Property Market

What's happening with NZ house prices right now?

Get the latest insights on New Zealand’s property markets, including trends, growth areas, and investment opportunities across regions.

Property Investment

7 min read

Author: Ed McKnight

Resident Economist, with a GradDipEcon and over five years at Opes Partners, is a trusted contributor to NZ Property Investor, Informed Investor, Stuff, Business Desk, and OneRoof.

Reviewed by: Laine Moger

Journalist and Property Educator, holds a Bachelor of Communication (Honours) from Massey University.

Thinking about investing in property? You might wonder: “Where is the best place to buy an investment property in New Zealand?

Currently, the top areas include:

After all, picking the right city to invest in is just as important (if not more) than picking the right property.

At Opes Partners we help over 500 investors find New Build properties every year.

These properties come from all over the country, and we are constantly looking for the best places to invest.

In this article, you’ll learn the top 5 places to invest in the country and the reasons we’ve picked them.

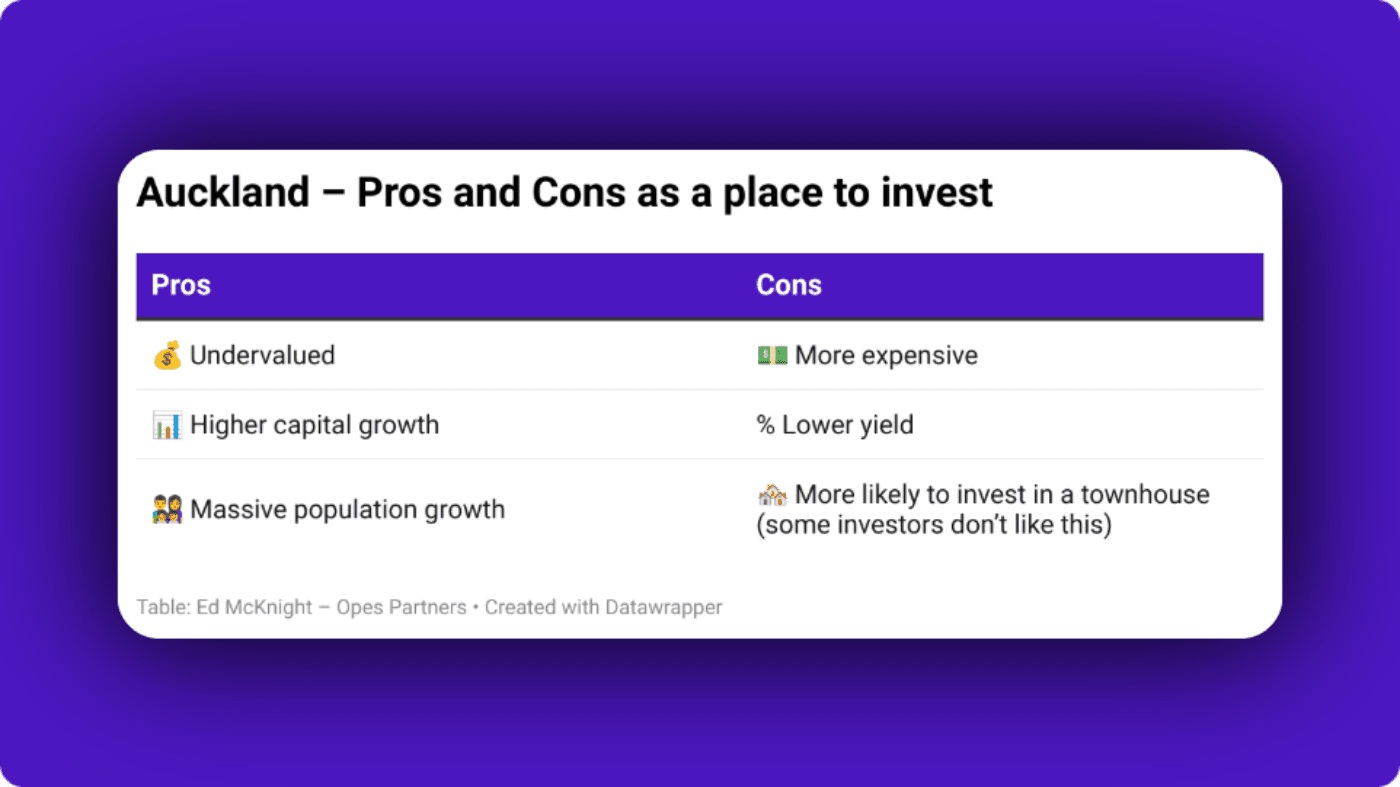

The country’s largest city is at the top of our list.

