Property Investment

Property Investment

3 min read

Author: Andrew Nicol

Managing Director, 20+ Years' Experience Investing In Property, Author & Host

Every family has an Uncle Lester. He’s the one at the BBQ who tells you what to do with your money … and he hates property.

When house prices go up fast, he says: “It’s a bubble”. When they drop, he says, “Told you so”.

But in 2026, Uncle Lester will be unusually quiet on property. He can’t really say anything when house prices are flat year-on-year.

Expect Uncle Lester to be talking about an AI bubble in the share market instead.

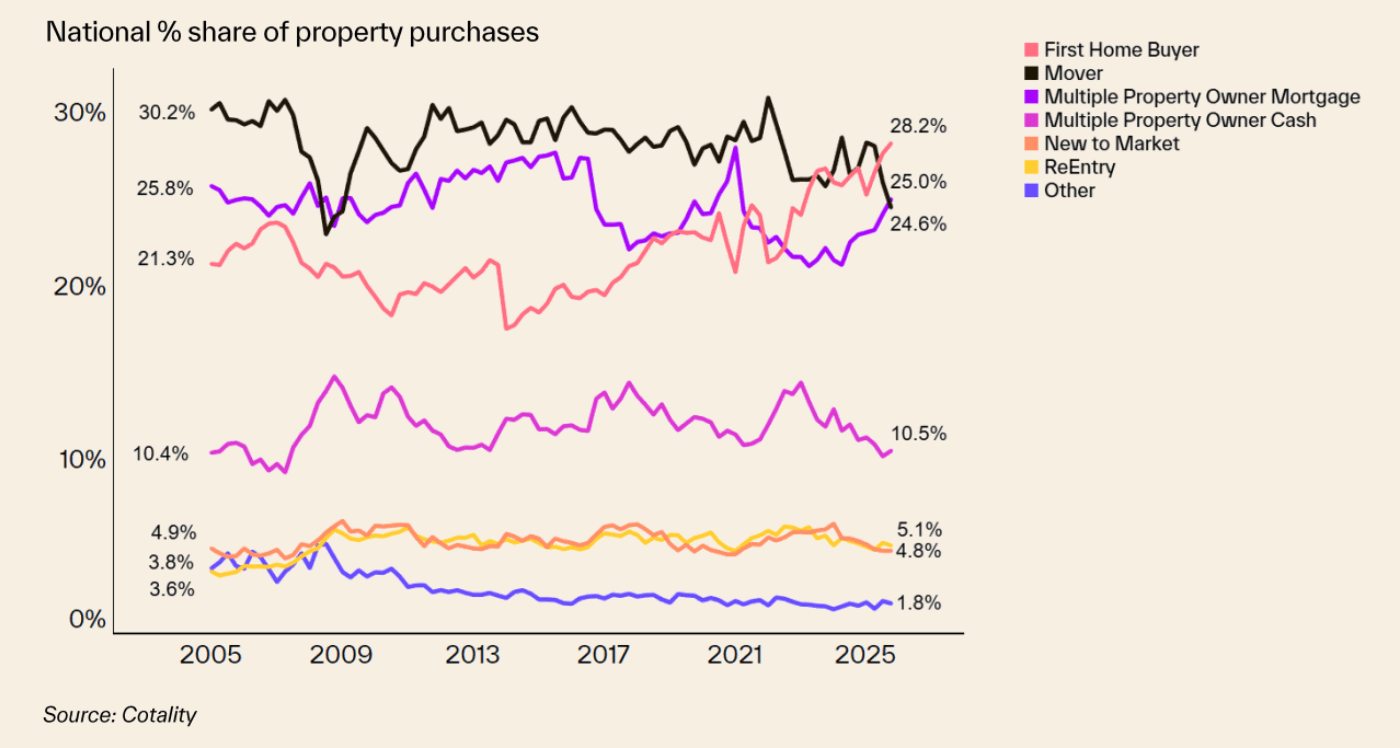

Even though house prices are about 2.8x higher than in 2005, the share of homes bought by first-home buyers is at a record high.

Here’s the latest data out from Cotality (formerly CoreLogic) this morning. First home buyers and investors who take out a mortgage are stepping up. I reckon they’ll be the big buyers in early 2026.

House prices tend to bounce up in spring and summer. And in February, they bounce back after the quiet Christmas period.

The real test will be in March and April.

If house prices keep rising after the seasonal sugar high has worn off … then we’ll know the recovery is really here.

Banks are still forecasting that house prices will go up 4–5% through 2026.

(But they were saying that last year too… so let’s see).

As investors show more interest, developers will follow … usually with more gimmicky ads.

We’ve all seen them on Facebook boasting “high yields” (which are usually based on misleading rental guarantees).

And once you click one, you suddenly see all of them.

So, April is the time for investors to slow down and run their own numbers. That way, you can see if a gimmick is worth the hype.

Even if interest rates go up slightly, banks will still compete hard for your mortgage.

At the end of 2025, all big banks offered up to 1.5% cashbacks to entice you to use them.

