Property Investment

Property investment NZ – The epic guide to property investment

Explore the latest in NZ property investment with our comprehensive 2026 guide. Gain insights into strategies and detailed steps for success.

Property Investment

20 min read

Author: Ed McKnight

Resident Economist, with a GradDipEcon and over five years at Opes Partners, is a trusted contributor to NZ Property Investor, Informed Investor, Stuff, Business Desk, and OneRoof.

Reviewed by: Laine Moger

Journalist and Property Educator, holds a Bachelor of Communication (Honours) from Massey University.

Want to build a passive income through property investment? This article is for you. Because we’re going to show you how to calculate the number of properties you need to get the passive income you want.

Ask most investors why they became interested in property investment, and the No.1 answer they’ll give is passive income. Our internal research shows passive income is the top driver for 41.1% of all property investors.

That not only shows investors are interested in passive income … but also that people who want to build a passive income are interested in property.

So how are people using property to build a passive income? Let’s find out.

And if you have a question, write your questions or thoughts in the comments section below.

Passive income is when you continue to get paid once the work to set it up is done.

On top of that, a true passive income takes little effort to maintain once the income-source is there.

Among other things, the source of your passive income could be:

The main similarity between all of these is that you don’t have to be physically present at the shareholder meeting, the side-hustle (if set up the right way), or the property to earn that income.

In essence, passive income is when you are no longer trading time for money. If you step away from your investments, the money still comes in.

If you are considering using property investment as your source of passive income, then you may be wondering how property compares with other investment types.

