Mortgages

How do I get a mortgage and pay it off?

This 9,500-word Epic Guide to Mortgages is the definitive article on how to get a mortgage and pay it off faster, today in 2026. The Ultimate Guide.

Mortgages

9 min read

Author: Peter Norris

Mortgage broker for over 10 years, property investor and Managing Director at Opes Mortgages

Reviewed by: Ed McKnight

Resident Economist, with a GradDipEcon and over five years at Opes Partners, is a trusted contributor to NZ Property Investor, Informed Investor, Stuff, Business Desk, and OneRoof.

It’s great news. You’ve found the right investment property, applied to the bank for the money ... and they said yes.

They’ve sent you an approval letter, and everything is going well. Or so it seems.

But these approval letters contain a lot of information.

So property investors often have questions about what their approval letter actually means.

That’s why in this article, you’ll learn:

Quick facts:

Approval letters show you:

An approval letter is good news. It is the document from the bank that confirms they are willing to lend you money, although it may sometimes still have conditions.

This is different from a pre-approval letter. But confusingly – you may receive one before your off-the-plan property is actually built.

Generally, you will get the approval letter 6 to 12 months before you settle and pay for the property.

This letter is important. It is the bank confirming that they will lend you $X to buy your property.

It will also confirm:

It will also include some final conditions required by the bank.

This is your checklist of what you still need to do to get the money released.

