guide you through the process. That means they will:

On the big day, your lawyer will pay the money to the developer and the property is now yours.

Next, your property manager will find a tenant for your new investment property.

The final step is the Background Wealth Builder. You’ll continually manage your property while it quietly goes up in value in the background.

Your property starts earning rent, and your property manager looks after it.

Your mortgage adviser will stick around. They’ll help you choose your interest rates and manage your mortgage.

Your accountant is with you, too; they’ll be managing your taxes.

You’ll also talk to your financial adviser every year to review your portfolio and plan the next steps. And you’ll regularly review your Wealth Plan to make sure you’re still on track.

There are some costs. But most of this service is free. It doesn’t cost anything.

Some investors ask, “How is this free if I’m not paying you?”

We make money in two ways.

We get paid by the developer when we can find you the right Rent Ready property.

We’re a bit like a mortgage broker in that way. Mortgage brokers don’t charge you to work with them; they get paid a commission from the bank when they organise the lending you want.

We work in the same way, but with properties.

Our team consistently talks to developers; they’re on the lookout for good investment properties.

So, when we recommend a property to you, the property developer pays us a fee. But that’s only if we can find the right investment for you.

We try to help property investors in many ways. That’s why we also have a team of mortgage advisers, property managers and accountants.

If you choose to go through the Wealth Plan framework with us (and we do a good job) you might consider using them.

So we can earn money through:

Although, of course, it is up to you whether you choose to use these services.

If you want to get started, your next step is to choose your financial adviser and book a time for the 1-hour meeting.

This is the Portfolio Planning Session. You’ll walk away with your written financial plan.

Once you have this, you can decide whether to move on to step #2 and look at Rent Ready properties.

Click here to book your free session and choose your financial adviser.

Your next step is to book a portfolio planning session. This is where a financial adviser will create you a financial plan. They will then find properties that fit your plan.

Book your free sessionFinancial Adviser with 7 years of experience. Property investor in Wellington and Christchurch

Stevie Waring is a Financial Adviser with over 7 years of experience in property investment and a successful investor herself. Stevie has successfully guided over 200 Kiwis in their property investments, helping them move closer to achieving their financial goals.

This article is for your general information. It’s not financial advice. See here for details about our Financial Advice Provider Disclosure. So Opes isn’t telling you what to do with your own money.

We’ve made every effort to make sure the information is accurate. But we occasionally get the odd fact wrong. Make sure you do your own research or talk to a financial adviser before making any investment decisions.

You might like to use us or another financial adviser