New Builds

New vs existing – Which is the best investment?

Learn the pros and cons of New Builds and existing properties, that way you can make an informed decision about which property type is right for you.

New Builds

9 min read

Author: Laine Moger

Journalist and Property Educator, holds a Bachelor of Communication (Honours) from Massey University.

Reviewed by: Ed McKnight

Resident Economist, with a GradDipEcon and over five years at Opes Partners, is a trusted contributor to NZ Property Investor, Informed Investor, Stuff, Business Desk, and OneRoof.

Can a developer or builder increase the price of the property or build once construction has started?

This question has seen a lot of heat in the media lately. Home buyers and investors are signing up for (what they think are) fixed price contracts, and then are being hit with price rises.

Some lawyers and mortgage brokers are being quoted as saying New Builds are “risky”, and there is “no such thing” as a fixed fee contract.

So, are they right?

This article will outline the exact instances where a developer can – and sometimes will – increase the price and how they do it.

If you have any questions or thoughts, please leave them in the comments section below.

Let’s get straight to the point.

Yes, developers can increase the price of a build, even after your signature has been placed on the contract or after works have started.

But they aren’t just doing it for jollies.

Currently, the price of building materials is shooting through the roof (pun intended) and so the overall cost goes up.

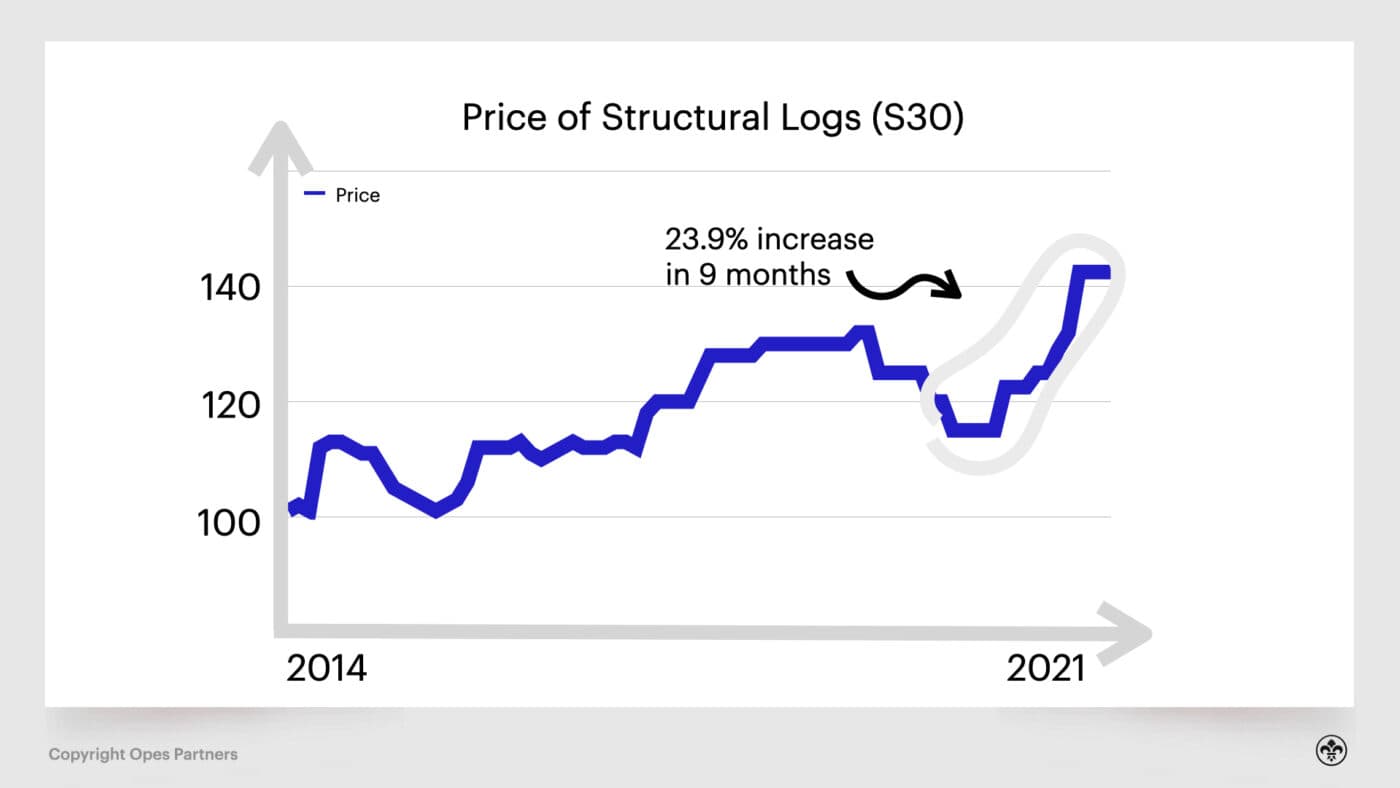

The price of structural S30 logs has risen 24% in 9 months. And it’s not just the price of timber rising but other materials too, and a tight labour market means it’s tougher to get staff.

All these factors contribute to squeezing developer margins.

And when this happens, developers think: “Oh crap, this building is going to cost me a lot more than I originally thought. I need to pass some of this cost on otherwise I’m going to lose money”.

So, it’s not so much the developer raising the price in order to pocket more profit, per se, rather them passing on the rising cost of materials to you - the buyer.

Their ability to pass on these cost increases is limited by the specific stipulations and clauses in your contract with the builder/developer.

In order to know how to protect yourself from unforeseen price increases, you’ve got to understand the two types of contracts we have here in New Zealand.

They are:

The ability to increase the price depends on which contract you have.

There is a sliding scale of how easy and hard it is to put up the price on each of these types of contracts.

But, out of the two, Progressive Payments have greater provision to increase the price of the build (or passing on the cost to the purchaser). That’s because you’re hiring the developer to build you a house.

With Turnkey contracts, it’s a little bit more difficult for the developer to increase the price – since it literally is a fixed price contract – but it’s not impossible. More on this below.