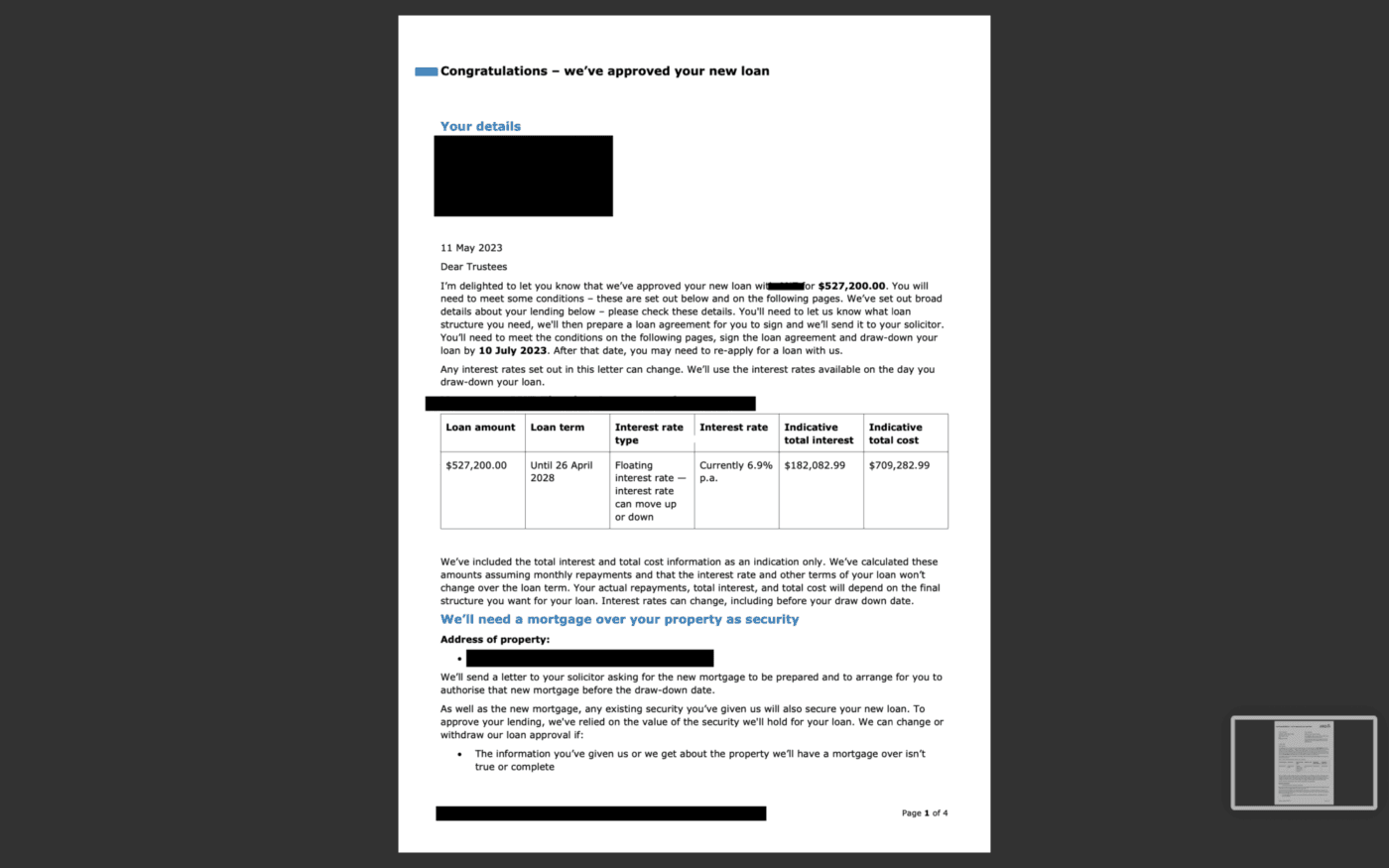

Here is an example of a real approval letter from ANZ. We’ve redacted the personal information for privacy reasons.

The first page states:

