Mortgages

Opes Mortgages vs other mortgage brokers – What’s the difference?

Learn the 6 differences between Opes Mortgages and other advisers. That way you can decide if we are a good fit for you (or not).

Mortgages

8 min read

Author: Laine Moger

Journalist and Property Educator, holds a Bachelor of Communication (Honours) from Massey University.

Reviewed by: Ed McKnight

Resident Economist, with a GradDipEcon and over five years at Opes Partners, is a trusted contributor to NZ Property Investor, Informed Investor, Stuff, Business Desk, and OneRoof.

NZ Home Loans (NZHL) promises to help Kiwis pay off their mortgages faster.

You’ve probably seen the ads – smiling families popping champagne as they burn their mortgage papers years ahead of schedule.

But here’s the truth: the strategies NZHL uses aren’t some secret hack. In theory, any mortgage broker could help you set up a similar plan.

So why go to NZHL?

What makes NZ Home Loans different is that debt reduction isn’t just part of what they do … it’s their whole business.

They’ve taken industry-standard mortgage strategies, then built tools and trained their team to just help Kiwis pay off their mortgage faster.

In this article you’ll learn how NZHL works, what’s changed recently, and help you figure out whether they’re the right mortgage broker for you.

New Zealand Home Loans (NZHL) is a large mortgage advice company solely dedicated to helping Kiwis pay off their mortgages faster.

In a nutshell they restructure your mortgage in an effort to get you debt-free, faster. (More on how that works in a moment).

The company was founded in 1996 by two Hamilton businessmen, John Erkkila and Murray Ferguson. Now, they have almost 300 staff across 72 offices around NZ.

Ownership-wise, NZHL sits under Kiwi Group Capital, the same parent company as Kiwibank.

So NZHL and Kiwibank are sister companies. That’s one of the reasons Kiwibank is one of just three lenders most NZHL advisers work with.

Most mortgage brokers out there focus on getting you more debt.

NZHL is different because it helps people manage the debt they already have.

They do this by setting borrowers up with a “smart home loan” structure - effectively a revolving credit or offset mortgage.

It’s like a big overdraft secured against your house.

And if you use it correctly you can save tens of thousands of dollars in interest and become mortgage-free faster.

One other key difference – which can be a drawback for property investors – is the number of lenders NZHL works with.

Many mortgage advisers work with 30+ lenders, but NZHL only works with 3:

So, with other brokers if one bank says “no” there are many other lenders you could work with.

But with NZHL there are only a few lenders that most of their advisers work with. This can make it harder to get your mortgage approved in some cases

It may be confusing for some homeowners and investors to hear that when you work with NZHL you may need to restructure your loan.

That often means you need to get approved for a new mortgage when you work with them.

You might be thinking: If NZHL is there to help me pay off my current loan, why do I need to be approved for a new loan?

Yes, NZHL will restructure your current loan and help you pay it off, but to do so they need to move your mortgage to one of the three lenders they work with. And you need to set up a revolving credit facility (sometimes called an Orbit).

To switch banks (or set up their structure) they need to raise a new loan with one of their lenders. They then pay off the mortgage you already have with your current bank/lender. Think of it as replacing one loan with another.

When they do this they then earn a commission from one of their lenders. So they don’t charge you a fee to work with them; they get paid by the bank.

Essentially, NZHL schools and guides homeowners and investors to make extra repayments against their mortgage (if you make extra repayments against your mortgage, you then pay it off more quickly).

You will not pay off your mortgage faster if you only make the minimum repayments the bank requires.

When you work with NZHL you will put together a budget with your consultant. They then work out how quickly you could pay off your mortgage if you put all the money left over towards your home loan.

You then make these extra repayments against your mortgage. This will make an enormous difference.

For instance, if you had a $500k mortgage with a 4% interest rate, your minimum repayment would be $550 a week. You would pay your mortgage off in 30 years and pay $359,000 in interest.

