Mortgages

Interest only mortgage calculator & guide to interest only mortgages NZ

Discover if an interest-only loan could lower your payments and boost your properties cash flow.

Mortgages

5 min read

Author: Laine Moger

Journalist and Property Educator, holds a Bachelor of Communication (Honours) from Massey University.

Reviewed by: Ed McKnight

Resident Economist, with a GradDipEcon and over five years at Opes Partners, is a trusted contributor to NZ Property Investor, Informed Investor, Stuff, Business Desk, and OneRoof.

Almost half of property investors use interest-only loans.

That’s because it decreases your mortgage repayments and increases your cashflow. At least in the short term.

Interest-only loans are cheaper in the short term, but are more expensive over their lifetime. Ironically, you end up paying more interest over the long term.

So, why do over 40% of investors use them?

In this article, you’ll learn the top 4 reasons investors use interest-only loans.

Let’s use a case study to show the 4 reasons investors use interest-only.

They are Joan and Bruce from Auckland. They are 48 and 50 years old and own their own home.

This couple had never invested in property before.

But they’d received a large inheritance of $1 million and they wanted to use that money to set themselves up for life.

To be honest, Joan and Bruce were in pretty good financial shape already.

As well as their large inheritance, they had $200k in KiwiSaver between them. And they both earned just shy of $100k each.

Joan and Bruce wanted to buy 2 investment properties. They were looking at one property worth $940k, and another worth $1 million.

So, is an interest-only loan right for Joan and Bruce? Here are the factors they looked at.

Find out in seconds what your mortgage repayments would be if you went on interest-only

Calculate nowIf Joan and Bruce get an interest-only loan, their mortgage repayments will be lower.

On their $940,000 property they will pay $177 less per week on the mortgage.

For their $1 million property, it’s $188 less per week.

What would happen if Joan and Bruce put these properties on principal and interest? They would have to pay that $256 difference out of their own pocket.

That’s because investment properties are often negatively geared (at least initially), especially at today’s interest rates.

That means the rent doesn’t cover all the costs of owning the property.

But, using an interest-only loan, their properties will become positively geared faster.

This assumes Joan and Bruce can keep renewing their interest-only period.

