Property Types

Houses vs townhouses vs apartments - Which goes up in value faster?

Want to know what sort of properties you should invest in? See the data about which grows in value faster – houses, townhouses or apartments.

Property Types

11 min read

Author: Laine Moger

Journalist and Property Educator, holds a Bachelor of Communication (Honours) from Massey University.

Reviewed by: Ed McKnight

Resident Economist, with a GradDipEcon and over five years at Opes Partners, is a trusted contributor to NZ Property Investor, Informed Investor, Stuff, Business Desk, and OneRoof.

Every year at Opes Partners we recommend over 1000 New-Build properties to Kiwi property investors.

And because we deal with over 57 developers, many of who build 3-bedroom townhouses, many people ask us “do 3-bedroom townhouses make a good investment?”

Never one to shy away from being blatantly honest. In this article, you’ll learn the pros and cons of 3-bedroom townhouses, and whether this type of property is suited for your property portfolio.

If you have any questions or thoughts, please leave them in the comments section below.

Many property investors assume that townhouses don’t appreciate in value as fast as a standalone property, but this isn’t necessarily true.

For instance, take a look at the above graph. This shows the long-term capital growth rate between houses and townhouses.

It suggests the difference in long-term capital growth between houses and townhouses is not very large at all. In some instances, it’s marginal.

On average, houses grew 0.6% faster than townhouses. Put simply, if houses received a capital growth rate of 7%, townhouses grew by 6.4% in that given year.

While there is a difference, you also need to consider that by buying a townhouse you can often purchase in a better quality area than a standalone house, since the cost will be substantially lower.

Now, let’s think about whether the number of bedrooms impacts how quickly your townhouse increases in value.

We’ve crunched the numbers comparing the long-term increase in value for townhouses based on the number of bedrooms the properties have.

Take a look at the below graph:

Between 2002 and 2010, it appeared that Auckland townhouses all increased at a very similar rate, no matter the number of bedrooms.

But, after 2010, 2-bedroom townhouses in Auckland appeared to have a slightly higher capital growth rate than those with 3 or 4 bedrooms.

This seems counterintuitive, since you might think that since 3 and 4 bedroom townhouses are larger, they might be more desirable. However, that’s not what we see in the data.

A few words of caution:

So, don’t rush out and buy a 2-bed as opposed to a 3-bed solely because of the above graph. But, intuitively, you might have thought it was the other way around.

Townhouse living is becoming more popular. As it becomes more the norm, a larger proportion of New Zealand’s building stock will be townhouses.

However, townhouse living is only popular in larger cities. This is where populations are large, land is scarce, and higher-density living is required and accepted.

Take a look at this map of New Zealand. It shows the percentage of new dwelling consents that were townhouses in each council area in 2021.

While over 60% of new dwellings consented in Hamilton were townhouses, only 1.1% of new dwellings consented in Hurunui District (north of Christchurch) are townhouses.

So, while a townhouse in a major city might be acceptable to tenants, if you are investing in a rural area like Hurunui or Stratford, townhouses may not be accepted as the norm.

When it comes down to townhouses with 3 bedrooms, Auckland has a boat load more 3-bedroom townhouses than Christchurch or elsewhere in the country. At the time of writing this article, Opes Partners had no 3-bedroom townhouses available in Christchurch on our stocklist.

This isn’t because investors don’t want to buy 3-bedroom townhouses; it’s because developers just aren’t building that many in Christchurch.

This means, when 3-bedroom opportunities do come up in Christchurch, they are often gobbled up quickly.

This could be because there are more 3 bedroom houses available in Christchurch. So, if someone wants to buy or rent a property with 3 bedrooms, they might decide to opt for a standalone house.

Whereas in Auckland it’s a different story. Land and space are at a premium, so 3-bedroom and 4-bedroom townhouse are more the norm.

So, if you want to buy a 3-bedroom townhouse you may have to wait to get one in Christchurch. But in Auckland, they’re more common.

Typically a 3-bedroom townhouse will have two or three stories.

If it’s a 2-story townhouse, the kitchen and living area is typically on the bottom floor, while the bedrooms and bathrooms are upstairs.

