Property Investment

Property Investment

3 min read

Author: Andrew Nicol

Managing Director, 20+ Years' Experience Investing In Property, Author & Host

Reviewed by: Laine Moger

Journalist and Property Educator, holds a Bachelor of Communication (Honours) from Massey University.

Private Property – our weekly newsletter that gives you insights into what's happening in the NZ property market. Written by managing director Andrew Nicol. Sign up to receive this in your inbox every Thursday.

Here’s a preview of one of the steps you’ll learn at next Tuesday’s webinar – 8 steps to build a passive income and retire on real estate.

This is step #3 – Buying your first investment property. There are four critical stages.

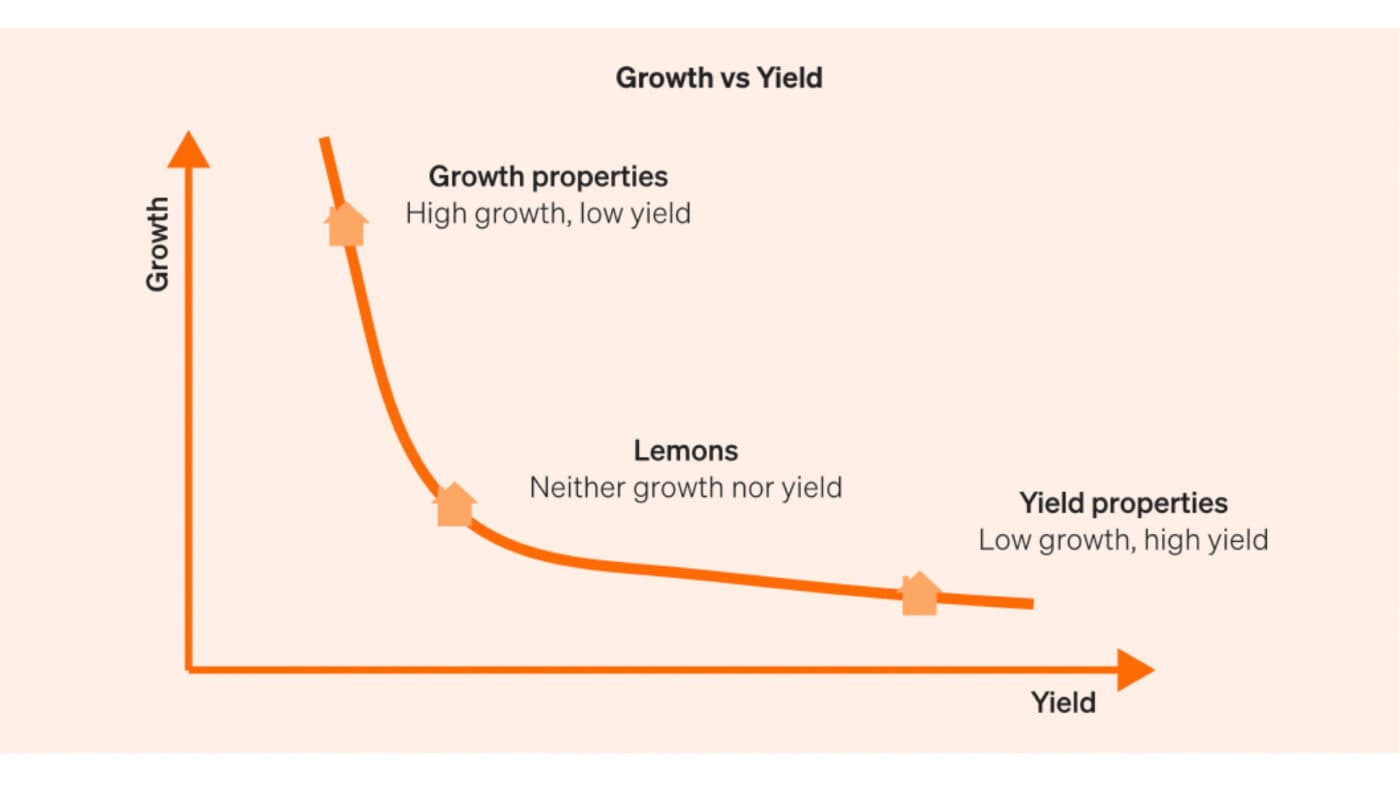

Your first step is to decide whether you’ll invest in a ‘growth’ or a ‘yield’ property.

Growth properties increase in value more quickly but tend to have poorer cash flow.

These are properties like standalone houses and townhouses.

Whereas yield properties have better cash flow but don’t go up in value at the same pace.

Think apartments, dual-key apartments, and student accommodation.

Most first-time investors go for growth.

That’s especially if you are 15+ years away from retirement, and your goal is to grow your wealth rather than live off your investment properties now.

But if you already have a high net worth or are close to retirement, you’ll typically go for yield.

Want to know which is right for you? Use this quiz to figure out which is the right fit for you

Let’s say you go for a growth property. How do you find one?

From our analysis, there are 8 attributes to look for:

You don’t need to find a property that hits all 8 of these. But, you should be looking for at least 4-5.

If you’re looking for yield instead. There are another 5 attributes to look for. We’ll go through these at the webinar on Tuesday night.

That brings us to the next step.

With your buying criteria in place … now’s the fun part – property shopping.

There are two main ways to go about it.

#1 – DIY it and use TradeMe or approach developers directly.

#2 – use a property investment company, like us here at Opes Partners. Though there are other property investment companies too.

