New Builds

New builds - The ultimate guide for every property investor

Explore the essentials of investing in new builds. Our guide covers key strategies, benefits, and tips to navigate the market and maximise your investment.

Property Investment

9 min read

Author: Laine Moger

Journalist and Property Educator, holds a Bachelor of Communication (Honours) from Massey University.

Reviewed by: Ed McKnight

Resident Economist, with a GradDipEcon and over five years at Opes Partners, is a trusted contributor to NZ Property Investor, Informed Investor, Stuff, Business Desk, and OneRoof.

If you buy a New Build townhouse or apartment, you’ll probably share parts of your property. There might be a shared driveway, wall or just common green areas.

Because of this, you need to have rules. You need to manage things like maintenance, insurance, and what people can and can’t do.

That’s why, if you buy a townhouse or apartment, you’ll often have either:

Body corporates involve owning the inside of your apartment and co-owning the building, common areas, and the land underneath, while residents' associations mean you own the land beneath your townhouse and co-own any common areas with your neighbors.

In this article, you’ll learn the main differences between the two options.

The big difference is how you own the land underneath the buildings.

Body corporates are compulsory under the Unit Titles Act. Unit titles are common with apartments.

This is where you own the inside of your apartment, but,you co-own the building, the common areas, and the land underneath.

Residents’ associations are a newer concept. They were created because developers are building more townhouses.

You own the land underneath your townhouse. Then you co-own any of the common areas with your neighbours. These are things like driveways, car parks and the grassy patches outside.

Typically, these associations are set up as an incorporated society.

Most townhouse developments with 10 or more units have a residents’ association. But, we at Opes prefer having a residents’ association whenever there are 5+ units.

Most of the time the developer will set up the association, but this isn’t always the case.

Residents’ associations and body corporates serve the same purpose; they are just different legal entities.

More from Opes:

Multi-unit apartments always have a body corporate. It’s compulsory under the law.

But townhouses don’t always have to have a residents’ association. It’s not legally required.

That’s because if you own a townhouse, it’s easy to own the land underneath it. But if you have four apartments stacked on top of each other, then you all need to own the land together.

Generally the developer will organise the body corporate or the residents’ association, although this isn’t always the case.

When you buy the property from the developer, you’ll need to join a body corporate or association. That will be one of the conditions of buying.

A residents’ association tends to have lower ongoing costs.

Why? Because a body corporate has more responsibility and organises more services.

For instance, a body corporate might own the exterior of an apartment block. So, it will organise a building wash and maintenance.

This costs money, and all owners pay a fee towards covering this maintenance.

But, with a residents’ association, you own the exterior of your building. So, the washing and maintaining is your responsibility. This also costs money, but you pay the cost yourself when they happen.

This means you don’t have to pay the residents’ association as much money per year, but you’ll still end up paying maintenance costs over time. This comes with the standard upkeep of your own home – like any homeowner.

Because body corporates are a legal requirement, they have more administration. This means more paperwork, more compliance and more cost to keep everything tickety-boo.

This is another reason a residents’ association tends to be cheaper.

