Property Investment

Build a $100k passive income plan in 20 minutes

You might be investing… but are you on track for $100k a year? Here’s how to check 👇

Property Investment

3 min read

Author: Andrew Nicol

Managing Director, 20+ Years' Experience Investing In Property, Author & Host

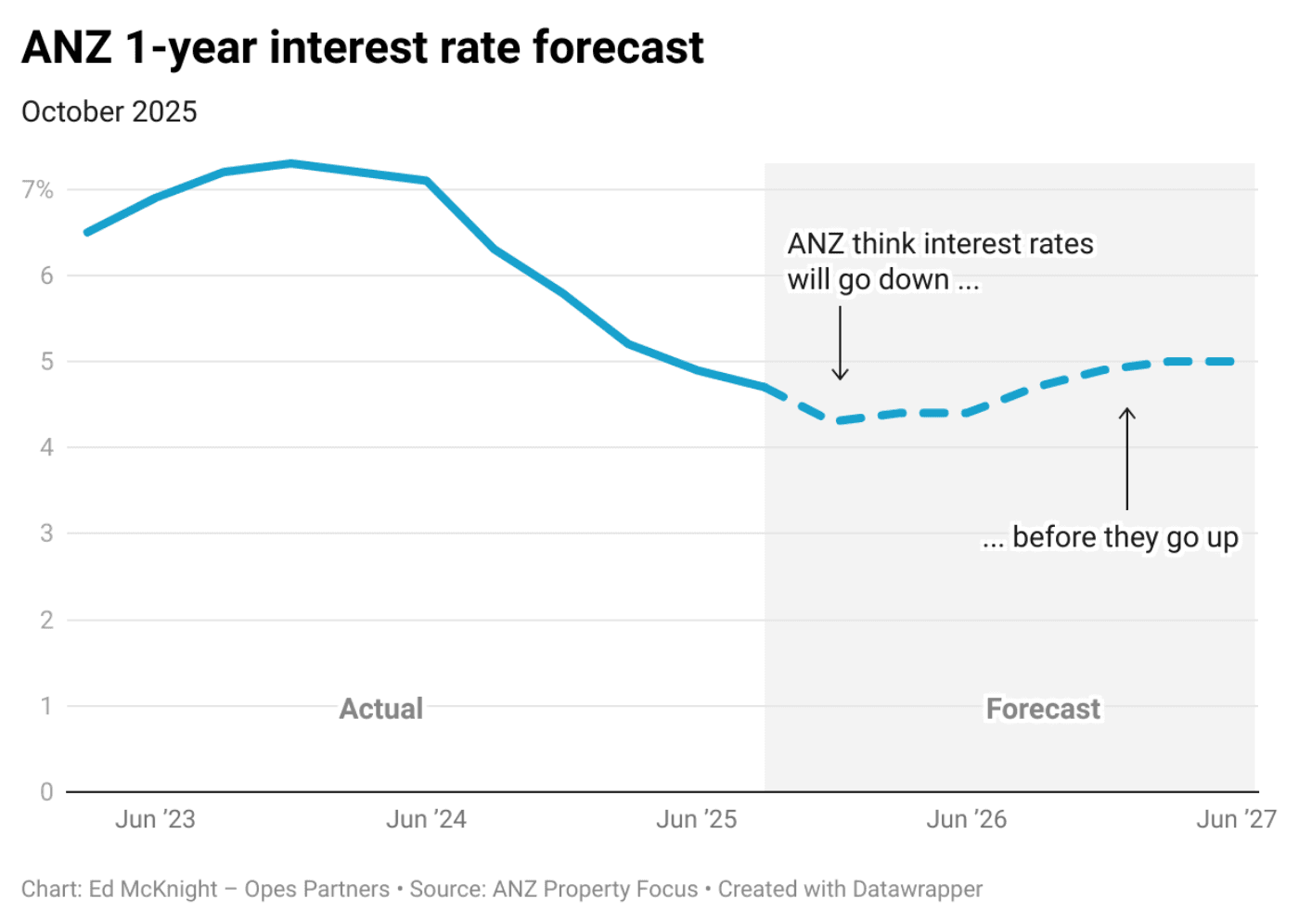

Interest rates plummeted over the last 2 years.

