Property Investment

Build a $100k passive income plan in 20 minutes

You might be investing… but are you on track for $100k a year? Here’s how to check 👇

Property Investment

3 min read

Author: Andrew Nicol

Managing Director, 20+ Years' Experience Investing In Property, Author & Host

Yesterday, the Official Cash Rate (OCR) got cut again to 2.25%.

You’d think your mortgage is about to get cheaper.

But this cut could mean that interest rates go up … not down. Here’s why 👇

The Reserve Bank trimmed the OCR throughout 2025. And mortgage interest rates went down.

But that’s not how it’s playing out this time.

Why? Because mortgage rates aren’t directly set by the OCR.

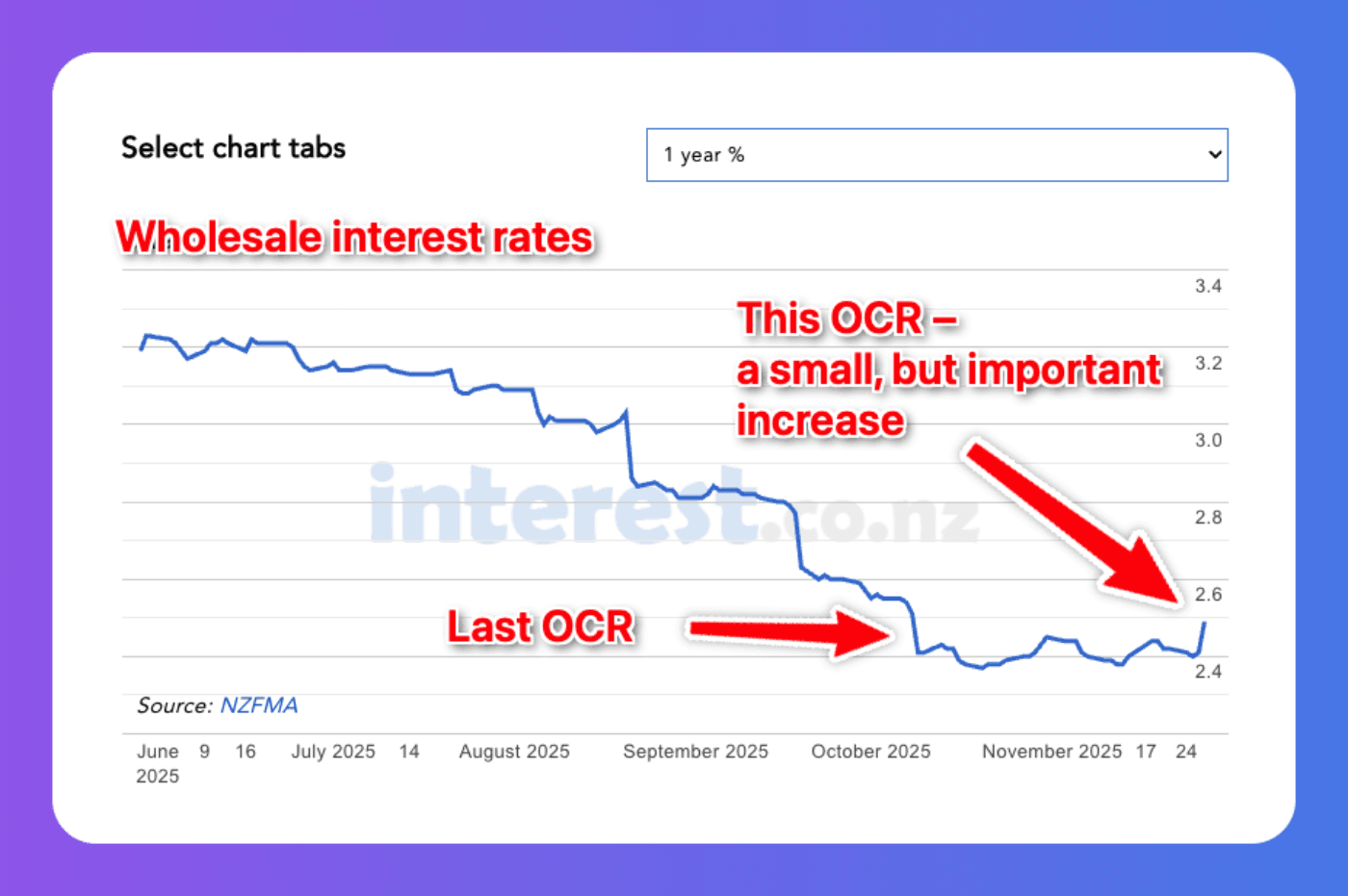

They’re really driven by wholesale interest rates. That’s what it costs the banks to borrow money and lend to you and me for our mortgages.

Even though the OCR went down yesterday, the swap rates went up (very slightly).

So today it costs the banks slightly more to lend money than the before the OCR was cut.

But how the hell does that happen?

Sure, the Reserve Bank cut the OCR. But it wasn’t what they said. It’s how they said it.

The Reserve Bank’s tone was “hawkish”. That’s economist-speak for “we’re still worried about inflation, don’t expect too many more OCR cuts.”

