Property Investment

What happens at the end of the Nest Egg strategy

How do property investors turn equity into income? This guide explains what happens at the end of the Nest Egg strategy, step by step.

Property Investment

6 min read

Author: Laine Moger

Journalist and Property Educator, holds a Bachelor of Communication (Honours) from Massey University.

Reviewed by: Ed McKnight

Resident Economist, with a GradDipEcon and over five years at Opes Partners, is a trusted contributor to NZ Property Investor, Informed Investor, Stuff, Business Desk, and OneRoof.

To be a successful property investor, you’ve got to have a bit more than just money, and a few savvy spreadsheets.

Investing in property demands a particular mindset. One that keeps you steady as the market tips up, down and side to side.

The way we think influences the decisions we make. Adopting the right mindset can be the difference between success and failure. At least when it comes to property investment.

In this article, you’ll learn the top 4 mindset shifts needed to be a successful investor.

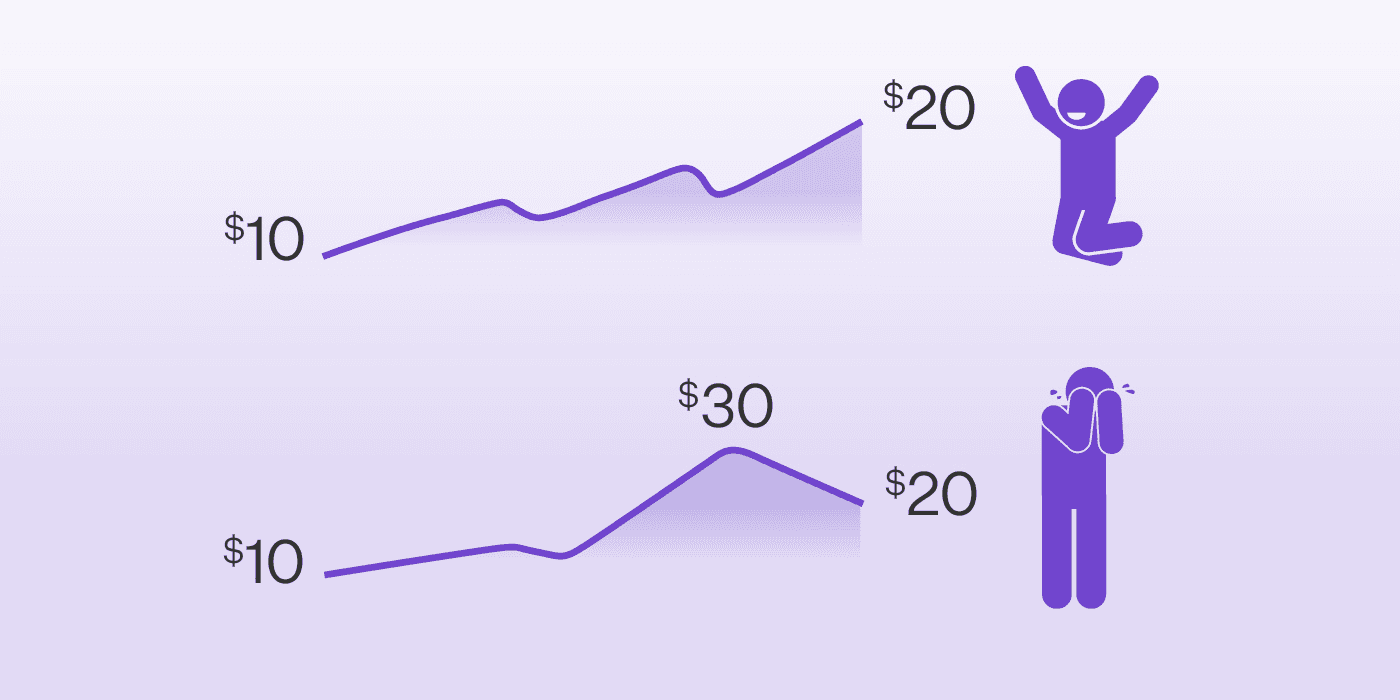

Let’s start with 2 scenarios:

Scenario 1: You buy a share for $10. Then over the next three years, it goes up to $20.

You doubled your money.

You’re feeling pretty good. You think "that’s a great return on investment."

Scenario 2: You buy a share for $10. Over the next three years, it goes up to $30.

This time, you’re ecstatic. You think: “OMG, wow. Look at me go”.

But then it drops back to $20. Now, how do you feel?

