Property Investment

Property Investment

3 min read

Author: Andrew Nicol

Managing Director, 20+ Years' Experience Investing In Property, Author & Host

It’s been a tough few years for property investors.

Interest rates are up. So, the rent doesn’t often cover all the property costs.

But interest rates are now coming down 🙌.

And investors are coming back into the market.

So, what does the cash flow look like for an investment property today?

Some investors have been toping-up their properties by $300 to $600 a week.

That’s especially true:

That’s where you borrow all the money to buy a property and don’t put in a cash deposit.

In fact, last year, Valocity – a data company – said that 93% of properties need a ‘top-up’.

In other words, the rent doesn’t cover all the costs of the property. So, an investor needs to cover the shortfall from their own pocket.

But that was when interest rates were 7%+. So this figure has come down. What does it look like today?

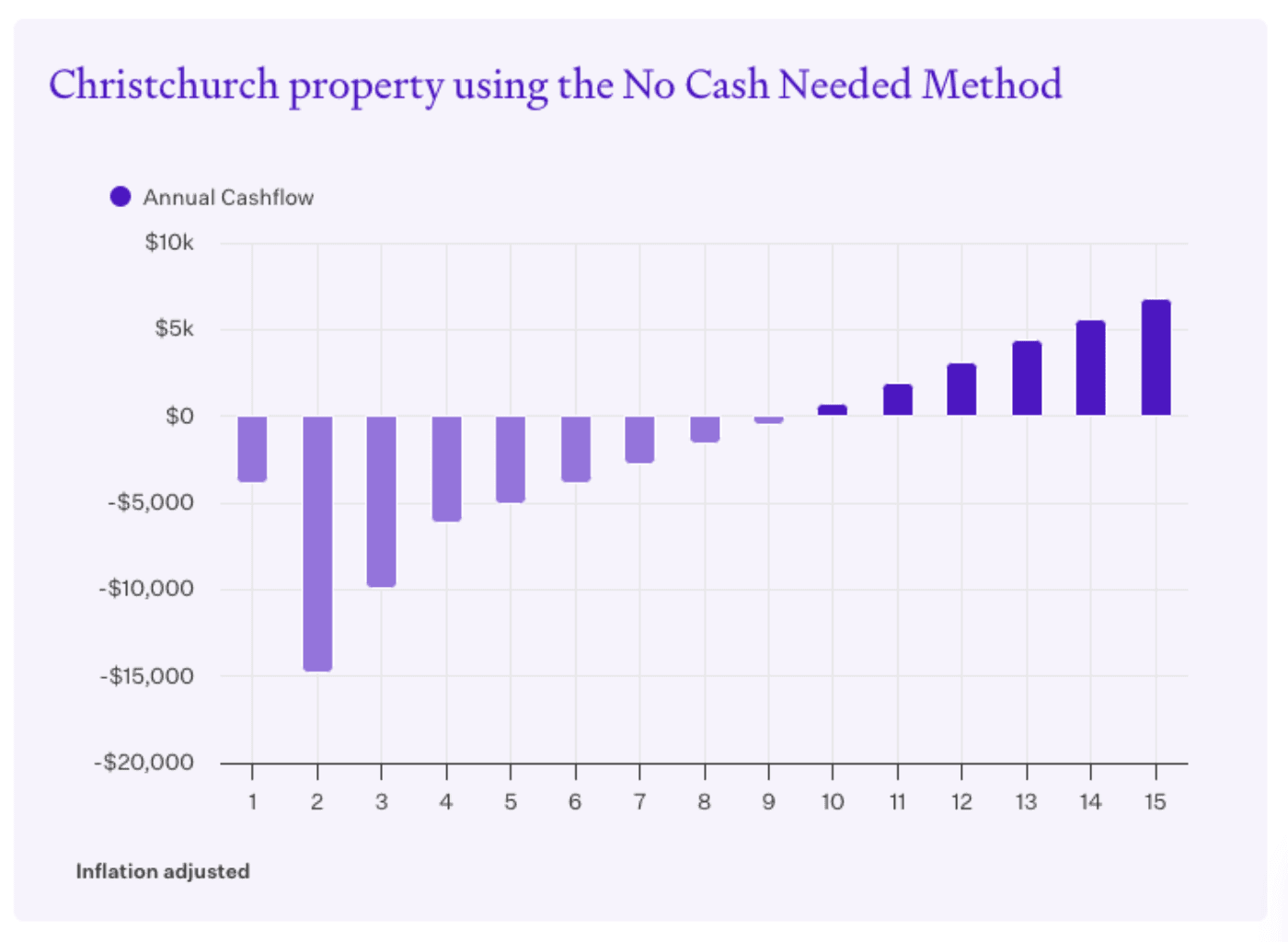

An entry-level property in Christchurch costs around $550k. And it might rent for $525 a week.

That’s a gross yield of just under 5%.

If you use the "No Cash Needed" method and borrow all the money – here’s what the cash flow looks like.

Once the property is built, the top-up will likely be around $280 a week.

Over time, rents go up, and interest rates will likely come down. That will start to improve.

Of course, you could also put in a cash deposit. That way, you have a smaller mortgage, so you’ll pay less interest to the bank.

The less interest you pay the bank, the better the cash flow.

