Property Investment

How to know if you can really afford an investment property top-up

Not sure if you can afford a $200-$350 weekly top-up on an investment property? Learn how to test your budget before you buy.

New Builds

9 min read

Author: Maxine Clason Thomas

Financial Adviser at Opes Partners with over 10 years of experience in property investment and 4 years advising clients on building wealth through real estate.

Reviewed by: Ed McKnight

Resident Economist, with a GradDipEcon and over five years at Opes Partners, is a trusted contributor to NZ Property Investor, Informed Investor, Stuff, Business Desk, and OneRoof.

Picture this: you’re thinking about buying a townhouse and you like the area; you like the development; you like the developer.

Then you get handed the development plans … and there are 46 potential units you could buy in this project.

How do you figure out which one to buy?

This is a common problem many investors face. In fact, one of the most common questions investors ask us here at Opes Partners is: “How do I choose the right townhouse or unit in a development?”

This is important when investing in New Build townhouses (or apartments) because there could be 3 to 300 units within that development.

In this article, you’ll learn the top 5 things to consider when choosing a good investment property. By the end of it you’ll also know which factors don’t really matter.

Firstly, when you’re out property shopping you’ve got to look at what is actually available – right here, right now.

This might sound a bit obvious, but sometimes investors will look at the units in a development and get caught up on the properties already sold.

For instance, one investor we were working with here at Opes Partners had his heart set on Unit 1 of a development.

To him, this was the most aesthetically pleasing townhouse from the road, and he believed it would be the most popular rental.

Instead of buying one of the other units within the development, he held out. He wanted to see if Unit 1 might become available again if the contract fell through. (It didn’t).

In the end, this investor missed out on buying any of the units within this development because they had all sold by the time he was ready to purchase another one.

He had to go back to the drawing board, looking for a developer, a development and a unit that met his criteria.

The moral of the story is: if the unit you really want is unavailable – that’s life. There’s no point worrying about a townhouse that isn’t available any more.

So, if your first preference is under contract, look at your second choice.

Even though it’s number 2 on this list, the price of your property is the most significant consideration. You need to ask yourself:

These two things will impact your cash flow.

Typically, here at Opes, we are a fan of purchasing cheaper units; they are more affordable and provide decent rental yields.

Some investors think spending a little extra for a “better” property is the right thing to do. For example, end units are usually slightly more expensive because they come with a touch more land.

However, this extra money doesn’t always translate into more rent.

Ideally, you want your property to be as cheap as possible without impacting the rent.

So, at the end of the day, it’s about affordability.

In some townhouse developments, the car parks aren’t directly outside the units.

Sometimes the units may be at one end of the development, and the houses at the other.

The above site map is from a Christchurch development at 100 Ruskin Street. This is being developed by Citrus Living.

The car parks are located at the left and bottom of the map.

If you buy the unit in the top right-hand corner, your car park could be a 30-metre (ish) walk to get to your car.

That’s not the end of the world, and it probably won’t impact how quickly your property goes up in value. But it won’t be as convenient for tenants compared with the unit in the top left-hand corner, where the car park is only a few steps away.

Again, that’s not to say that the unit in the top right-hand corner is a bad investment property.

But, if you have the pick of the bunch, and there was no difference in price between the units, proximity to car parks might be a consideration.

Ultimately, it won’t make that much of a difference, but it’s something to bear in mind.

Occasionally some units in a development will have garages, while others will just have a car park.

These properties are generally more expensive, but will often get more rent. So if you can afford the extra cost, this can be something to consider.

Read our complete guide on buying a unit with a car park vs garage vs no car park.

The bedroom count is going to affect the amount of rent you’ll ultimately get. And it will also have some say in the type of tenant you attract.

For example, more bedrooms are likely to attract a family. In contrast, a professional couple without kids won’t need as many.

Having said that, you also need to consider the size of the bedrooms.

You don’t want to buy a 4-bedroom townhouse thinking you’ll get a high level of rent … only to discover that the 4 bedrooms are tiny.

That won’t be attractive to a family wanting to rent the place.

So you need to look at the floor plans to check the size of the bedrooms.