How come? Auckland house prices tend to rise faster than in other parts of the country.

Since 1992, Auckland house prices have increased 6.7% a year on average. The rest of the country only increased 6.0% on average (April ’25, REINZ).

Yes, house prices are expensive and the yields can be lower than small towns, but Auckland looks about 9.5% undervalued.

That means in the medium term I think they’ll increase in value faster than the rest of the country. This presents a buying opportunity.

The other factor that makes Auckland the one to watch is that the population is quickly growing.

Stats NZ forecasts Auckland’s population will grow 421,600 over the next 25 years. That means there will be over 2 million people living in Auckland.

Or, think of it another way, that’s like everyone in Christchurch packing their bags and moving to Auckland.

All these people will need a place to live. That increases the demand for housing and could put pressure on house prices and rents.

I recently worked with Jenny and Keith. They’re currently living in Auckland, and are renting. They couldn’t afford to buy a property in the school zone they wanted to send their child to, so they decided to rent and had planned to buy their own home a little later on.

But after they came along to one of our webinars, they thought that waiting to buy a house later could cost them more in the long run. They also saw property as a way to provide for their children’s future.

Initially, they were a bit hesitant to invest. They thought property investing was only for rich people.

But then they looked at the stats and realised Auckland was about 9% under where we’d expect it to be (based on long-term averages) so they decided to buy a property as an investment sooner than planned.

Today, they’ve bought their first investment property and are now planning their next move.

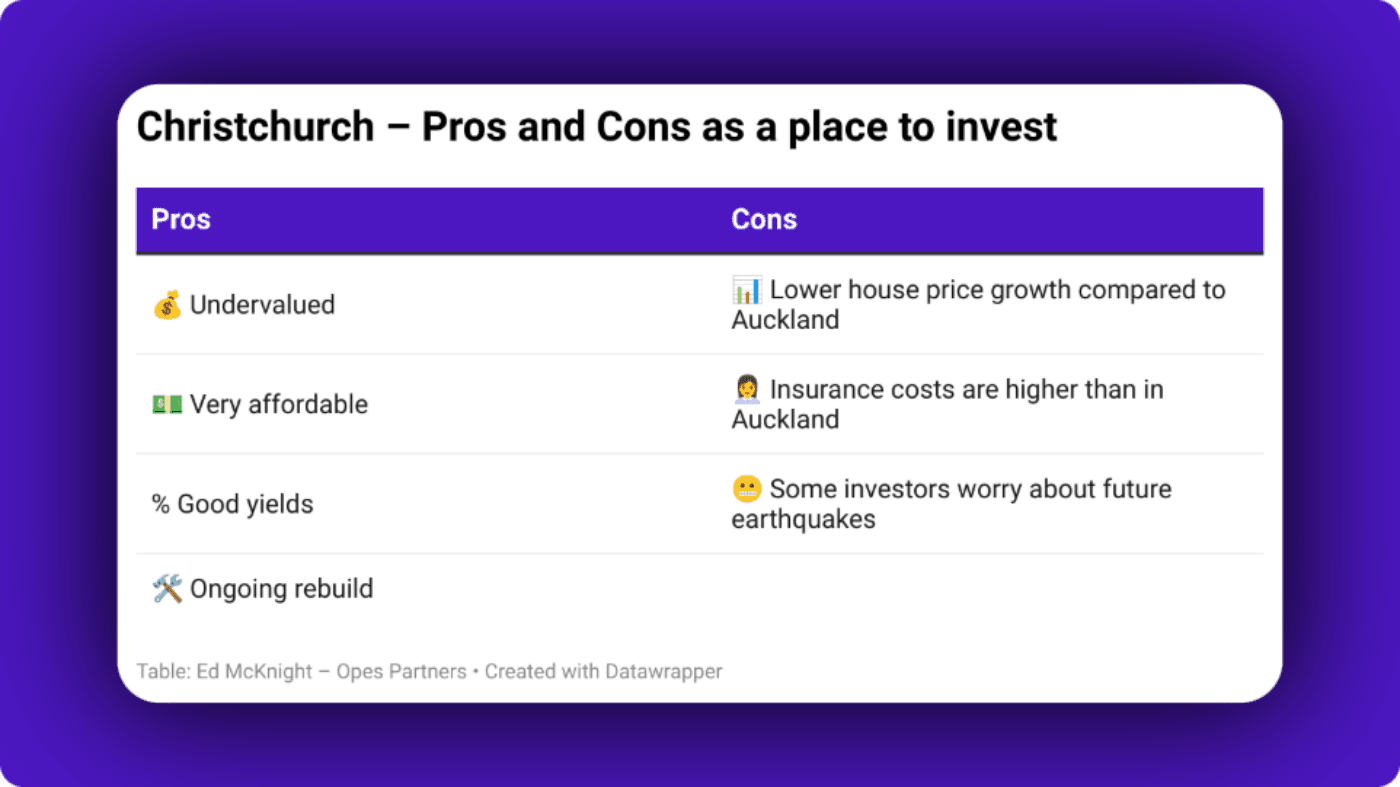

Next up is Christchurch, the largest city in the South Island.