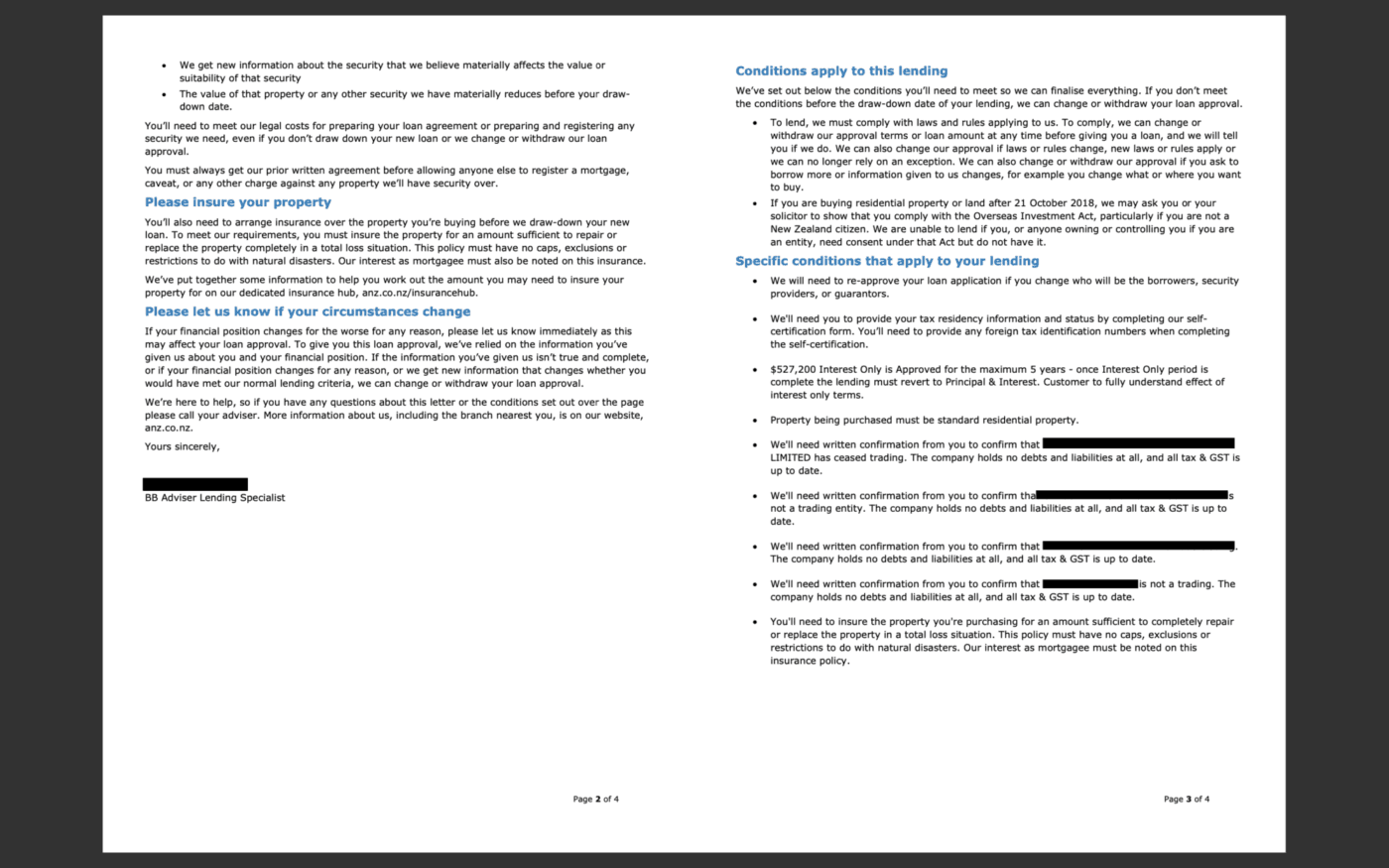

The second page outlines some of the conditions the investor still needs to meet:

There are some others too. For instance, if your personal circumstances change, you will need to tell the bank.

That’s because they approved your loan based on the information you gave them.