So if you had a $500k mortgage, they might pay you $7,500 to use them (with some Terms and Conditions). That’s huge.

I’m expecting to see some other incentives as they elbow each other to maintain and increase their market share.

By mid-2026, the economy might finally feel like it’s looking up.

Not because we’ll suddenly have a rockstar economy … but because 2025 was so bad.

Business confidence is already at an 11-year high, and by June, that optimism should start to flow through into a growing economy.

The new pet bond regime is now in place (it officially came in on the 1st December).

And by July, we’ll see Tenancy Tribunal cases discussing:

That’s how the rules always get clarified … on a case-by-case basis. Expect to see some interesting disputes.

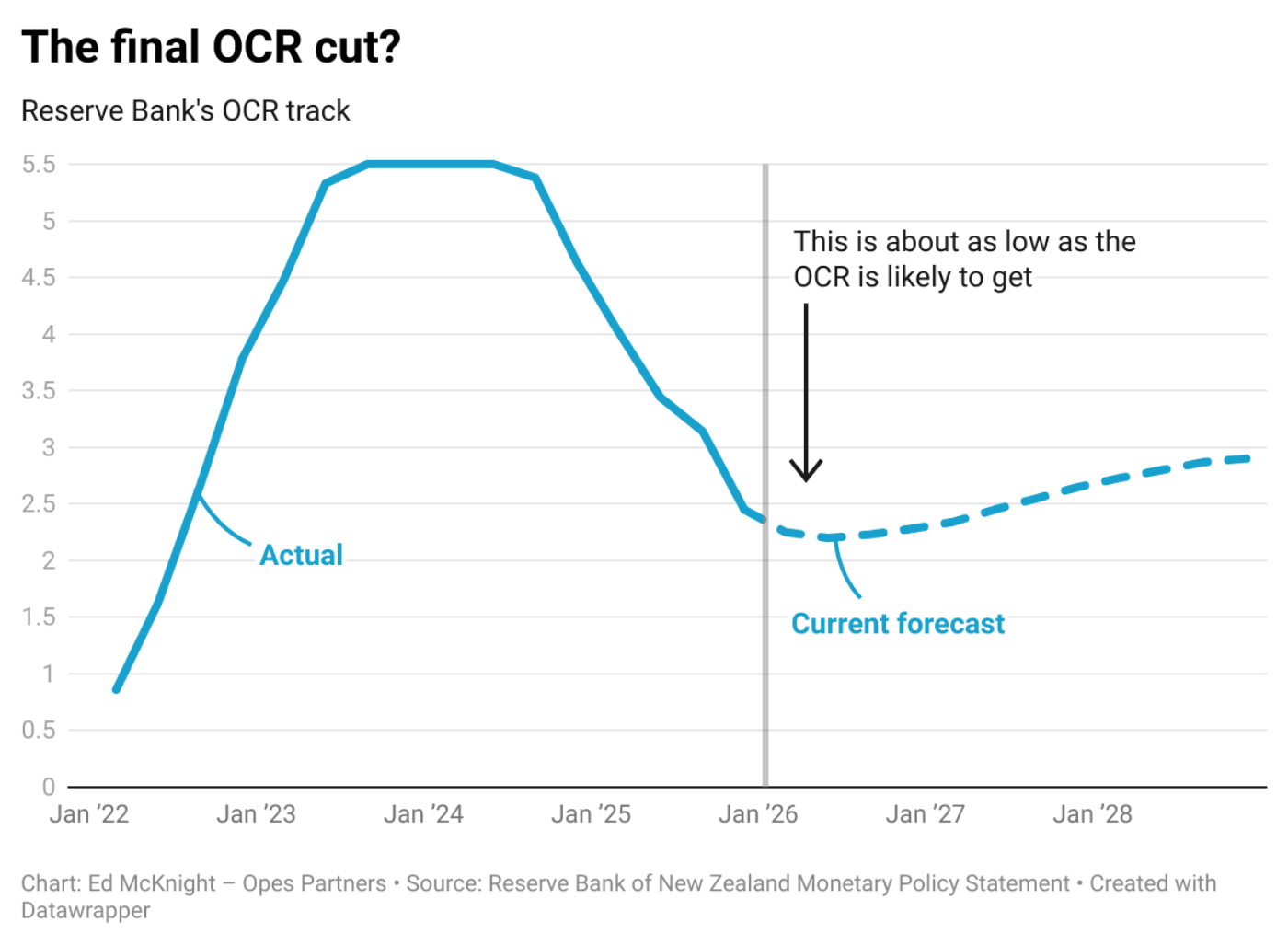

I expect to see 1-year mortgage interest rates going up by August (if not before).

Markets are always forward-looking.

Right now, the market is expecting a possible OCR increase in October 2026. So, that expectation is likely to start flowing through to rates by August, if not much earlier in the year.

Not all markets move together. Property values will increase in some areas, while they go down in others.

Southland is currently looking strong, as is Christchurch.

Auckland, Wellington and Palmerston North are looking weak. But I wouldn’t be surprised if, in 2026, a few of these 3 become the comeback kids.