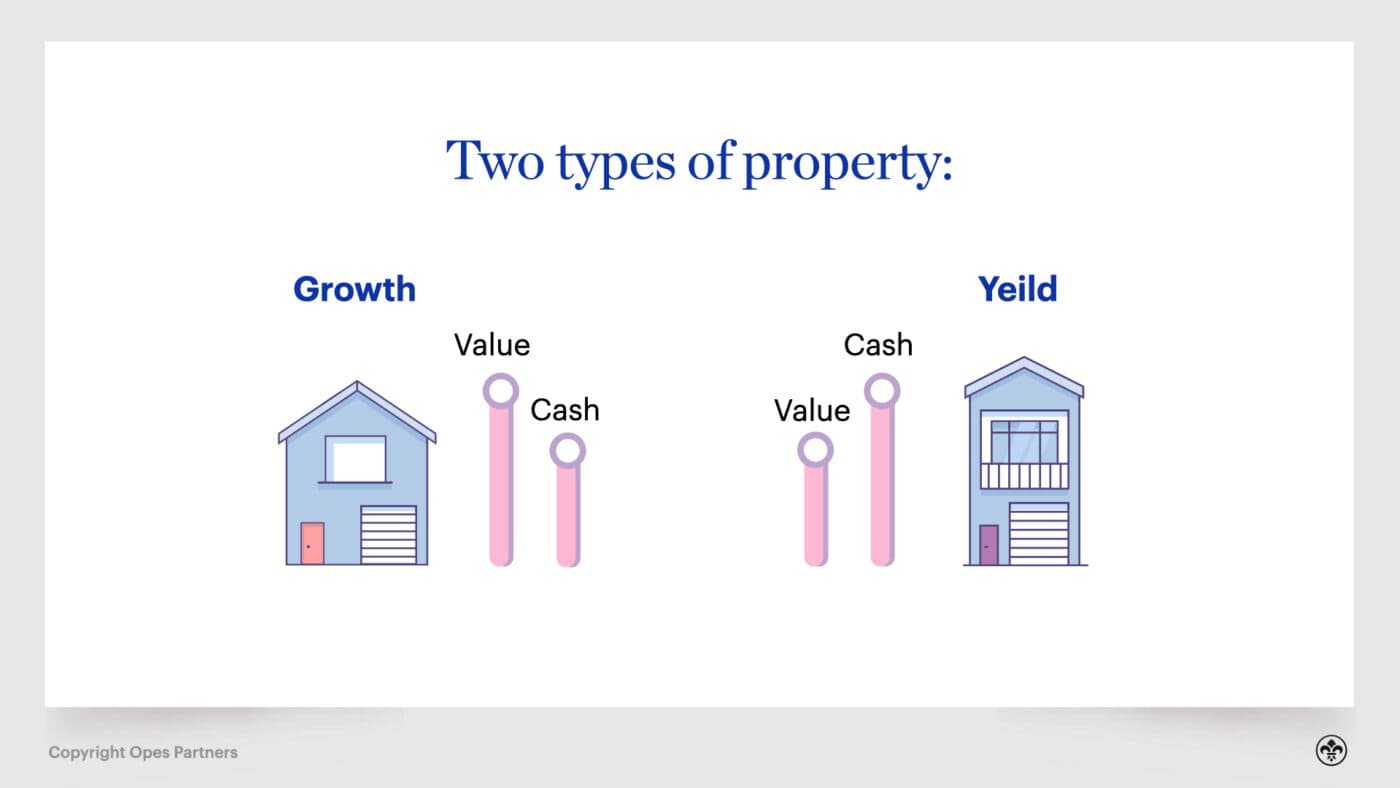

There tend to be two types of property.

On the one hand, you have properties that go up in value more quickly, but earn less cash each week (i.e. they have lower yields).

On the other, you have properties that earn more cash now (yield), but appreciate in value more slowly.

If using investment property to earn a passive income, then once you’re ready to focus on ‘cash now’, you’ll tend to invest in yield properties.

Gross yields can vary widely, but from our experience at Opes Partners, a yield property in the current market might earn 6% of its purchase price.

That means that if a property was worth $600,000, we would expect the rent to be $692 a week. The way you calculate this is $600,000 x 6% = $36,000 annually. Divide that by 52, and you get $692 a week.

However, you can’t keep all of that. That’s because you also have operating costs. These are the costs to actually run your property investment business: rates, insurance, property management and maintenance, among others.

It is usually safe to estimate that these operating costs might add up to 2% of the value of the purchase price each year. That means you are likely to have a net yield of 4% … that is the gross yield of 6% – 2% for operating costs.

This is the money you can actually use for your passive income.

That means that if you had a $600,000 yield property, without a mortgage secured against it, it would likely pay you $24,000 annually before tax.

Secure a comfortable retirement with 3 easy steps

Book your free sessionThe benefit of using property as a source for your passive income is that it is stable and predictable. Your tenant will pay you the exact same amount every week or fortnight.

The cost of this predictability is that property, in some years, will be lower yielding compared with some yield-specific shares.