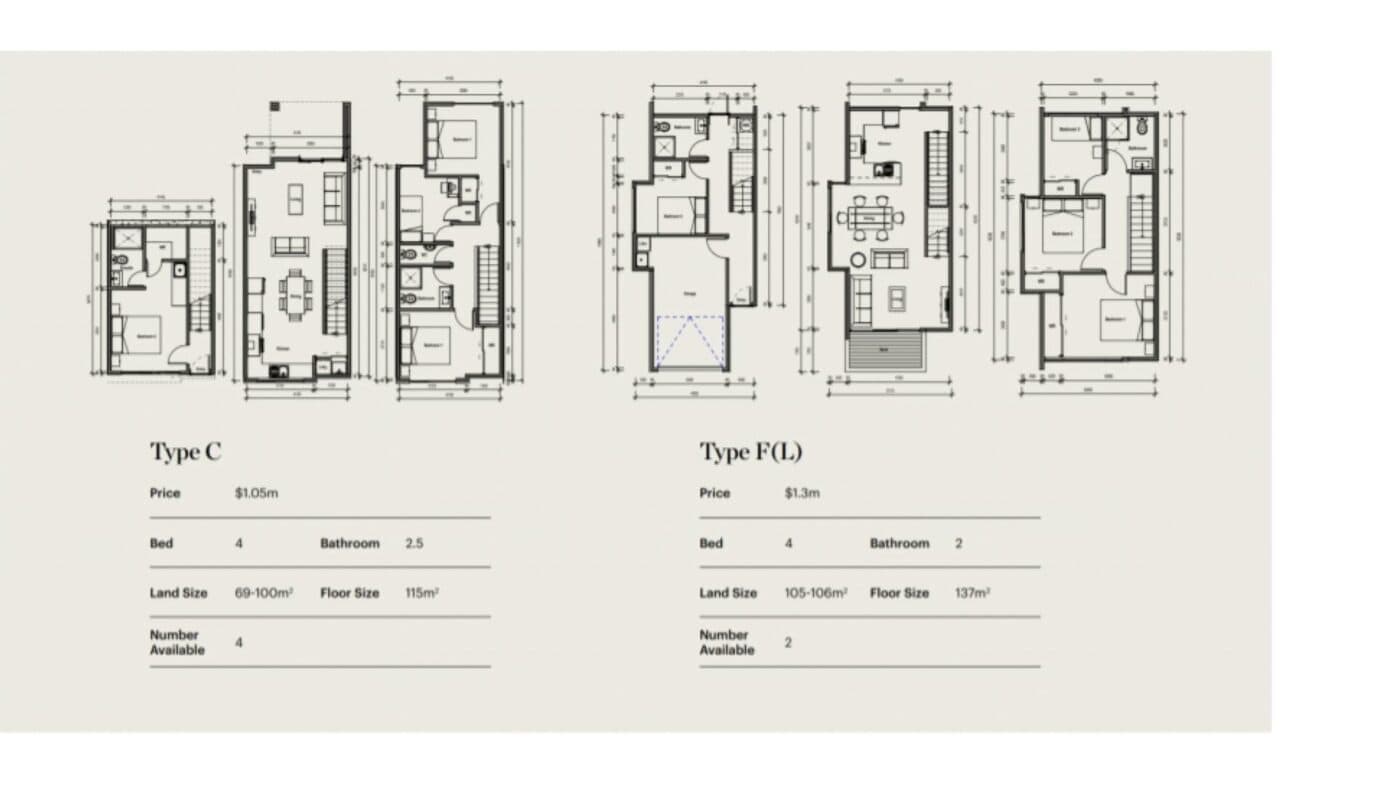

For example, in the above floor plans, there are 4 bedrooms in the townhouse, but one is a single bedroom.

This could be used as a child’s room, TV room or home office.

This doesn’t necessarily mean this is a bad property. But, you need to factor in the smaller room when considering the price and potential rent.

You might also consider the number of bedrooms in a unit compared with the rest of the development.

Let’s say there are 6x 2-bedroom townhouses and 2x 3-bedroom townhouses in a development. You might choose to buy a 3-bedroom property because when you go to rent the place out there are fewer units to compete with.

Not all the properties in a development are the same.

You might have some with 3 bedrooms and some with 2 bedrooms.

Other times, some units will have garages, and the rest might have car parks.

