Property Investment

What’s a good investment property?

You might like a property… but is it actually a good investment? There’s now a tool to check👇

Property Investment

2 min read

Author: Andrew Nicol

Managing Director, 20+ Years' Experience Investing In Property, Author & Host

House prices went up 0.8% in September and 0.4% in August.

So, prices have risen for two straight months.

But how much could house prices go up next year?

And, are the last 2 months the start of a genuine recovery? Or is it the usual Spring bump we get every year?

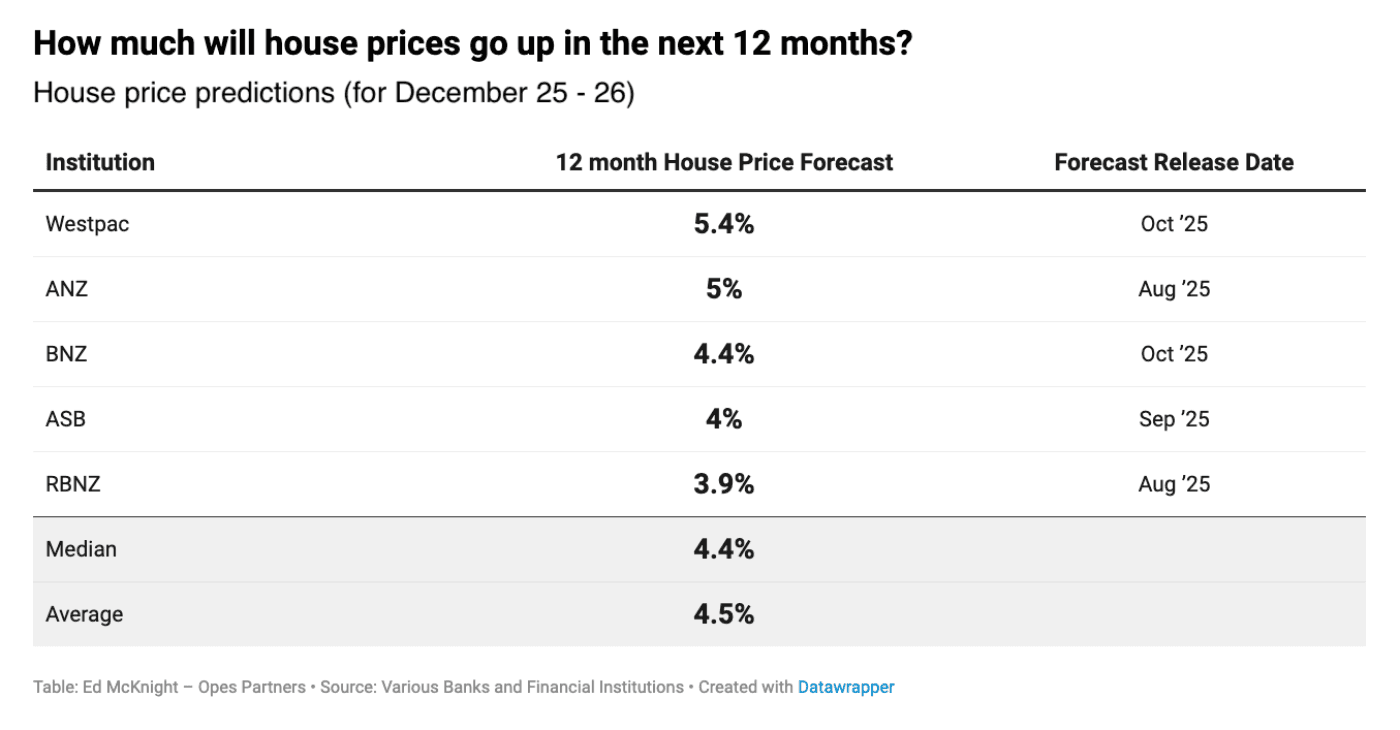

The average bank thinks that property values will go up 4.4 – 4.5% in 2026.

That’s largely because interest rates are falling and confidence appears to coming back.

Westpac are the most aggressive. They think house prices will rise 5.4% in 2026.

The Reserve Bank is the most conservative at 3.9%.

Now you can’t take these forecasts as gospel. Last year, each bank forecast similar numbers for 2025.

And house prices have basically been flat this year.

But I’d rather know what the economists think (rather than not).

So, what’s happening to house prices right now?

To figure out if house prices are really turning a corner, you need to look at seasonally adjusted house prices.

This takes out the usual ups and downs of the year and shows whether the market is actually improving.

House prices went up 0.8% in September. But take out the seasonal effect, and they only went up 0.2%.

Similarly, house prices went down 0.8% in June this year. But take out the seasonal effect, and they only fell 0.4%.

That’s why I rolled my eyes a few weeks ago, when someone said to me, “I thought I read in the paper that house prices were going down this year.”

(Rolling my eyes at the media, not the investor).

And that’s because house prices did go down 2.4% from February to July.

But take out the seasonal effect, and they only fell 0.7% over the same period. And the last 2 months have reversed that dip.

It’s like if the papers wrote a headline that said: “Kiwis are wearing fewer clothes.”

