Property Investment

Property Investment

3 min read

Author: Andrew Nicol

Managing Director, 20+ Years' Experience Investing In Property, Author & Host

The best and worst part of hosting the Property Academy Podcast? Seeing the deals, investors actually go through with.

I want to help Kiwis grow their wealth.

But every so often, I get an email.

Someone will send me a link to the Trade Me listing for a property they just bought.

Now, that’s not me throwing shade at Trade Me – or anyone wanting to build wealth

But there is a big difference between a nice-looking house and a great investment.

Here’s an example.

I recently got sent a link to a property an investor recently bought.

So when I opened the link, I was curious …

Was it a shoebox studio in Auckland?

A do-up in Gore?

Nope. It was a shiny, beautiful New Build in Rolleston.

And that’s exactly the problem.

That might surprise you. After all,

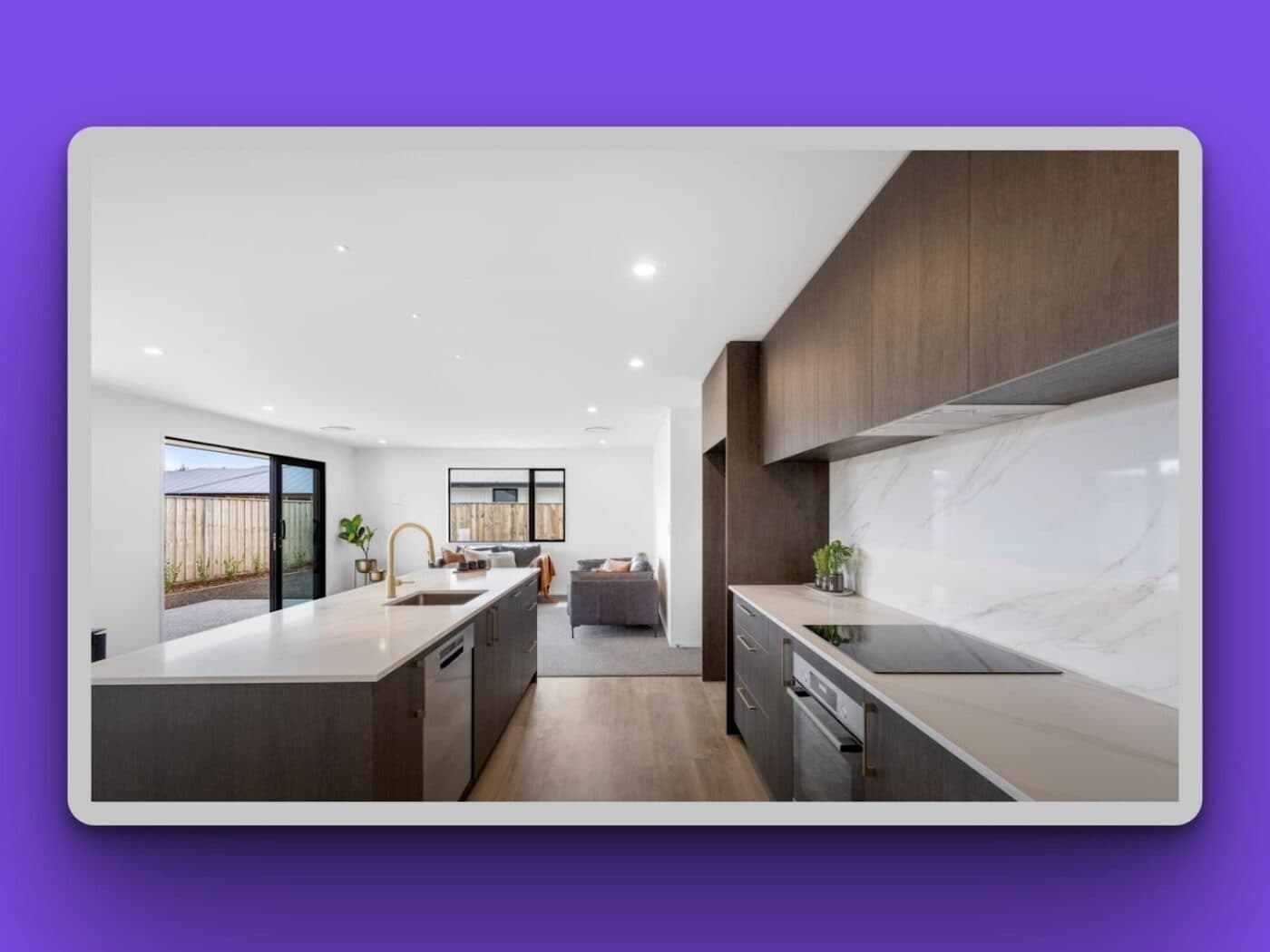

Here’s what he was planning to invest in:

It’s a beautiful home.

Great kitchen, real timber floors, golden tapware … the works.

And that’s the problem.

It’s the kind of house to buy if you plan to live in it.

Those extra features cost more – but don’t get much more rent. So:

Sure, your tenants will probably appreciate the nice touches, too.

But that doesn’t make it a good investment. Not every property that can be rented out is a great rental.

Let’s start with the price. It’s around $800K.

That’s not outrageous for a 3-bed new build in Rolleston.

In fact, that’s probably a fair price for this house. But as an investor, I wouldn’t be paying that. Here’s why:

#1 – It’s too big.

It’s a 190 sqm palace. Great for a family. Bad for your wallet.

Tenants pay for bedrooms, not square metres. Simple as that.

A smaller 4-bed home often rents for more than a larger 3-bed.

#2 – It’s too bougie

The gold tapware seems great. Until you have to replace it.

