Property Types

Houses vs townhouses vs apartments - Which goes up in value faster?

Want to know what sort of properties you should invest in? See the data about which grows in value faster – houses, townhouses or apartments.

Property Types

8 min read

Author: Laine Moger

Journalist and Property Educator, holds a Bachelor of Communication (Honours) from Massey University.

Reviewed by: Ed McKnight

Resident Economist, with a GradDipEcon and over five years at Opes Partners, is a trusted contributor to NZ Property Investor, Informed Investor, Stuff, Business Desk, and OneRoof.

Dual-key apartments are a relatively new concept for New Zealanders.

And depending on where you buy, they can be one of the more expensive investment options.

So you might ask … “are they a good investment?” And more importantly, “who are they a good investment for?” Here’s our honest review.

In this article you’ll learn what a dual-key apartment is; their unique features; and if this type of property is suited to your property portfolio.

Do you have a question or comment about dual-key apartments? Feel free to leave your thoughts in the comment section at the end of the page.

Essentially, a dual-key apartment is two separate but adjoining units held under one legal title.

So, from a tenant’s or home buyer’s perspective, the two apartments feel separate, but legally they are the same property.

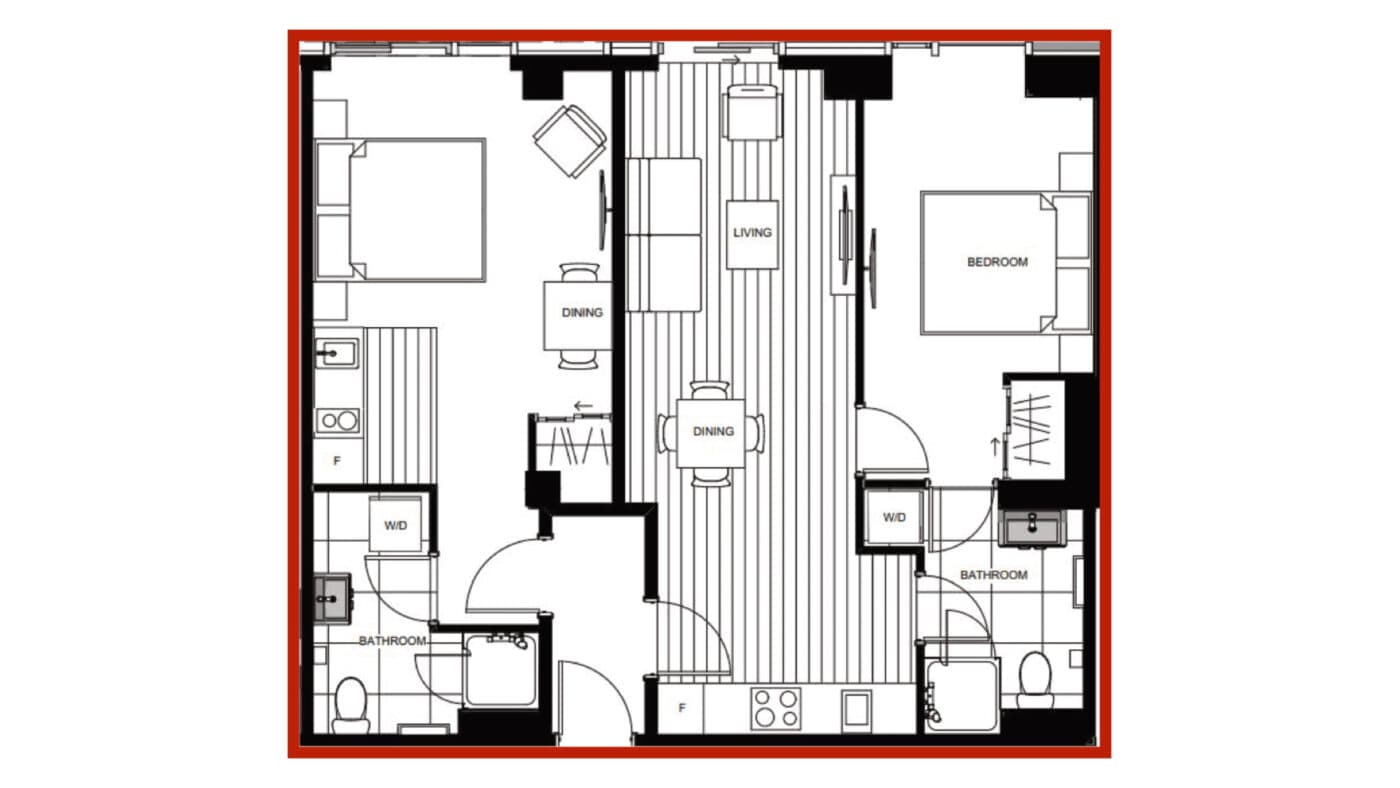

Here’s an example floor plan from a development in Ellerslie, Auckland

In the above example the size of the property is the same as a 2-bedroom apartment (75sqm). However, it is configured as a 1-bedroom and a studio.

For a property investor that means the two units can be rented separately to two different households under separate tenancy agreements. So you have two sources of income, which maximises your Rental Yield.

From the tenant’s perspective, apart from a shared entrance way, they are totally separate.

Generally speaking you can expect to pay anything from $950,000 up to $1.3 million for a dual-key apartment in Auckland.

