Property Investment

Property Investment

3 min read

Author: Andrew Nicol

Managing Director, 20+ Years' Experience Investing In Property, Author & Host

Reviewed by: Laine Moger

Journalist and Property Educator, holds a Bachelor of Communication (Honours) from Massey University.

The housing market looks like it’s turning.

We are now at the bottom of the market. That's my best guess. Here's why –

House prices are down 18% compared to their peak in November 2021.

Auckland is down 23%, and Lower Hutt is down 30%.

At the same time, incomes have gone up 21% since the start of the pandemic.

Lower house prices and rising incomes make houses more affordable.

The house price to income ratio is back to where it was pre-pandemic.

Sure, they’re still expensive, and banks have tightened their purse strings.

But even at the peak of the market, over 100,000 properties sold per year.

Now, we're sitting at 58,000 per year.

Kiwis can buy more houses … if they feel it's the right financial decision.

Once the general punter feels like the tide turning, buyers will re-engage.

Interest rates are high … but give it another year, and they will likely be on the way down.

The general public knows this.

45% of borrowers prefer the 1-year interest rate or less.

A touch under 45% prefers the 2-year rate.

People know interest rates are close to their peaks and will likely trend down.

How do we know? If people think interest rates will stay high, they'll lock in the cheaper 5-year rate.

That's not happening.

Why? Because no one wants to lock in a high long time rate only to see rates fall in the next few years.

That feeling that interest rates are due to get better (rather than worse) will change the mood of the market. This will draw buyers in.

Tony Alexander (my favourite economist 😉) released his Real Estate Agent survey this week.

It shows that more people are turning up to open homes and auctions. In addition, first-home buyers are coming back.

Some investors are getting tempted back into the market, hoping to find a bargain.

This change in demand creates the conditions for prices to nudge upwards.

More demand won't push house prices up on its own. You also need to look at the supply.

The number of listings available has peaked and is trending down.

Some people will have to sell as they re-fix their mortgages. You'll read about these in the papers.

But it seems that many sellers are holding off and will only sell once prices rise.

That means this new demand is not being met with a flood of supply.

Remember how last year you'd read lots of articles about banks checking how much you spend at the local cafe?

That was due to the updated CCCFA rules that came in November 2021.

