Property Investment

Property investment NZ – The epic guide to property investment

Explore the latest in NZ property investment with our comprehensive 2026 guide. Gain insights into strategies and detailed steps for success.

Property Investment

7 min read

Author: Laine Moger

Journalist and Property Educator, holds a Bachelor of Communication (Honours) from Massey University.

Reviewed by: Ed McKnight

Resident Economist, with a GradDipEcon and over five years at Opes Partners, is a trusted contributor to NZ Property Investor, Informed Investor, Stuff, Business Desk, and OneRoof.

It can feel pretty painful to be a property investor at the moment.

Mortgage interest rates are high, so more investors have to top-up their investment properties because the rent doesn’t cover all the costs.

The average top-up for a property bought today is $350 to $550 a week. That’s if you’re borrowing all the money to invest.

That’s a lot.

So many property investors look for ways to free up cashflow. That way they can put more money towards investing in property.

So, in this article, you’ll learn 10 ways to manage that top up.

If you have any questions or thoughts, please leave them in the comments section below.

The first strategy is for those potential investors stuck on the fence.

Maybe you’re thinking about buying a property, but you don’t know if you can afford the $350 a week contribution.

A good strategy is to behave like you already own that property … right now.

Set up an automatic payment of $350 into a new savings account. Have it take money out every week.

This does 3 things:

This is more effective than only saving “what’s leftover”. This is a good way to force yourself to live within your means.

Secure a comfortable retirement with 3 easy steps

Book your free sessionMany Kiwis sign up for subscriptions and then forget about them. Things like streaming services, or random app purchases you forgot about.

These days, it’s easy to sign up and forget.

So, do an audit of your phone.

If you have an iPhone head to your settings, click your Apple ID, and scroll down to subscriptions.

This is where you can see what you’ve subscribed to, and if you don’t want it, cancel it.

Banks also have tools you can use to see what’s going in and out.

For example, ASB has a “card tracker” in the app. This shows you all your subscriptions and the places your details are stored.

BNZ has something similar; in the app swipe over to the “activity” page.

Of course, you can do it the old-fashioned way and print out your credit card statement.

Most parents know how expensive daycare is.

You’re looking at around $100 a day.

So, think about whether your job has the flexibility to work from home 1 or 2 days a week.

I know to some this may sound quite unusual. But, here at Opes Partners, quite a few of our staff are parents to young kids. So, they work from home a day a week.

Yes, it is a juggling act. And if you have screaming toddlers maybe it won’t work for you,

but it is a possibility for some people over the short term.

Most of us know we could save money by eating out less, but we still don’t do it.

That’s why eating out less is on this list. To remind you to do it … so you actually do it.

A good solution to curb the cost of restaurant meals is to limit it to one night a week.

So, set a “date night”, and that’s the only night you go out. Every other night, you eat at home.

If you’re a really bad cook, there are some options available (that cost less than a restaurant meal).

Supermarkets are designed to make you spend more.

They put the essentials like eggs and milk at the back, and the chocolate at the front. Sneaky.

This means even the most well-intentioned shopper can overspend when going in for a few items.

Have you ever walked into a supermarket looking for milk, and all of a sudden have spent $70-plus?

If you buy online you end up buying way less, and you save yourself time too.

Click and collect costs an extra $5 to your shopping bill; home delivery is $15.

It’s a cost, but it could save you money since you’ll buy less stuff.

Often it’s the financial payments that take up a lot of cashflow.

So, finding ways to reduce or consolidate those, even temporarily, can be a massive help.

For instance, hire purchases usually have high repayments.

Let’s say you’re paying back $100 a week for a $10k sofa.

What if you consolidate that debt into your mortgage? You’ll have a bigger mortgage, yes. And you’ll start paying interest, but your repayments could go down to $15 a week.

Yes, you are going to pay a lot more interest over the next 30 years if you do it this way. And no, you don’t want to be paying off a couch for 30 years.

But, if cashflow is your major issue right now, doing something like this might save you $85 a week.

Then, as interest rates come down, you might be able to pay the couch off.

Similarly, if you’ve got a lot of insurance, it might be a good idea to have a chat with your insurance adviser.

You could raise some of your excesses on your house or car insurance, to bring your premiums down.

Are you putting 10% into your KiwiSaver? If your employer is only putting in 3%, it might not be the right move for you right now.

So, it could be an idea to reduce your contributions to match your employers.

You're still doubling your money through their contribution, but you have that extra cashflow for your investment property.

And later on you can increase your contributions again, or you might put that extra money into a managed fund.

If you’re on $100k, and you reduce your KiwiSaver from 10% to 3%, you’re saving about $134 a week.

There are a few things to think through, so talk to a financial adviser before you do this.

Chop up your credit card and turn off Apple Pay.

Why? They make it easier for you to spend money.

If it’s easy to spend, you’ll spend more.

With credit cards, the issue isn’t that you get charged interest. A lot of people diligently pay off their credit card every month.

The real problem is that you spend more because you are delaying the payment.

If you feel the pain of parting with your money immediately, you give that purchase a second thought.