Here’s an example of a property that we recommended in Mangere Bridge, Auckland, which follows this format. Note that in this specific example one of the bedrooms is a single, which can also double as an office.

Just be aware that this is not always the case. Not all 3-bedroom townhouses have 2 doubles and a single bedroom.

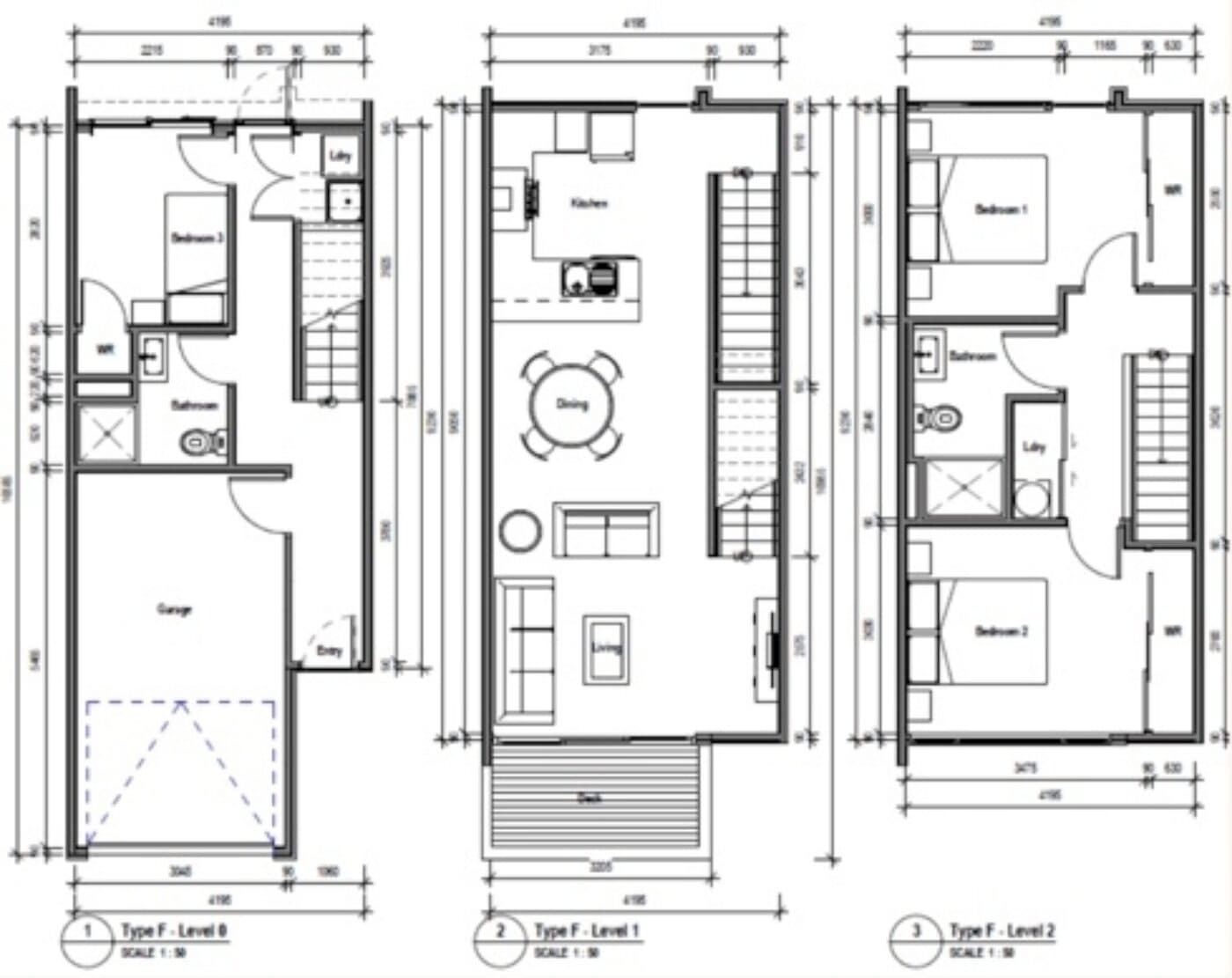

If it’s a 3-story townhouse, the layout can be different. It’s often popular to have a garage, bedroom and bathroom on the bottom floor. There’ll then be kitchen and living on the second floor, and often 2 bedrooms and a bathroom on the top floor.