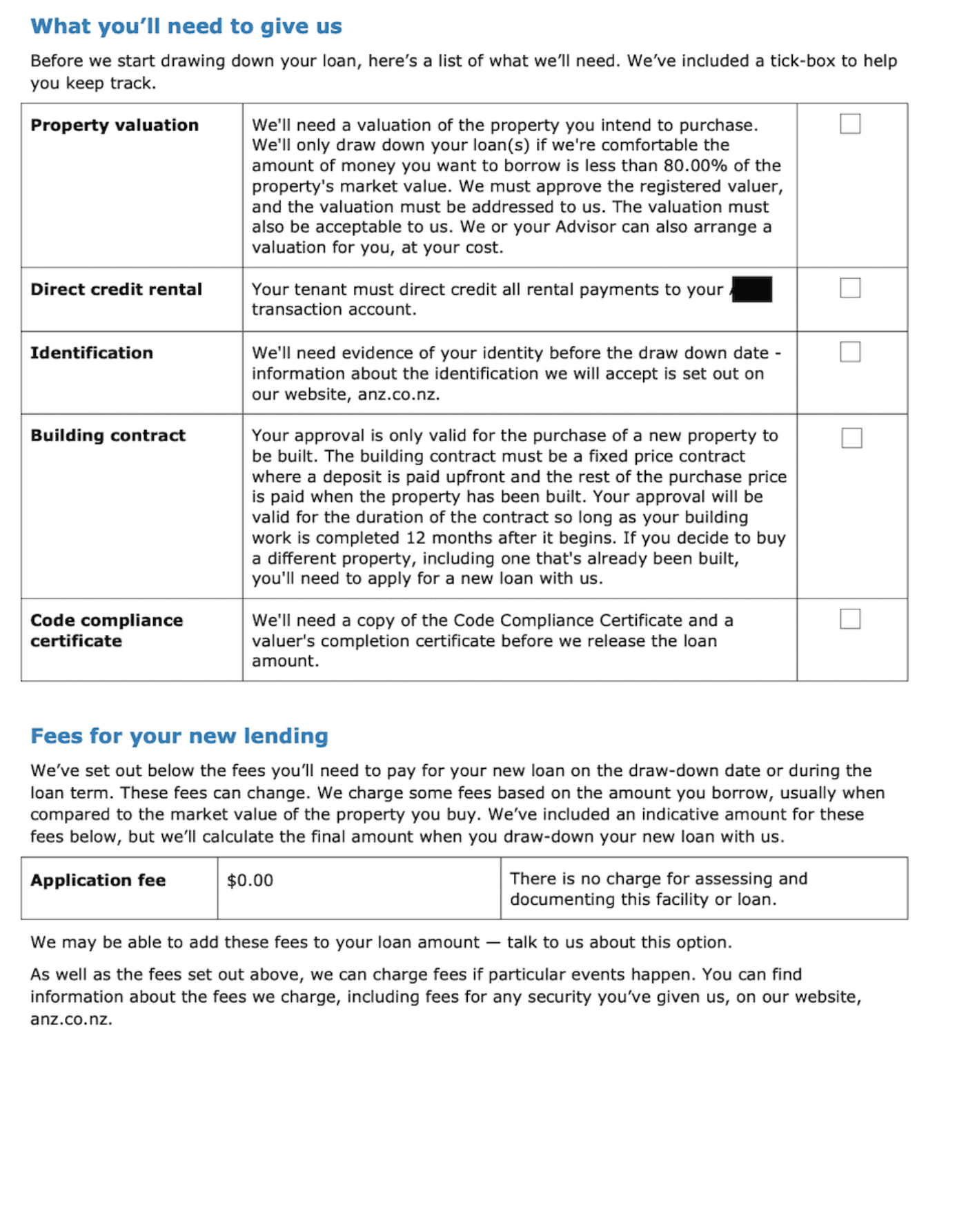

The third page is the tick-box list.

The investor has to provide 5 documents to get the loan.