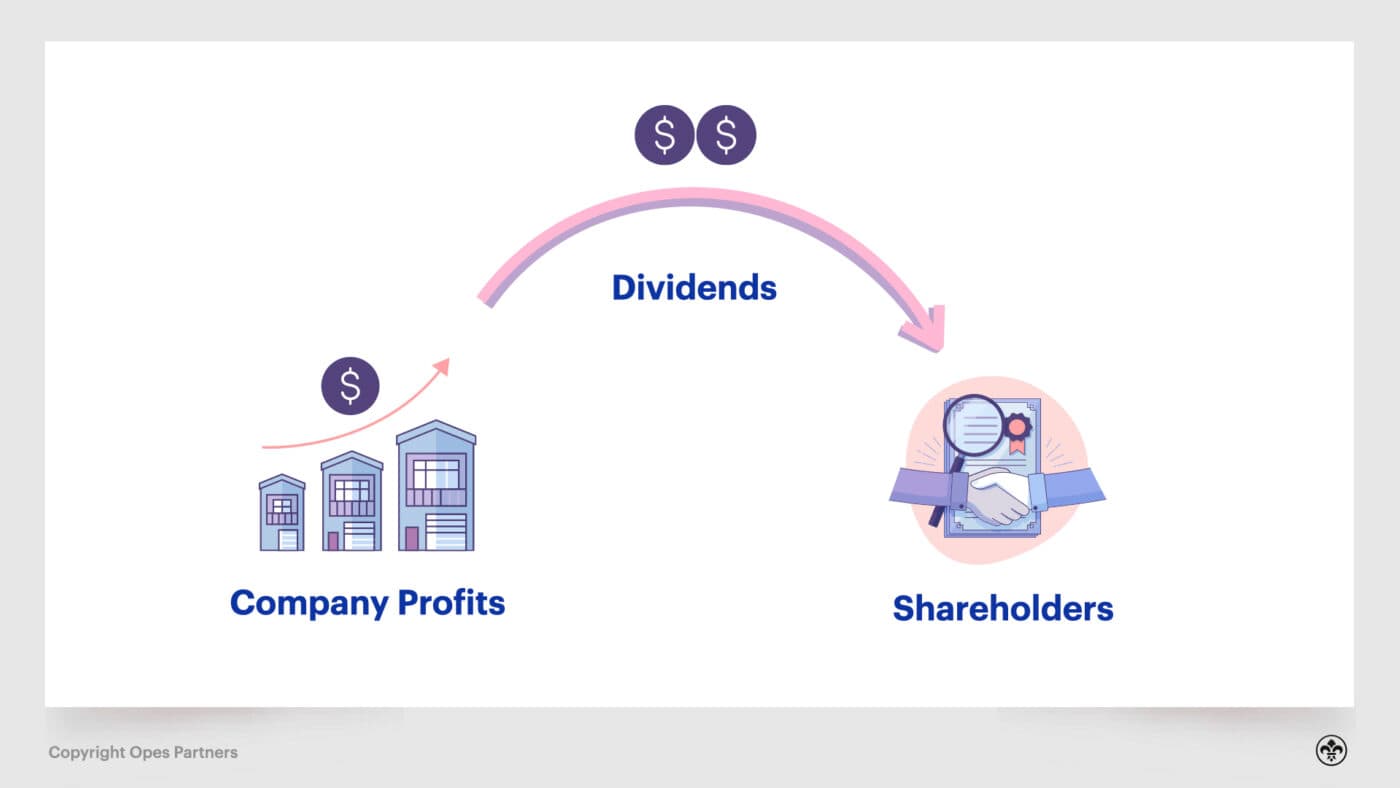

The income earned from shares is called dividends, and they’re a bit simpler to calculate than property. This is because you don’t have to subtract operating costs. A dividend is a straight payment to you as the shareholder from the company you own a stake in.

However, the yield taken from shares is highly variable. That’s because:

For instance, as at 31st December 2019, of the 172 shares available on the NZX, 63 (36.6%) didn’t pay a dividend in the 12 months prior.

Of those that did pay a dividend, the yields ranged from 0.31% from Allied Farmers, all the way up to 51.72% from Sky Network TV.

The average yield was 3.39% for all shares, and 5.35% from those shares that paid a dividend.

So the benefit of shares is that if you focus on higher-yielding stocks, the dividend yield you can get is likely to be higher than property in some years.

However, dividends can be more volatile. They will change based on each company’s performance.

A good case study for this is Air New Zealand. In the 12 months to December 2019, the company had the highest yielding stock at 16.42%. An enormous return.

However, after the Covid-19 induced shutdown and the closing of New Zealand’s borders, it is now unlikely the company will pay out a dividend for many years.

Tenants, on the other hand, will continue to pay their rent because they still require a place to live. If they stop paying you have the ability to replace them with a tenant who can make rent, and the original tenant will still be liable for what they owe you.

The final option for passive income generating investments (that we’ll explore) is fixed interest term deposits.

This is where you invest your money with a bank, and they will pay you interest on that investment.

Right now the yield on term deposits is meagre.

The leading four banks in New Zealand are paying between 1.6 – 1.8% per annum for investments of $5,000 and over.

Again, like shares, there are no operating costs, so the money you get is yours. Although, more like property, the income is very secure. That means you’re highly likely to keep getting the income from that investment even if the economy takes a turn for the worst.