Chances are (if you’re like most investors) you feel stupid and think:

“I should have sold when it was at $30.”

In both scenarios, you've made you made the same amount of money, in the same amount of time.

But in the second scenario you're more likely to feel like you lost $10 instead of making $10.

This principle, definitely applies to the New Zealand property market.

Since the peak last year, property prices have fallen 18%. And all the headlines groaned.

But house prices had initially gone up by over 40%.

Even though property prices have dropped back about 18%, you could still be up 20%-ish. That’s an enormous return, depending on when you bought.

I'm not here trying to tell you that a falling market doesn't hurt anyone or that it doesn't feel bad. Because you could be thinking:

– “oh man, I should have sold at the top of the market”

or

– “I should have borrowed more against my properties to buy more”.

But you should ask yourself: "if my property went up by 20%(ish) over the last 3 years, would I be happy?"

If the answer is yes, you should focus more on the gains you've made, rather than the potential money you've lost.

If you stay in the market, you may get it back.

There are always investment opportunities in any market.

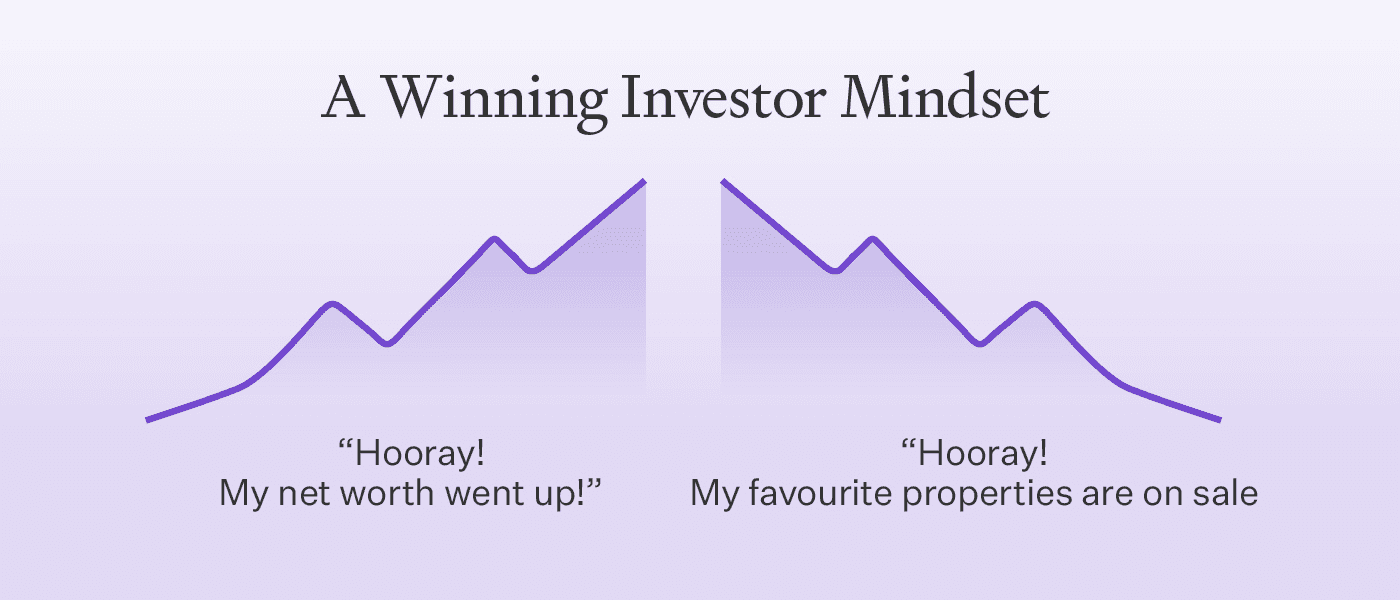

When prices go up, most people think: “The price of houses is going up, I should get in the market now so I don't miss out."

If prices go down, the same people think: “Oh, it's a bad time to buy a house, property prices are going down”.

Winning investors see property prices falling and think: “Properties are now on sale. They are cheaper, there are more options, and I face less competition."

"There are now properties that I can afford that I couldn't have afforded before.”

Opes Partners Managing Director, Andrew Nicol says: “I like when house prices go down. Then I can afford to buy more”.

It's such a different mindset. But it makes sense.

If tins of tomatoes were on sale at the supermarket – you’d buy more. What if we thought about a market crash, as a property sale?

Right now, properties are more affordable. This is great in our current market.

