Property Types

What is a cross lease? Pros and cons

Learn what a cross-lease property is, and what you need to know before buying or selling one – to ensure you don’t trip on commonly found issues.

Property Types

8 min read

Author: Laine Moger

Journalist and Property Educator, holds a Bachelor of Communication (Honours) from Massey University.

Reviewed by: Ed McKnight

Resident Economist, with a GradDipEcon and over five years at Opes Partners, is a trusted contributor to NZ Property Investor, Informed Investor, Stuff, Business Desk, and OneRoof.

If you’re thinking about investing in a new build investment property, you’ve probably seen that most properties being built today are townhouses.

That leads many investors to think, “are townhouses a good investment?”

In this article, you’ll learn what a townhouse is and how they stand up as an investment property.

Though, just before we get into it, you should know that here at Opes, we recommend a lot of townhouses to investors.

That does mean there is an incentive for us to say that townhouses are a good investment.

But, this will still be an unbiased review based on the facts. Because the truth is, investing in townhouses isn’t the right fit for every investor.

Do you have a question or comment about townhouses? Feel free to leave your thoughts in the comment section at the end of the page.

Let’s begin with what a townhouse actually is.

Often, when discussing townhouses, we’re referring to terraced housing.

It’s usually a row of properties attached by at least one wall (if you’re on the end) or joined by two if your townhouse is in the middle.

This is what you commonly see in central areas, and they are your classic developments from Wolfbrook, Williams Corporation and similar other developers.

But, unlike apartments, townhouses come with their individual front doors, either accessible directly from the street or down a shared driveway.

Typically, townhouses are spread over 1 to 3 storeys, have a private patio garden, and often come with an internal garage or off-street car parking.

Townhouse developments can also vary in size, ranging from small, single-digit clusters to large scale neighbourhoods.

But there are other types of townhouses too:

Townhouses are an attractive way for first home buyers to get on the ladder in central locations and are often purchased by investors.

This is because they are more affordable than standalone houses; new build townhouses come with significant tax benefits and have a reasonable yield and capital growth mix.

Townhouse living is becoming more popular as New Zealand’s population grows – especially in the main cities.

Developers have responded by building more townhouses over the last 15 years.

Over time, a larger proportion of New Zealand’s building stock will be townhouses.

However, townhouses are only popular in larger cities. This is where populations are large, land is scarce, and higher-density living is required and accepted.

Take a look at this map of New Zealand. It shows the percentage of new dwelling consents that were townhouses in each council area in 2021.

While over 60% of new dwellings consented in Hamilton were townhouses, only 1.1% of new homes consented in Hurunui District (north of Christchurch) are townhouses.

Obviously – townhouses range in price, which is dependent on a whole bunch of things.

The exact price depends on how nice the property is (the spec) and the location.

But here are a few examples to give you a rough idea of what real investors are currently paying in today’s market.

Read our article here for a more in-depth discussion about how much you should be paying for an investment property.

These properties are not as common as the 2 or 3-bed townhouses. But they can be a good option for a single person or a young couple looking to get their foot on the property ladder.

They range from around $500K and can go up to about $750K.

In Christchurch, Wolfbrook is advertising a 1-bedroom in Woolston for $520,000, and Williams Corporation has a 1-bedroom in Christchurch central for $625,000.

In Auckland, a 1-bedroom townhouse on Te Atatu Peninsula is being advertised for $745,000.

In Auckland, 2-bedroom townhouses with a car park (no garage) can start from around $750,000 to $800,000.

In Christchurch, it’s slightly cheaper. 2-bedroom townhouses are popular and commonly found in Christchurch’s inner-city suburbs like Addington. These properties are usually priced between $610,000 and $660,000 and rent for around $500 a week.

If this townhouse was further out of the city centre, in say Waltham, it would be slightly cheaper again.

However, if these Christchurch-based townhouses have garages, they will be priced around the $700,000 mark.