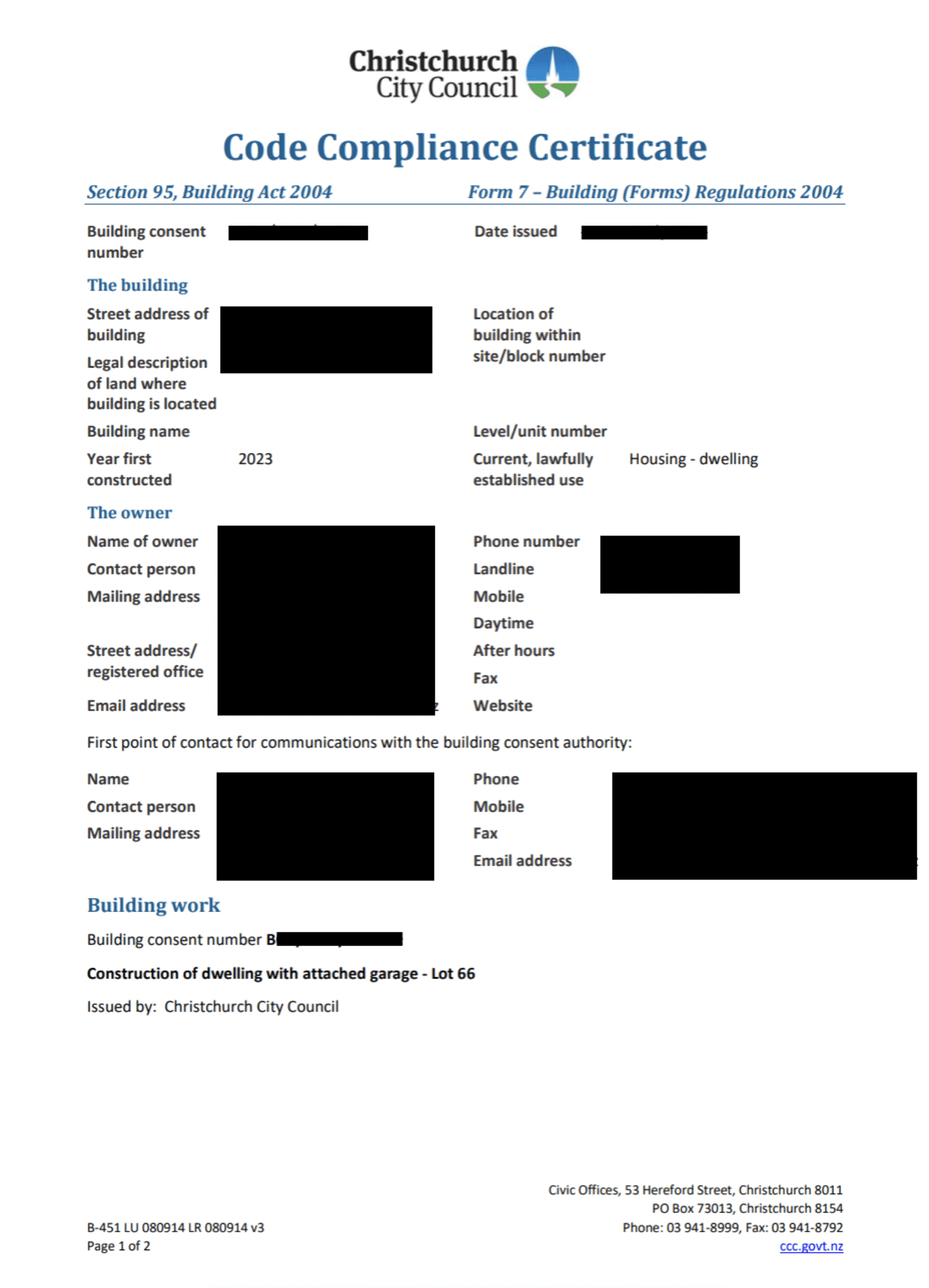

The last document is the Code Compliance Certificate. This will come 10 days before the investor settles and pays for the property.

