Property Investment

What does a financial adviser actually do?

In this article, you’ll learn what a financial adviser does, what are the different specialties of the trade, and how they can help you on your investment journey.

Property Investment

6 min read

Author: Dennis Schipper

Financial adviser for 3+ years. Helped nearly 500 Kiwis buy property.

Reviewed by: Nefe Teare

Financial adviser at Opes. Formerly a senior adviser at one of NZ largest investment firms. Owned 3 properties by 30.

If you’ve ever met with a financial adviser, you’ve probably wondered: “Is this advice really unbiased? Is it the best for me … or is this just what’s best for the adviser?”

It’s a fair question.

After all, financial advisers often “sell” financial products. It doesn't matter if it's mortgages, insurance, shares, or property ... they often get paid when you buy.

That alone can make people wonder if the advice they’re getting is truly impartial.

So in this article, you’ll learn how to spot a biassed financial adviser and how to find yourself one that’s got your best interests at heart.

But just before we get into it. You need to know. I am a financial adviser. So I have an incentive to say: “Nothing to see here. Nope, financial advisers aren’t biased at all”.

I’m not going to say that. Instead, I’ll take you behind the curtain, so you can see for yourself how to spot a biased financial adviser

A good financial adviser is upfront ... about what they earn, what they know, and the numbers behind their advice. That’s how you know they’re really working for you.

The healthy suspicion we have about financial advisers isn’t because we think they’re bad at their jobs. It’s about money.

After all, most financial advisers are “selling something”.

If an adviser recommends:

But there are other biases too:

All of this feeds the fear: “What if I make a bad financial decision because my advisor steered me in the wrong direction?”

The good news is there are clear ways to check whether your adviser is truly acting in your best interests.

Here are five ways you can check for bias (before making any big decisions):

