Property Market

What’s a good rental yield in Auckland?

In this article you’ll learn what a good rental yield looks like in Auckland.

Property Market

4 min read

Author: Ed McKnight

Resident Economist, with a GradDipEcon and over five years at Opes Partners, is a trusted contributor to NZ Property Investor, Informed Investor, Stuff, Business Desk, and OneRoof.

Reviewed by: Laine Moger

Journalist and Property Educator, holds a Bachelor of Communication (Honours) from Massey University.

Investors always ask: “What’s a good yield in today’s market?”

When you see it asked online, most people respond: “Well, it depends.”

It depends on your strategy. It depends on where you buy it. It depends on what you buy.

It’s not a straightforward answer. But as a property investor, you still want an answer.

Here at Opes Partners we want investors to be as informed as possible. That’s why we searched out the data. That way you can make an informed decision with your investment properties.

In this article you’ll learn what a good rental yield looks like in Christchurch.

The median yield investors are willing to accept in Christchurch is 4.36%. That is only 0.16% lower than the country’s median.

This is higher than yields in Auckland, but lower than some other parts of the country.

But some properties fetch a lower yield; 25% of properties rent for 3.95% or below.

On the other hand, 25% of properties have a gross yield of 4.70% or more.

But, of course, it depends on the property type too.

A 4.5% gross yield is good for a growth property, like a townhouse. But a 5% gross yield would be bad for a yield property.

Here at Opes Partners we aim for a 4.5-5% gross yield for growth properties (houses and townhouses).

For standalone houses in places like Rolleston and Kaiapoi (Selwyn and Waimakariri District) we aim for 4.4-4.6%.

Find out instantly how much your property will earn or cost you per week

Find out nowTo get these numbers, the team at Opes hired someone to get data from Trade Me and OneRoof.

The Trade Me listings show what properties are renting for. We then match that with OneRoof data to see what those properties are worth. This shows us the gross yield property investors are actually willing to accept. We then did this for every property on Trade Me.

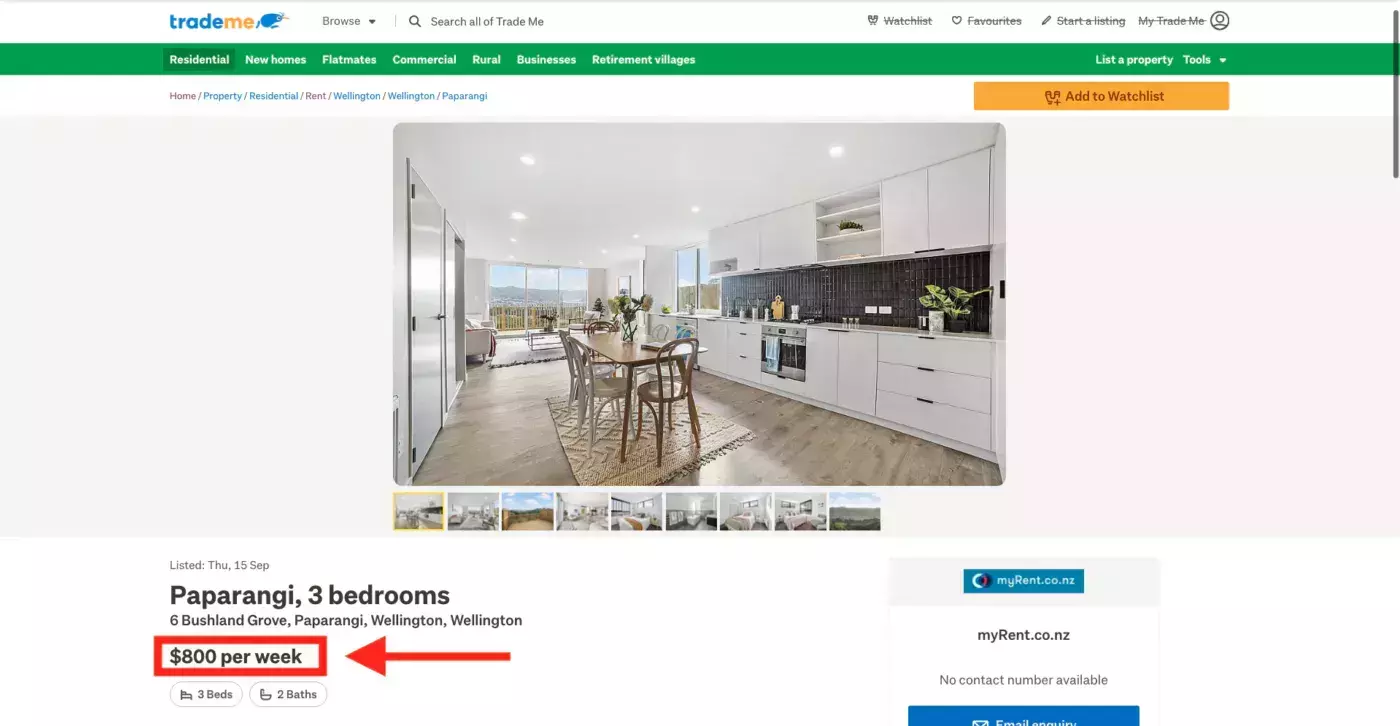

For instance, here is a property available for rent at the time we did the analysis:

It’s a 3-bed New Build townhouse in Wellington, and it’s available to rent for $800 a week.

Then, we cross-referenced this with OneRoof’s estimated valuation.

And in this instance, this property is estimated to be worth $920,000, giving it a gross yield of 4.52%. Bang on average for the country.

We then use a computer to do this over 7,000 times. After cleaning up the data, we’ve now got figures no-one else has.

If you follow a lot of property investors on social media, you might think: “Why are these numbers so low? The numbers I see online are higher.”

Some investors calculate their gross yield using the price they paid 10 years ago, not what that property is worth today.

When you calculate the gross yield you should always use the value of the property today.

What you spent isn’t relevant. That’s because you could always sell your property and do something else with the money.

This is an important point.

Christchurch yields have been steadily declining. In 1993, they were about 7.17%. Today (using another calculation) they are closer to 4.06%.

The reason is that property prices have been increasing by around 6% per year. At the same time, rents have increased at about 4-5% per year.

Since property prices are rising faster than rents, yields have declined. This is important. Investors need to be cautious when reading older material that mentions specific yields. What was a realistic yield 5 years ago may be unachievable in today's market.

Here at Opes, we aim for 4.5-5% gross yield for a growth property in Christchurch. In Rolleston and Waimakariri, we aim for 4.4-4.6%.

For a yield property, you’d want to aim for a yield of 5.5% to 6.3%.

Once you’ve found a property, you might want to analyse it further.

Either use our return on investment (ROI) spreadsheet or this rental yield calculator.

Resident Economist, with a GradDipEcon and over five years at Opes Partners, is a trusted contributor to NZ Property Investor, Informed Investor, Stuff, Business Desk, and OneRoof.

Ed, our Resident Economist, is equipped with a GradDipEcon, a GradCertStratMgmt, BMus, and over five years of experience as Opes Partners' economist. His expertise in economics has led him to contribute articles to reputable publications like NZ Property Investor, Informed Investor, OneRoof, Stuff, and Business Desk. You might have also seen him share his insights on television programs such as The Project and Breakfast.

This article is for your general information. It’s not financial advice. See here for details about our Financial Advice Provider Disclosure. So Opes isn’t telling you what to do with your own money.

We’ve made every effort to make sure the information is accurate. But we occasionally get the odd fact wrong. Make sure you do your own research or talk to a financial adviser before making any investment decisions.

You might like to use us or another financial adviser