Property Investment

Property Investment

4 min read

Author: Andrew Nicol

Managing Director, 20+ Years' Experience Investing In Property, Author & Host

Labour wants to introduce a capital gains tax.

How would this policy affect property investors?

I’ve met with 10 investors since the announcement (on Tuesday). Every single person has asked me about it. So here’s what you need to know

Just keep in mind...

I’m a property investor. Not a politician.

So I’m not here to tell you who to vote for. But politicians’ policies impact you as a property investor. So, we have to talk about it.

My promise to you is that I’ll stick to the policies (the facts), rather than tell you which box to tick on election day.

Labour’s proposing a flat 28% tax on profits made from selling property, starting from the 1st July 2027.

Now, this isn’t a full-blown capital gains tax on everything you own. It’s just on investment property.

Here’s how it would look in practice:

Let’s say you bought a property 10 years ago and have made $400k in capital gains so far.

Those gains aren’t taxed.

But if in July 2027 your property is worth $700k. You hold onto it for 10 more years, and you sell it for $1 million.

That extra $300k gain (that you made after July 2027), that’s what the IRD would take a slice of.

Labour says the money would be ring-fenced for healthcare. That way every Kiwi would get three free GP visits per year.

Your own home wouldn’t be taxed. And if you inherit a property from Nana, the gains she made wouldn’t be taxed either.

But all investment properties, holiday homes and baches would be fair game.

House prices will almost certainly keep going up.

In fact, Labour’s projections need house prices to go up. Otherwise, there’s no extra money to pay for the free GP visits.

And if you look overseas, house prices have still gone up even with capital gains taxes (CGT) in place.

My data only goes back to the 1970s. But since that point, their house prices are up 5.4% per year.*

*Average annual compounding growth rates. Source: OECD.

One of the biggest risks I see is that investors will let this talk of a potential capital gains tax spook them.