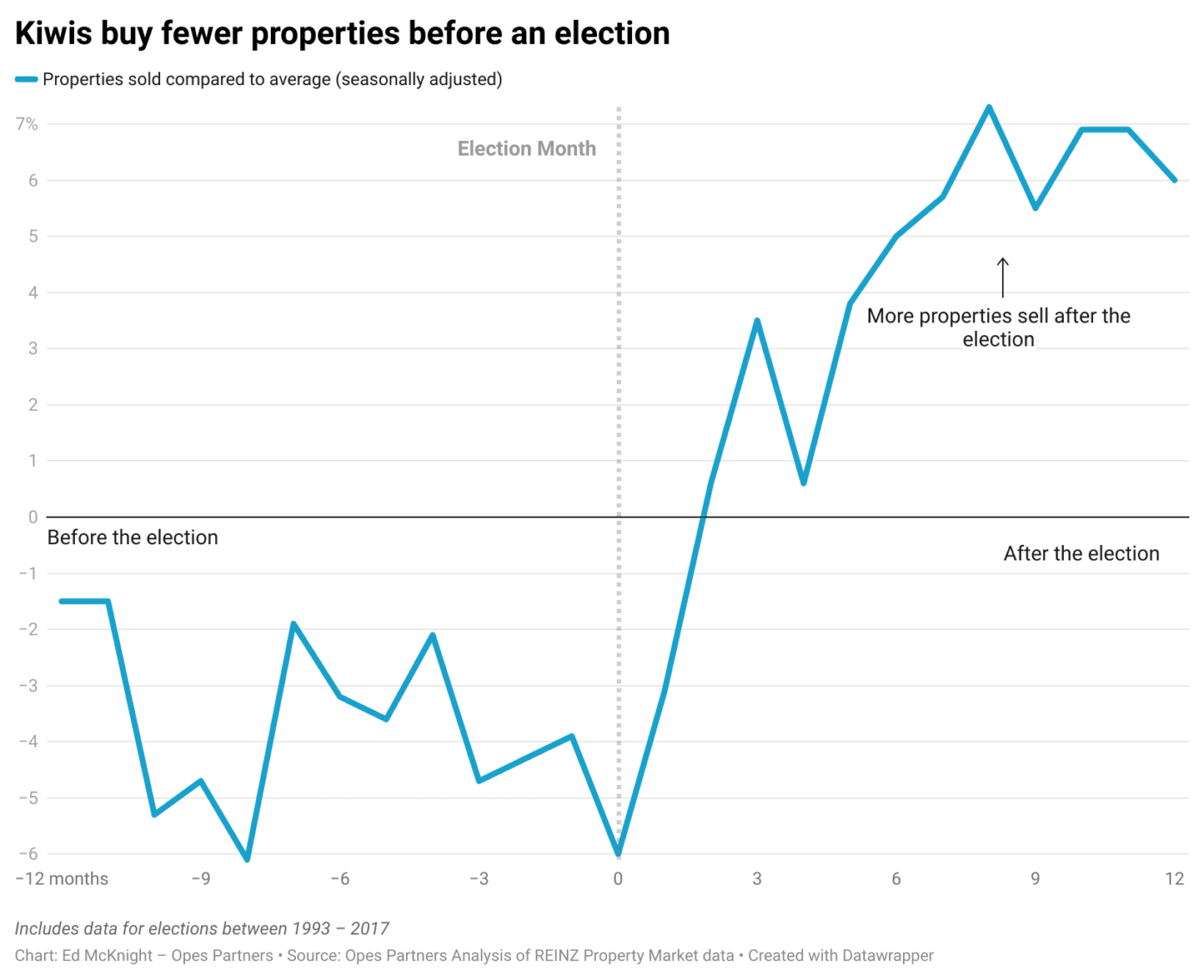

As we head toward the election, expect bold and scary policy announcements.

Remember the last election? One party floated an 8% wealth tax. It never happened.

Expect to see a few curly policies from parties vying for attention.

Uncertainty makes people hesitate.

In the lead-up to elections, people stop buying as many houses, “waiting to see what happens”.

It happens every 3 years. And that creates an opportunity for the brave to step forward and negotiate a deal.

By December, we’ll know which predictions hit and which ones missed.

We’ll release Episode 2,668 of the Property Academy Podcast and celebrate our seventh year of the show.

And then we’ll do it all again next year.

Managing Director, 20+ Years' Experience Investing In Property, Author & Host

Andrew Nicol, Managing Director at Opes Partners, is a seasoned financial adviser and property investment expert with 20+ years of experience. With 40 investment properties, he hosts the Property Academy Podcast, co-authored 'Wealth Plan' with Ed Mcknight, and has helped 1,894 Kiwis achieve financial security through property investment.

This article is for your general information. It’s not financial advice. See here for details about our Financial Advice Provider Disclosure. So Opes isn’t telling you what to do with your own money.

We’ve made every effort to make sure the information is accurate. But we occasionally get the odd fact wrong. Make sure you do your own research or talk to a financial adviser before making any investment decisions.

You might like to use us or another financial adviser