24 months ago, ANZ’s 1-year rate was 7.39%. Today it is 4.49%.

Almost 3% lower!

But will interest rates keep falling? Or could they start going up?

Here are my interest rate predictions for the next 2 years.

Here’s where I see the 1-year mortgage interest rate going:

Over the next few months, I think interest rates will fall. I’m picking that the 1-year rate could go down to 4.25 – 4.3% over the next few months.

After all, the Reserve Bank will likely cut another 0.25% off the OCR in just 2 weeks' time.

But (and this might surprise you), I expect they’ll likely start creeping up in mid-2026.

That broadly aligns with ANZ’s latest interest rate forecast. They too see rates falling before slowly rising.

The next OCR cut will likely come on the 26th of November. That will probably be the last cut in this interest rate cycle.

Remember, the Reserve Bank cut interest rates to kick-start our sluggish economy.

But, as the Kiwi economy starts to recover, they’ll want to increase the OCR again gradually.

If they keep interest rates too low, the economy could overheat and produce too much inflation.

And although most economists don’t expect the OCR to go up until early 2027, the banks will start to factor those hikes about 8-11 months earlier.

That’s why the 1-year rate may start going up as early as April 2026.

Because mortgage interest rates aren’t based on where the OCR is today, but the average of what it could be in the future.

So if banks and wholesale markets think the OCR will go up in the next year … they start factoring that in.

That’s not to scare you off investing or taking out a mortgage. It’s to say that today’s interest rates are low. And they may not stay this low forever.

Forecasts are designed to be wrong. They’re snapshots of what we know today, and as the data changes, so do we.

Let’s rewind back to February this year. At that time, the Reserve Bank expected the Official Cash Rate (OCR) to bottom out around 3 – 3.25%.

Today, it’s sitting at 2.5% and will likely fall again. So, in this case, interest rates fell more than most people expected.

Funnily enough, I just interviewed Sharon Zollner, ANZ’s Chief Economist. She’ll appear on the Property Academy Podcast over the next few weeks.

I asked her if she ever looks back at her old forecasts. She said:

“Never look back, darling – you’ll be too scared to ever make another prediction again.”

So I don’t expect these predictions to be exactly right. Because there’s a lot that could change. Perhaps I’m wrong and interest rates will stay lower.

Any surprise economic event can throw any forecast off.

If the economy recovers faster than expected, interest rates will rise sooner.

If the economy stays sluggish or unemployment remains high, interest rates could go lower still.

And then there are the wildcards. Who knows which countries could invade each other next, or what Trump will announce next Thursday?

I can’t see (or predict) any of that. So those surprises aren’t factored into my forecast.

Right now, we’re probably near the bottom of the interest rate cycle.

So, if you’re fixing soon, shorter terms might win in the short run. But don’t forget about the longer terms.

If you believe an interest rate rebound is coming, those longer-term fixes might start looking a little more attractive.

Make sure you talk with your mortgage adviser to choose the right rate for you.

And if you haven’t talked to an adviser for a while, you might like to try my team at Opes Mortgages.

Sure, no one can predict the future.

But that doesn’t stop us from trying.

Managing Director, 20+ Years' Experience Investing In Property, Author & Host

Andrew Nicol, Managing Director at Opes Partners, is a seasoned financial adviser and property investment expert with 20+ years of experience. With 40 investment properties, he hosts the Property Academy Podcast, co-authored 'Wealth Plan' with Ed Mcknight, and has helped 1,894 Kiwis achieve financial security through property investment.

This article is for your general information. It’s not financial advice. See here for details about our Financial Advice Provider Disclosure. So Opes isn’t telling you what to do with your own money.

We’ve made every effort to make sure the information is accurate. But we occasionally get the odd fact wrong. Make sure you do your own research or talk to a financial adviser before making any investment decisions.

You might like to use us or another financial adviser