But, if you decided to pay $650 a week, you would then pay off your mortgage in 22.4 years and only pay $257,000 in interest.

You will then be mortgage-free 7.6 years earlier and have paid over $100k less to the bank in interest.

For some borrowers it may sound impossible to come up with the extra cash. That’s why you’ll put together a budget with your NZHL consultant.

As well as moving your main mortgage to their lenders, NZHL’s “smart home loan structure” sets you up with revolving credit.

A revolving credit is like a big overdraft secured against your home.

You then use this to place your extra repayments. You also move any other money you have (e.g. holiday savings or emergency funds) into the revolving credit.

This money then works like an extra repayment against your mortgage and saves you interest, but you can still take the money out at any time.

So if you move your holiday savings into the revolving credit, you’ll save on interest while they are there. Then, when it’s time to book your flights to Bali, you still have the money to do it.

So, it’s kind of like a smart savings account. You’re saving the interest you would otherwise pay. But, like a savings account, it only works if you are making the repayments.

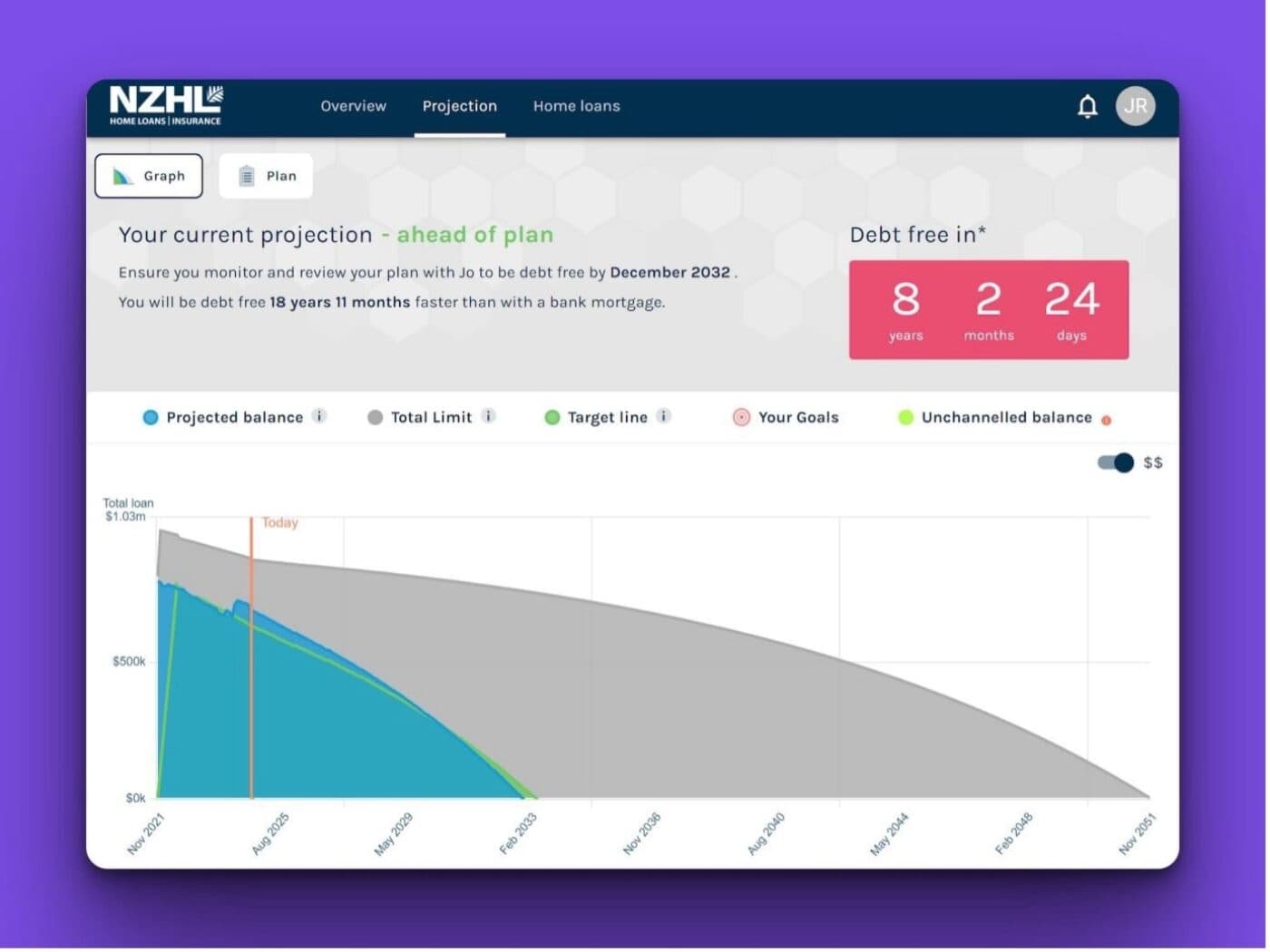

NZHL is also unique because it has built its own software to help you manage your mortgage. It’s called debtnav.

It shows your debt-free date, the amount of interest you’ve saved, and whether you’re ahead, on track, or behind on your goals.

You can add things like buying a car or doing renovations, and see how that would change your repayment timeline.

About 70% of clients say it gives them better control and confidence over their finances.

NZHL has recently updated debtnav, here's what it looks like:

NZHL works really well for people with 1-2 properties who want to pay off their mortgage faster. And they have a lot of good reviews from Kiwis who have taken control of their mortgage.

That’s why NZHL works well for borrowers who need a bit of help. Sure, you could call up the bank or your current mortgage broker and decide to make extra repayments against your mortgage.

But, if you don’t feel comfortable with that, or you want to work with someone to help you set it up, they could be a great fit.

For investors with 2 rental properties or more, NZHL may not be the right fit for you. Why?

It can become harder to grow your portfolio because NZHL only works with 3 lenders. So it’s harder to split bank (use multiple banks).