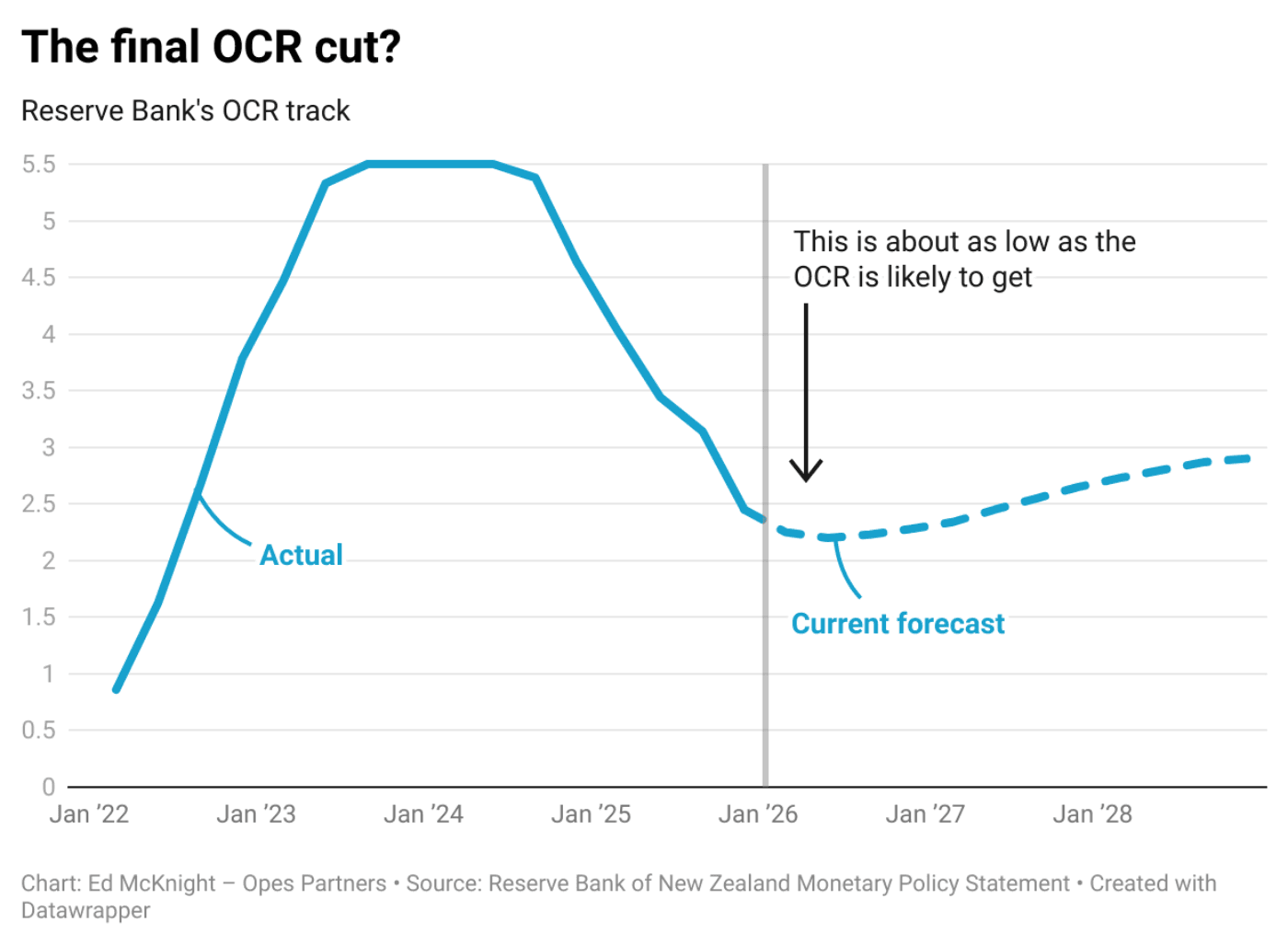

The Reserve Bank’s OCR projection (the OCR track) implies that there’s an 80% chance this was the last cut in the cycle.

What happens if this was the last cut in this cycle? The OCR will be slightly higher over the next year compared to what some people expected.

That’s why the wholesale rate went up.

And there’s an important lesson here for Kiwis. The interest rate you pay on your mortgage isn’t really based on what the OCR is.

It’s based on what markets think the OCR will be over the next year or so.

If people think there’s a risk that the OCR could go up, they start pricing that in today.

So don’t expect banks to start cutting their interest rates over the next week.

Even though parts of the economy look rough:

… we are starting to see the beginnings of an economic recovery. That’s in part because this low OCR is helping to get the economy going.

Once the recovery is on, the economy won’t need as much support. So, the OCR will go up again.

On top of that, the Reserve Bank’s previous OCR cuts are still flowing through.