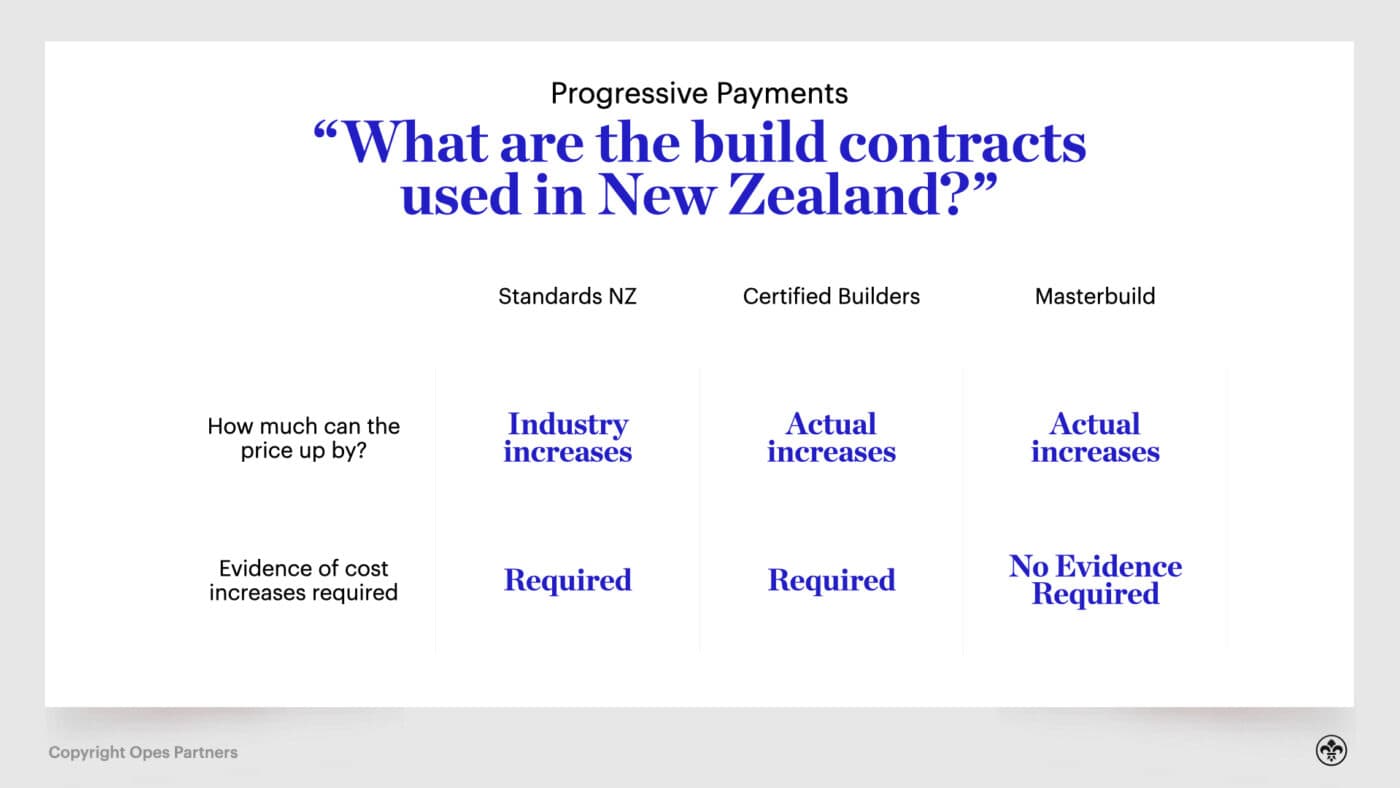

So, if we think of Progressive Payments as the overarching umbrella - there are three types of build contracts that are commonly used in New Zealand.

This is important because the amount the developer can raise the price of the build depends on which contract you are using.

Here’s a quick guide on how much the developer can increase the price depending on the contract:

But let’s dig into a bit more detail.

Let’s start with Standards NZ. Under this contract, the builder can only increase the price as per the industry average. The average comes from Stats NZ and there is a formula to dictate the percentage.

So, if the industry faces cost inflation of 4%, but the developer is looking at a 10% overall increase in costs, you will only ever have to pay the 4%.

Not only that, under this contract the builder is required to present you with evidence of those cost increases. So, receipts and quotes will be given to you as proof that timber has hiked up overnight and it is not possible to use a substitute (as an example).

However, Certified Builders and Master Builders differ because they can pass on the actual percentage increase, above and beyond the industry average, if this is the case.

But under a Certified Builders contract (like Standards NZ), the builder has to present evidence on why these cost increases are required.

