Mortgages

How do I get a mortgage and pay it off?

This 9,500-word Epic Guide to Mortgages is the definitive article on how to get a mortgage and pay it off faster, today in 2026. The Ultimate Guide.

Mortgages

6 min read

Author: Ed McKnight

Resident Economist, with a GradDipEcon and over five years at Opes Partners, is a trusted contributor to NZ Property Investor, Informed Investor, Stuff, Business Desk, and OneRoof.

Reviewed by: Laine Moger

Journalist and Property Educator, holds a Bachelor of Communication (Honours) from Massey University.

Buy now, pay later services like Afterpay and Laybuy are convenient.

You walk into a store, buy a couple of pairs of jeans, walk out … and pay them off over 6-8 weeks.

But these services have a dark side and can stop you from buying property.

This article breaks down exactly how Afterpay and Laybuy can stop you from buying your next property, and how to reverse their effect.

Buy Now, Pay Later has increased in popularity since 2014, the year Afterpay – one of the largest short-term lenders – started up.

The market is now booming. The amount spent through these payment platforms increased 105% in 2019.

New firms have started joining the industry. Buy Now, Pay Later providers now include Afterpay, Laybuy, Oxipay and PartPay, with many new companies starting to cash in on the trend.

This payment method is particularly trendy among millennials (those born after 1981) and Gen Zs (those born after 1997).

These generations grew up being told credit cards were wrong. They were told they'd pay a fortune through high interest rates with credit card companies. After all, the standard rate for a low-interest credit card is 12.95%.

So it’s obvious why some young people consider Buy Now, Pay Later a safer alternative.

But, for all Buy Now, Pay Later's benefits, there are downsides.

Chiefly, they make it harder for young New Zealanders to get into a housing market, which they already struggle to access.

There are two ways Buy Now, Pay Later will impact your mortgage application:

When the bank assesses your mortgage application, they will check whether you have enough income to make the repayments under a few strict 'servicing test conditions'.

They need to see that you could still afford the mortgage even with a higher interest rate and if you’ve maxed out all credit facilities.

And the way they check affordability is by poring over your bank statements.

As well as handing in the standard mortgage application form, you'll also give your prospective lender your bank statements for the last 3 months.

They'll go through the statement line-by-line to match the expenses you’ve claimed on your mortgage application, with what you’re really spending in practice.

Let's say the bank sees a $50-a-week Afterpay payment going out of your account, that’s due to finish in 3 weeks.

They won't say "that's going to finish in 3 weeks, so let's include that as income that could be used to pay the mortgage".

Instead, they‘ll look at those payments as if they’ll continue forever. Even though once your Afterpay has finished, you may never plan to use the service again.

That might sound unfair, but remember the bank can't guarantee that you won't spend the credit again once you’ve finished your repayments.

You might look at an Afterpay or Laybuy and think "what's the harm, it's interest-free! I was going to spend the money anyway, I'm just paying it off differently."

That's not really true.