Here is an example of this sort of floor plan for a project of townhouses we recommended to investors in Manurewa, Auckland.

Obviously, the floor plans change depending on the individual development and what the developer decides to build. While these sorts of floor plans are popular, they’re not all like this.

First off, it goes without saying that a 3-bedroom townhouse is usually going to be more expensive than a 2-bed, but is likely to be cheaper than a 4-bedroom townhouse.

This can place them a little bit further out of reach for investors who are just starting out and may be budget constrained. Those sorts of investors might set their sights on 2-bedroom townhouses, which tend to be more affordable.

In Auckland, the price tag for a 3-bedroom can range from $850,000 to $1.25 million.

In Christchurch, you’re likely to be looking at mid-$700K’s and above.

3-bedroom New Build townhouses tend to be a good fit for investors who can afford to spend a bit more on an investment property.

That’s because you might need to invest in a more expensive city (like Auckland), and then it costs more to build a 3-bedroom property than one with only 2 bedrooms.

These sorts of townhouses also tend to work better in main cities with decent populations. Tenants and purchasers are used to living in higher-density properties, so there is demand for these types of developments.

A 3-bedroom townhouse is also more likely to attract a small family compared to a 2-bedroom townhouse. So this could be a good option for an investor who wants security of tenure. It’s reasonable to think that a property with 3-bedrooms might attract less transient tenants.

Finally, these sorts of properties could be the right fit for investors who already own 2-bedroom townhouses, or one type of property. In that instance you might look for diversification and seek to buy a 3-bedroom townhouse.

On the other hand, if you are a seasoned investor with a lot of 3-bed townhouses, you might consider your next purchase in the wider context of your portfolio.

Perhaps it would be better to invest in another type of property to diversify your portfolio.

Also, a 3-bedroom townhouse is likely not to be the right fit if you are investing outside one of the main centres. If you are dead set on investing in Kaitaia, Te Anau or Kaikoura, a 3-bedroom townhouse may not be the right fit at all.

It’s not as common for people to live in townhouses in these rural areas, so these sorts of properties are better suited for those investing in the main centres.

In addition, renovations-focussed BRRRR investors are not suited to New Build townhouses, no matter the number of bedrooms. That’s because they don’t have the ability to increase their value.

So, if you’re an investor looking to nab a perfect property to execute a BRRRR strategy, a New Build 3-bedroom townhouse just isn’t for you.

All things considered, a 3-bedroom townhouse can be a good investment for some investors.

Different regions make them a good investment for different reasons. But, it is important to note that not every townhouse with 3-bedrooms is automatically a good investment.

Ultimately, it comes down to the numbers and being able to sort the good investments from the bad.

That’s why, here at Opes, we work with 57 developers from around NZ to find the right properties for Kiwi investors. And then once we find them, we rigorously run the numbers to offer good investment properties to our investors.

This means considering not just whether it is a townhouse with 3 bedrooms, but also an assessment of the location, the neighbourhood, the price, the rental capacity and the developer.

To find out more about how we find quality investment properties for investors, click here to read about our property investment programme.

Journalist and Property Educator, holds a Bachelor of Communication (Honours) from Massey University.

Laine Moger, a seasoned Journalist and Property Educator holds a Bachelor of Communications (Honours) from Massey University and a Diploma of Journalism from the London School of Journalism. She has been an integral part of the Opes team for four years, crafting content for our website, newsletter, and external columns, as well as contributing to Informed Investor and NZ Property Investor.

This article is for your general information. It’s not financial advice. See here for details about our Financial Advice Provider Disclosure. So Opes isn’t telling you what to do with your own money.

We’ve made every effort to make sure the information is accurate. But we occasionally get the odd fact wrong. Make sure you do your own research or talk to a financial adviser before making any investment decisions.

You might like to use us or another financial adviser