When you invest in property you take on a lot of debt; often it’s a better idea to use the split-banking strategy.

This is where you use multiple banks and lenders to get your debt. Using multiple lenders will help protect your main home, give you more control over your money, and in some cases help you borrow more.

On top of that, right now TSB and ANZ offer 10-year interest-only mortgages. These are good for some property investors.

But if you’re working with an NZHL franchise, a 10-year interest-only mortgage isn’t an option for you. That’s because NZHL don’t work with those banks.

So, because NZHL only works with a few lenders, they are often not the right fit for ambitious investors. In that case another mortgage broker may fit the bill. If you’re looking for recommendations, here is our list of the top mortgage brokers in NZ. And, yes, NZHL is on there.

Having said that, it doesn’t mean NZHL can’t work with property investors with 2+ properties. But in my view they have set their business up to help homeowners get out of debt.

So they’re not as set up to help property investors get into lots of debt to grow their portfolios.

The debt-reduction strategy isn’t unique – any broker or even your bank could help you make extra repayments.

What sets NZHL apart is:

If your goal is to pay off debt and get financially free faster, NZHL could be a great fit.

If your main goal is rapid portfolio growth with many lenders and complex lending structures, another broker might be better for you.

Journalist and Property Educator, holds a Bachelor of Communication (Honours) from Massey University.

Laine Moger, a seasoned Journalist and Property Educator holds a Bachelor of Communications (Honours) from Massey University and a Diploma of Journalism from the London School of Journalism. She has been an integral part of the Opes team for four years, crafting content for our website, newsletter, and external columns, as well as contributing to Informed Investor and NZ Property Investor.

This article is for your general information. It’s not financial advice. See here for details about our Financial Advice Provider Disclosure. So Opes isn’t telling you what to do with your own money.

We’ve made every effort to make sure the information is accurate. But we occasionally get the odd fact wrong. Make sure you do your own research or talk to a financial adviser before making any investment decisions.

You might like to use us or another financial adviser