So the benefit of fixed interest is that the income source is secure. However, the actual yield is inferior.

The right asset class for you will depend on how much risk you are willing to take.

For instance, although property is not always the highest yielding asset class, it does have a mix of yield and stability of income. This makes it a good option for people who are willing to take a moderate amount of risk.

If you are more risk-seeking, then you might be willing to seek the higher yields that shares can bring. As part of seeking those higher returns, you’ll accept that the passive income you get from your dividends will go up and down each year and frequently change.

Similarly, if you are very risk-averse, then investing with a bank may be the right fit for you. In this case, your income will be totally predictable, and for that you’ll accept the lower yield.

We tend to find that many Kiwis when weighing their options will opt for property which has that mix of yield and income security.

Watch our video below which explains the possible difference in returns between shares, property, managed funds and term deposits.

From this point on, we’re only going discuss property as your investment vehicle to build this passive income. That’s because this is what we specialise in here at Opes Partners.

If you feel your risk appetite is more suited for shares or fixed interest, then the rest of this article may not be for you. If investment property has piqued your interest, then keep on reading, because this is where it gets good.

If you are using property to build this passive income, then you need to build a level of debt-free assets to make serious money.

By that we mean investment properties that don’t have a mortgage.

Why is this?

We mentioned before that a property with a gross yield of 6% might have 2% of operating costs, leaving you with a 4% net yield.

But if you are borrowing 100% of the purchase price of the property and the interest rate on your mortgage is 3%, then that leaves you with just 1% in cash each year after you pay your mortgage. i.e. 6% rent – 2% operating costs – 3% interest = 1% cash left.

On a $600,000 property, that’s just $6,000 a year, or $115 a week. It’s not going to change your life.

If you want an annual income of $60,000, you’d need to buy 10 of these properties. That is unrealistic for many Kiwis.

Instead, if you owned the property and didn’t have the mortgage against it, then you would earn $24,000 annually from the property after costs.

To make the same $60,000 of passive income, you’d only need 2.5 of these properties … that’s $1.5 million of debt-free assets.

That demonstrates that if you want a decent passive income, then you need to own properties with very little debt secured against them.

Said another way, you need to have a lot of equity in your properties.

If you own properties that are highly geared, then the interest costs will take away most of the income you would otherwise enjoy.

