Private Property – our weekly newsletter that gives you insights into what's happening in the NZ property market. Written by managing director Andrew Nicol. Sign up to receive this in your inbox every Thursday.

“Aaaargh!!! 50 basis points!! Our rental cashflow is going to take a hammering!”

This is an actual text I received yesterday, from one of my investors.

That’s because the Reserve Bank announced they will lift the OCR by 0.5% (to 1.5%).

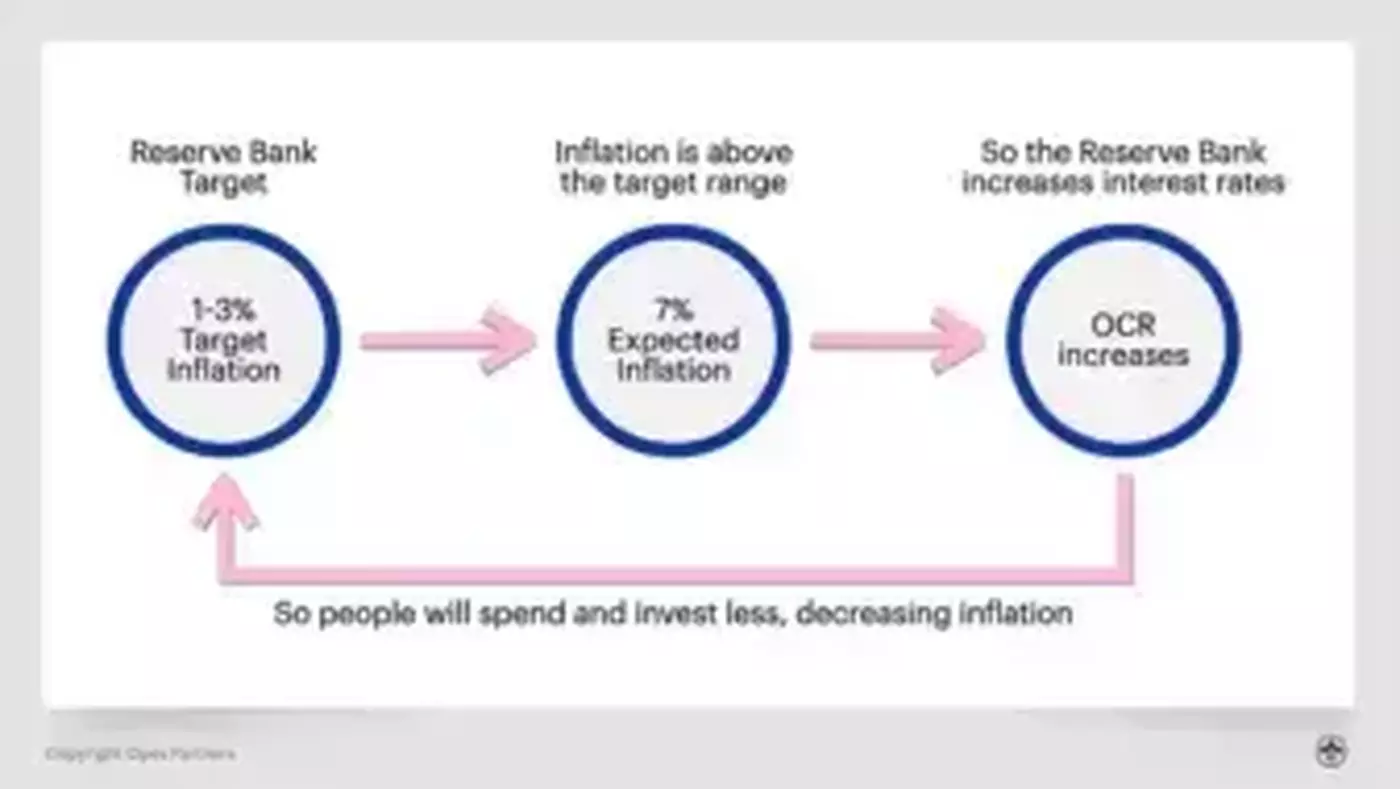

They’ve made this move to fight inflation and the rising cost of living – which is expected to peak later this year at 7%.

Before we talk about what higher interest rates mean for you as an investor – here's a quick summary of why the Reserve Bank made the move.