Opes

Opes vs iFind property vs propellor vs positive

Deciding to invest in property is a big decision. So, when embarking on this exciting journey you might decide on enlisting some expert help.

Opes

10 min read

Author: Laine Moger

Journalist and Property Educator, holds a Bachelor of Communication (Honours) from Massey University.

Reviewed by: Ed McKnight

Resident Economist, with a GradDipEcon and over five years at Opes Partners, is a trusted contributor to NZ Property Investor, Informed Investor, Stuff, Business Desk, and OneRoof.

If you want to buy a New Build property as an investor, you have two options:

This leads many investors who focus on New Builds to ask: “Why would I use a company like Opes Partners? Why not go to a developer directly?”

This is a great question and an important one too. The truth is using a property investment company isn’t always the right answer for everyone.

So, in this article, we’ll go through the five key differences between buying an investment property through a property investment company like Opes, compared with buying directly from a developer.

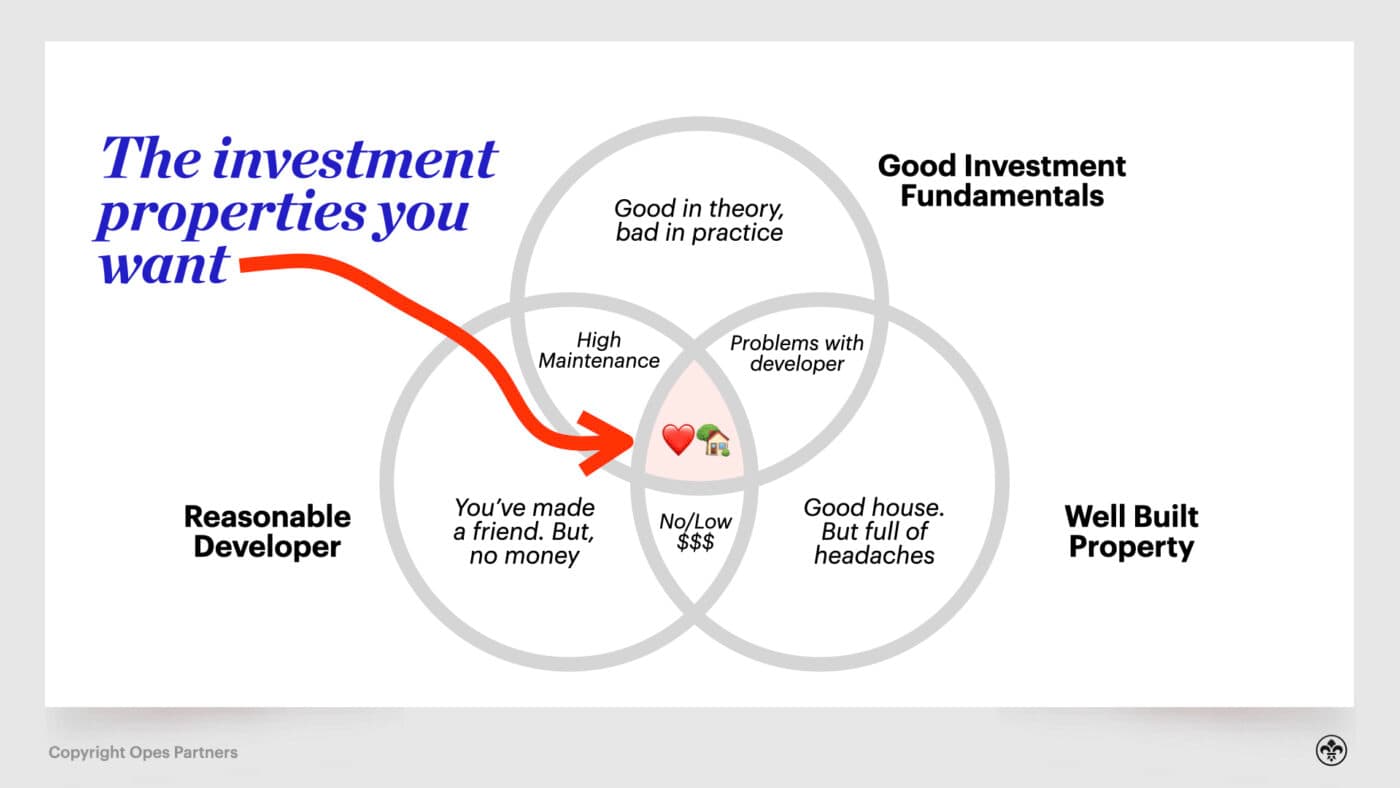

Any property can be a rental property.

But not every property can be a good investment property.

What do we mean by this?

Any property can be rented out. But, for it to be a successful investment, much more analysis is needed.