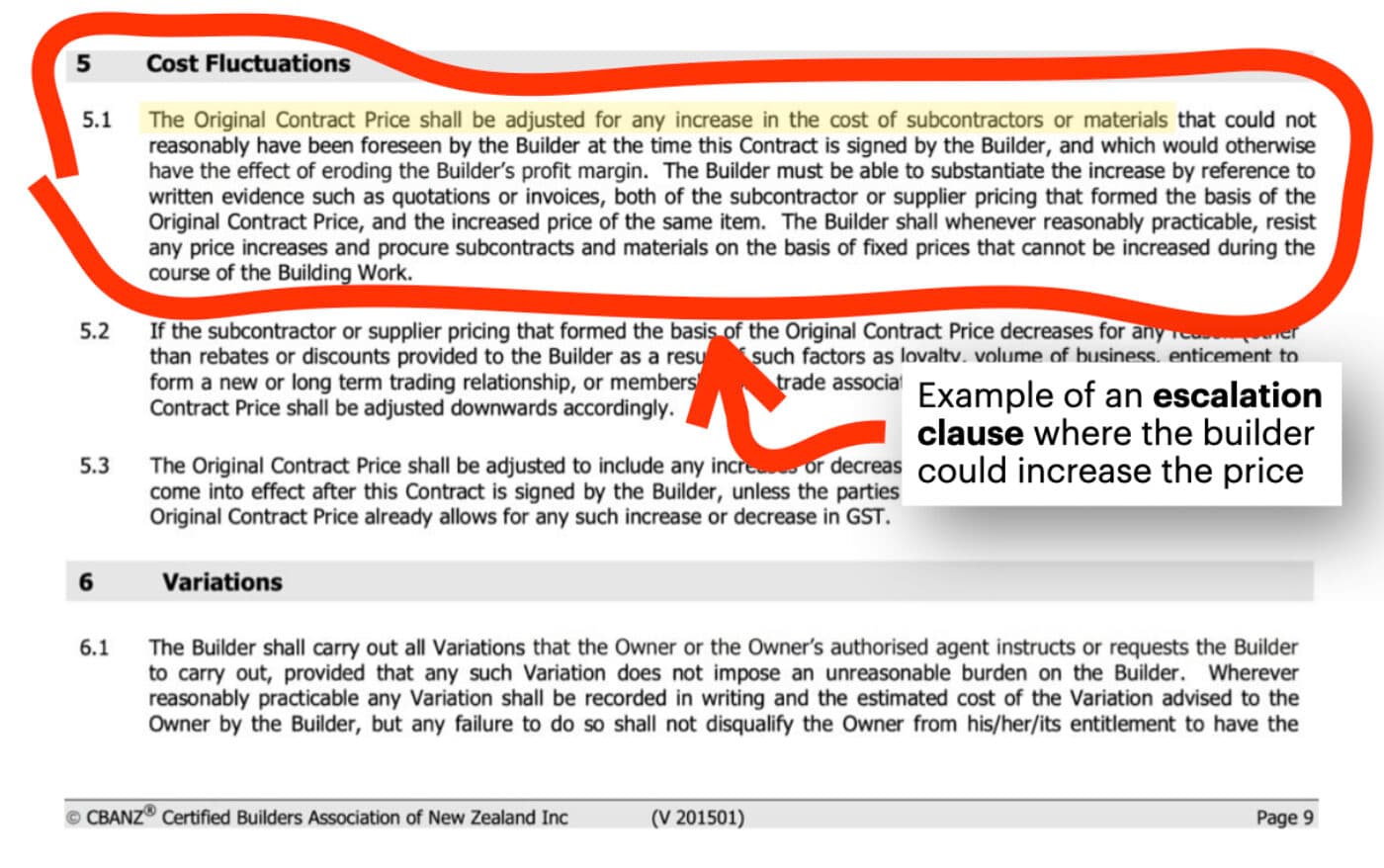

This is enabled by escalation clauses in the build contract.

Here is an example for the Certified Builders Contract section 5:

Unlike the other two contracts, Master Build doesn’t have to provide any evidence of cost increases. They can just pass them on.

Now, to be clear, we are not saying: “Don’t use Master Build”. They are extremely popular contracts and the builders who use these contracts often deliver good quality houses.

All this article is outlining is that if there is a good property you want to buy, make sure you understand the contract to avoid finding yourself in a position where you can’t pay the additional money.

So, you’re halfway through a build and you get a notification that the cost of the build is increasing by 10%. You think: “I don’t want to pay that – how do I get out of it?”

Unfortunately, if the builder has the ability to increase the price in the contract – you have to pay. This is why we reiterate what we have said above. It’s so important to understand the contract and what you are getting yourself into, so you don’t end up in a situation where you can’t pay.