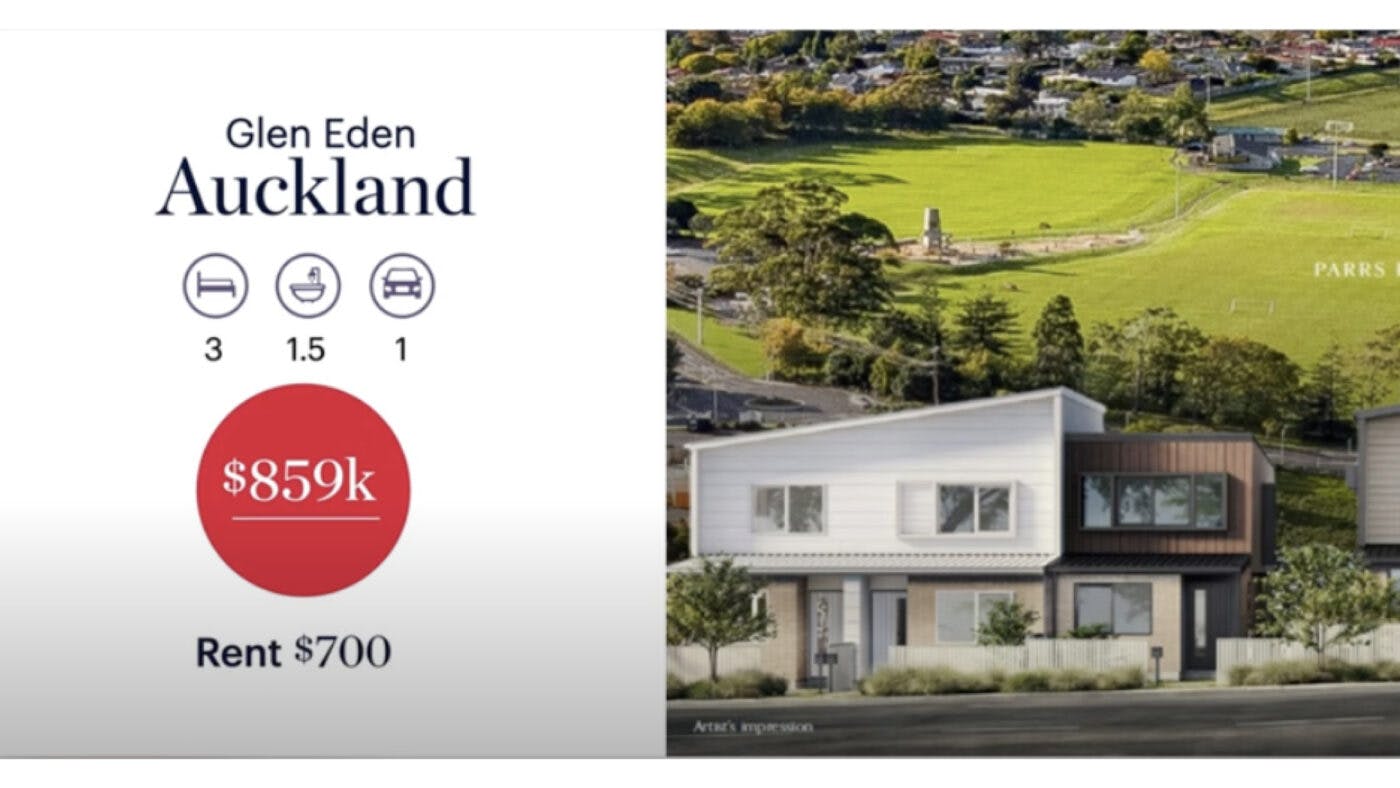

In Auckland, a 3-bedroom townhouse with a car park will start around $850,000 and head up towards $1.2 million.

For example, a 3-bedroom, 1.5-bathroom property in Glen Eden with a car park has recently been purchased by investors for $859,000.

In another example, a Mangere 3-bed, 1.5-bathroom townhouse is currently advertised for between $775K and $787K.

In Christchurch, 3-bedroom townhouses are less common.

Since standalone properties have more land, many investors often think that they’ll grow in value faster than a townhouse.

In other words, more land = faster capital growth.

That leads some to think that townhouses will grow in value much more slowly than standalone properties.

And while Opes Partner’s data-crunching did find some difference between the long term capital growth between houses and townhouses – the difference is surprisingly small.

Yes, standalone properties tend to grow in value slightly faster than townhouses, but it’s a photo-finish.

For instance, on average, in Auckland, standalone houses tended to increase in value by 0.6% faster per year than townhouses.

Take a look:

For a more in-depth look at how the capital growth data compare between houses and townhouses across the country, check out our graphs and data below.

A townhouse can be a good investment choice for a passive, long term buy and hold investor.

They tend to grow in value well over the long term; they are relatively affordable and usually have a reasonable rental yield.

For example, a 2-bedroom New Build townhouse could be a good fit for investors who are just getting started. For these sorts of investors, affordability is a big drawcard.

However, a townhouse will not be the right fit for every investor.

For example, because townhouses are considered a growth-focussed investment, they won’t be the right fit for investors who really need yield.

Those tend to be investors who are close to retirement or already have significant assets and are ready to live off the rental income from their portfolios.

In that case, higher-yielding investments like dual-key apartments are likely a better fit.

Similarly, if you are a renovations-focused investor, townhouses might not be the right for you. The reason is that renovations-investors often add bedrooms to a property, which is easier to do with a standalone house than with a townhouse.

Finally, some investors can’t get their heads around townhouses and only want to invest in standalone houses.

Look, if a townhouse will cause you to lose sleep at night, then it’s probably not the right fit for you.

All things considered, a townhouse can be a good investment for some investors.

These tend to be investors who want to follow a passive buy-and-hold strategy. If that’s you, great. A townhouse could be a good fit.

But, it’s important to note that not every townhouse is automatically a good investment.

Ultimately, it comes down to the numbers and being able to sort the good investments from the bad.

That’s why, here at Opes, we work with 58 developers from around NZ to find suitable properties for Kiwi investors. And then, once we find them, we rigorously run the numbers to offer sound investment properties to our investors.

This means considering not just whether it is a townhouse but also an assessment of the location, the neighbourhood, the price, the rental capacity and the developer.

To find out more about how we find quality investment properties for investors, read about our property investment programme here.

Write your questions or thoughts in the comments section below.

Journalist and Property Educator, holds a Bachelor of Communication (Honours) from Massey University.

Laine Moger, a seasoned Journalist and Property Educator holds a Bachelor of Communications (Honours) from Massey University and a Diploma of Journalism from the London School of Journalism. She has been an integral part of the Opes team for four years, crafting content for our website, newsletter, and external columns, as well as contributing to Informed Investor and NZ Property Investor.

This article is for your general information. It’s not financial advice. See here for details about our Financial Advice Provider Disclosure. So Opes isn’t telling you what to do with your own money.

We’ve made every effort to make sure the information is accurate. But we occasionally get the odd fact wrong. Make sure you do your own research or talk to a financial adviser before making any investment decisions.

You might like to use us or another financial adviser