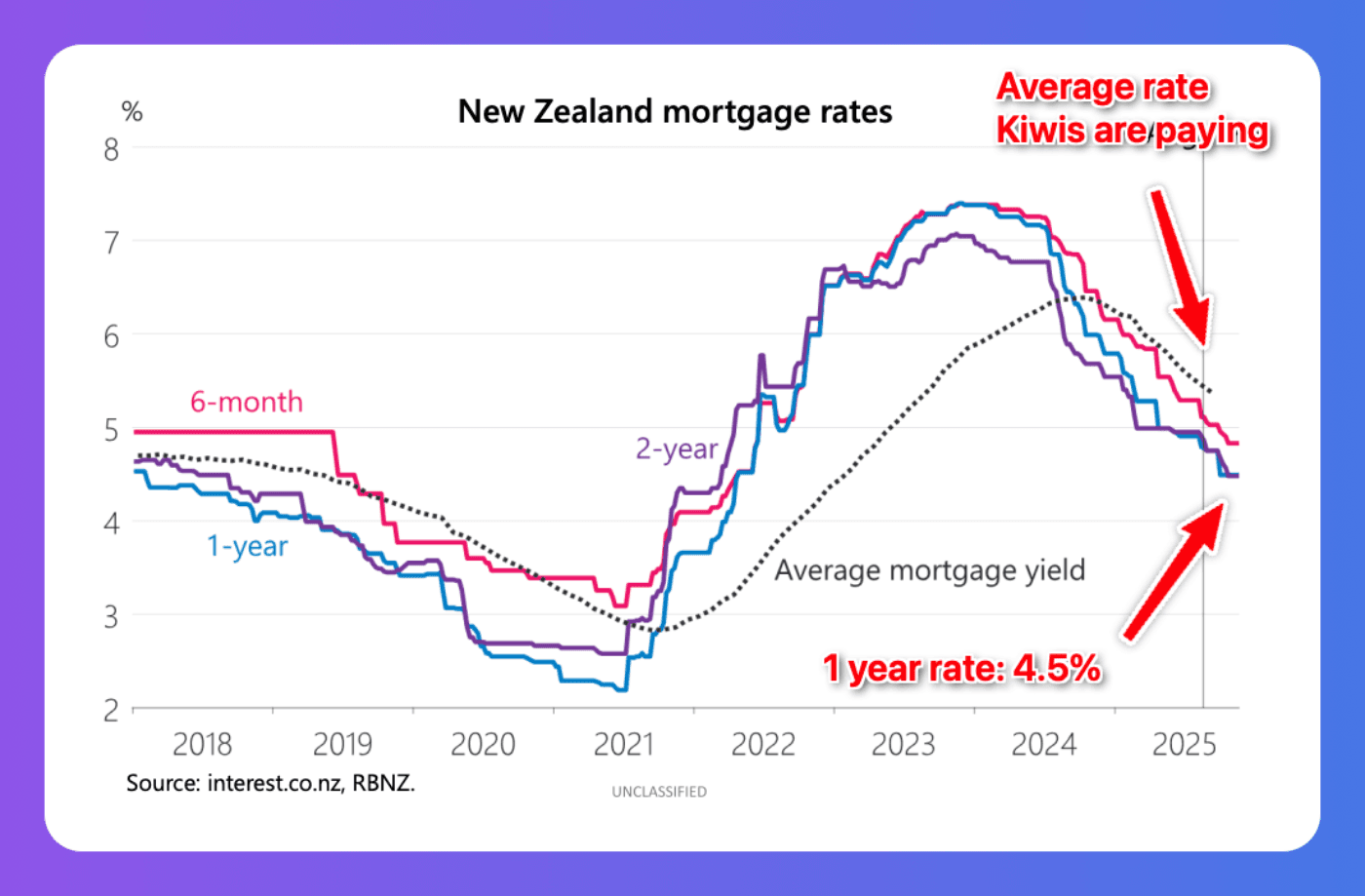

The average bank is advertising 4.5% for its 1-year rate. But the average interest rate Kiwis are paying is 5.4%.

A lot of us are still paying higher interest rates. So we’re hanging out for our interest rates to expire so we can lock in at a cheaper rate.

About 40% of mortgages will refix in the next 6 months. So, the average rate we’re all paying will fall to around 4.7%.

That means households will have more money to spend. That gives businesses an economic boost, even if mortgage rates don’t fall further.

The Reserve Bank wants to see how that plays out before making another move. They don’t want to overshoot, cut too much and ignite more inflation.