Let’s turn now to turnkey contracts.

These are the contracts we most commonly use, here at Opes Partners.

This is important because even though turnkey properties are signed at a fixed price, there are ways a developer can increase it.

And most people will think: “How can you increase the price of a fixed price contact?” Isn’t that impossible?

Let’s explain.

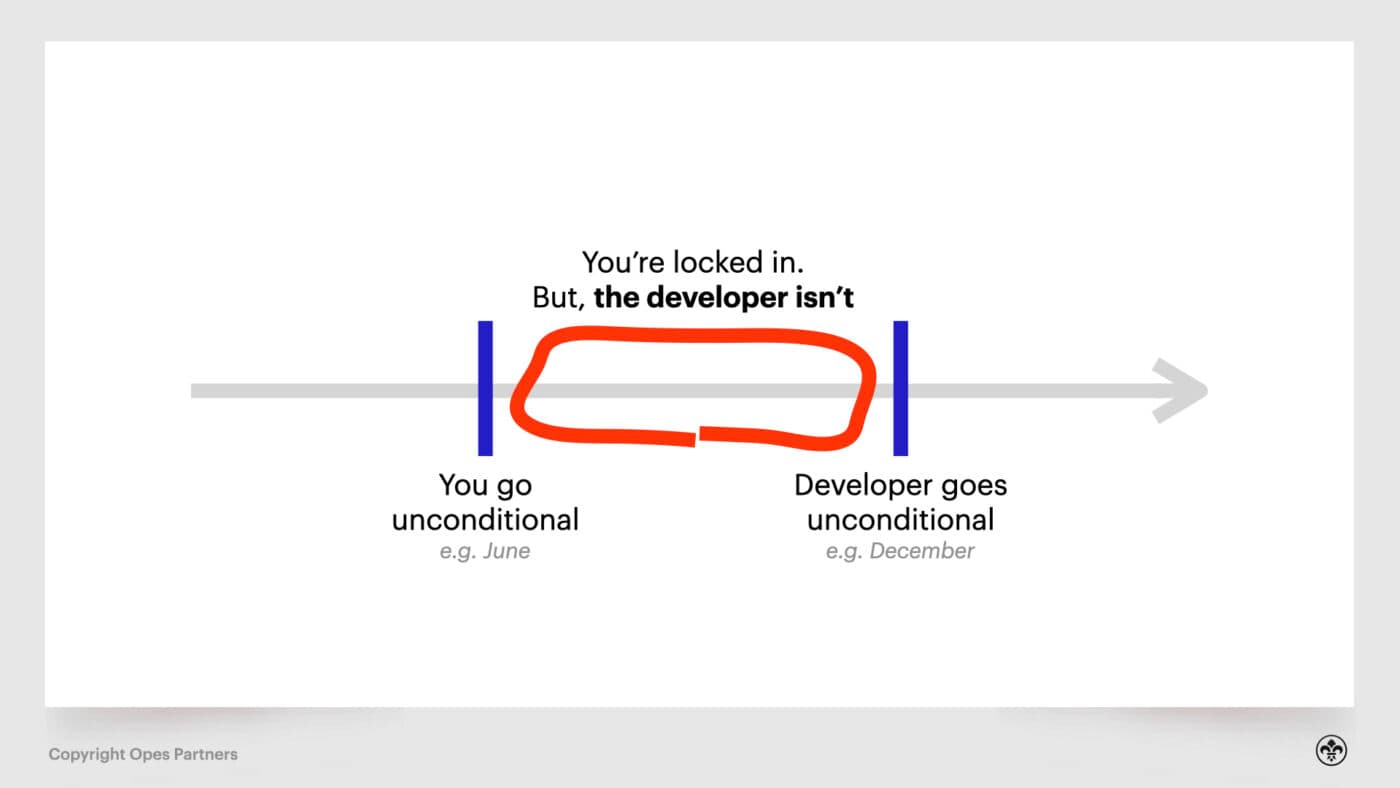

What it comes down to is, in some contracts there is time between when you lock in your contract unconditionally and when the developer becomes unconditional.