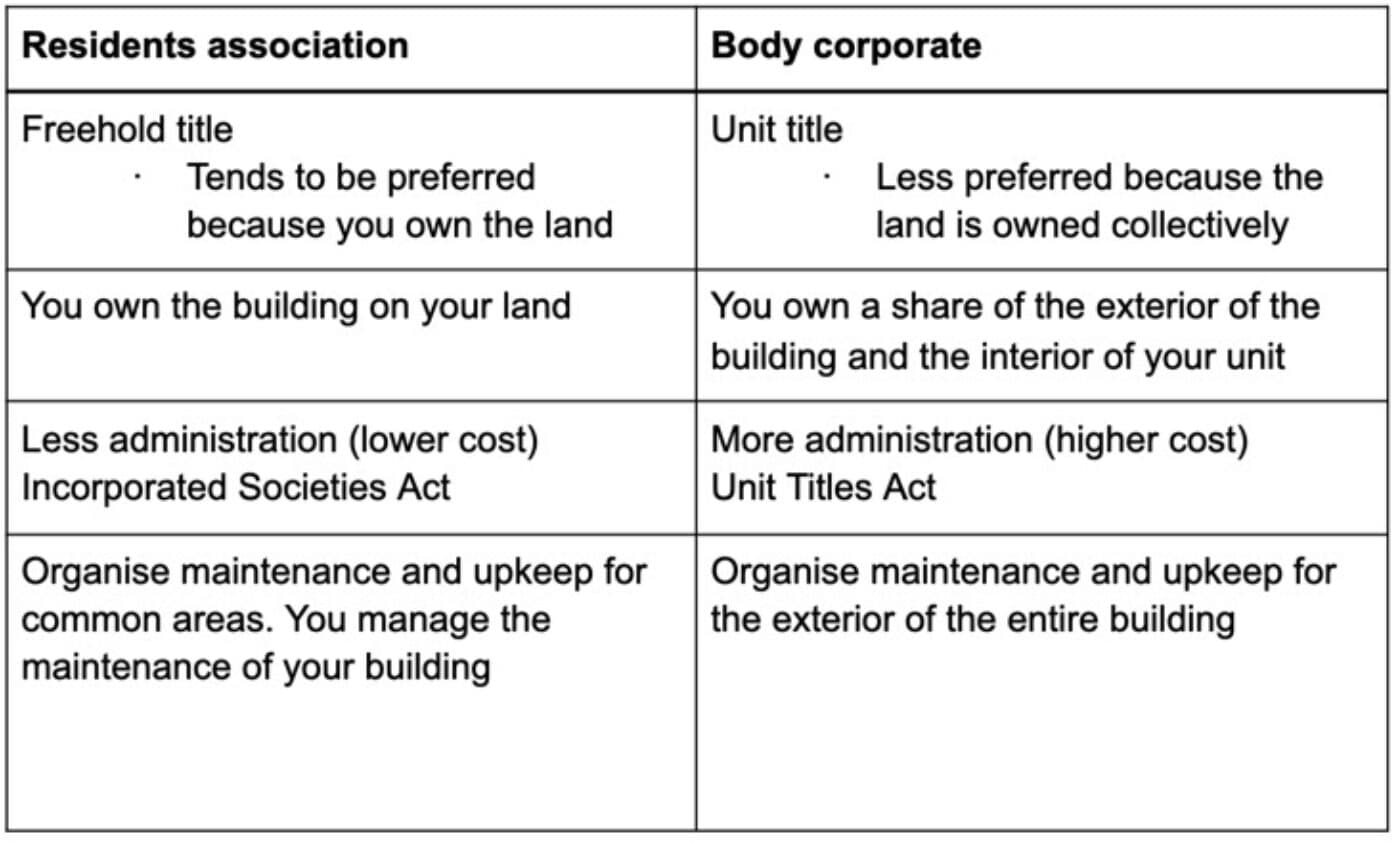

Here is a table outlining the differences between the two:

Each residents’ association will have different costs. That means some will be more expensive than others.

If the association has larger common areas, they’ll need more money, so you’ll pay a higher residents’ association fee.

Here at Opes Partners, we typically budget $500 a year for residents’ association fees, but these can go up to $900 annually.

On top of this, you may need to pay your insurance through the association too.

But if you do get insurance through your residents’ association, you might save money. That’s because you buy your insurance policy as a group and get a group discount.

You’ll agree the annual membership fees and the budget for the year at the Annual General Meeting.

It can be hard to work out the costs associated with a residents’ association when buying New Builds. This is because the developer won’t set up the association until the properties are almost built.

You should also know that each member might not pay the same amount. If you have more access to the common areas or a larger piece of land, you may pay a larger share of the levies.