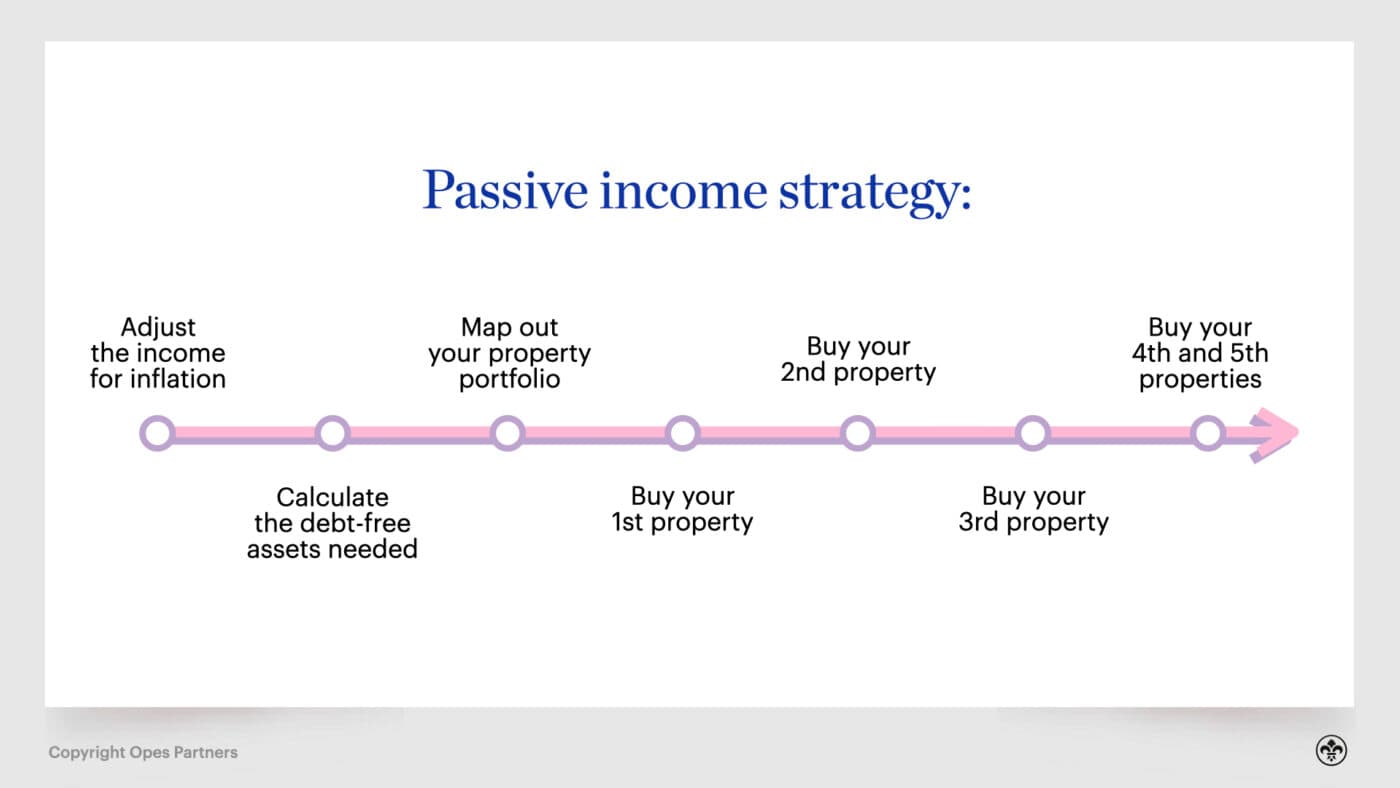

So, how do you calculate the level of assets you need?

First, take the annual passive income that you want to live on. Then divide that number by 0.04 (i.e. 4%, or the equivalent of multiplying the figure by 25).

That will give you the level of debt-free assets you need.

To give a worked example, let’s say that you want an annual income of $100,000 in today’s dollars (more on that below). Once you divide that by 0.04, you get $2.5 million of debt-free assets.

That means that after your $2.5 million of high-yielding property has paid rates, insurance, maintenance, body corporate and any other expenses, you make $100,000 every year before tax.

If you’re like most people, you’ll be thinking “OK, that’s great … but I don’t have $2.5 million of debt-free assets!”

That’s fine. That’s where you can use property investment to get to the point where you do have the assets you need.

Before we move on to how to build a portfolio that creates the assets you need, we have to talk about inflation.

Over time, the cost of most things increases.

Think of it this way, 40 years ago a 50c ice-cream was massive …. 20 years later it would be an OK size … today it would barely buy you the cone.

The point is this: the price of things go up, and what $100 can buy this year will be more than what $100 can buy in 20 years.

Why does this matter?

Because when you are trying to create a passive income for your future, you can’t just think in terms of the income you want today.

For instance, if you want a passive income of $50,000 to start 20 years from now, you can’t just divide $50,000 by 0.04 and be done with it. Because by the time 20 years have passed, $50,000 won’t buy you the same amount of stuff that it can today. In fact, based on the 2% inflation factor often used, it would only buy you $33,649 worth of stuff (in today’s money).

So you first need to figure out: “How much income do I need in the future to buy the equivalent of $50,000 worth of stuff in today’s money”. Once you’ve done that you can divide the new number by 0.04.

So how do we do that? To keep it simple, you can use an inflation calculator like the one below.

But, as an example, if you want to build a passive income of $50,000, and you want it in 20 years, then you need to aim for $74,297.

Multiply that by 25, and you will need $1.86 million of debt-free assets to generate that passive income.

