Property Investment

Property Investment

3 min read

Author: Andrew Nicol

Managing Director, 20+ Years' Experience Investing In Property, Author & Host

It might come as a surprise, but the biggest risk in property investment isn’t your tenants. It’s often not the house you buy.

It’s you.

What happens if you get sick, can’t work, and don’t earn an income?

That’s where most people start to think about life and income protection insurance.

The trouble with insurance is that it's often hard to know how much you need and what it'll cost you.

If you find a normal life insurance calculator online, it'll ask you how much life insurance you want to take out ...

But how are you supposed to know how much life insurance you need?

And that’s why I’ve come up with the Risk Reducer. This is the smallest amount of insurance I reckon you need to protect yourself as a property investor.

Here’s my new calculator to figure it out. But here’s how the Risk Reducer works. There are three types of insurance I reckon you need –

What is it? The insurance company pays your family a big lump sum if you (unfortunately) pass away.

How much do I need? This should be enough to clear your home mortgage and any personal debts (e.g. car loans).

Under the Risk Reducer, you'd also take out enough to cover:

What is it? The insurance company pays you a big lump sum (e.g. $100k). It's paid out if you get a serious illness (e.g. a heart attack).

How much do I need? Under the Risk Reducer, you'd take out a policy that covers 12 months of your after-tax salary.

For example, if you earn $80k a year (after tax), you'd take out $80k of trauma cover.

What if you’re in a relationship? You'd both take out a trauma policy that covers a year of the highest income earners' after-tax salary.

What is it? If you get sick and can’t work anymore, the insurance company pays you part of your income each month.

How much do I need? I reckon you need half of your after-tax income.

You need to make lots of choices when you take out this insurance. How long do you want the insurance to pay you? And when do you want the payments to start?

This can get confusing. Most of us have no idea. And, of course, it all comes at a cost.

So, under the Risk Reducer, I'd get it to start paying me 3 months after my income stops. And I'd have it pay me out for 5 years.

That's a good mix of protection while keeping the cost of the insurance manageable.

The trouble with insurance is that the cost depends.

Life insurance is cheaper when you are younger, and men are more expensive to insure than women.

If you've got a bigger mortgage, you'll take out more life insurance under the Risk Reducer. That comes at a cost.

So, to help you figure out what you might need (and what it costs), I’ve just released this calculator.

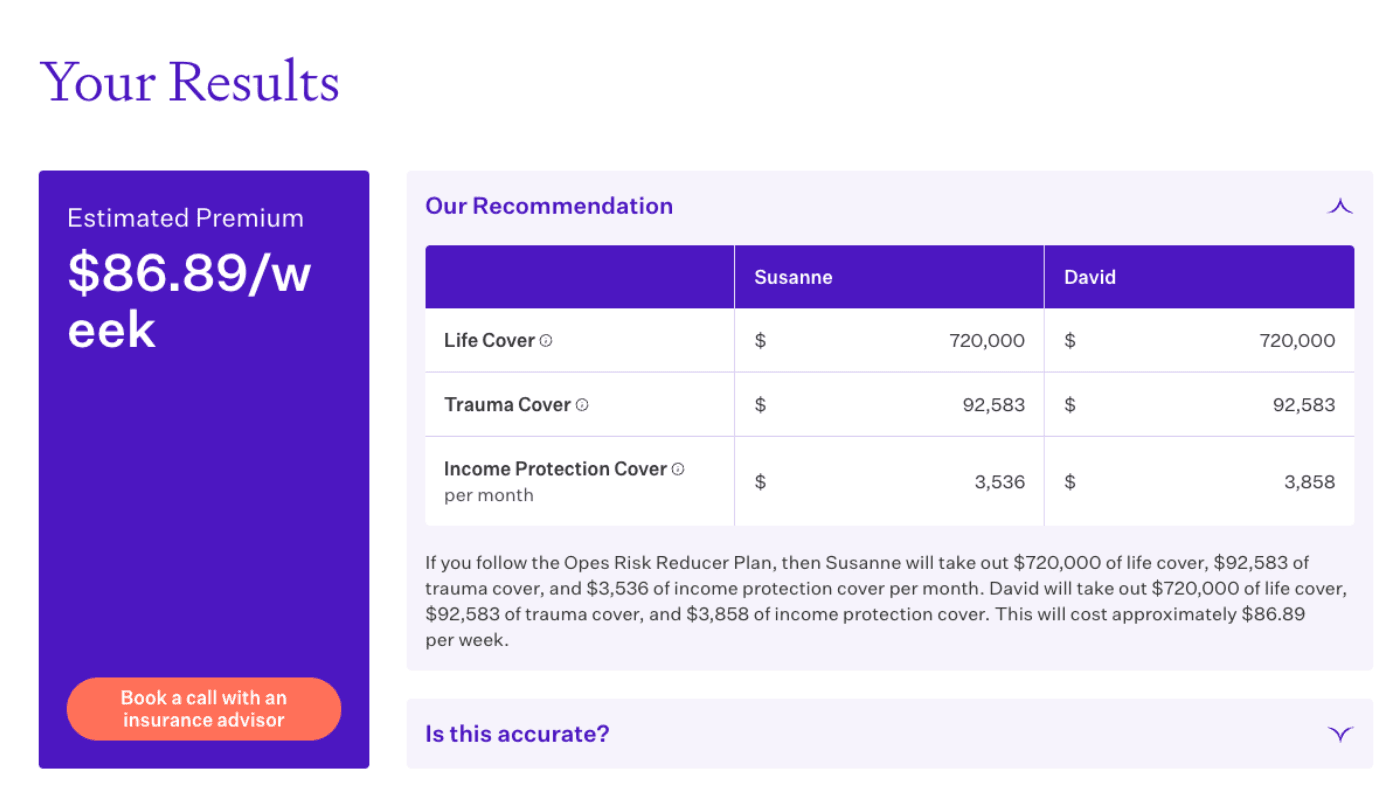

You can put in your details, and it gives you an indication of the insurance you’d need and what it could cost. Here’s what the results look like:

And you don’t even need to put in your contact details to get the answer.

Give it a go because the cost of your insurance might surprise you. It’s often lower than many people think.

And if you want to have a chat about your insurance, you can book a call with Bill, my insurance adviser, here.

Managing Director, 20+ Years' Experience Investing In Property, Author & Host

Andrew Nicol, Managing Director at Opes Partners, is a seasoned financial adviser and property investment expert with 20+ years of experience. With 40 investment properties, he hosts the Property Academy Podcast, co-authored 'Wealth Plan' with Ed Mcknight, and has helped 1,894 Kiwis achieve financial security through property investment.

This article is for your general information. It’s not financial advice. See here for details about our Financial Advice Provider Disclosure. So Opes isn’t telling you what to do with your own money.

We’ve made every effort to make sure the information is accurate. But we occasionally get the odd fact wrong. Make sure you do your own research or talk to a financial adviser before making any investment decisions.

You might like to use us or another financial adviser