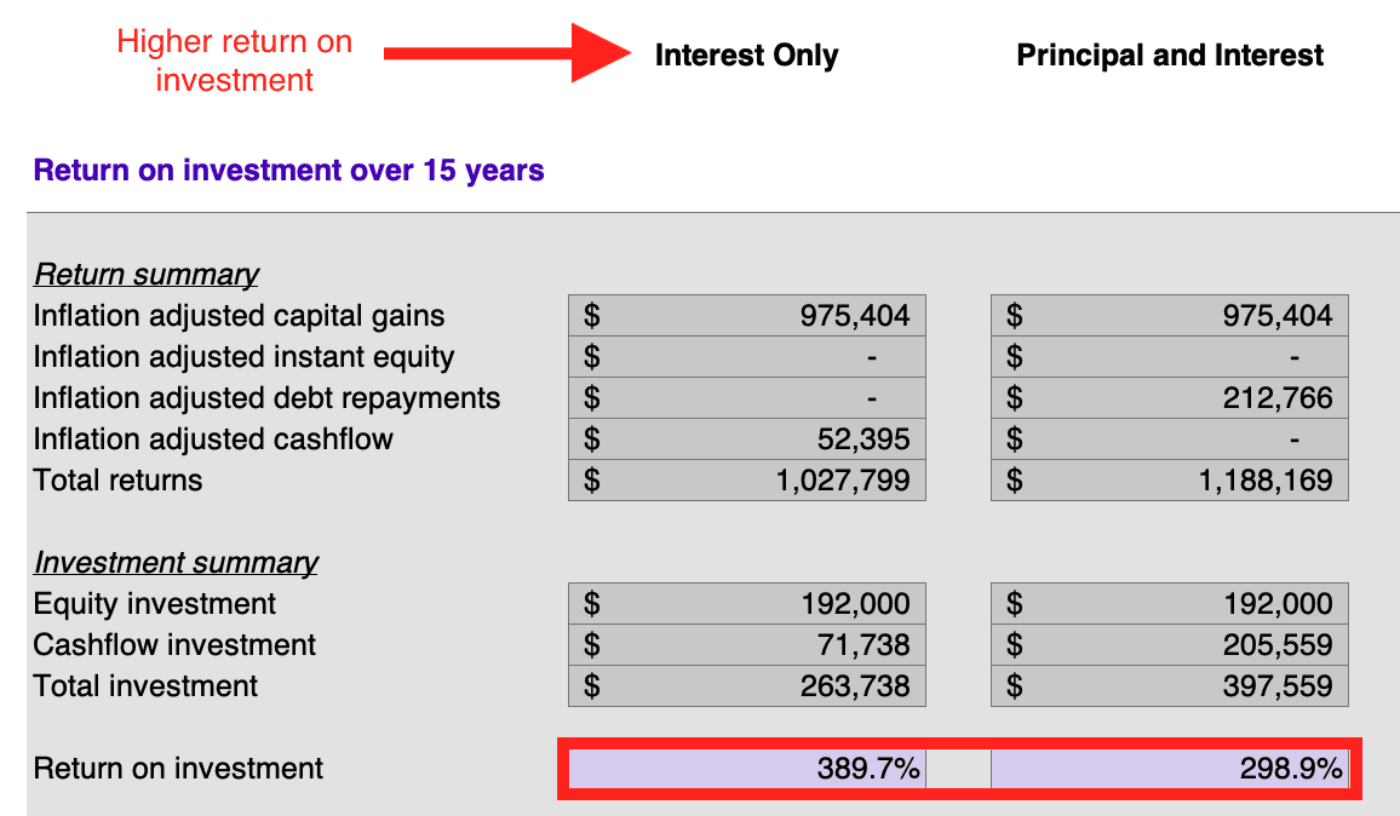

The properties Bruce and Joan are buying have an expected return on investment of 340% each. That’s using an interest-only loan.

But, if their loans were on principal and interest the ROI drops to 300%.

This is because most of the return comes from the property going up in value (capital growth).

You get that increase in value whether you pay down the mortgage or not.

So, paying down the mortgage takes up a lot of cashflow, but doesn’t always give you a much higher return.

At least, not when you look at it over 15 years.

That’s why it’s often a good idea to use that extra cashflow to invest in something else.

In 3 years, Joan and Bruce’s Auckland properties will likely be positively geared. They’ll make money.

At that point Joan and Bruce want to buy a third investment property.

One option is to use the positive cashflow from their two properties to cover the shortfall on the next one.

But if they paid down principal on both properties, the third one might not be doable.

It’s usually better to pay off one mortgage at a time.

So if you have a home mortgage, you should generally pay that one down first.

Why?

Many investors can borrow more if they pay down their home mortgage.

This is down to loan-to-value (LVR) restrictions. Let me explain.

Let’s say Joan and Bruce buy these investment properties. They’re New Builds, so only need a 20% deposit.

But they are going above and beyond; they’ll use a 30% cash deposit.

So they will get a 70% loan for each of them.

But as soon as they pay for these New Builds the banks consider them “existing”.

If they wanted to borrow against these properties again they need to get the debt under 65% of the property’s value.

That sounds technical, but here’s what it means.

If Joan and Bruce pay $1 off the debt of their investment properties, they can’t borrow that dollar back. Not until the value of the property goes up, or the debt comes down.

But if they take that same $1 and pay it off against their own home, what’s different?

They can borrow that same dollar back to use as the deposit for their next investment property.

Whether they put that $1 into their investment or their own home, their debt still goes down.

But in one case, they have the option to use that money again for another property. (If they put the money in their own home).

In the other case, they can’t borrow that money back. (If they put their money into the investment property).

This is why you should generally pay down debt on your own home before you pay down debt on an investment property.

Now, let’s say Joan and Bruce disagreed with me about using an interest-only loan.

Maybe it’s important to them to pay down the principal on the investment debt.

Well, there is one way to get the best of both worlds.

In this case, they could set up a part of their investment debt as an offset loan.

This way, all the money they were going to pay on principal will accumulate in an offset account.

They won’t pay interest on the difference between their mortgage and the money in the offset, so they pay less interest.

An offset account is sort of like a savings account. They can pull out the money whenever they want, but it saves them interest in the meantime.

Your situation is probably different from Joan and Bruce’s, but it might have got you thinking about interest-only loans.

You’ll pay more interest to the bank if you use one, but they can still be a good option for investors.

That’s especially true if you already have a mortgage on your own home.

But, this type of loan isn’t right for every investor.

It’s like any financial decision. Carefully consider your situation before deciding on interest-only vs principal and interest.

Journalist and Property Educator, holds a Bachelor of Communication (Honours) from Massey University.

Laine Moger, a seasoned Journalist and Property Educator holds a Bachelor of Communications (Honours) from Massey University and a Diploma of Journalism from the London School of Journalism. She has been an integral part of the Opes team for four years, crafting content for our website, newsletter, and external columns, as well as contributing to Informed Investor and NZ Property Investor.

This article is for your general information. It’s not financial advice. See here for details about our Financial Advice Provider Disclosure. So Opes isn’t telling you what to do with your own money.

We’ve made every effort to make sure the information is accurate. But we occasionally get the odd fact wrong. Make sure you do your own research or talk to a financial adviser before making any investment decisions.

You might like to use us or another financial adviser