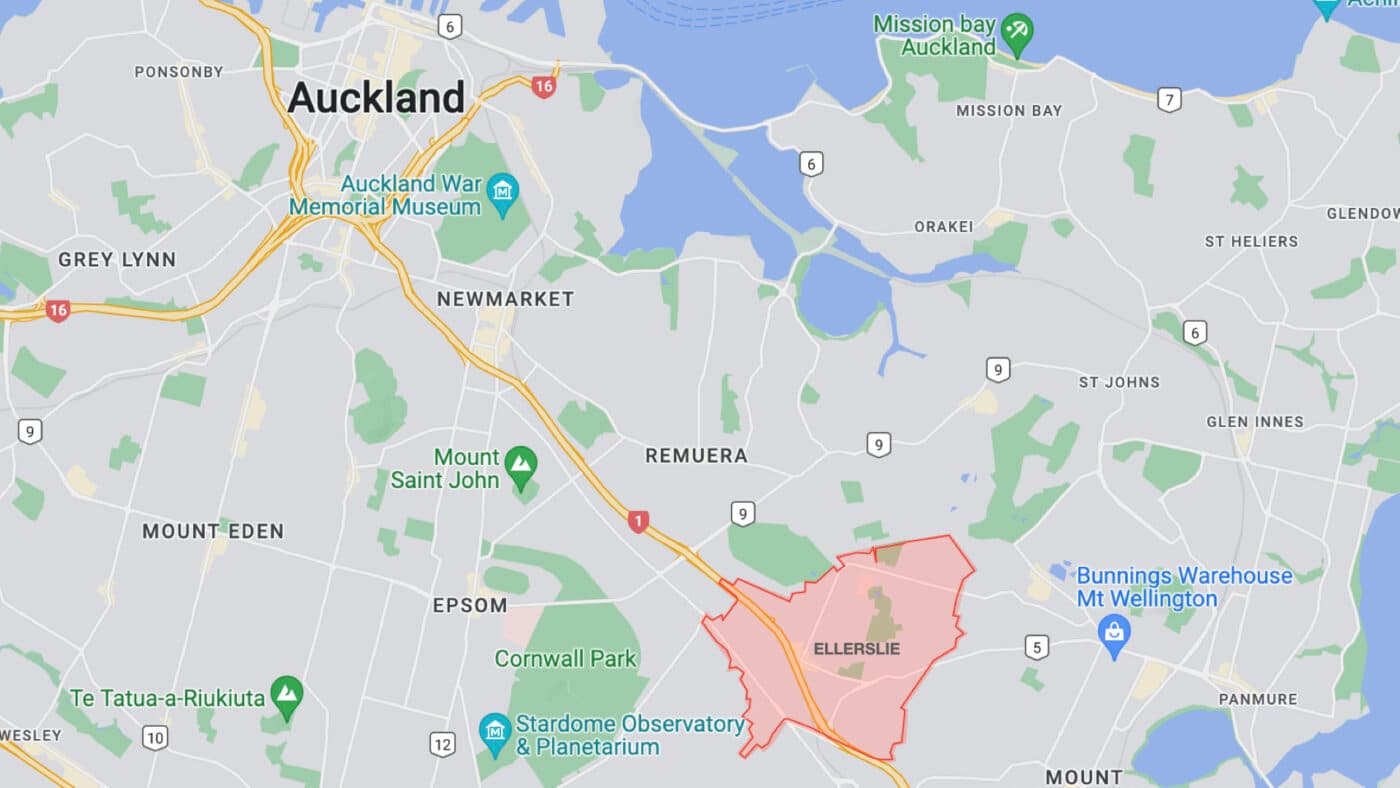

For example, Opes recently recommended dual-key apartments being built in Ellerslie, Auckland. The developer was Safari Group, and the project featured on our reality TV style show, The Deal.

The most affordable dual-key apartment in this development was $915,000. This is at the upper end of what an investor would typically spend on a New Build investment.

However, purchasing a dual-key apartment is generally cheaper than purchasing the equivalent apartments separately.

For instance, in the example of this Ellerslie development, a dual-key (1-bedroom apartment + studio) cost $915,000.

But, if you were to buy a 1 bedroom apartment and studio separately (i.e. not dual-key) in the same building, it would cost $1.15 million.

In Christchurch properties tend to be cheaper. Another set of our investors recently purchased into a development of dual-key townhouses.

In this situation the bottom floor was a studio apartment, and the top two floors were a two-bedroom townhouse.

This was purchased for $799,000, and the estimated rent was $920 a week.

Dual-key apartments are considered a yield-based investment. They tend to grow in value more slowly, but they offer higher rental yields.

To take the example of the Ellerslie apartment above, the rent was expected to be $515 for the one-bedroom, and $480 for the studio. That’s $995 of income per week. Based on the purchase price of $915,000 – the property would generate a 5.7% gross yield.

In the example of the Christchurch dual-key townhouse, the properties would earn $920 a week. This is a 6.0% gross yield, based on the $799,000 purchase price.

Generally, an acceptable gross yield for a dual-key apartment is between 5.5% – 6.5%.