When you read that headline, you might think that perhaps we’ve all become more comfortable with our bodies.

Maybe you think Gen Z is particularly liberal and show more skin.

Or, is it that it’s almost summertime? The weather is warmer. So, we shed our Winter layers?

If you just cherry picked the last 3 months, you could reach the wrong conclusion.

Context matters.

And the truth of the matter is that house prices went sideways over the last year. They are up just 0.2% year on year. Barely moving at all.

While house prices aren’t skyrocketing, the number of property transactions is.

At the bottom of the market, Kiwis sold around 59,000 homes a year.

Now, that’s up to about 78,000. Just shy of the long-term average of around 81,000.

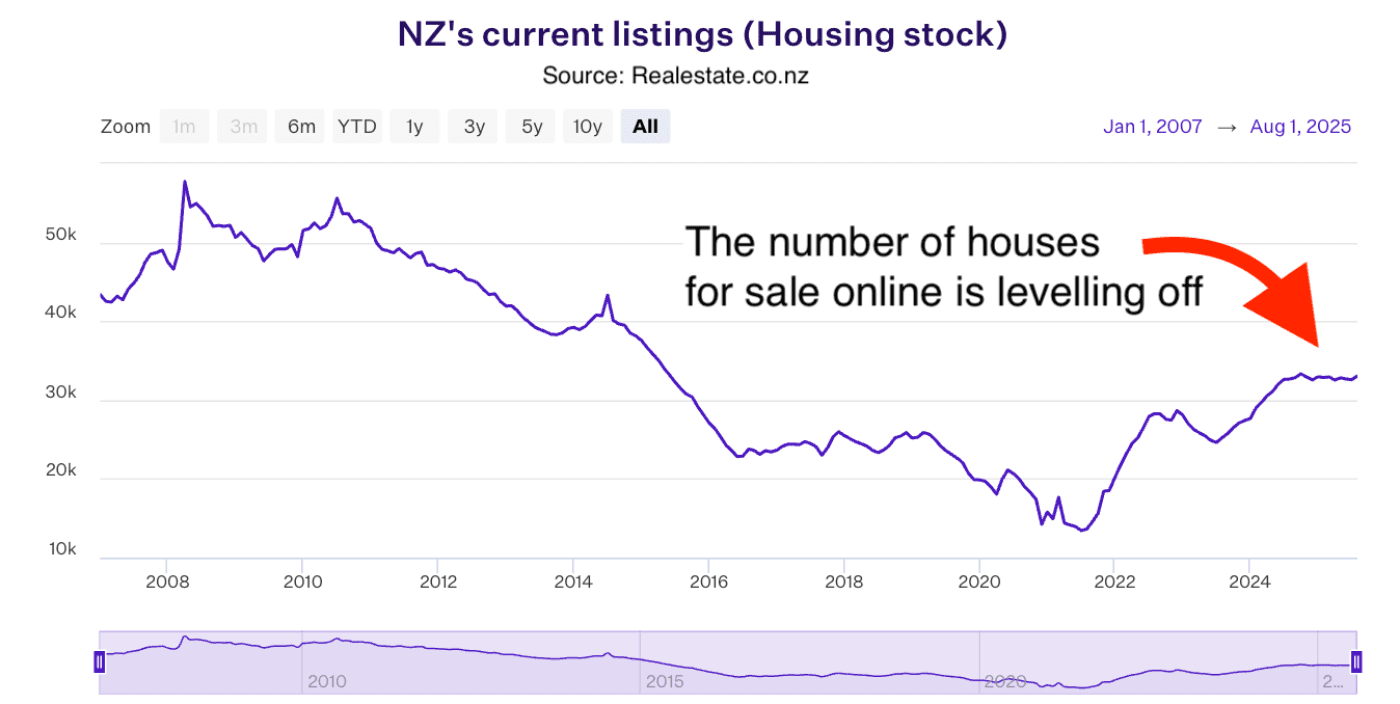

This is important, because over the last few years it’s the build-up of property listings that has kept house prices lower

We’ve got the highest number of properties for sale online that we’ve had in a decade.

But after a large build-up, those stock levels have stopped going up.

Sure, they’ve still settled at a high level. But you’re not seeing that same build-up you’ve seen before.

That tells me that the market is now stable. House prices have stopped falling.

The build-up of listings has stemmed.

So maybe (just maybe) those house price forecasts could be correct.

Managing Director, 20+ Years' Experience Investing In Property, Author & Host

Andrew Nicol, Managing Director at Opes Partners, is a seasoned financial adviser and property investment expert with 20+ years of experience. With 40 investment properties, he hosts the Property Academy Podcast, co-authored 'Wealth Plan' with Ed Mcknight, and has helped 1,894 Kiwis achieve financial security through property investment.

This article is for your general information. It’s not financial advice. See here for details about our Financial Advice Provider Disclosure. So Opes isn’t telling you what to do with your own money.

We’ve made every effort to make sure the information is accurate. But we occasionally get the odd fact wrong. Make sure you do your own research or talk to a financial adviser before making any investment decisions.

You might like to use us or another financial adviser