Property Investment

Property Investment

3 min read

Author: Andrew Nicol

Managing Director, 20+ Years' Experience Investing In Property, Author & Host

House prices jumped 1.4% in February.

That’s a decent leap, especially after property prices went down 0.5% in December and 0.3% in January.

So, have we finally turned a corner?

That 1.4% increase in February seems good.

But summer often messes with property prices.

December and January are slow – no one’s buying, no one’s selling. We’re all on Holiday.

Then property prices tend to bounce back in February.

So, that February house price bump doesn’t tell us much. We knew that would happen.

What we really care about is whether this was a particularly large increase (for February) or a smaller increase than expected.

In other words, we need to ‘seasonally adjust’ the data. This takes out the usual ups and downs of the year and shows whether the underlying market is improving (or not).

Here are the month-by-month changes in house prices. You can see both the actual changes and the seasonally adjusted changes.

For example, in January, house prices fell by 0.3%.

But that wasn’t a big fall for January. It was smaller than what you’d usually expect.

So, seasonally adjusted house prices went up 0.1% in January.

Even though actual house prices fell, the property market was a wee bit stronger than expected.

Similarly, in February, actual house prices went up 1.4%.

But once you take out the seasonal effect, they actually only went up by 0.3%.

That can seem a bit confusing. So you might think: “Andrew, just tell me what’s going on in the market.”

So here’s the punch line. Here are the 4 stages the property market has gone through over the last 3.5 years:

🔴 Downturn (November 2021 – April 2023) – Property prices fell 16.8%.

🟢 Early recovery (May 2023 – February 2024) – House prices went up 4.8%

🔴 Mini Downturn (March 2024 – August 2024) – House prices fell 3.7%

🟠 Recovery? (September 2024 – Today) – House prices up 2.6%

I’ve given the current market an 🟠 rather than a 🟢 because house prices have stopped falling. That’s clear. But it’s not clear that property prices are rocketing up, either.

We’re still close to the bottom of the market.

As a property investor, you probably don’t just care about house prices. You likely care about the rental market, too.

And in my experience, investors are often less concerned about the rent itself.

But, about how fast they can find a tenant.