Then there might be different floor plans where units have different layouts.

Here is an example of the price schedule for a development on Coronation Road based in South Auckland.

There are 8 different layouts to choose from, all with different prices.

For instance, there are 3 different-sized choices for 3-bedroom townhouses:

So in this example, some 3-bedroom homes are slightly larger and have more space but they are more expensive. That might be desirable for you, but similarly, you might prefer to buy at the more affordable end.

This is the level of detail you’ll go through when comparing units within a development so you can make an informed investment decision.

While these are the top 5 most important considerations when choosing a unit, some other factors are not important. Let’s go through the main ones.

Some investors believe end units are more desirable because they will likely come with a bit more land (and one less neighbour).

This leads to the perception that these properties will rent more quickly and may be easier to sell.

That isn’t necessarily the case.

One investor we worked with decided to buy an end unit, thinking the property would rent more quickly. But when tenants viewed the development, deciding which one to buy, the end unit was the last one to rent.

When deciding which property to rent, tenants first opted for the middle units since they weren’t as close to the road. The tenants were concerned about potential road noise.

That doesn’t mean all end units are bad and are less desirable. It just means they’re not always preferred by tenants either.

And no stats say an end-unit townhouse will increase in value faster.

It might be something to consider if you were purchasing your own home, but not necessarily for an investment property.

That’s because an end unit is often more expensive but doesn’t necessarily rent quickly or for more money.

So there is a risk that you spend more on the property but don’t necessarily get a return from that extra spend.

Again, we’re talking about minor points here. So if the end unit is gone don’t sweat the small stuff.

Real estate agents may talk a lot about the direction a house faces, but it’s not something to worry about when investing.

Sure, let’s say you’re investing in a family home in Rolleston. You may consider where the house is positioned on the section.

But in an inner city townhouse … you don’t need to worry about this.

Where the sun will set on your property will not impact your rent or result in the property’s price going up more quickly.

It just doesn’t matter.

If you have big enough windows with white paint on the walls, the sunlight will bounce around anyway (most likely while your tenants are at work).

Some investors worry about buying a property next to (or near) a Kainga Ora house. They fear there may be anti-social behaviour from Kainga Ora tenants, making renting the property harder.

The truth is some Kainga Ora tenants do have social problems and show anti-social behaviour, but that is true of all tenants and some owner-occupiers too.

However, painting all Kainga Ora tenants with the same brush is unfair. Yes, some former (and current) gang members may be Kainga Ora tenants, but Kainga Ora also serves people who might be disabled, in a wheelchair, or unfortunately down on their luck. Not all of these people will throw raucous, 24/7 parties.

Also, it’s more than likely you already live on the same street as a Kainga Ora property, and you don’t know it.

For instance, Kāinga Ora owns just under 10% of the 690,000 rentals on the open market.

And since about 40% of houses in Auckland are rentals, about 1 in 25 homes will be owned (or rented) by Kainga Ora. Said another way, if your street has more than 25 letterboxes, there’s a good chance one of those is a Kainga Ora house.

In our view and experience, buying near or next to a Kainga Ora house does not matter. What matters is the deal in front of you. If it’s a good deal, it doesn’t matter whether Kainga Ora owns a house down the street.

The bottom line is: don't over-think things.

If you like the house, the price, the area, and the long-term prospects … it doesn’t matter which direction the sun rises in or whether it’s an end unit or not.

It’s about the numbers – the price and the rent.

Yup, some other factors like the layout and where the car park is can play into your decision. But these are small, marginal factors.

Don’t fall into the trap of thinking that some factors are essential when they’re not.

Invest on the numbers.

Financial Adviser at Opes Partners with over 10 years of experience in property investment and 4 years advising clients on building wealth through real estate.

Maxine Clason Thomas is a financial adviser at Opes Partners. She has over 10 years of experience in property investment and 4 years advising clients on building wealth through real estate.

This article is for your general information. It’s not financial advice. See here for details about our Financial Advice Provider Disclosure. So Opes isn’t telling you what to do with your own money.

We’ve made every effort to make sure the information is accurate. But we occasionally get the odd fact wrong. Make sure you do your own research or talk to a financial adviser before making any investment decisions.

You might like to use us or another financial adviser