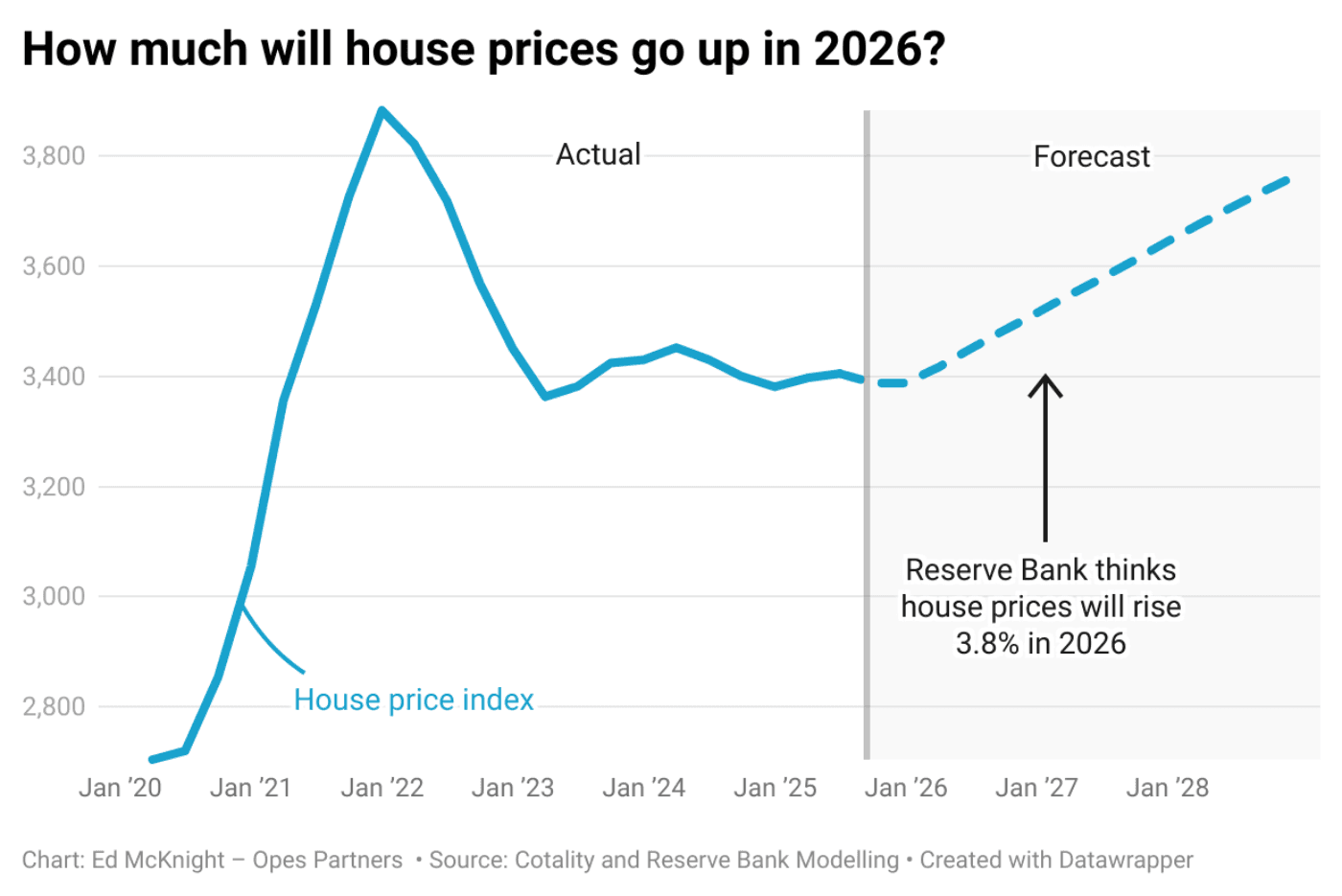

The Reserve Bank expects house prices to rise 3.8% throughout 2026.

That’s basically the same as incomes. Governor Christian Hawkesby called that level of growth “Sustainable.”

After the COVID boom (and bust), a mild 3 - 4% is very welcome news.

Some banks will trim their interest rates anyway.

But these are mostly on the floating rates. You might see some small trims on the fixed rates.

But the big, juicy cuts? Those are almost certainly done. This is likely the bottom. Get them while you can.

Managing Director, 20+ Years' Experience Investing In Property, Author & Host

Andrew Nicol, Managing Director at Opes Partners, is a seasoned financial adviser and property investment expert with 20+ years of experience. With 40 investment properties, he hosts the Property Academy Podcast, co-authored 'Wealth Plan' with Ed Mcknight, and has helped 1,894 Kiwis achieve financial security through property investment.

This article is for your general information. It’s not financial advice. See here for details about our Financial Advice Provider Disclosure. So Opes isn’t telling you what to do with your own money.

We’ve made every effort to make sure the information is accurate. But we occasionally get the odd fact wrong. Make sure you do your own research or talk to a financial adviser before making any investment decisions.

You might like to use us or another financial adviser