Developers

The developers Opes recommends (and the ones we don't)

Who are all the developers you work with? Well, we counted them. In total there are 123 developers that we have had a relationship with over the last 3 years.

Property Investment

9 min read

Author: Laine Moger

Journalist and Property Educator, holds a Bachelor of Communication (Honours) from Massey University.

Reviewed by: Ed McKnight

Resident Economist, with a GradDipEcon and over five years at Opes Partners, is a trusted contributor to NZ Property Investor, Informed Investor, Stuff, Business Desk, and OneRoof.

In the 10 years we’ve been in business, some investors think that our company, Opes Partners, has done a lousy job.

They might say, “Opes messed up” … or “you didn’t tell me X, Y, Z would happen.”

Some of that is normal. We’ve worked with thousands of investors over the last 10 years. And each year we help (just shy of) 600 people to invest.

Where the criticism is valid, it’s taken on board, and we improve our processes.

Other times, the ‘bad thing that happened’ is not something we can control (we’ll give you some examples in a moment).

Because we’re committed to transparency, you’ll learn the 6 things that annoy the heck out of Opes Partners’ investors in this article.

You’ll learn what problems can happen and how to fix them.

That way, you can make a fully informed decision about whether to invest with us (or not).

Because the truth is, investing in property and working with Opes Partners may not be the right fit for you.

Just before we get into the 6 things that annoy Opes investors, it’s worth clarifying what Opes Partners does and doesn’t do. Because that’s sometimes where frustration can creep in.

To be clear, Opes Partners is a property investment company.

We are not a developer. We don’t build properties.

Our job is to build you a financial plan that helps you achieve your goals. We then find the properties that create the wealth to achieve those goals.

You’ll get a lot when working with us, like figuring out whether you can afford to invest. You’ll also get recommendations and advice on:

And through this process you’ll work with a financial adviser (a Property Partner).

As much as we are heavily involved throughout your investment journey, there are things we cannot control or predict.

Let’s take a look at them in more detail.