Why? Because getting a mortgage, and paying it back, are becoming more challenging.

A lower property price can be your friend if you are investing for the long term.

Simran Kaur, author of Girls That Invest, says she often puts a couple of grand into the market when prices are low. For this exact reason.

Secure a comfortable retirement with 3 easy steps

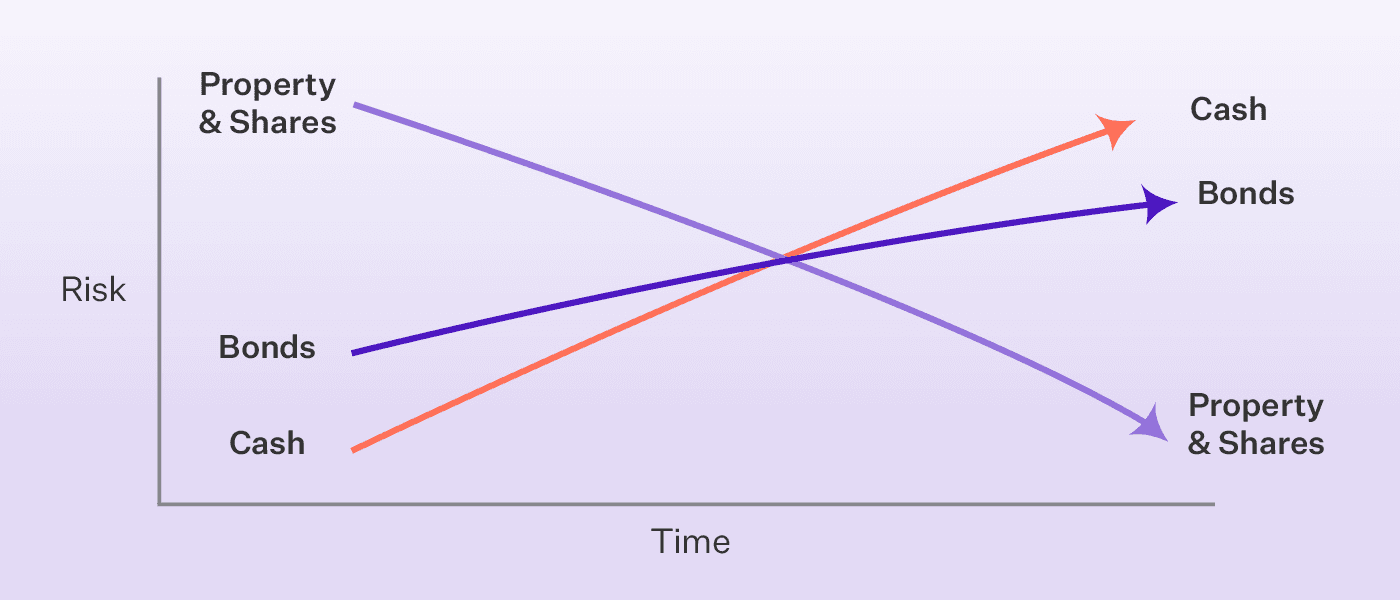

Book your free sessionMost investors think assets like cash in the bank and term deposits are “safe” investments.

Whereas they think that managed funds, property and shares are higher risk.

But it depends on how long you plan on holding the investments. That's your investment horizon.

Over the short term, keeping cash in a term deposit is not very risky.

This is because the likelihood the investment will decrease in value is very low.

And the likelihood that the bank pays you back the money with the agreed interest rate is very high.

But over the long term, things like term deposits become risky.

Why? Inflation makes your cash worth less.

On top of that, you miss out on more and more of the gains from assets that grow in value faster.

Shares and property are risky over the short term. The prices of these assets are volatile. They can go up, and go down, quickly.

This means the value of your investment could go down within the next year. If you sell you could lose money.

But over the long term, the share market tends to increase faster than term deposits.

So if you hold for longer, the risk goes down. You just have to deal with the ups and downs of the market in the meantime.