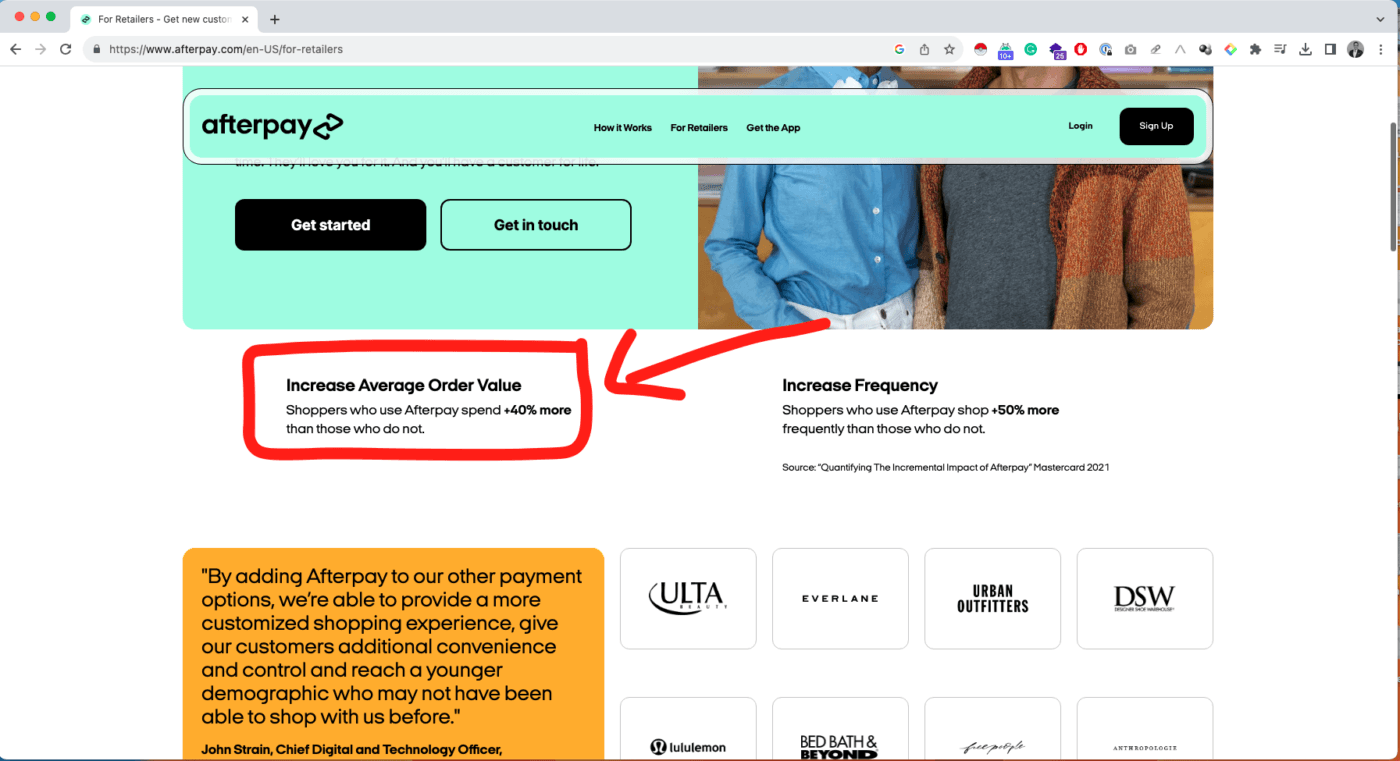

According to Afterpay’s own website, people who use Afterpay spend 40% more than people who don’t.

Here at Opes Partners we were working with a pair of investors. They had signed up to buy a property, but when it came time to take out the mortgage, interest rates had gone up.

This meant their top-up doubled. They thought it was going to be $200 a week, but it ended up being $400 a week.

What did they do?

They had 2 grown-up daughters and both were living at home rent-free.

So they asked them to pay $100 a week board. This bridged the gap, so the property was still affordable.

And finally, our favourite: Go ask your boss for a pay rise.

It will surprise you how often this works.

We know a pair of investors who increased their household income by $40k a year.

But even an extra $5k a year might equate to an extra $80 a week (after tax).

That’s enough to make a dent in an investment property top-up.

Many investors do ask us: “Why would I invest in today’s market when I have to pay such high top-ups?”

It can seem like a logical decision to wait until interest rates come down.

And the truth is … it might not be the right time for some investors right now.

But, there is always something working for and against you in the property market.

Yes, right now interest rates are high, but property prices have dropped.

So, there’s an opportunity for investors to get into the market while property prices are low.

Then, as rates come down, you can breathe a little easier. But you still have the benefit of having bought that property, at that lower price.

You can’t control interest rates, but you can control the property you buy, and how disciplined you are with your money.

These strategies are some inspiration to help you on your way.

Journalist and Property Educator, holds a Bachelor of Communication (Honours) from Massey University.

Laine Moger, a seasoned Journalist and Property Educator holds a Bachelor of Communications (Honours) from Massey University and a Diploma of Journalism from the London School of Journalism. She has been an integral part of the Opes team for four years, crafting content for our website, newsletter, and external columns, as well as contributing to Informed Investor and NZ Property Investor.

This article is for your general information. It’s not financial advice. See here for details about our Financial Advice Provider Disclosure. So Opes isn’t telling you what to do with your own money.

We’ve made every effort to make sure the information is accurate. But we occasionally get the odd fact wrong. Make sure you do your own research or talk to a financial adviser before making any investment decisions.

You might like to use us or another financial adviser