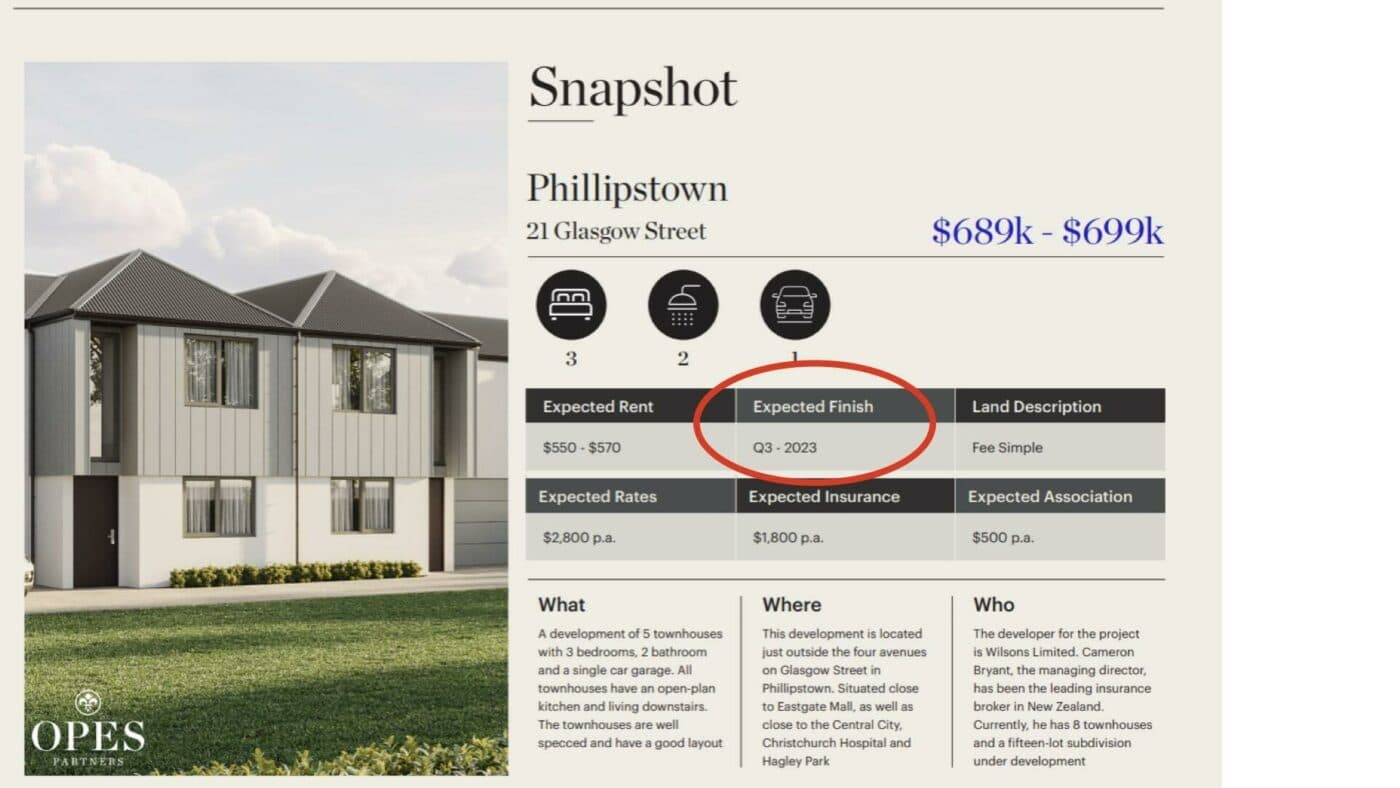

Sometimes developers take way longer to build properties than they initially said.

That’s where investors might say: “Hey, Opes, why didn’t you make sure the developer finished on time?”

We get that because when you buy a property, you’ll get a property pack from us that shows when the property is expected to be finished.

And on top of that, you’ll get a recommendation about which developer to use.

So you might think, “Shouldn’t you know when it’s going to be built … you recommended me the wrong developer.”

We do our best to choose good developers (and have a good process for choosing them).

Even so, there can be delays – even when you’re using the best developers in the country.

This could be because:

All of these (and more) can slow down the process.

That doesn’t mean we’re passing the buck … blaming someone else or leaving you alone.

When there are delays, we’ll pass on the information from the developer. And if there are issues, we’ll pick up the phone and do our best to get things sorted.

But we aren’t the ones building the property.

Just like any property, New Builds sometimes come with defects.

The most common defects found in these inspections are:

These happen because houses are built by humans … and humans make mistakes.

That doesn’t mean they can’t be fixed. In fact, you have a 12-month period to report defects. And the builder has to correct these defects in a reasonable time frame.

To handle this, you should:

Again, it’s important to emphasise that Opes Partners is not the developer. We can:

But we aren’t the ones who will organise a builder to go through and fix them. That is the developer’s job.

One of the most common complaints is when the developer changes something about the property.

In your contract with the developer, they will have the right to make minor changes.

For example, their property information packs might say the appliances will all be Fisher & Paykel.

But, when it comes to ordering the appliances, none of that particular brand is available. So instead, they buy Miele appliances (an equivalent brand).

The developers need these clauses in the contract so they can make small changes based on:

Essentially, it gives the developer some wiggle room to make minor amendments to the original contract to get the property built.

All build contracts include these clauses and are industry standard.

For instance, there might be:

Sometimes investors will get upset when they learn about these modifications, especially if they feel the developer is using a cheaper product or appliance than stated in the contract.

Here at Opes, if there are changes we will let you know as soon as we know about them. And if the developer uses cheaper material, we’ll have frank conversations with them.

We want to do our best for you, so we will advocate heavily on your behalf to ensure materials are equivalents.