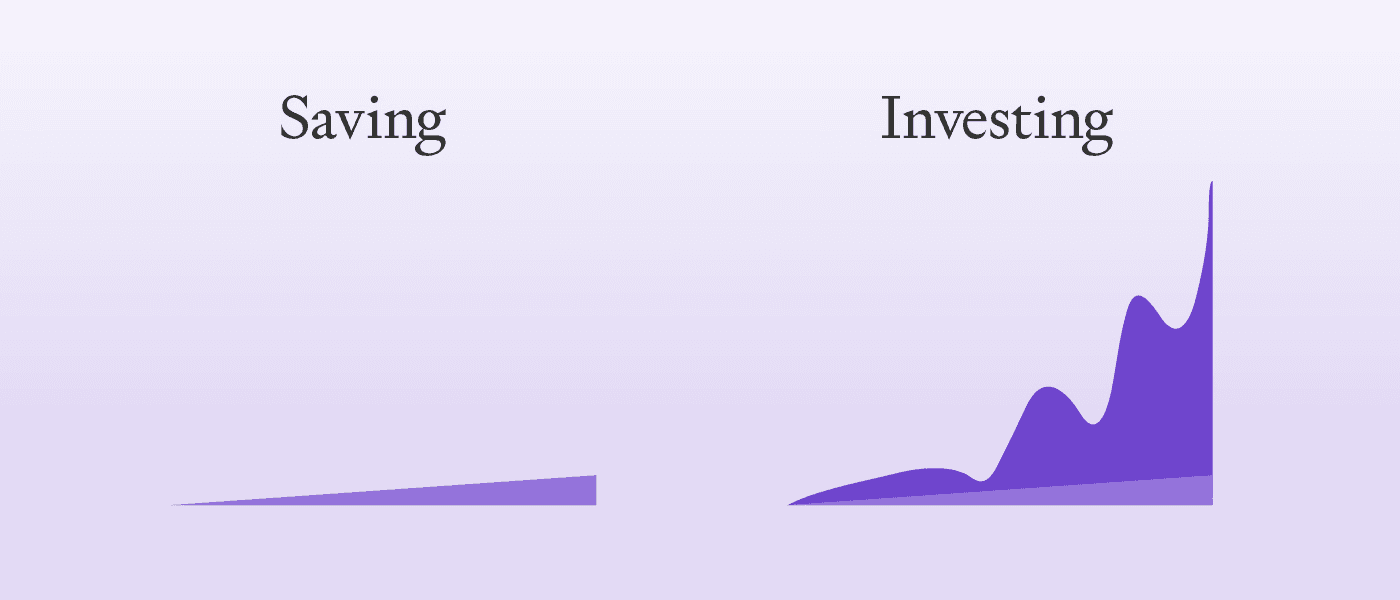

When you invest the price of your assets will go up and down. That's part of investing.

But you'll often get more returns if you can accept more volatility.

For instance, if you take $100 a week and put it into the bank for the next 10 years you might get a 2% return (on average).

At the end of that 10 years, you'll have $58,000.

Great.

But if you invested that same money, you'd have just over $78,600 in the New Zealand stock exchange.

That's over $20k extra, which is 36% more.

Over time that difference compounds and you'll often have more money if you invest in assets. That's things like shares and property.

Yes, the price of assets go up and down more than just having your money in the bank.

But you'll often be ahead when you model it out over the long term.

Look at the last 10 years in history.

Yes, there are some drastic market drops. For instance, when Covid hit the share market dropped drastically.

But you are still ahead of where you would've been if you were just putting that money into savings.

The following scenario applies to both of the above 2 principles.

An investor bought a property for about $600,000 a few years ago.

But now he wants to sell it because property prices are falling.

He wants to put the money into a term deposit because that's "safer".

When he first put it up for sale, the price was $775k. It's dropped to $725k, and he still hasn't sold it.

In his mind, he's lost money.

It’s dropped $50k in value since he started trying.

But there are two ways to look at this.

#1 - You could think: “I lost $50k. I need to sell now and exit that investment.”

#2 - You could think: “I've already made $125k. If I hold onto it for the next 10 years, I'm likely to get X amount of extra gains from that also”.

These 4 mindset shifts will change the way you invest.

Once you start thinking like a pro-investor, you set yourself up to make those long-term property investment gains.

Journalist and Property Educator, holds a Bachelor of Communication (Honours) from Massey University.

Laine Moger, a seasoned Journalist and Property Educator holds a Bachelor of Communications (Honours) from Massey University and a Diploma of Journalism from the London School of Journalism. She has been an integral part of the Opes team for four years, crafting content for our website, newsletter, and external columns, as well as contributing to Informed Investor and NZ Property Investor.

This article is for your general information. It’s not financial advice. See here for details about our Financial Advice Provider Disclosure. So Opes isn’t telling you what to do with your own money.

We’ve made every effort to make sure the information is accurate. But we occasionally get the odd fact wrong. Make sure you do your own research or talk to a financial adviser before making any investment decisions.

You might like to use us or another financial adviser