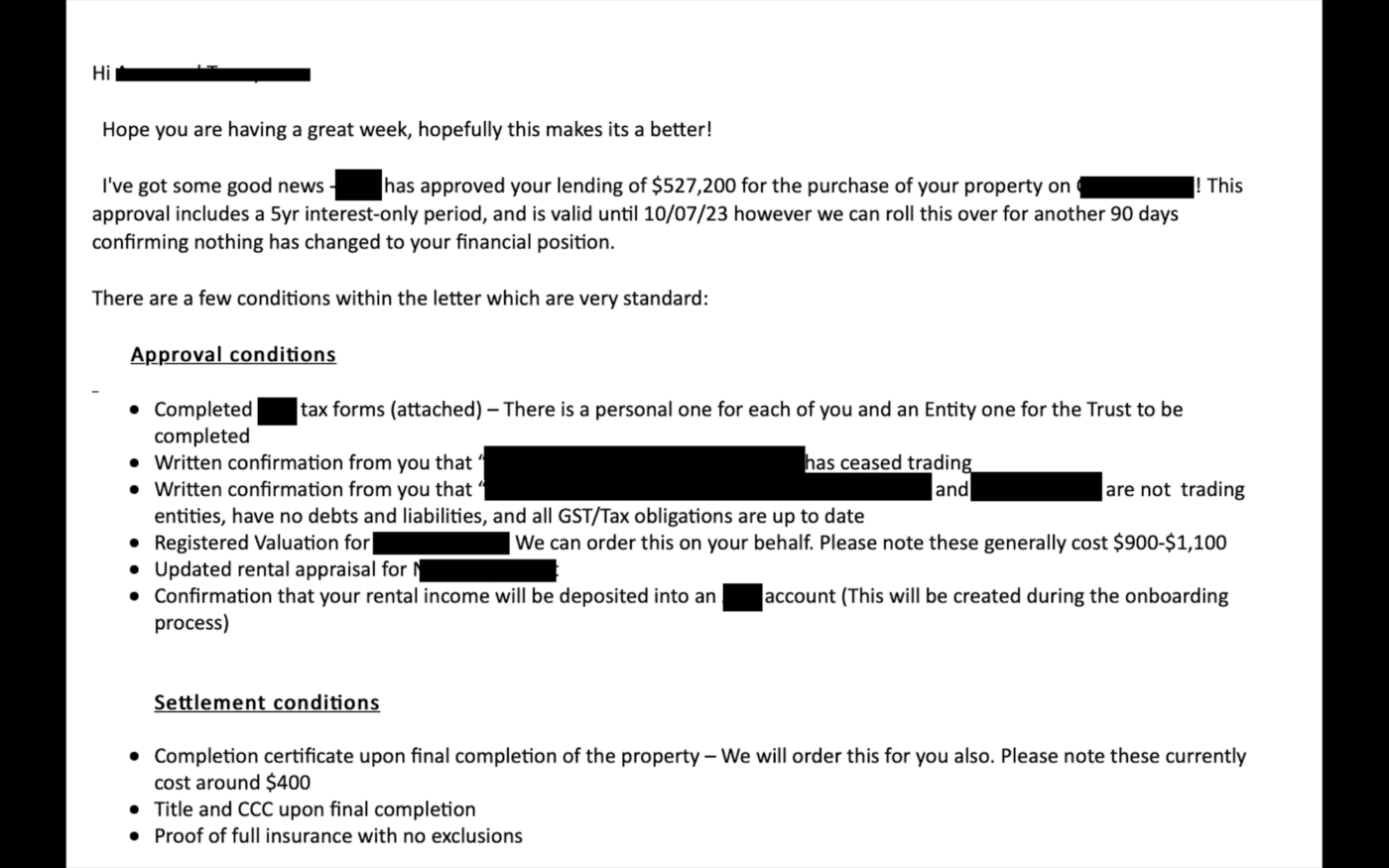

Your mortgage broker will email you the approval letter as an attachment. At the same time, they will usually send you other tax forms to fill out.

They’ll often write out the conditions in the body of the email.

For instance, it usually starts with something like ... “I've got some good news - ANZ has approved your lending of $X for X property”.

It will then bullet point the most critical information you need to know.

For example:

Here is an example of an email Ella Mclean, a mortgage adviser, sent to the investors.

Sometimes investors see conditions in their approval letter that they didn’t expect.

Here is a list of the most common questions:

Generally, interest-only loans last for 5 years (at most).

But sometimes the bank will only approve interest-only for 2 or 3 years.

That is usually for 1 or 2 reasons:

1) The specific bank doesn’t lend interest-only for 5 years. For example, some banks only do up to 3 years interest-only, so you may have the longest period available at that bank.

2) The bank doesn’t think you can afford 5-years interest only.

Let’s explain this second point a bit more.

When you get interest-only, you actually get a 30-year principal and interest mortgage.

It just starts with a 5-year interest-only period.

This means at the end of those 5 years your loan will revert to principal and interest by default. (It says this in the approval letter).

But remember, you won’t have been paying down the total loan amount in the first 5 years.

This means at the end of that 5 years you’ve got your whole mortgage waiting for you, but now you only have 25 years to pay it off.

So, before the bank approves your interest-only period, they ask ... “Will this borrower be able to repay the loan over 25 years?”

If the answer is “yes”, you will likely get 5 years interest-only.

If the answer is “no”, they will keep reducing the interest-only period until they can say “yes”.

For instance, let’s say the bank only approved you for 2 years interest-only. That means they think you can only afford a 28-year principal and interest loan term.

The bank requires a registered valuation when buying a New Build.

Your mortgage broker will organise this for you. This costs somewhere between $900 and $1100.

This part is important: Don’t organise your own registered valuation. The bank won’t accept it, and you will have to pay again.