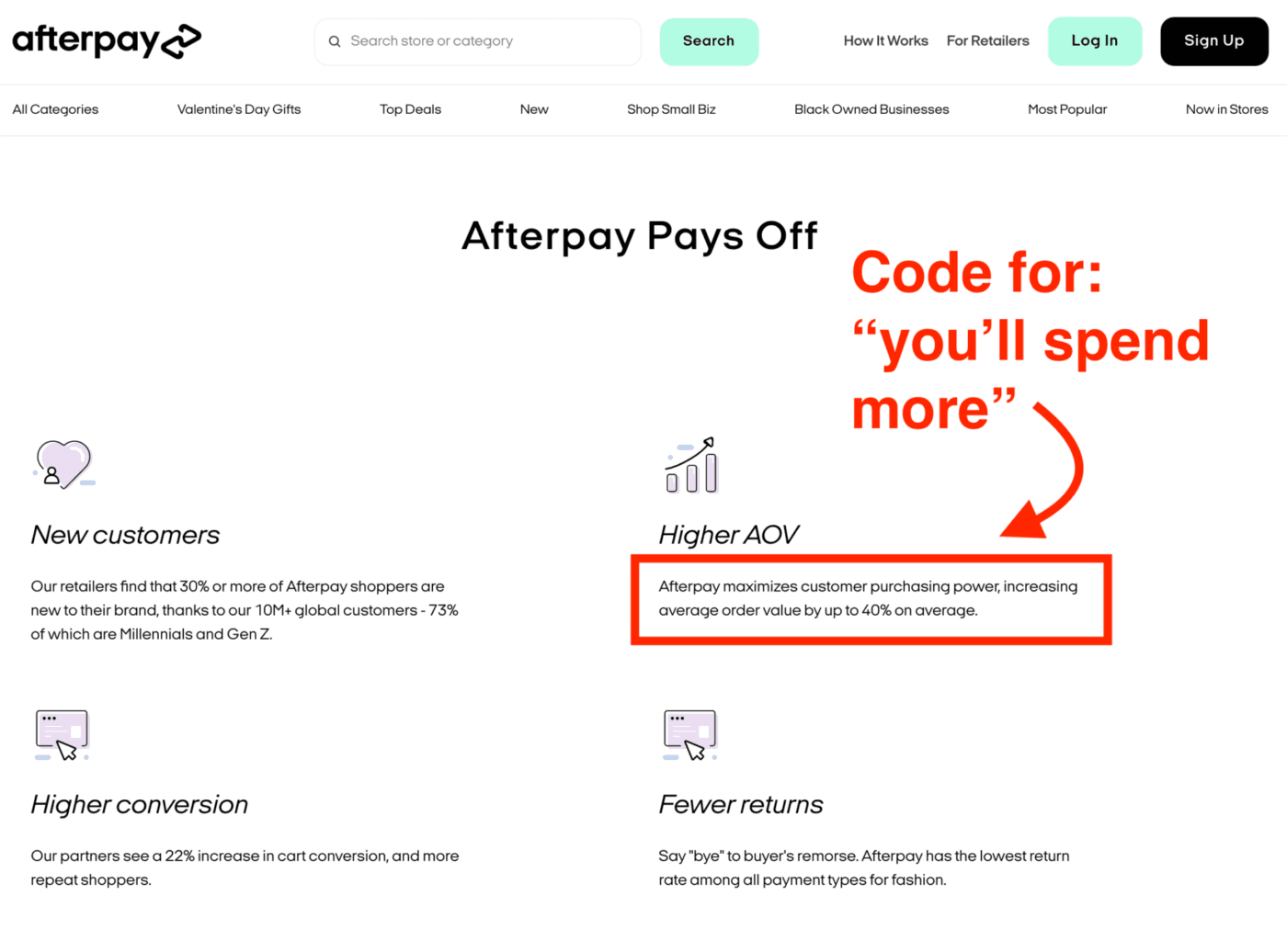

Just look at how Afterpay markets itself to retailers.

Their research shows that if you use Buy Now, Pay Later you are

So, the impact isn't just that the bank will look at your short-term payments as if they're going to go on forever, your actual expenses will be higher too.

That means there's even less income available to go towards your mortgage under the bank's calculations.

The impact of an Afterpay payment can be significant. In some instances, you can borrow up to $70,000 more if you don’t have an Afterpay.

Let's say you want to buy an investment property and you earn the median income in NZ, $80,354 per year.

You've got a personal mortgage of $400,000, and your personal expenses are low – you're single, living alone without children and you've got one car.

Say you want to buy an investment property, the maximum possible amount you could borrow from ANZ is $411k.

That’s enough to buy an entry-level investment property in some parts of Canterbury.

But, add a $50/week Afterpay, and the maximum amount you could be approved to borrow drops to $340k. A massive $70,921.28 by our calculations.

One small Afterpay can have a huge impact.

Not everyone who uses a Buy Now, Pay Later service will have their mortgage application declined.

If you're on a higher-than-average income, you’re less likely to be impacted. That’s because you're more likely to pass the bank's income tests even with the additional expense included.

Instead, the borrowers who will be most impacted are those who would have otherwise scraped by the bank's income tests.

That could be because you live in Auckland or Wellington and need to borrow a lot of money to get into the housing market. That extra $40k worth of borrowing could be the difference between buying your first home or not.

Similarly, if your income is on the low side, you’re more likely to be impacted.

That could be because you're a one-income household or work in an industry where salaries tend to be lower.

If you've used Buy Now, Pay Later in the past, don't worry, there are ways to get around how the bank assesses your application.

Whether each of them will work depends on how closely the bank looks at your application.