Dual-keys are a yield-based investment (as opposed to a growth-based investment). This means they earn high income, but they grow in value more slowly.

This is because:

1) Dual-keys tend to be apartments, and apartments tend to grow in value more slowly.

That doesn’t mean they don’t increase in value; they just do so at a slower rate.

2) Dual-keys are a niche product. There aren’t as many buyers out there looking for a dual-key.

Typically, these properties are bought by investors for rental yield. So, the increase in value primarily depends on how fast the rental income grows and the return other investments could provide the investor.

This limits how fast the value of these properties will increase compared with other properties, which owner-occupiers will bid up the price for.

However, that doesn’t mean these properties aren’t bought by owner-occupiers, or that you could only resell the property to an investor.

For instance, some people purchase these properties, live in one apartment and rent the other. This provides a home and income. They then use the rental income to help pay the mortgage.

Others use these types of properties for their multi-generational family. A teenager or parent lives in the studio while another family member of members live in the other dwelling.

In one case an elderly lady bought a dual-key apartment so she could live in the larger unit while her full-time carer lived in the other.

As multi-generational living becomes more popular it’s fair to say that dual-keys will become more accepted and the resale market will continue to grow.

So, while they are a relatively new style of investment available in New Zealand, there are genuine reasons why they’re becoming popular, which is worth knowing in terms of the re-sale market.

Using the same Ellerslie property as an example, here’s what a dual-key set-up can look like.