This will be set out in the constitution of the residents’ association. You’ll get this from the developer.

Insurance is different if you buy in a townhouse development where 5+ units are connected.

In that case you need to have a group insurance policy. There is no wiggle room to change it.

This is usually organised by the residents’ association, but in some cases it’s not. So be sure to check this.

Regardless, you still need to pay these costs. Happily, group insurance will often end up being cheaper.

Generally speaking, body corporates are more expensive. But, again, fees vary.

You pay a difference based on the size of the apartment, car parks, and amenities in the building.

These are set by a registered valuer before the build begins. Here’s an example of the fees one apartment development had. We, here at Opes, were helping investors buy apartments in a new development.

The body corporate fees ranged from $2,808 for a one-bedroom, to $3,569 for a two-bed dual-key.

Generally, body corporate fees range from $2,500 - $4,500 a year.

Some complexes will have elevators, pools and gyms. These add significant costs.

So, if these nice-to-haves are within the building, expect to pay a bit more. If they’re not, expect to pay a bit less.

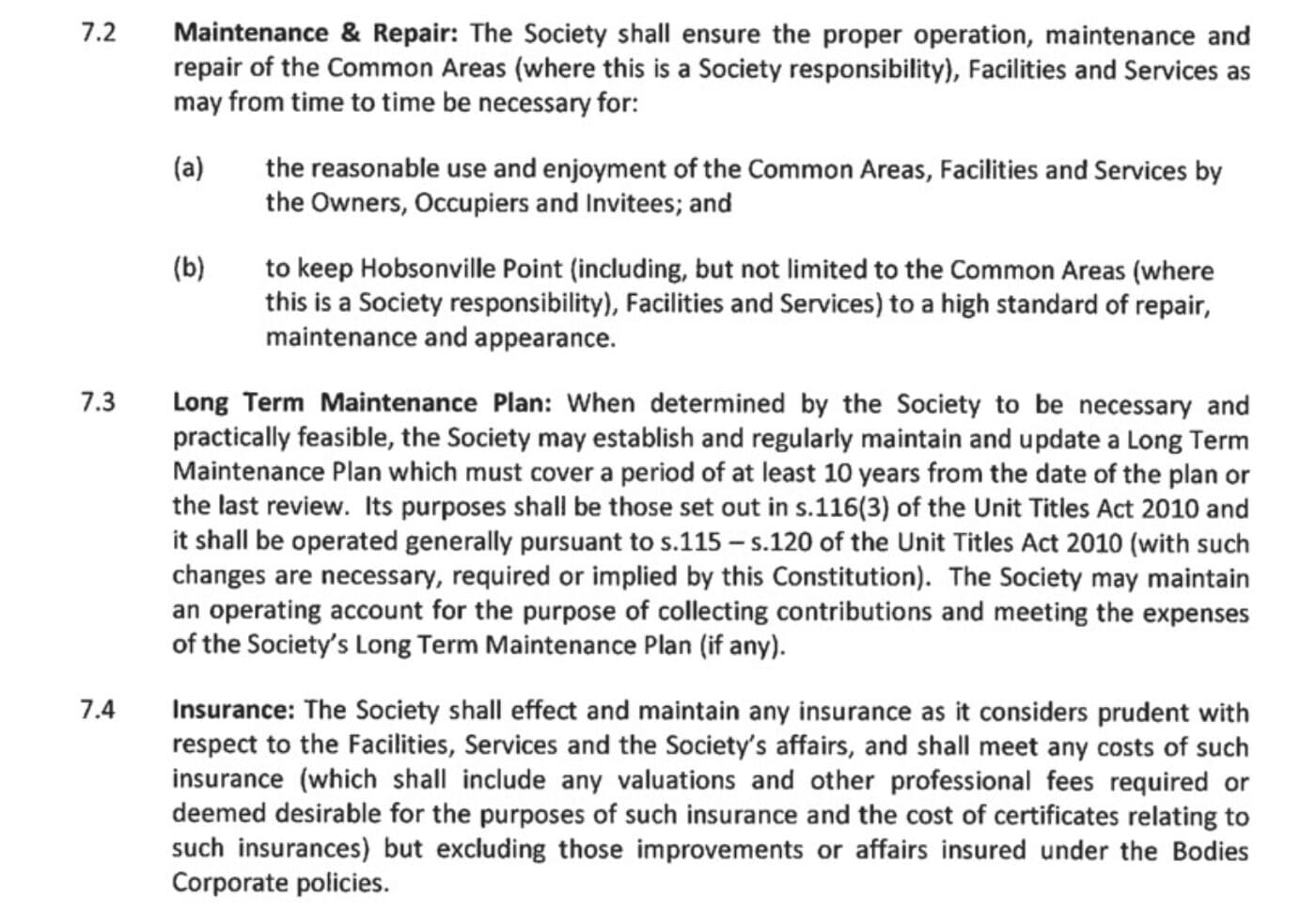

Older buildings often need more maintenance. So, these body corporates will often have a “sinking fund” or a Long-Term Maintenance fund. This covers long-term costs.

Some older apartment buildings we’ve seen have body corporate costs over $6,500 per year.

Often, yes. It’s like a body corporate. If a developer is setting one up, joining the association will be a condition of sale.

It sounds harsh, but it’s not negotiable. If you don’t like it, don’t buy the property.

Legally there will be an encumbrance on the title. That means whoever buys the property must join the association and pay the fees.

Usually associations will outsource the management to a professional company. This includes companies like Crockers Body Corporate Ltd or Auckland Property Management.

Helen O’Sullivan, from Crockers, says each association has a constitution that includes:

Don’t be put off by the compulsory aspect of joining the association. It often works in your favour.

If your neighbour wants to paint their house bright pink or park a used car on the lawn ... that impacts your property. So, you want rules to make sure that doesn’t happen.

What sort of rules will I have to follow?

Each residents’ association has a constitution. This document sets out the rules.

If the developer sets up the society, their lawyer will draft a constitution. These are all publicly available through the Incorporated Societies Register.

So, if you’re buying an already-built property that has an association set up, you can look up these rules.

The constitution covers how the residents’ association runs. These are important (but sometimes boring). Things like:

But, it also sets out rules for how residents (your tenants) behave.