For example, here at Opes Partners, we currently recommend properties from 58 developers over a whole bunch of projects.

And even though each of these developers is trustworthy and can build a solid house … not every property they build will have the right investment fundamentals. And that means not every unit they build will be appropriate for investment.

What would make something not have the right fundamentals?

Don’t get us wrong, they’ll build a good property. But that doesn’t make it a good investment. And being able to spot the difference is key for investors.

Here is a recent example of an excellent property, but a bad investment. This development of nine luxury, terraced homes, designed by an award-winning architect, are on the market from $2 million.

If you choose to go to developers directly, then you’ve got to vet the developer, the property and the investment fundamentals yourself.

But a good property investment company will recommend pre-vetted investment-grade stock from developers they’ve already checked out and likely worked with before.

This saves you time as an investor – since you don’t personally have to vet properties and developers.

It also means that you’re less likely to make a mistake. Because many investors will only evaluate a handful of properties in their time, whereas a property investment company is doing it daily.

Here at Opes Partners, we use our rigid 23-point checklist to determine if a property meets the grade.

So, the first reason some investors choose to work with a property investment company rather than a developer is the ability to determine whether a property is a good investment or not.

When you’re searching for a New Build investment, you can gander through Trade Me, head to a real estate agent, or contact a developer’s sales team.

But it may surprise you to know not every developer sells properties via these routes.

There are lots of small developers out there who build good quality property and who don’t want to sell through these traditional means.

They work exclusively with companies like Opes to find investors to purchase their properties, usually because landlords are often able to purchase more quickly.

So an investor working with an investment company can usually access properties that aren’t marketed on Trade Me or by traditional means.

It’s important to note, property investment companies work with a range of developers across the country. This has two benefits for investors:

Developers are experts at building properties. They don’t specialise in providing financial advice.