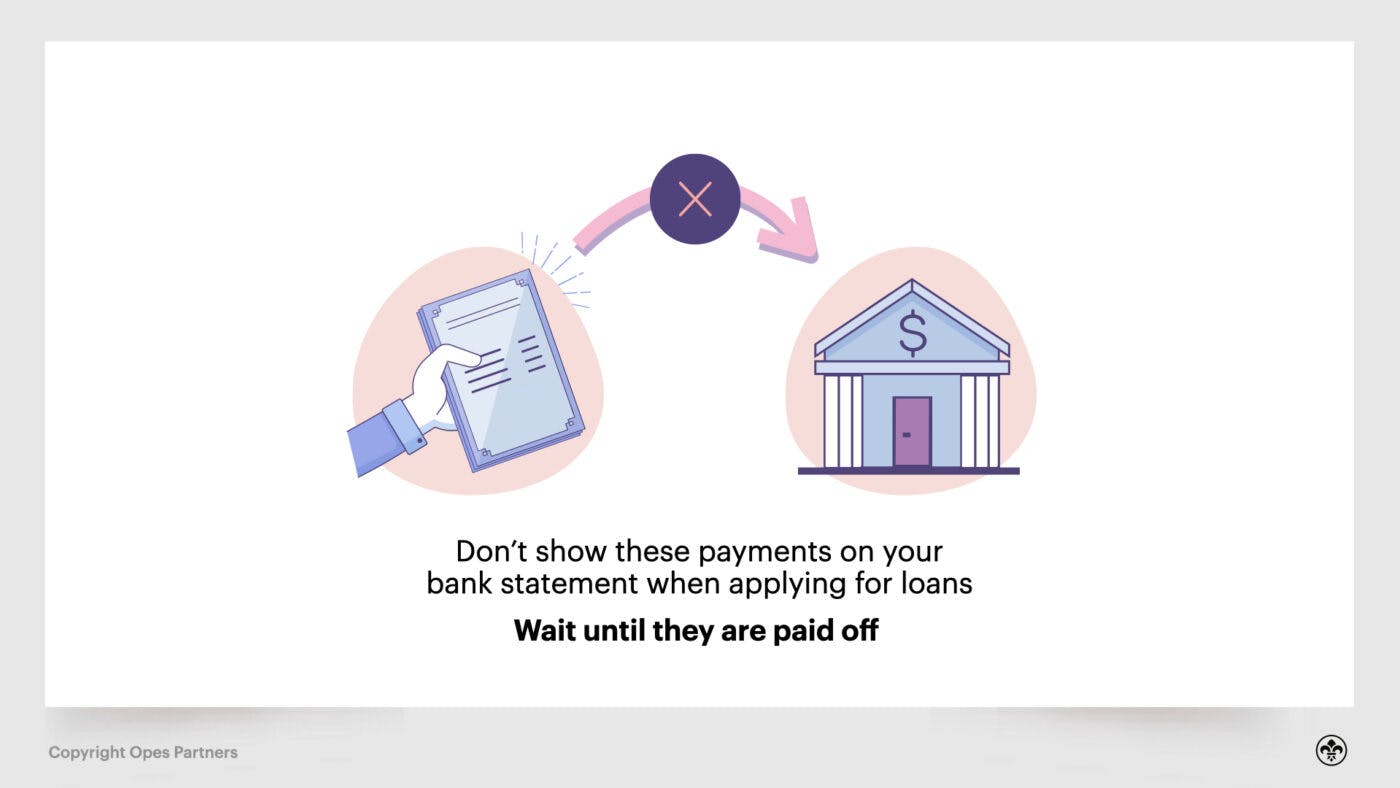

Firstly, make sure Afterpay, Laybuy, PartPay, or any of the other Buy Now, Pay Later firms don’t appear on the statements you submit to the bank.

That means paying off any of these short-term debts and then not using them for the next 3 months.

Even then, the banks can still see that you have used these services in the past by looking at your credit record.

In that case, you may need to cancel your Afterpay and Laybuy accounts so the bank has confidence you won’t be using them in the future.

Remember the banks aren't just looking at what debts you currently have, but the credit you could spend once the mortgage is approved.

This doesn't mean that Afterpay is always wrong and should never be used.

These services are handy for younger people, especially if your income is constrained, or you need this type of 'forced savings' to buy what you want.

But, if you're applying for a mortgage within the next 6 months, whether for yourself or for an investment property, then you probably don’t want to apply or use one of these services.

If you are on the cusp of having your lending approved, it could make all the difference.

Resident Economist, with a GradDipEcon and over five years at Opes Partners, is a trusted contributor to NZ Property Investor, Informed Investor, Stuff, Business Desk, and OneRoof.

Ed, our Resident Economist, is equipped with a GradDipEcon, a GradCertStratMgmt, BMus, and over five years of experience as Opes Partners' economist. His expertise in economics has led him to contribute articles to reputable publications like NZ Property Investor, Informed Investor, OneRoof, Stuff, and Business Desk. You might have also seen him share his insights on television programs such as The Project and Breakfast.

This article is for your general information. It’s not financial advice. See here for details about our Financial Advice Provider Disclosure. So Opes isn’t telling you what to do with your own money.

We’ve made every effort to make sure the information is accurate. But we occasionally get the odd fact wrong. Make sure you do your own research or talk to a financial adviser before making any investment decisions.

You might like to use us or another financial adviser