Inflation is an odd concept for many people. It’s obvious when looking back … just think about how big a 50c lolly mixture was when you were a kid, and how puny they are now. But looking forward it’s harder to see the same thing happening in 20 years’ time.

That’s because it hasn’t happened yet. But that doesn’t mean it won’t happen. It’s vital that you factor inflation in now, because you don’t want to get 20 years into the future and realise you’ve aimed short of what you really wanted.

To build a significant level of debt-free assets as a long-term buy and hold investor, you will likely want to focus on properties that go up in value quickly.

As mentioned, two types of properties are available to most investors – growth and yield.

A growth property is one that will increase in value more quickly over time, but will attract a lower rental yield.

On the other hand, a yield property is one that will attract a higher rental yield but will increase in value more slowly.

When you eventually start to enjoy your passive income, you’ll probably be using yield properties to get the 4% net we talked about above.

But to build the assets to create your passive income, most Kiwis will invest in growth properties first.

Let’s walk through a case study to show why this is true.

Within this example we’re going to assume that your goal is to build wealth through a buy and hold property investment strategy.

Let’s say you can purchase a property worth $500,000 and you’ll be borrowing at 100%. That means you’re not putting any cash in as a deposit.

On the one hand, you could purchase a growth property. This is expected to appreciate at 5% annually, but the property will be cashflow neutral (i.e. it will earn $0 a week).

On the other, you can invest in a yield property that is forecast to appreciate at 3% annually and will make $100 a week in cashflow.

Which will make you better off in 15 years?

Note: for the purposes of this example, we are going to ignore the impact of inflation on rent and expenses, and will ignore the fact that within this timeframe the profits from the properties would be taxed.

Well, in 15 years your growth property is forecast to be worth $1,039,464, and the yield property is forecast to be worth $778,984 with an additional $78,000 in cash saved.

In both examples, you still have a $500,000 mortgage.

So, once the mortgages are paid off, investing in the growth property will have earned this investor $539,464, whereas the yield property would have netted $356,984.

That means the growth property provided a 51.12% better total return than the yield property.

This is why, to create the assets needed to generate a passive income, it pays for a long-term buy and hold investor to focus on growth properties first.

These properties tend to be standalone houses or townhouses located in the main cities of New Zealand – Auckland, Wellington, Hamilton and Christchurch.

Let’s say that you and your partner are both 40 now and in 20 years you would like a passive income of $100,000.

That means that you can retire 5 years earlier than the current age of superannuation entitlement. You can live off your rental properties for the rest of your lives and still leave this as an inheritance for your family.

How do you do this?

Using the inflation calculator above, we see that the inflation factor is 1.49. So, you actually need to aim for $149,000 of passive income to be able to live the same life you could today on $100,000.

Multiplying $149,000 by 25 shows that you’ll need $3,725,000 worth of debt-free assets to create that passive income based on a 4% net yield.

In this case study, you’re looking to create a lot of equity. Generally, you might have other assets that would help you get to this goal, like shares or savings. But let’s assume you don’t have any of these and you’re just going to do it through property.

You might start by investing in a property in Christchurch. Let’s say you buy this for $500,000. Let’s forecast that this property will grow in value by 5% each year.

By the end of the 20 years we would forecast that property to be worth $1.32 million.

It would have $827k worth of equity in it, even if you used an interest-only loan and didn’t pay off any of the debt.

That means that this one Christchurch property is projected to create 22% of the equity you need to achieve your passive income goal.

The next year you might decide to invest in an Auckland-based property that costs $800,000. Similarly, you might project that the property will increase in value at a rate of 5% (which is well below the historical average).

You’ll hold this property for one year less than your Christchurch property, although because it’s a higher value asset it will create more equity for you in the end.

Based on these numbers it’s projected to be worth $2.021 million by your goal date, creating $1.22m of equity. That fills 33% of your overall equity goal.

So between the Christchurch and Auckland properties, you’re projected to close 55% of the overall equity you need to create to hit your goal.