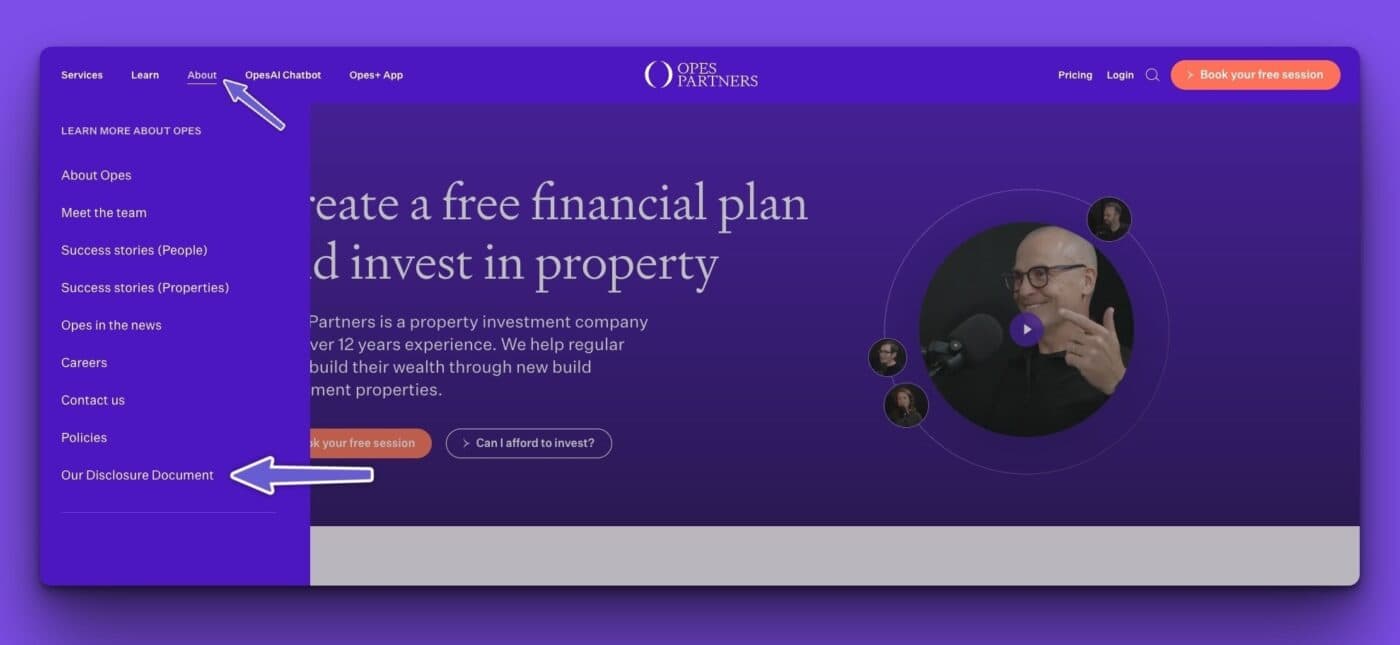

All financial advisers in New Zealand must have a disclosure statement on their website.

This document tells you:

For example, a mortgage broker might disclose all the lenders they work with.

So, before working with any financial adviser, check the disclosure statement first.

They’re often tucked away under headings like Important Information or at the very bottom of the website. If you can’t find it, ask for it.

A big red flag is when an adviser says to you their approach works for everyone. Because spoiler alert … it won’t.

A good financial adviser knows there’s no one-size-fits-all, and they will explain:

So, they’ll say something like: “This strategy works well for investors who want long-term growth … “but may not suit someone who needs quick access to their money.”

Here at Opes, we do this by telling people exactly who we’re the right fit for, and who we’re not. We even made a video called Don’t use Opes if… to be upfront about it.