TradeMe is a good option for experienced investors who have negotiated with developers before.

Whereas first-timers (or time-poor investors) often prefer to use a property investment company.

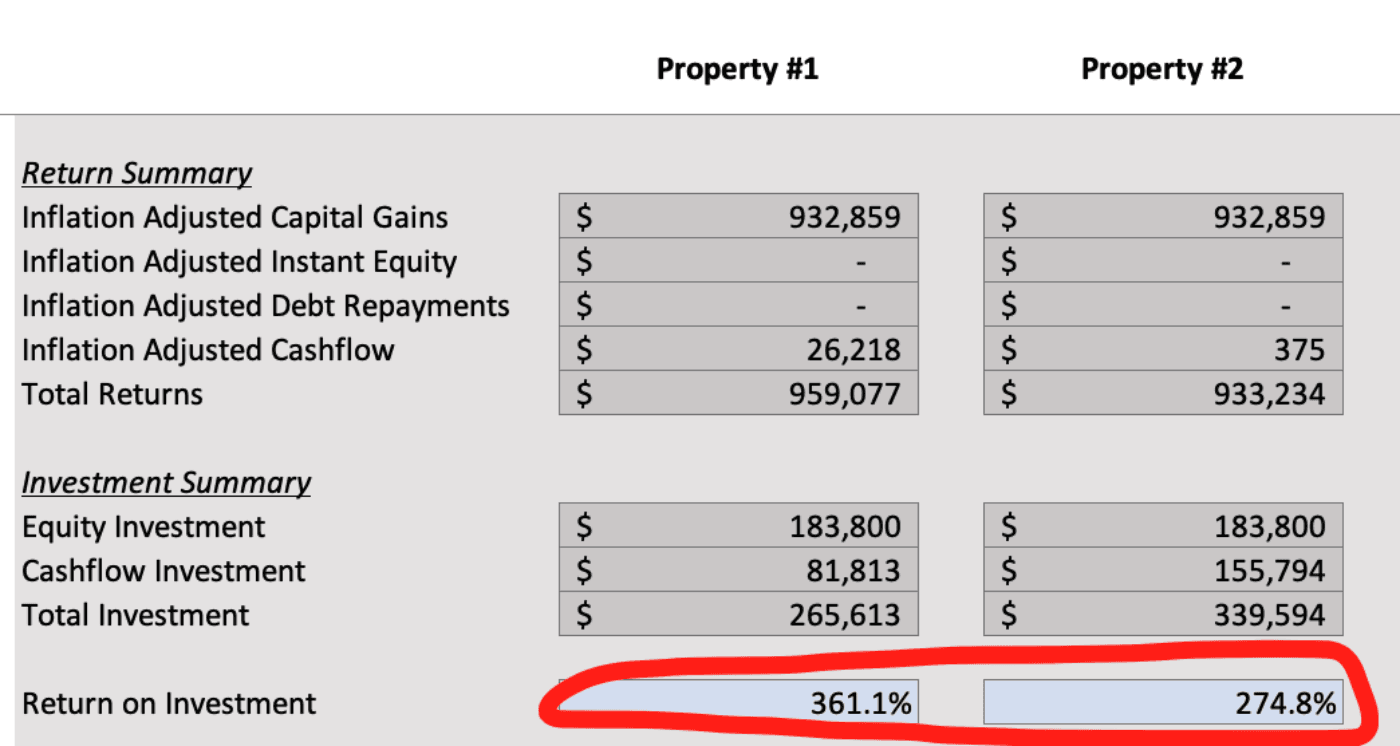

Once you’ve found a selection of properties (2-4) that meet your criteria, you need a spreadsheet to compare them.

That way, you can see which is better – based on the numbers.

You can make your own, but over 8,000 Kiwi property investors use our Return-on-Investment spreadsheet (it’s free).

This projects each property's cash flow and capital gains over the next 15 years.

And importantly, it shows you which gives the highest return on investment.

Once you’ve done this, you can move ahead with your property purchase. And you can genuinely say you’ve made your decision based on the numbers.

Download the spreadsheet here (for free).

This is only step #3 out of the 8 steps to build a passive income and retire on real estate.

You can learn all 8 steps at next Tuesday’s webinar (11th October). If you’re not signed up yet, your next step is to click this link and register. {webinar link}

The webinar starts at 7pm.

Remember, these are the same 8-steps you’ll read about in our upcoming book: Wealth Plan, which comes out in November.

And as part of the book’s launch, we’re going on tour. Ed and I are coming to Auckland, Wellington, Christchurch, Havelock North and Queenstown.

These tickets will go live at the webinar. So if you register (and turn up), you’ll get first dibs on tickets. Register for the webinar here.

Managing Director, 20+ Years' Experience Investing In Property, Author & Host

Andrew Nicol, Managing Director at Opes Partners, is a seasoned financial adviser and property investment expert with 20+ years of experience. With 40 investment properties, he hosts the Property Academy Podcast, co-authored 'Wealth Plan' with Ed Mcknight, and has helped 1,894 Kiwis achieve financial security through property investment.

This article is for your general information. It’s not financial advice. See here for details about our Financial Advice Provider Disclosure. So Opes isn’t telling you what to do with your own money.

We’ve made every effort to make sure the information is accurate. But we occasionally get the odd fact wrong. Make sure you do your own research or talk to a financial adviser before making any investment decisions.

You might like to use us or another financial adviser