Christchurch properties are more affordable than many other places in the country. The average price is about $774,614 (March ’25, QV).

That is about $125,000 less than the average price for the country as a whole.

Christchurch is also currently undervalued. Prices are 6.2% lower than we would expect them to be (Mar ’25. REINZ).

One of the main factors driving house prices is access to new infrastructure. The city is still recovering despite the fact the earthquakes happened over a decade ago. So, the council is still investing in infrastructure and rebuilding is still on.

The new Canterbury stadium, Te Kaha, will finish this year. Te Pae, the new convention centre, has now opened and is attracting more people to the city.

Andrew and Bonnie, a young couple with two kids, had been thinking about investing for a while but weren’t sure where to start.

They already lived in Christchurch when I met them.

They were pretty nervous investors. They worried about making a mistake and getting stuck with a property they couldn’t afford.

And they preferred to invest in their own backyard rather than somewhere else. That helped them pass the ‘sleep test’.

After running the numbers, they decided property could help them reach their long-term goals, so they bit the bullet and decided to invest in Christchurch.

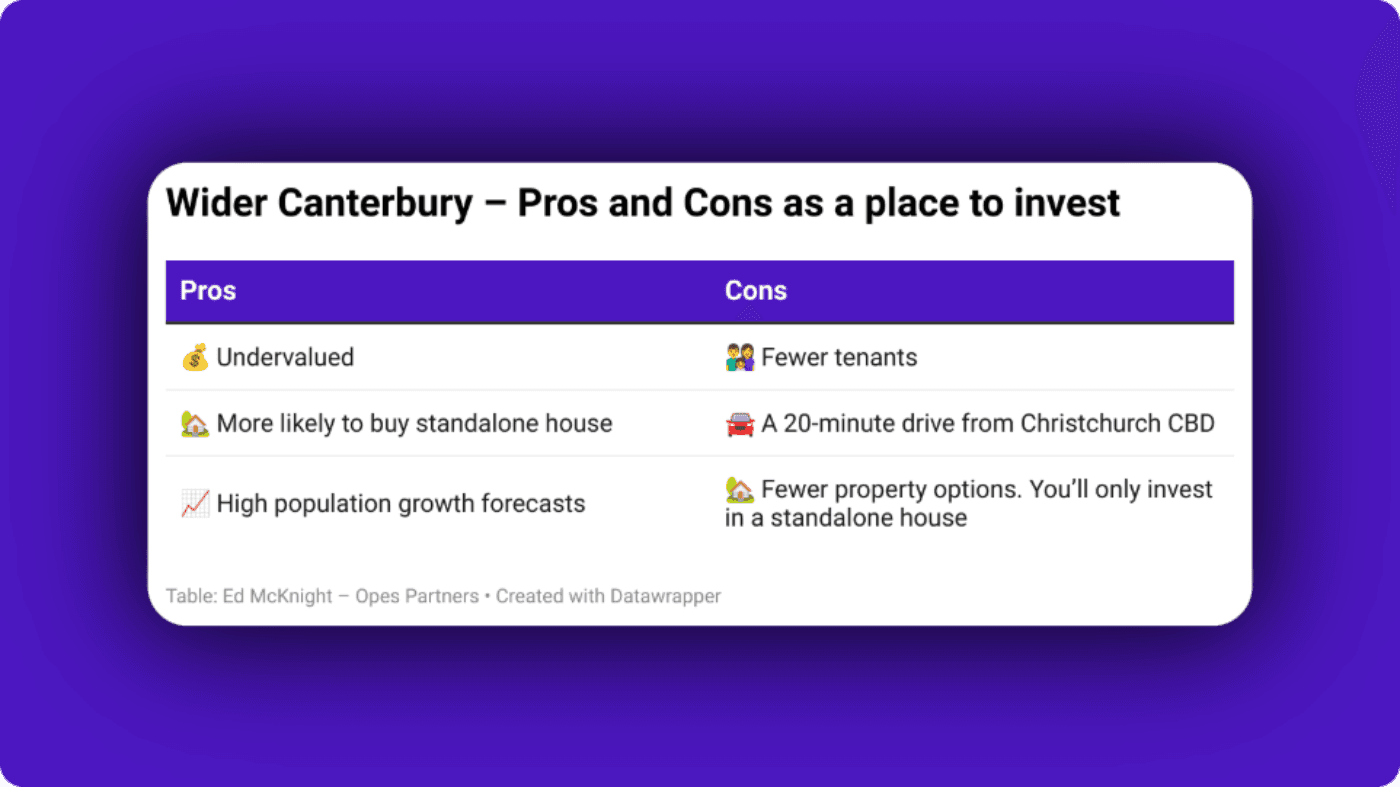

Selwyn and Waimakariri districts are right next to Christchurch. They also make the list because their populations are booming.

You might never have heard of these districts. They’re home to towns like Rolleston and Kaiapoi.

Stats NZ expects Selwyn’s population to increase by another 47% over the next 25 years (2023 – 2048), while Waimakariri’s population is expected to grow 25% over the same timeframe.

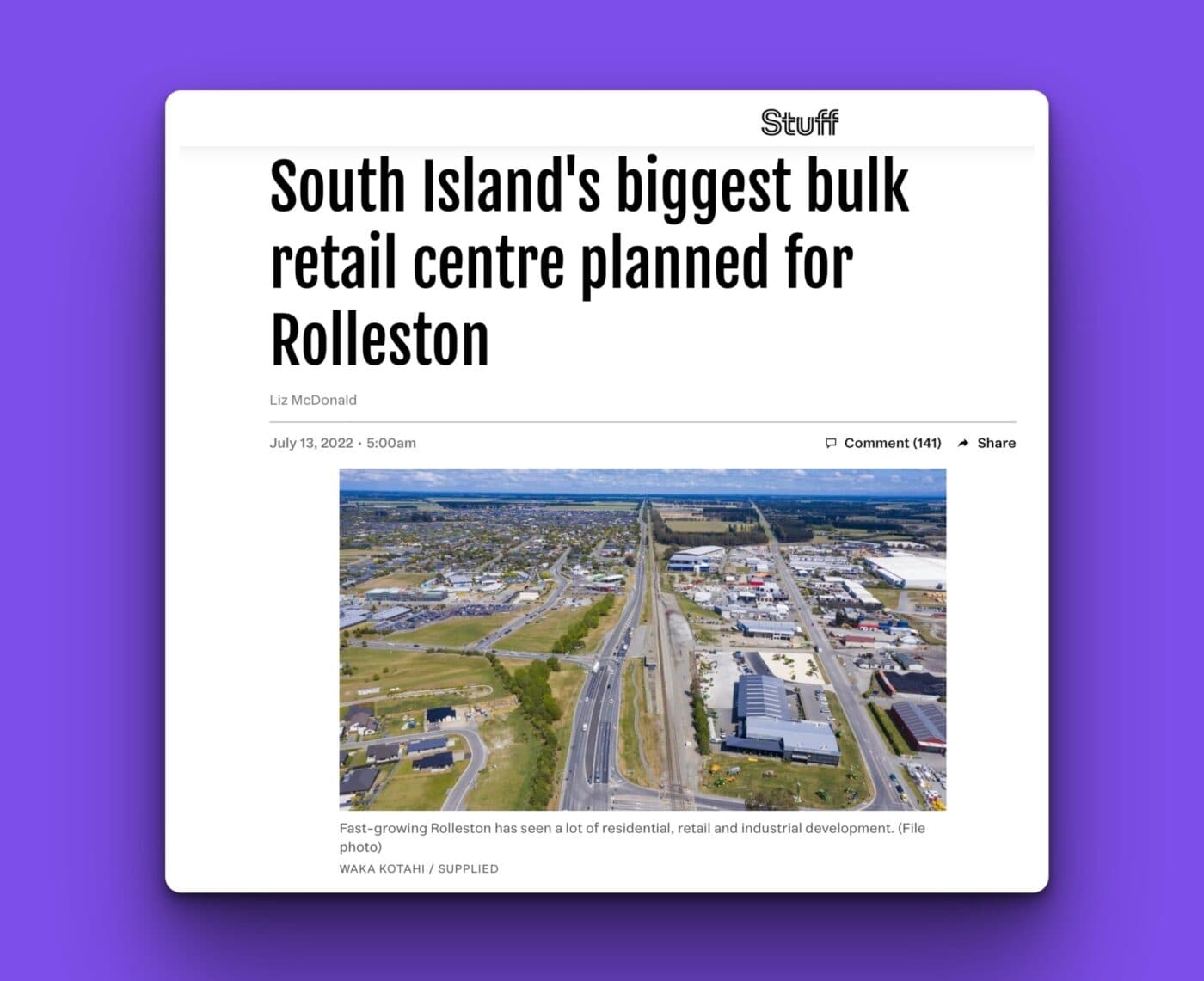

That population growth is pulling more businesses into the regions.