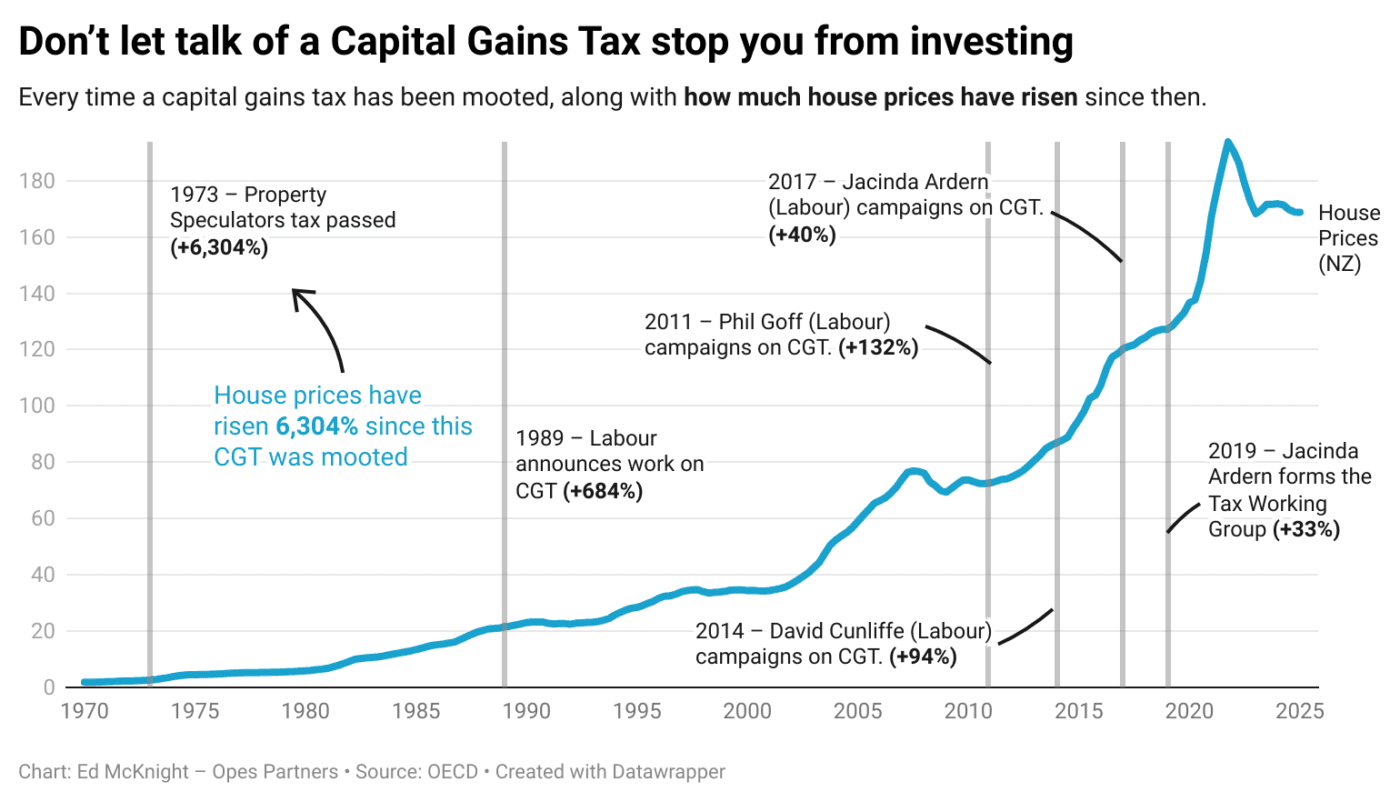

This is the 7th time a major political party has suggested a capital gains tax.

The government brought in a property speculation tax in 1973. That was Labour under Norman Kirk.

They taxed up to 90% of your capital gains. (This was actually the law!)

But then National won the next election and got rid of that policy.

Since that law was first introduced in 1973, house prices have gone up 8.3% per year.*

Then, in the late 1980s, the Labour Government was working on a Capital Gains Tax under David Lange.

They dumped the policy before the 1990 election, but still went on to lose.

Since 1989. House prices are up 6% a year.

Then in 2011, Labour was led by Phil Goff. He proposed a flat rate 15% Capital Gains Tax.

He lost that election.

Since January 2011, house prices are up 137%

Attempt #4 came in 2014. That was Labour under former leader David Cunliffe. He lost that election.

If you got spooked by that talk of a Capital Gains Tax, you would have lost out then, too.

Since January 2014, house prices are up 99 per cent.

Attempt #5 came in 2017.

Labour campaigned for a capital gains tax under Andrew Little. And then Jacinda Ardern.

She won that election. But the policy didn’t go ahead. She needed the support of NZ First. They put a stop to that policy.

Since January 2017 (when they started talking about a CGT), house prices are up 40.4%

Attempt #6 came in 2019. The Labour government started the Tax Working Group, which wanted a broad Capital Gains Tax.

They couldn’t get support. So, Jacinda Ardern ruled out ever bringing in a CGT while she led the party.

And we all know what happened to house prices after 2019.

Property values are up 32% since January 2019.

So, if you let talk of a CGT spook you off property … you could have lost out then, too.

And that brings us to today. This is the latest in a series of proposals from different political parties to tax capital gains.

That’s not to say that a Capital Gains tax won’t come in. Because maybe this time is different.

But if you did let a potential capital gains tax spook you off investing in the past ... you could have lost out on hundreds of thousands of dollars.

You’ve got to base your decision on what the tax settings are today. Not necessarily what they could be in the future.

Before the last election, National were saying that they were going to bring back interest deductibility.

But as an investor, you couldn’t bank on the rules changing … until they won the election (and changed the rules).

Because you don’t know what will happen in the next election (or after it, in the coalition negotiations).

The reality is that a major political party is proposing a capital gains tax – a policy that we’ve been debating as a country since 1973.

Do I want to pay capital gains tax? No.

But if I have to, it’s just another cost of doing business.

You don’t say “I’m not going to get a job” because you have to pay income tax.

And you don’t stop investing because the IRD wants a slice of your gains.

At the end of the day, property still builds wealth. One political party just wants a small piece of the pie.

Managing Director, 20+ Years' Experience Investing In Property, Author & Host

Andrew Nicol, Managing Director at Opes Partners, is a seasoned financial adviser and property investment expert with 20+ years of experience. With 40 investment properties, he hosts the Property Academy Podcast, co-authored 'Wealth Plan' with Ed Mcknight, and has helped 1,894 Kiwis achieve financial security through property investment.

This article is for your general information. It’s not financial advice. See here for details about our Financial Advice Provider Disclosure. So Opes isn’t telling you what to do with your own money.

We’ve made every effort to make sure the information is accurate. But we occasionally get the odd fact wrong. Make sure you do your own research or talk to a financial adviser before making any investment decisions.

You might like to use us or another financial adviser