But, and this is a big but, we are not the developer. We can’t organise a builder to go on-site and make changes.

We will work with your lawyers to get the best outcome (e.g. a discount from the developer or ask them to put it right).

But, it is essential to remember that your contract (sale and purchase agreement) is with the developer.

Now, having a property investment company like Opes on your side may mean you are more likely to be protected in this event.

The developer will lose financially (in the future), mainly if Opes stops recommending their properties to investors.

The worst case scenario is the developer goes bankrupt during the building of your investment.

If this happens, it’s unlikely your property will be finished.

You will get your deposit back – after all, it’s been held safely in a lawyer’s trust account. But that property will not be built, and you’ve missed an investment opportunity.

That’s not good.

This is why we vet rigorously, doing our best to work with financially secure developers.

We’ll check 3 main aspects:

But, even after that, the developer could still go bankrupt. We don’t have a log-in to their accounting systems to see how they spend their money.

If we do the job right, we can minimise the chances that the developer goes broke.

But that doesn’t mean there is no risk that the developer goes broke. There’s no such thing as “no risk” in investment.

To learn about our entire vetting process, read our article: How do you know if a developer is any good (or not)?

There’s no escaping it. Interest rates change all the time.

They can either go up or down. Sometimes it feels like even economists don’t know what’s going on.

If interest rates go down, that’s going to help investors.

But if they go up, it can impact the cash flow of your investment. Mainly if you take out a large mortgage.

Unfortunately, there’s nothing you or we can do (if only about interest rates).

And while we will do our best to predict interest rates … no-one has a crystal ball.

That’s why when the bank approves your mortgage, they will run your application through a series of test conditions.

They will test it at a much higher interest rate, and as if you were paying principal and interest, even though many property investors use an interest-only loan.

So even if interest rates go up, there is a good chance you can still afford your mortgage.

On top of this, our financial advisers can work with you to adapt your financial situation to make the higher interest rates more bearable. Our mortgage advisers can also help select the right interest rate for you.

When you buy a New Build property, the value will often go up between when you signed the contract and when the property gets built.

But property prices can also go down. And naturally, investors will feel a little down when property prices slump in the short term.

In these times, it’s important to remember that over 6 months, property prices tend to go up 84% of the time. Property prices will decrease 14% of the time.

It’s also important to remind yourself that when you decided to invest in a property, you didn’t plan to sell it in a short time frame.

You will have invested for the long term (10+ years).

People have made a lot of money investing in property over the years. Historical data for property prices shows those prices tend to go up.

In 10 years you will likely be grateful that you decided to invest.

But none of us can individually control what happens to the property market.

This article isn’t an attempt to pass the buck or tell you it’s someone else’s fault when something goes wrong.

Instead, this article is as transparent as possible and is saying: “These are the things that tend to frustrate investors … and here’s the game plan to fix them.”

We are here to help you be successful as a property investor. That includes:

But there are things that we can’t fully control. These are primarily to do with the developer and the current market.

We will guide you through the process – and do our best to tackle any issues as they come – but investing in property isn’t always smooth sailing. It does come with a certain amount of risk.

Rather than pretending that these risks don’t exist, we think it’s essential that you’re made aware of what they are.

Loading...

Journalist and Property Educator, holds a Bachelor of Communication (Honours) from Massey University.

Laine Moger, a seasoned Journalist and Property Educator holds a Bachelor of Communications (Honours) from Massey University and a Diploma of Journalism from the London School of Journalism. She has been an integral part of the Opes team for four years, crafting content for our website, newsletter, and external columns, as well as contributing to Informed Investor and NZ Property Investor.

This article is for your general information. It’s not financial advice. See here for details about our Financial Advice Provider Disclosure. So Opes isn’t telling you what to do with your own money.

We’ve made every effort to make sure the information is accurate. But we occasionally get the odd fact wrong. Make sure you do your own research or talk to a financial adviser before making any investment decisions.

You might like to use us or another financial adviser