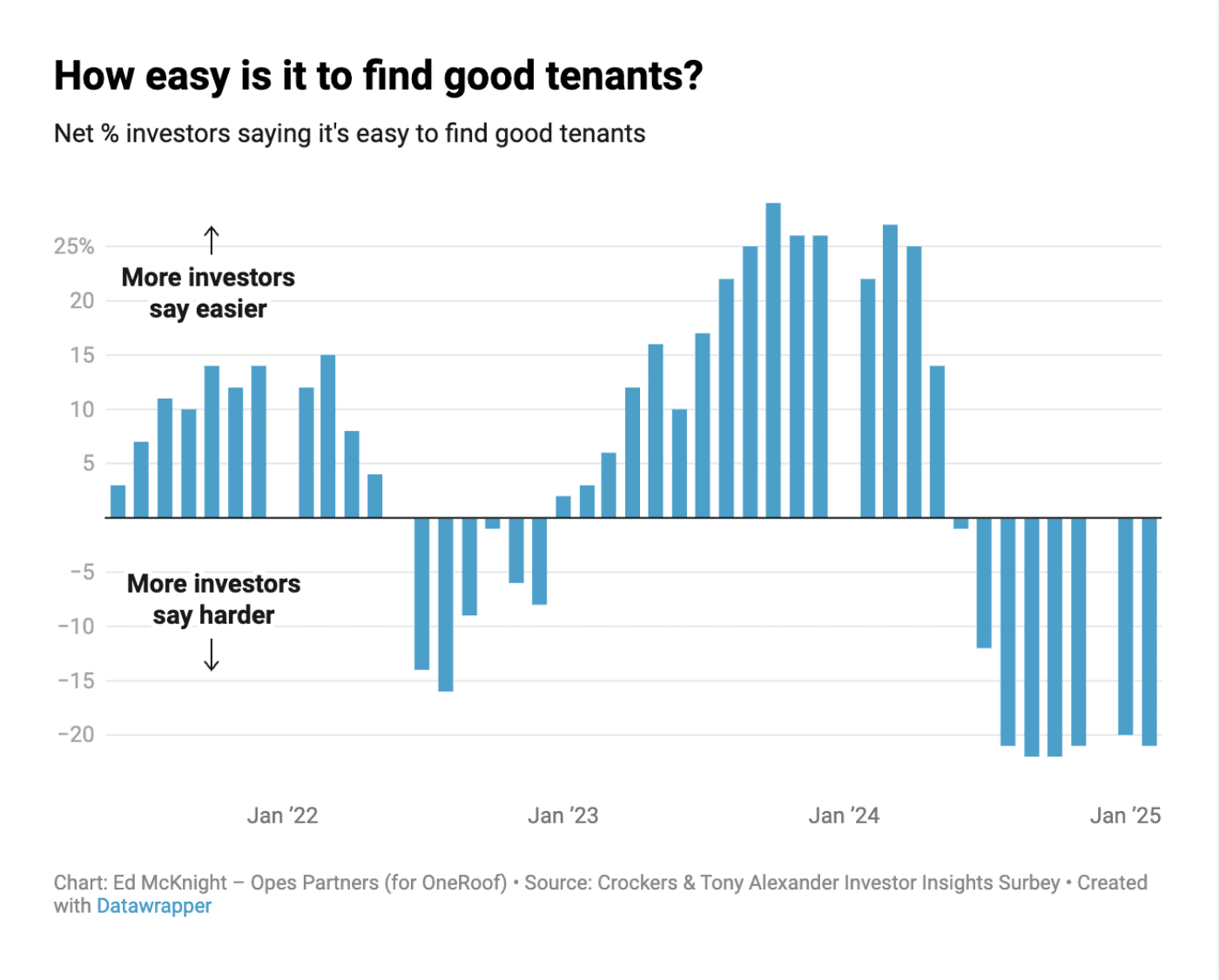

And if you look at Tony Alexander’s survey of landlords, it’s clear that the rental market is a bit tough.

A net 21% of landlords say it’s harder to get good tenants at the moment.

So, I’ve dug into the numbers at my own property management company (Opes Property Management).

I usually say that if you’ve just bought a property … expect to have 4 weeks of vacancy before your first tenant moves in. That’s if your property is in Christchurch.

Or 6 weeks of vacancy if your property is in Auckland.

And I religiously track this. I don’t just want 50% of investors to rent their properties that fast.

I want a super-majority of investors, over 2 thirds, to find a tenant that quickly.

Here are the numbers for Christchurch.

86% of investors are finding tenants with 4 weeks of vacancy (or less).

That’s above my goal of 70%.

And in Auckland 87.5% of tenants are finding their first tenant with 6 weeks of vacancy or less.

You’ll see that we haven’t always met the goal. Usually we don’t over the Christmas period.

That’s because a property might come to market in December. But a tenant might not move in until February. So there can be more vacancy.

I’m comfortable with these numbers. It shows that you can still find a good tenant. But it can take a little longer than usual.

Managing Director, 20+ Years' Experience Investing In Property, Author & Host

Andrew Nicol, Managing Director at Opes Partners, is a seasoned financial adviser and property investment expert with 20+ years of experience. With 40 investment properties, he hosts the Property Academy Podcast, co-authored 'Wealth Plan' with Ed Mcknight, and has helped 1,894 Kiwis achieve financial security through property investment.

This article is for your general information. It’s not financial advice. See here for details about our Financial Advice Provider Disclosure. So Opes isn’t telling you what to do with your own money.

We’ve made every effort to make sure the information is accurate. But we occasionally get the odd fact wrong. Make sure you do your own research or talk to a financial adviser before making any investment decisions.

You might like to use us or another financial adviser