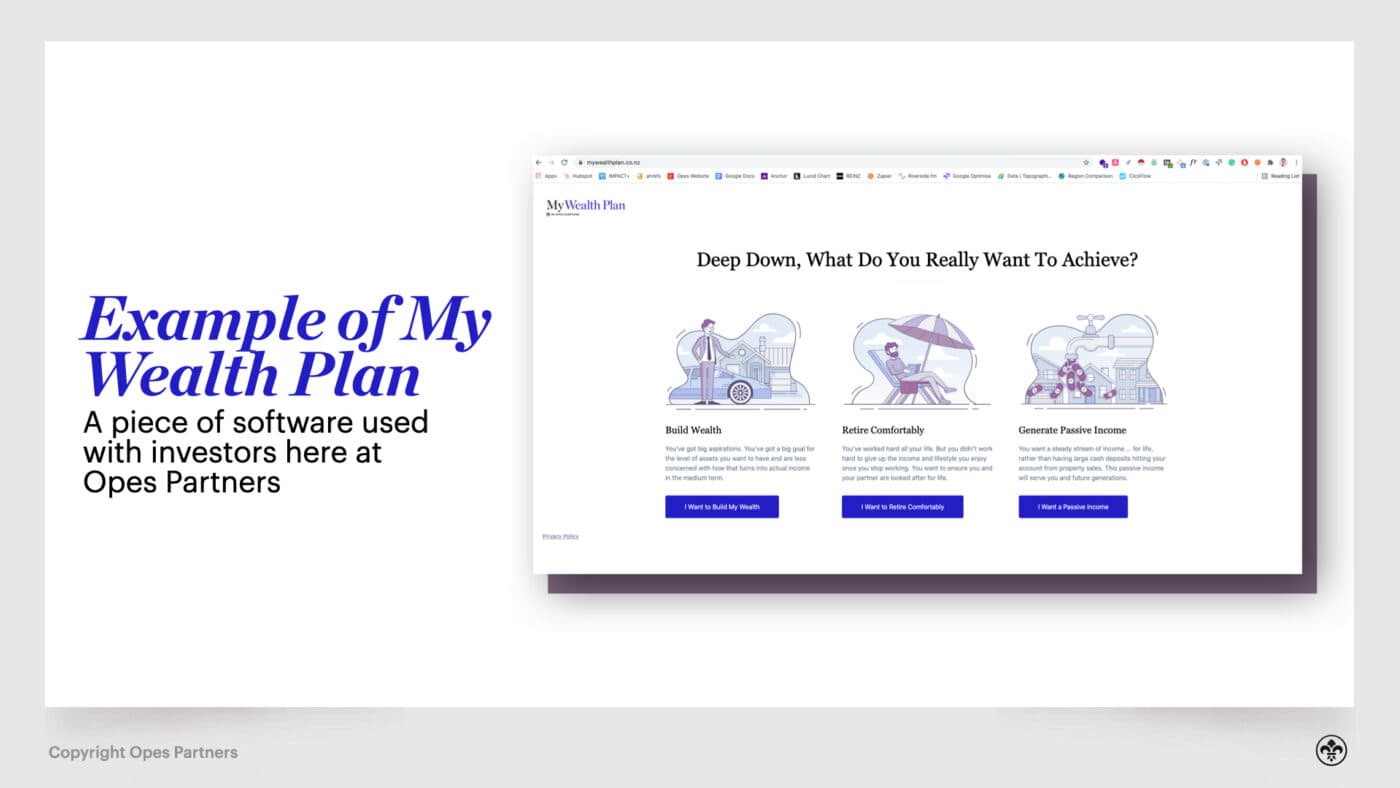

So a big point of difference for investors who choose to work with a property investment company is the financial advice on offer.

This means not just choosing the right property, but building a portfolio to help the investor achieve their long-term goals.

For instance, here at Opes we use our inhouse software, MyWealth Plan, to figure out:

This, along with planning how each property will be used to further build a portfolio, is the difference between purchasing from a developer and through a property investment company.

A property investment company will also help you regularly review your plan and help you grow your portfolio.

When you use a property investment company to purchase a new-build, they will often have a set process you can follow during Due Diligence.

Remember, this is the time where you have signed a contract for a property … but you aren’t yet committed to purchasing it. So you’ve got 10 days to confirm whether it’s the right property for you.

A property investment company’s process will often be more thorough than a developer.

For instance, a developer will encourage you to talk to a mortgage broker so you can get finance. And it will be compulsory to talk to a lawyer so you can get the contract over the line.

However, a property investment company will also encourage you to:

Here's an example of our due diligence process here at Opes Partners:

A property investment company will often organise these conversations for you with trusted professionals to save time and make sure the advice is sound.

Don’t get us wrong, a developer’s team will be helpful, but their focus is more on the property, rather than how the property works as an investment.