One factor investors sometimes look at is where big box retailers are moving to. These big businesses do more research than any of us could do on our own, so if they move into an area it’s a good sign the region could grow.

Currently, the Selwyn District Council is developing Rolleston town centre. It will have retail shops, a community centre, restaurants ... the works.

This will open up job opportunities and make Rolleston more self-sufficient. It won’t be marketed as “a 20-minute commute” to Christchurch city anymore. It will be a city in its own right.

And the Carter Group is planning to build The Station, a new 18-hectare shopping development.

Selwyn and Waimakariri appear to be undervalued. Prices there are 2.5% and 6% lower than we’d expect them to be, respectively (March ’25, REINZ).

One of the benefits of buying in these areas is that it’s still possible to buy a standalone house with a decent yield. This is increasingly hard to achieve in larger cities.

Next on the list is Lower Hutt.

The Wellington region is an interesting one. For the last few years I advised investors against buying in the Wellington region. Property prices were so overheated, and in my view had a long way to fall.

Loading...

That happened; Lower Hutt property prices fell 30% compared to their peak. So now Lower Hutt prices are much more in line with where I’d expect them to be.

They were about 16% overvalued; now they’re about 2% undervalued. So, Lower Hutt presents more of a buying opportunity than it used too.

On top of that, property prices are still cheaper than in Auckland and rental yields tend to be strong. So, it’s attractive for investors with a tighter budget.

Last on our list is Queenstown. The region is famous for its scenery and tourism industry.

Properties are expensive, with an average value of around $1.8 million (Mar ’25, QV) but Queenstown still makes the list because of its long-term growth potential.

There’s a constant flow of people looking for permanent and holiday homes and these people generally have high incomes.

However, investors should be cautious when banking on Airbnb income.

Queenstown has strict rules around Airbnb, and you can’t forget about commercial rates and insurance costs.

Lee and Denise had always dreamed of owning a cozy Airbnb in Queenstown. They imagined snow-capped mountains, bustling tourists and a steady income.

They’d signed a contract to buy a 1-bedroom apartment and were going through their final checks before going unconditional. But then they heard about Queenstown’s tough Airbnb rules and realised they couldn’t legally rent that property out all-year.

So they pulled out of that contract and I helped them buy a unit that already had consent to operate as an Airbnb for 365 days of the year.

They were also careful to make sure the numbers still worked as a long-term rental. They didn’t put all their eggs in the Airbnb basket. Because if new Airbnb rules come in, or tourist numbers dip, they don’t want to be left with a dud property.

For any investor eyeing short-term rentals, always ask: Would this still work if I had to rent it long-term?

You might also wonder why I’ve mainly picked larger cities rather than small towns.

Between 2015 – 2020 property prices in regional New Zealand boomed. At the same time prices in some of the main centres remained flat.

For instance, prices in Gisborne almost tripled from the end of 2016 to the peak in 2021. That stellar growth won’t continue forever.

The regions have had their boom, and it looks like the next 5 years will see prices increase in the larger cities.

You might ask, “What about [insert your area here]?” If we haven’t mentioned an area on this list, we genuinely don’t believe it’s the best area right now.

If you want to dig into more of the data, here is a full comparison of every council area in New Zealand.

Want to check out data on your region? Check out our Area Analyser. You can get free data for any suburb, council area or region in New Zealand.

Resident Economist, with a GradDipEcon and over five years at Opes Partners, is a trusted contributor to NZ Property Investor, Informed Investor, Stuff, Business Desk, and OneRoof.

Ed, our Resident Economist, is equipped with a GradDipEcon, a GradCertStratMgmt, BMus, and over five years of experience as Opes Partners' economist. His expertise in economics has led him to contribute articles to reputable publications like NZ Property Investor, Informed Investor, OneRoof, Stuff, and Business Desk. You might have also seen him share his insights on television programs such as The Project and Breakfast.

This article is for your general information. It’s not financial advice. See here for details about our Financial Advice Provider Disclosure. So Opes isn’t telling you what to do with your own money.

We’ve made every effort to make sure the information is accurate. But we occasionally get the odd fact wrong. Make sure you do your own research or talk to a financial adviser before making any investment decisions.

You might like to use us or another financial adviser