The units have a shared entrance, which then flows into two separately lockable apartments. Hence the name: Dual-key.

So, as you enter the door to your dual-key from a corridor, you are met with a small lobby space of about 3sqm.

To your right is the 1-bedroom unit; turn to the left for the studio.

Each apartment has exactly what you would expect of a separate dwelling – its own bedroom (or bedrooms), living area, kitchen and bathroom.

To give another example, Opes recommended some “off-the-plan” dual-key apartments in Dixon Street, Wellington back in March 2017.

At the time the apartments cost $525,000.

There were big delays, and the development took an extra two years (4 years in total) to complete, but the value had ballooned during the construction period to $840,000.

That’s a 60 per cent ($315,000) increase over just 4 years and 2 months.

Despite this being a large amount of growth, it was still 20% slower than the surrounding Wellington market. (Remember, dual-keys don’t increase in value as quickly as other properties).

During this period dual-key apartments grew 10.8% per year while the overall Wellington market lifted 12.2%, according to the REINZ House Price Index.

However, let’s think about the rental income and yield within the same period.

When the apartments were first advertised, the rental income was estimated at around $650 per week.

By the time they were finished they were renting for between $1,000 and $1,200 per week. That’s a 7.4% gross yield.

As higher-earning, yield apartments, dual-keys are found in the central suburbs of a city, which is where the rental demand makes sense for them to be.

In Auckland those are areas like Newmarket, Ellerslie and Parnell, which are close to the CBD and have great access to public transport and are near all the amenities like shopping malls.

The flexibility of these units makes them an attractive option to investors who are looking for a high-yielding option to add to their portfolio.

These tend to be older investors, or those looking to slow down from work and use property to supplement their income.

However, if you are building your wealth dual-key apartments can still be used in your portfolio. Some investors will use these properties to top up other properties in their portfolio that are negatively geared.

In other words, if you own a townhouse that is negatively geared by $100 a week, you might buy a dual-key apartment that earns $100 a week. This way the yield property pays for the growth property’s contributions.

While it's cheaper to buy a dual-key, rather than to buy two units separately, it still requires more to invest. So, these tend to be a good fit for investors who can afford to spend a bit more on an investment property and are looking for yield.

On the other hand if you are an emerging investor with limited borrowing potential then you might think about starting off with a less expensive option.

Also, since dual-keys are a high-yielding product, rather than a growth asset, if you were looking to build your portfolio with growth properties you might be better suited to something like a 3-bedroom townhouse in Auckland, or a 2-bedroom townhouse in Christchurch.

In addition, since dual-keys tend to be newly-built by developers, renovations-focused BRRRR investors are not suited to this type of investment. That’s because the developers have already fully-specced out the property: you can’t renovate to improve value.

All things considered, dual-key units can be an attractive option for investors.

More flexibility and more potential income make them a good investment for different reasons. But it is important to note that not every dual-key will automatically be a great investment for every investor.

Ultimately, it comes down to the numbers and being able to sort the good investments from the bad.

That’s why, here at Opes, we work with 58 developers from around NZ to find the right properties for Kiwi investors. And then once we find them, we rigorously run the numbers to offer good investment properties to our investors.

To find out more about how we find quality investment properties for investors, click here to read about our property investment programme.

Journalist and Property Educator, holds a Bachelor of Communication (Honours) from Massey University.

Laine Moger, a seasoned Journalist and Property Educator holds a Bachelor of Communications (Honours) from Massey University and a Diploma of Journalism from the London School of Journalism. She has been an integral part of the Opes team for four years, crafting content for our website, newsletter, and external columns, as well as contributing to Informed Investor and NZ Property Investor.

This article is for your general information. It’s not financial advice. See here for details about our Financial Advice Provider Disclosure. So Opes isn’t telling you what to do with your own money.

We’ve made every effort to make sure the information is accurate. But we occasionally get the odd fact wrong. Make sure you do your own research or talk to a financial adviser before making any investment decisions.

You might like to use us or another financial adviser