Those higher-spec nice-to-haves aren’t just expensive to buy.

They’re also expensive when they eventually break.

#3 – It (probably) has hidden costs.

Here’s a little tip. If you look at a photo on Trade Me. And the house looks new. Check if there are any curtains or blinds in the photos.

If there aren’t … they’re often NOT included in the price.

It can cost you at least $10k to put blinds in.

It also looks like there aren’t enough heaters to meet the Healthy Homes Standards.

So, first, you pay a higher price.

Then you pay an extra $10 - $15k+ to get it Rent Ready.

How do you tell the difference between a good and bad investment?

Cold, hard numbers.

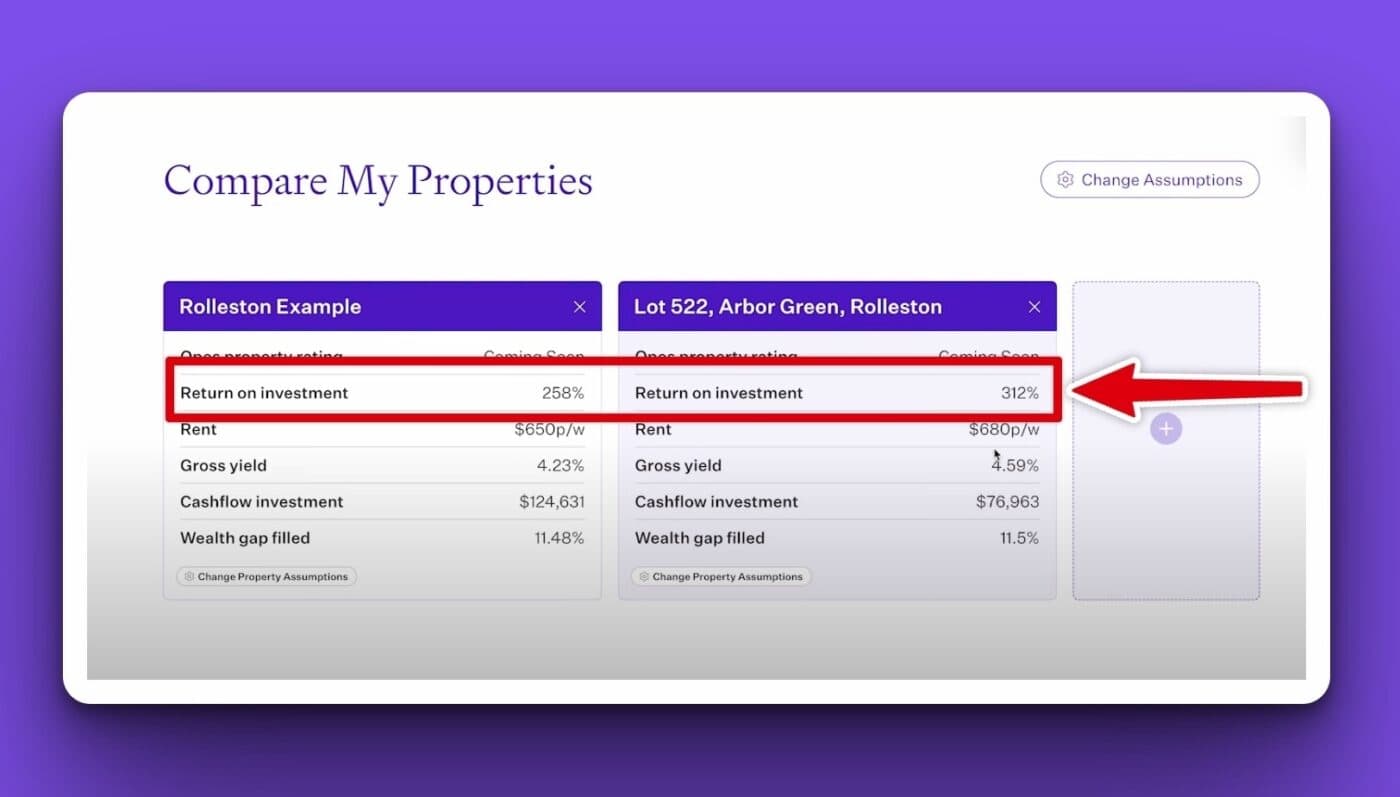

Remember, you can use Opes+ (for free) to compare different properties.

Compare the one we’ve just talked about to a cheaper 4-bed in the same city.

Which is the better investment?

From a hard-nosed investor perspective … the smaller, more affordable 4-bed is the better call.

I never want it to come across on the podcast or through this newsletter that all you need to do as a property investor is:

There’s a lot about the property you need to look out for. So, I’ll cover this even more in future newsletters.

But there are 30,000+ property listings online right now …

Trade Me shows you what’s available, not what’s good.

And the way to figure out what’s good … is to run the numbers through Opes+.

So here’s my challenge: This Easter weekend:

I’ll jump in personally (or loop in my team) to give you feedback.

Let’s make sure you’re building wealth — not just buying homes.

Managing Director, 20+ Years' Experience Investing In Property, Author & Host

Andrew Nicol, Managing Director at Opes Partners, is a seasoned financial adviser and property investment expert with 20+ years of experience. With 40 investment properties, he hosts the Property Academy Podcast, co-authored 'Wealth Plan' with Ed Mcknight, and has helped 1,894 Kiwis achieve financial security through property investment.

This article is for your general information. It’s not financial advice. See here for details about our Financial Advice Provider Disclosure. So Opes isn’t telling you what to do with your own money.

We’ve made every effort to make sure the information is accurate. But we occasionally get the odd fact wrong. Make sure you do your own research or talk to a financial adviser before making any investment decisions.

You might like to use us or another financial adviser