Let’s say that you then spread your next purchases over several years and use slightly lower growth rates to be even more conservative.

The third property you decide to invest in might be a Wellington apartment. This would be the sort of property that would produce excellent cash flow, which can help pay for any unexpected costs within your other properties.

The property you purchase in this case could be worth $750,000, and you are buying it another year after the Auckland property. That means that you’ve got 18 years of capital appreciation in the asset before your goal date.

But, since it’s a yield property, you’ll forecast that it will grow at just 3% a year.

That means by the time you reach your goal date, it is forecast to be worth $1.28 million and will have created $527k worth of equity for you.

This fills 14% of your goal and will end up producing the least amount of capital from any of your properties.

You buy it anyway, knowing that your risks are covered if interest rates rise, or unexpected maintenance costs crop up within your portfolio.

So far you’ve filled 69% of your equity gap with property.

You’ve only got 31% to go.

But each property you purchase after this earns less and less of the total equity.

Why?

Because each additional property you purchase is being held for less time before your goal date. That’s because you’re making the decision to build your portfolio gradually in this example.

So, 3 years after purchasing your Wellington property, you invest in an $800,000 Hamilton property, and 5 years after that you invest in another worth $1 million, also located in Hamilton.

Remember, the values of the properties you’re investing in keep going up because of inflation – houses will be more expensive in the future than they are today.

To be conservative, you use a forecasted growth rate of 5% for your first Hamilton property and 4.5% for your second.

Your first property will fill 23% of your equity gap and the second, 15%.

If you had followed the strategy as set out here, in 20 years’ time you’re forecast to have properties worth a combined $7.84m, with total equity worth $3.99m.

That’s above the target you initially aimed for.

In fact, if you add up all the percentages mentioned so far, you’ll note that you’ve actually hit 107% of your total equity goal. That wasn’t by chance. The reason you want to produce more equity than you need is that while you’ve been building your portfolio, you will have primarily been focusing on growth properties.

But, to build the passive income you wanted to create, you need yield properties. By the time your goal date arrives, you’ll want to sell all your growth properties and purchase high-yielding properties instead.

These will generally be higher-yielding apartments or room-by-room rentals near universities, hospitals and significant employment areas.

So we need to allow for a buffer for sales costs and real estate agent fees.

In the above example, you’d budget for $235k of real estate agent fees (using a flat 3% rate), so you can sell the properties and purchase new ones.

That leaves you just shy of $3.76m worth of equity to invest, and based on the 4% net yield you’ll earn a passive income of $150,400 every year, which will go up as the rent of your properties increase.

In today’s dollars that’s the equivalent of earning $101,100 every year without having to work a single day.

You can retire at 60 and be sorted for as long as you live because you’ll own 3-4 high-yielding properties with no debt on them.

What does it take to build a passive income?

No matter which asset class you decide to invest in, it’s going to take time. Time for your assets to build to the point where the return can make the passive income you want.

And while property investment may not be the highest yielding asset class, or be the most risk-free, it is the asset class that has an acceptable mix of both.

Write your questions or thoughts in the comments section below.

Resident Economist, with a GradDipEcon and over five years at Opes Partners, is a trusted contributor to NZ Property Investor, Informed Investor, Stuff, Business Desk, and OneRoof.

Ed, our Resident Economist, is equipped with a GradDipEcon, a GradCertStratMgmt, BMus, and over five years of experience as Opes Partners' economist. His expertise in economics has led him to contribute articles to reputable publications like NZ Property Investor, Informed Investor, OneRoof, Stuff, and Business Desk. You might have also seen him share his insights on television programs such as The Project and Breakfast.

This article is for your general information. It’s not financial advice. See here for details about our Financial Advice Provider Disclosure. So Opes isn’t telling you what to do with your own money.

We’ve made every effort to make sure the information is accurate. But we occasionally get the odd fact wrong. Make sure you do your own research or talk to a financial adviser before making any investment decisions.

You might like to use us or another financial adviser