The valuation is usually done when you organise the 10% deposit for your New Build.

Most of the time the New Build isn’t built yet, so the valuer makes their assessment off the plans.

Once construction finishes you’ll get that same valuer back to the property. They then create a completion certificate (see next section).

Once the developer finishes your New Build you need to get the valuer back to the property.

They will create a Completion Certificate.

This is the valuer acting as the eyes and ears of the bank.

The certificate basically says: “Yes, this property is worth X amount and is ready for tenants to move into.”

Your mortgage broker will order this for you, and it costs around $400.

This process takes up to 3 weeks. It is usually 7 to 10 days before the valuer can view the property. Then it might take 5 days for the valuer’s report to come through.

That is why you want to work closely with your mortgage broker to organise this well in advance.

A Code Compliance Certificate (CCC) says the work matches the building consent. It’s a document issued by the council to show that the building complies with the Building Act.

It’s a formal statement saying the property is what it promised to be.

The title is the legal description of the land the property is on, along with a record of who owns it (you, as the new owner).

Most of the time a title is issued before you settle and pay for the property. But not always.

These two documents will come from your solicitor at the very end of the buying process.

Say you buy a townhouse in a development where 5 or more properties are connected.

This group of properties will have one insurance policy.

There is no wiggle room to change it. This means you and your neighbour will use the same insurance company.

This often raises questions for investors as many townhouses have a fee simple title.

They often think they can choose the insurer because they are buying a freehold title, but in reality they can’t.

But this one-for-all policy is for a good reason.

For example, you buy into a development with 50 townhouses. Each has its own insurance policy with a different insurer.

What happens if there is damage caused to a shared driveway?

With too many insurance companies involved, claim time will be messy.

So, when there are 4 properties or less, it’s manageable for each to have its own insurance.

After that, one insurer covers the lot.

This insurance will be run through a body corporate or residents’ association. This association will divvy up the premiums and invoice the owners to pay their share.

A single credit card can impact how much you can borrow … even if it stays in your wallet and you never use it. Why?

Because the bank has to assume the worst-case scenario.

If you have a credit card, a bank will assess your mortgage application as if you have already maxed it out.

That's because once you get the mortgage, you could go and max out your card.

So, if you have a $10,000 limit on a credit card (even unused), this can cost you up to $55k worth of borrowing power.

The interest rate you see on your approval letter is going to be very high. Don't panic.

Why? Because it is the bank’s current floating rate.

The bank can only offer rates once you get closer to settlement. This is because there is a limited length of time they will hold them, without having a customer paying for them.

(This is the same for a cash contribution- banks don’t often have these on an offer letter as the promotions are subject to change).

In practice, the bank puts this rate on the offer to illustrate what the repayments would be at that rate. It’s not an interest rate offer.

So, once the loan conditions are met, we will negotiate rates (fixed and floating) for you, the investor.

Approval letters only last for a set amount of time. Your letter will say the end date on the first page.

If you don’t provide all the details the banks ask you to before this date you’ll have to start the process again.

Mortgage broker for over 10 years, property investor and Managing Director at Opes Mortgages

Peter Norris, a certified mortgage adviser with 10+ years of experience, serves as the Managing Director at Opes Mortgages. Having facilitated over $1.2 billion in lending for 2000+ clients, Peter is a respected authority in property financing. He's a frequent writer for Informed Investor Magazine and Property Investor Magazine, while also being recognized as BNZ Mortgage Adviser of the Year in 2018 and listed among NZ Adviser's top advisers in 2022, showcasing his expertise.

This article is for your general information. It’s not financial advice. See here for details about our Financial Advice Provider Disclosure. So Opes isn’t telling you what to do with your own money.

We’ve made every effort to make sure the information is accurate. But we occasionally get the odd fact wrong. Make sure you do your own research or talk to a financial adviser before making any investment decisions.

You might like to use us or another financial adviser