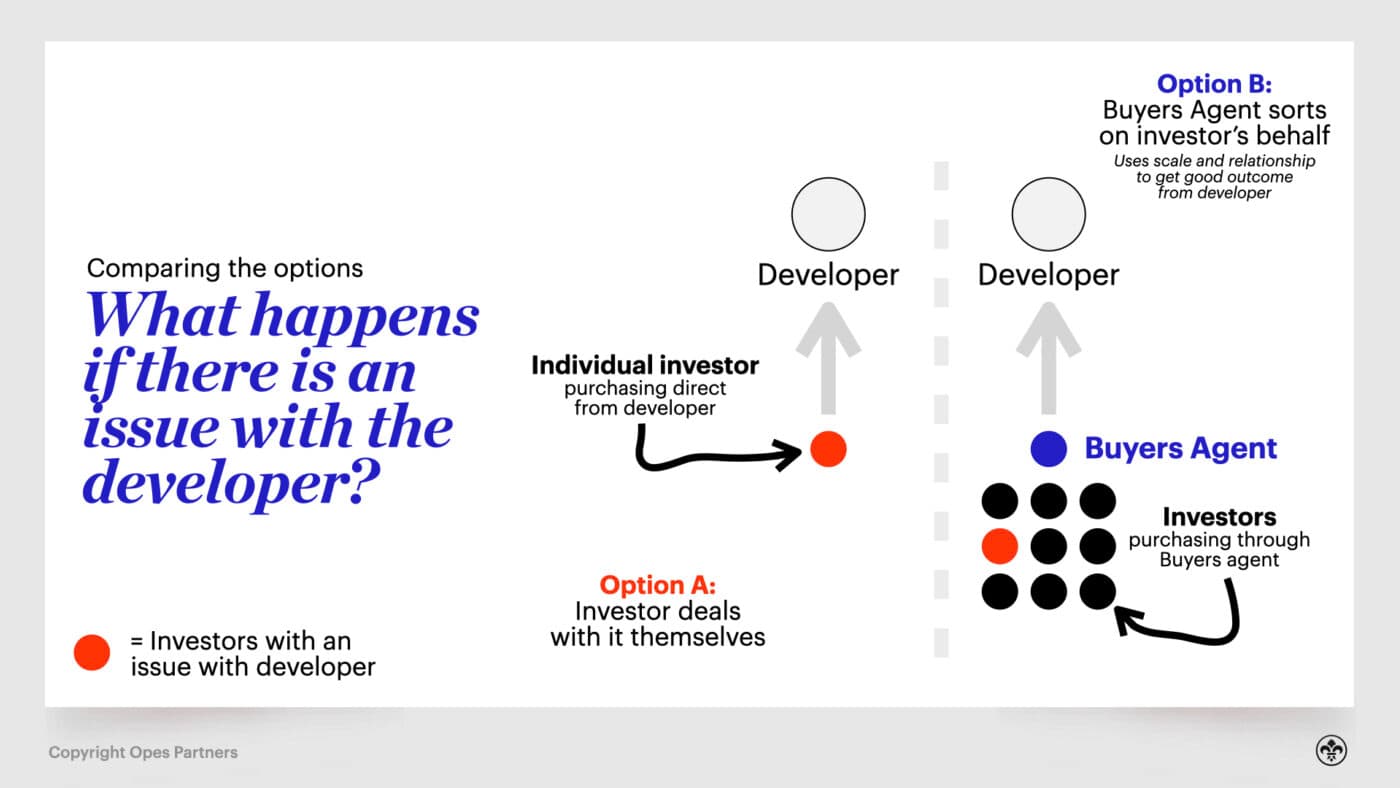

Building properties is complicated. So, sometimes things can go wrong.

A developer might guarantee that a property will meet Healthy Homes standards – a legal requirement for landlords. But then once the inspection has been completed, perhaps the property fails the standards.

It’s at this point that a property investment company will often show its value.

This is because one property investment company might represent a large number of buyers within a project, giving the property investment company more scale and clout with the developer.

A property investment company will have the developer’s ear and can step in to sort our problems as they arise.

Some common instances where that might happen:

Could you sort all this out yourself? Yes, of course, but it’s always nice to have someone on your team who does this full-time, and has a lot of extra bargaining power when you really need it.

Now, there are situations where going to a developer direct may be a better option for you or your situation.

Let’s go through three key examples.

Firstly, no single property investment company represents every developer in the country.

So, if you have one specific property you are interested in – and it’s from a developer or in a town the property investment company doesn’t represent – going direct may be the better option.

For instance, right now at Opes Partners we do not recommend any properties in Dunedin, Gisborne, Hawke’s Bay or Wellington.

The reason for that is we believe these regions are at poor parts of their property cycle.

But if you have a different view of the market and want to purchase properties in these regions then you are likely to need to purchase from the developer directly.

For full transparency, here is a map of every area we've ever recommended a property in, here at Opes Partners. If you want to buy a New Build outside these areas – then going direct to a developer may be a better option.

The most common time that purchasers will buy from a developer directly is if they are purchasing a home for them to personally live in.

In this instance, buyers don’t care about a hard-nosed look at the numbers and instead want to walk through a house and see whether they’d like to live there.

That’s where approaching a developer directly is a much more natural fit.

Another common instance, where investors should go direct, is if you already have a piece of land and want the developer to build on that land.

Property investment companies are more focused on helping investors purchase turnkey/off-the-plans properties from a developer. They tend to be less focused on helping investors build properties for themselves.

So in this case it’s better to go to a developer directly.

Just be aware that not every developer is available to build property on other people’s land.

For instance, developers like Golden Homes, Stonewood, Mike Greer and GJ Gardner are all available for you to hire to build a property ‘on your own bit of dirt’.

On the other hand, companies like Williams Corporation, Safari Group and Wolfbrook will only build properties on land they are contracting to purchase. So you can’t hire them to build on your land.

Now we can’t speak for all property investment companies, but here at Opes all the properties we recommend come with fixed prices. They are pre-negotiated and the haggling has already been done.

So, a common – and fair – question investors often ask is whether they can get a property cheaper if they go direct to a developer.

The answer is “no”. That’s for 2 reasons:

The decision about whether to use a property investment company or go direct to a developer depends on your situation.

If you have a very specific area or property in mind; want to contract a developer to build on a piece of you own land; or are purchasing to live in yourself – then approaching a developer direct may be the right decision for you.

However, if you want to purchase a property as an investor, and want advice about where to purchase, what to purchase, and which developers are quality, then working with a property investment company – like Opes Partners – may be a better fit.

Your next step is to book a portfolio planning session. This is where a financial adviser will create you a financial plan. They will then find properties that fit your plan.

Book your free sessionJournalist and Property Educator, holds a Bachelor of Communication (Honours) from Massey University.

Laine Moger, a seasoned Journalist and Property Educator holds a Bachelor of Communications (Honours) from Massey University and a Diploma of Journalism from the London School of Journalism. She has been an integral part of the Opes team for four years, crafting content for our website, newsletter, and external columns, as well as contributing to Informed Investor and NZ Property Investor.

This article is for your general information. It’s not financial advice. See here for details about our Financial Advice Provider Disclosure. So Opes isn’t telling you what to do with your own money.

We’ve made every effort to make sure the information is accurate. But we occasionally get the odd fact wrong. Make sure you do your own research or talk to a financial adviser before making any investment decisions.

You might like to use us or another financial adviser