Usually, a developer will go unconditional a short while after you have signed your end of the deal. That means you can’t cancel the contract, but the developer can.

I see your eyebrows rise, but this lag can be for a lot of genuine reasons.

As an example, perhaps it’s because the developer needs a certain amount of presales locked in before the bank will lend money for the project. In this instance, they may need those few months just in case they do have to cancel the contract, because they can’t secure the money for the build.

Or, it could be the developer needs to get resource consent and may need to have the flexibility to change some things in the contract if there are unforeseen problems.

While these reasons are genuine, the risk here is that the price of materials goes up during this period.

The developer can then cancel the contract and ask you to re-sign at a higher price. If you don’t they’ll sell the property to another purchaser.

To give an example, let’s say you’ve signed the contract but a few months later the developer comes back to you and says: “I’m sorry, we have to cancel your contract. Here’s a new contract that is $20,000 more because it covers our cost increases”.

This usually happens in a hot market, where a) costs of building increase, and b) the developer has the confidence that they’ll be able to sell the property even if they raise the price.

Then don’t.

Unlike Progressive Payments contracts, you don’t have to take on the extra cost. You can choose not to sign the new contract and walk away.

The price increase the developer asks for can be unlimited, since the increase doesn’t come from a specific clause, it comes from cancelling the existing contract.

Yes, we get it, while there are a lot of positives to buying New Builds – lower deposit, newer, great tax incentives, low maintenance – they do come with a certain amount of additional risk.

Now you might say “I want to hold out until I get the perfect contract where the developer carries all the risk.”

You probably don’t want that to happen. Why? Because if the developer takes on even more risk, they will hike up the price to compensate, so they have more of a buffer when things go wrong.

So, it’s about finding a middle ground. You don’t want to transfer all the risk, but you do want to feel comfortable with the amount of risk you are signing up for.

And, it’s equally important to not be blindsided when something comes up unexpectedly for you.

The risks you take on are going to be specific to the wording in your contract, which will be different between buyers. This is where you want to be speaking to your property lawyer when negotiating the contract.

The main and most important factor to minimise the risk to you is to work with a good quality property lawyer - someone who specialises in build and turnkey contracts.

They will be able to spell out what the fine print says, and let you know what you can do to amend your contract to make clauses more reasonable.

For example, striking out some clauses and amending others to include evidence for price increases.

Be aware, these changes might not be accepted by the developer, but at least with a property lawyer you are completely aware of the risks you are taking on and have a chance to change them.

Here at Opes Partners we say: “The quality is in the contract”.

If you want a recommendation for property lawyers, we have reviewed the top 5 property lawyers in NZ.

In conclusion, all the reporting on the risks of New Builds, and the myth of the non-existent fixed fee contract – are true.

Yes, New Builds do come with a certain amount of risk. But these risks are born from the benefits they also carry.

While you can’t do much about the rising price of building materials, you can minimise the risk with a good quality contract.

And having a great property lawyer on your team is a must.

Journalist and Property Educator, holds a Bachelor of Communication (Honours) from Massey University.

Laine Moger, a seasoned Journalist and Property Educator holds a Bachelor of Communications (Honours) from Massey University and a Diploma of Journalism from the London School of Journalism. She has been an integral part of the Opes team for four years, crafting content for our website, newsletter, and external columns, as well as contributing to Informed Investor and NZ Property Investor.

This article is for your general information. It’s not financial advice. See here for details about our Financial Advice Provider Disclosure. So Opes isn’t telling you what to do with your own money.

We’ve made every effort to make sure the information is accurate. But we occasionally get the odd fact wrong. Make sure you do your own research or talk to a financial adviser before making any investment decisions.

You might like to use us or another financial adviser