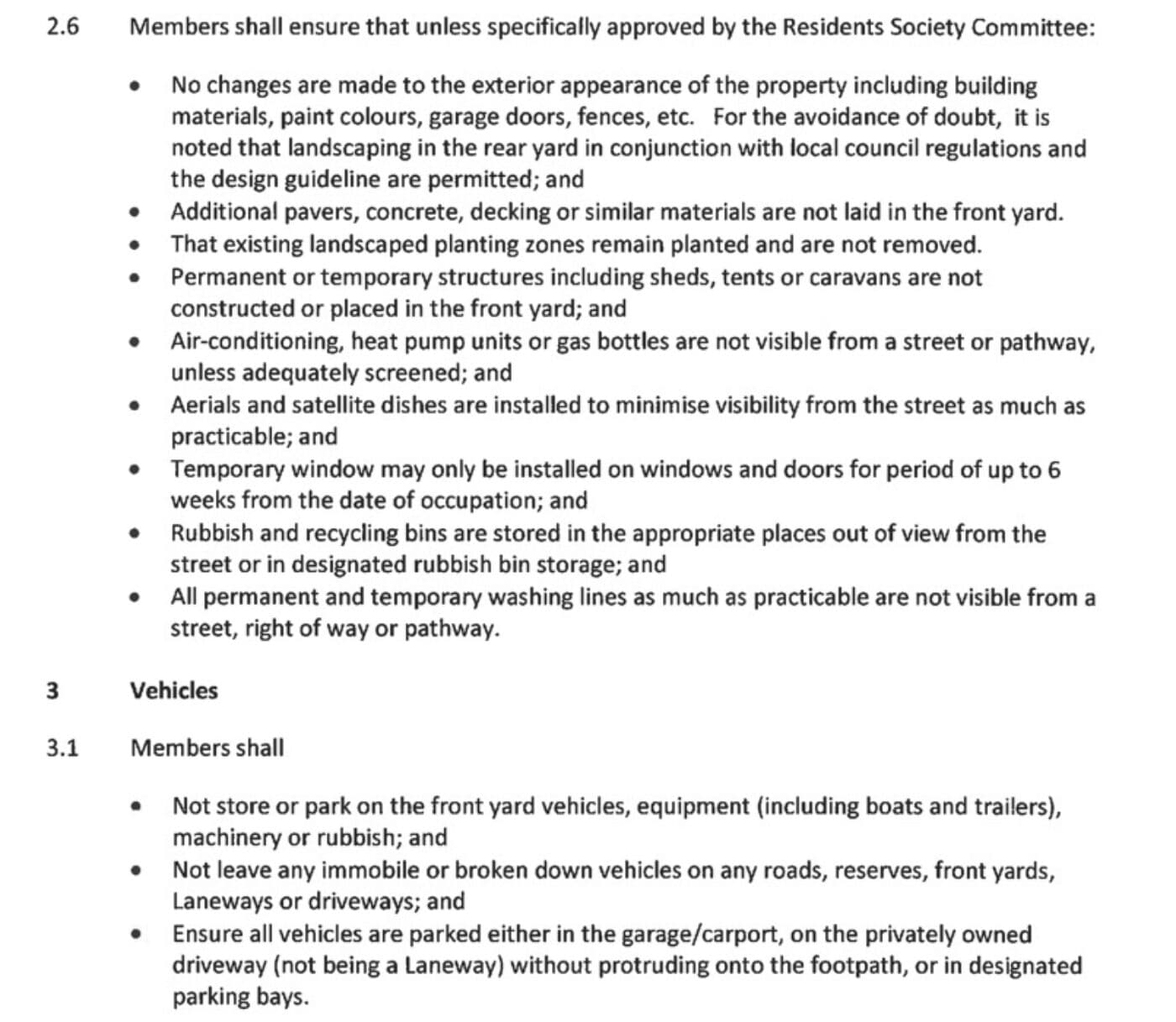

For instance, in one Hobsonville Point residents’ association constitution there are rules around:

Here’s an example:

The residents’ association does not cover everything. There are still things that are your responsibility.

These things include your rates, landlord’s insurance, and the maintenance of your building.

How does a residents’ association function?

Even if an external company, like Crockers, runs things, this doesn’t mean you can sit back and relax.

There are annual meetings to attend to play your part. But, your property manager may attend these in your place.

Also, your association will elect a committee and chairperson. They administer the society and make sure the professional company does its job.

You might decide you want to be a member of this committee.

Some investors worry about properties with a residents’ association or body corporate. They see it as an extra cost.

But, these associations work for you. They’re there to make sure your investment is maintained over time.

They make sure you pay your fair share alongside your neighbours.

It also keeps you from appearing on an episode of Neighbours at War.

Journalist and Property Educator, holds a Bachelor of Communication (Honours) from Massey University.

Laine Moger, a seasoned Journalist and Property Educator holds a Bachelor of Communications (Honours) from Massey University and a Diploma of Journalism from the London School of Journalism. She has been an integral part of the Opes team for four years, crafting content for our website, newsletter, and external columns, as well as contributing to Informed Investor and NZ Property Investor.

This article is for your general information. It’s not financial advice. See here for details about our Financial Advice Provider Disclosure. So Opes isn’t telling you what to do with your own money.

We’ve made every effort to make sure the information is accurate. But we occasionally get the odd fact wrong. Make sure you do your own research or talk to a financial adviser before making any investment decisions.

You might like to use us or another financial adviser