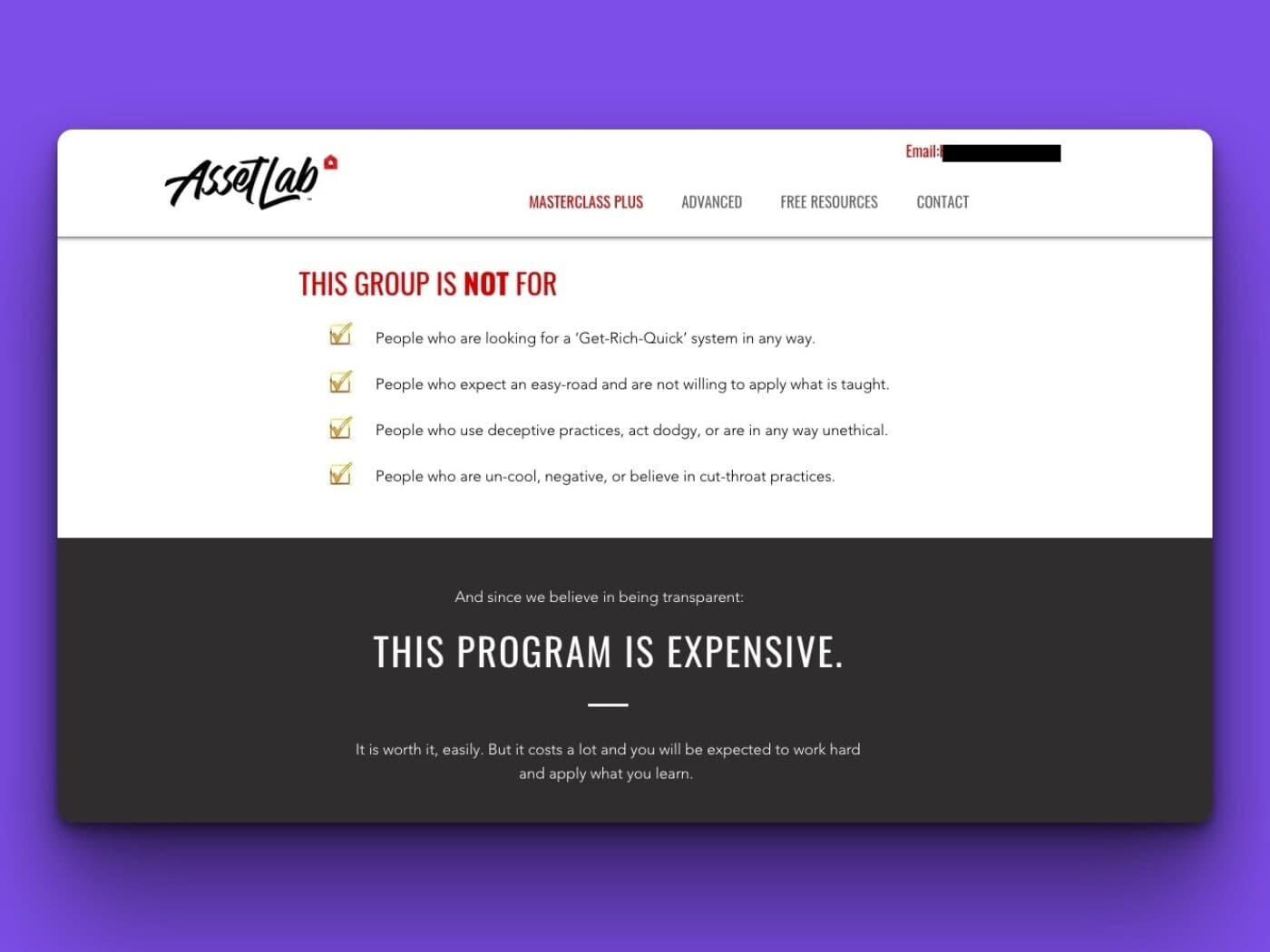

AssetLab is another property investment company who are very transparent (even though they aren’t financial advisers).

They clearly state who their course isn’t the right fit for, and they’re honest about the cost upfront: “The programme is expensive.”

So, if your financial adviser can’t name a single scenario where their advice wouldn’t be appropriate … I'd be asking more questions.

Check the adviser’s website, blog, or social media.

Ask yourself: “Are they producing educational content that covers a lot of different strategies? Are they trying to educate me? Or are they just pushing the one thing they sell?”

You want to see content that:

For instance, a property investment firm that also talks about the pros and cons of shares is showing they care about educating … not just selling property.

One good example is Darcy Ungaro from Ungaro & Co, and their podcast: Everyday Investor.

Ungaro & Co focuses specifically on mortgages, insurance and KiwiSaver.

But Everyday Investor covers the whole spectrum of investment. That’s because it wants to educate the everyday Kiwi to develop wealth.

This is an important one (because we’re the data nerds).

Before you follow any advice, ask:

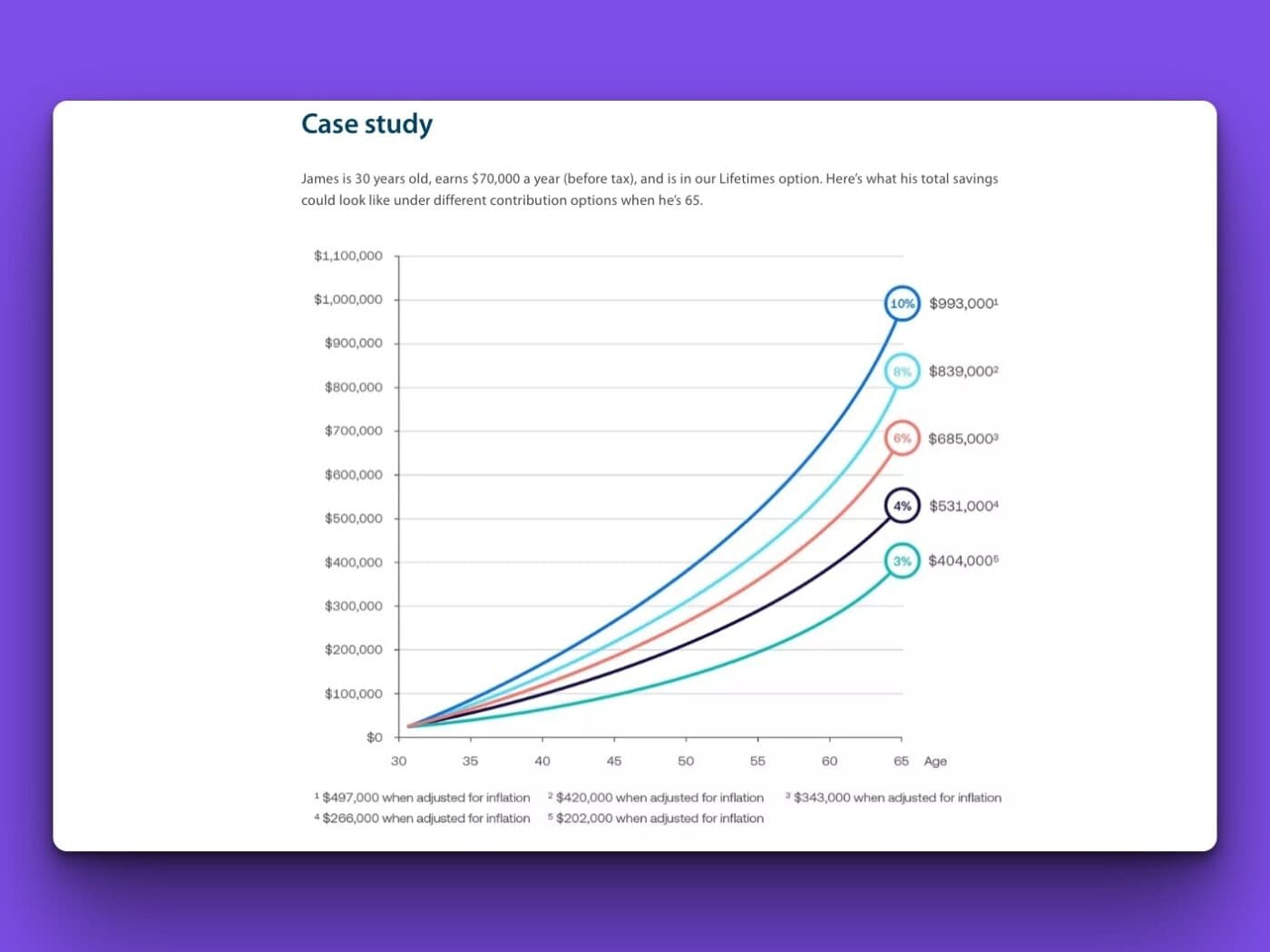

For example, ANZ publishes a set of case studies showing how KiwiSaver contributions can affect your wealth.

So they'll compare the outcomes of contributing more money to Kiwisaver vs contributing less.

They also show you how to double-up and use another investment to top up your Kiwisaver.

This way you can build more wealth over time. This type of data is important because it’s giving you options, not saying something like “Kiwisaver is the best and it’s perfect”.

An adviser using only sales talk or personal opinions might be more interested in persuading you, rather than helping you make an informed decision.

Some advisers have access to dozens of investment providers, but others only work with a few.

To be fair, neither is necessarily wrong. But it can change the way you think about the advice given.

That’s why you need to ask:

Think about it like this, if a mortgage adviser works with 25 lenders you can be more confident they’ll compare options for you.

But if they only work with two, their recommendations may be limited simply because their product range is.

And no, the goal isn’t to find someone with unlimited options. But you do need to understand how choice may affect your decision.

No advisor is completely free from bias, unfortunately. It’s human nature.

Because if you’ve seen a strategy (like investing in property) work before, you are more likely to think it’s always the right solution.

But the best type of advisers are the ones that are upfront about it. They tell you how they get paid, and throw loads of data and advice at you – rather than just pushing a product.

A good financial adviser should help you make better decisions, even if sometimes that means saying: “Our strategy isn’t right for you.”

So read the disclosure, check the data, and ask tough questions.

A trustworthy adviser won’t shy away from them … they’ll welcome them.

Financial adviser for 3+ years. Helped nearly 500 Kiwis buy property.

Dennis joined the Opes Group back in 2017, and he’s now one of the longest-serving team members. He’s met with thousands of Kiwis to talk about their financial goals and has helped close to 500 of them become property investors.

This article is for your general information. It’s not financial advice. See here for details about our Financial Advice Provider Disclosure. So Opes isn’t telling you what to do with your own money.

We’ve made every effort to make sure the information is accurate. But we occasionally get the odd fact wrong. Make sure you do your own research or talk to a financial adviser before making any investment decisions.

You might like to use us or another financial adviser