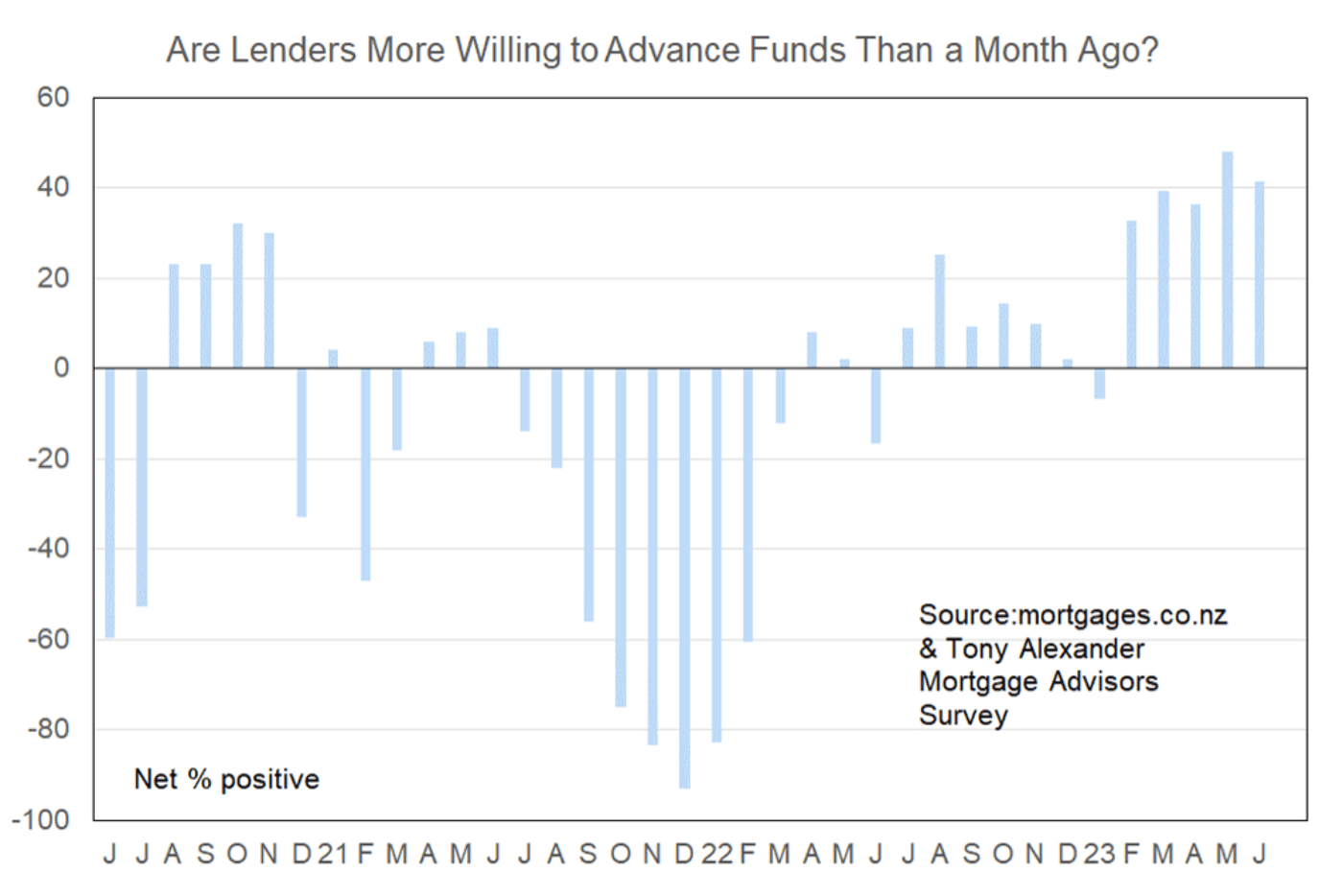

The government reversed some of these rules, which were rolled back in May 2023.

Mortgage brokers say that banks are more willing to approve loans.

My money is on house prices turning a corner this year. Nation-wide, I think they've already bottomed out.

But that doesn't mean everyone should buy right now. If you're going to invest now, you've got to:

You've also got to pick the right area to invest in. Because the house price bounce back will be uneven.

Auckland could go up while Gisborne stays flat.

Wellington house prices may continue to fall while Canterbury starts to rise.

You've also got to pick the right deal. To learn how to do that, come along to my webinar this coming Tuesday.

You'll learn how to spot the difference between a good and bad investment property. Click the link below to sign up:

-> I want to learn how to spot a good vs bad investment property

You’ll also notice that I’ve referenced a lot of Tony Alexander’s data in this newsletter.

That’s because he has the best data for finding out what’s happening in the property market today.

He surveys mortgage advisers and real estate agents to see what they’re seeing. So his data can show movements in the market before the official real estate data does.

I recommend reading some of his reports and signing up for Tony’s View. You can do that at tonyalexander.nz

Managing Director, 20+ Years' Experience Investing In Property, Author & Host

Andrew Nicol, Managing Director at Opes Partners, is a seasoned financial adviser and property investment expert with 20+ years of experience. With 40 investment properties, he hosts the Property Academy Podcast, co-authored 'Wealth Plan' with Ed Mcknight, and has helped 1,894 Kiwis achieve financial security through property investment.

This article is for your general information. It’s not financial advice. See here for details about our Financial Advice Provider Disclosure. So Opes isn’t telling you what to do with your own money.

We’ve made every effort to make sure the information is accurate. But we occasionally get the odd fact wrong. Make sure you do your own research or talk to a financial adviser before making any investment decisions.

You might like to use us or another financial adviser