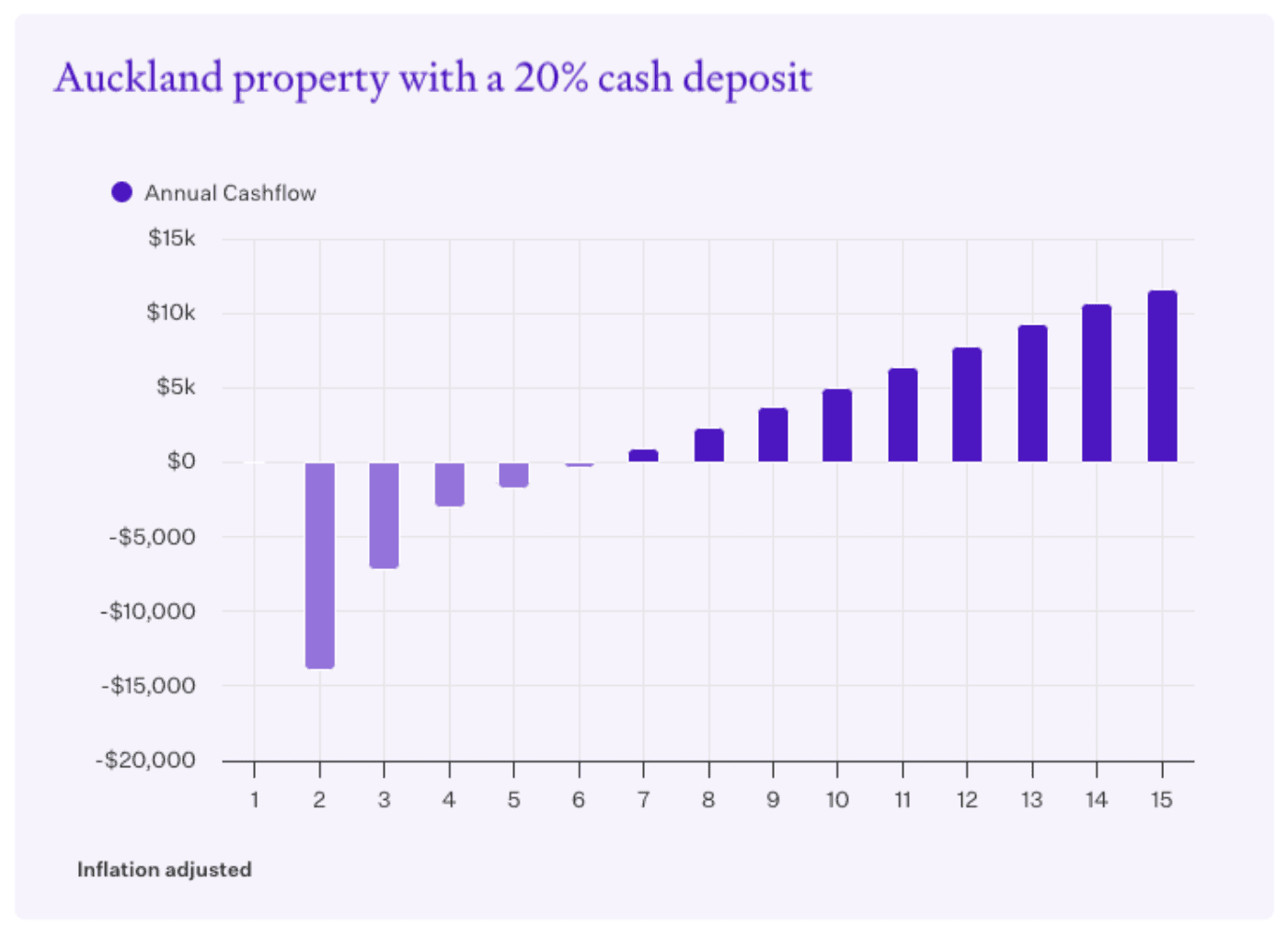

In Auckland, an entry-level property might cost $750k. And it might bring in $635 a week in rent.

That’s a slightly lower 4.4% gross yield.

Using the "No Cash Needed" method, you’d be topping up about $440 weekly.

But with a 20% ($150k) cash deposit, that drops to roughly $250 a week.

You might have noticed that I’m no longer using an Excel spreadsheet to run these numbers.

I’ve just binned my old Return on Investment spreadsheet (the one I used to send out).

And I’ve just launched Opes+. It’s a free app that you can use to run your cashflows. And it’s way more user-friendly than Excel. You can sign up for it here.

Last year, your top-up might have been $300 to $600 a week.

This year, it’s more looking like $250 to $450 a week.

That’s an improvement of $50 - $150 a week. That difference comes from those lower interest rates.

At a recent webinar, one investor asked: “Is there a way to buy a property without a top-up?”

The answer is yes. But, no investment is free. You’ll always have to put something in.

Your investment in property often comes in three ways:

To buy any investment property … you need to invest something. Will it be cash up front, cash each week, or your own time and effort?

I also had an investor see me this week. He asked me to look over his numbers for an investment property.

He’d missed out about $200 of costs each week. Because he’d only looked at the rent he’d get and the interest he’d pay to the bank.

He didn’t include rates, insurance, maintenance, vacancy, or the 4 other costs investors should think about.

That’s part of the reason I built Opes+. Because it prompts you to think about all the costs you might have to pay.

It’s free to sign up here. Or just go to opespartners.co.nz and click the login button. You can use it for free (forever).

It’s still in its early stages, so I’d love your feedback.

Managing Director, 20+ Years' Experience Investing In Property, Author & Host

Andrew Nicol, Managing Director at Opes Partners, is a seasoned financial adviser and property investment expert with 20+ years of experience. With 40 investment properties, he hosts the Property Academy Podcast, co-authored 'Wealth Plan' with Ed Mcknight, and has helped 1,894 Kiwis achieve financial security through property investment.

This article is for your general information. It’s not financial advice. See here for details about our Financial Advice Provider Disclosure. So Opes isn’t telling you what to do with your own money.

We’ve made every effort to make sure the information is accurate. But we occasionally get the odd fact wrong. Make sure you do your own research or talk to a financial adviser before making any investment decisions.

You might like to use us or another financial adviser