Property Investment

What’s a good gross yield?

Property investors always chase the best rental returns. But what’s good in one city can be disappointing in another. Here’s the data.👇

Property Investment

3 min read

Author: Andrew Nicol

Managing Director, 20+ Years' Experience Investing In Property, Author & Host

Reviewed by: Laine Moger

Journalist and Property Educator, holds a Bachelor of Communication (Honours) from Massey University.

Last week’s newsletter said the bottom of the property market has been and gone.

I got mixed responses:

I want to respond to the negative replies … because they help clarify the evidence.

Jamie-Lee emailed saying:

“What a load of dribble buddy” [sic] … “Clearly the last email [the prior week’s Private Property] was back and forth.”

“Maybe, maybe not this could happen but might not happen, no one really knows anything. But I’ll put this article out too try look smart.”

I get where Jamie-Lee is coming from.

Three weeks ago, I sent an email saying that different parts of NZ will bounce back at different times.

2 weeks later, I sent an email saying that the property market had bottomed out and prices were increasing.

It might look like these 2 newsletters are saying different things.

But both are correct.

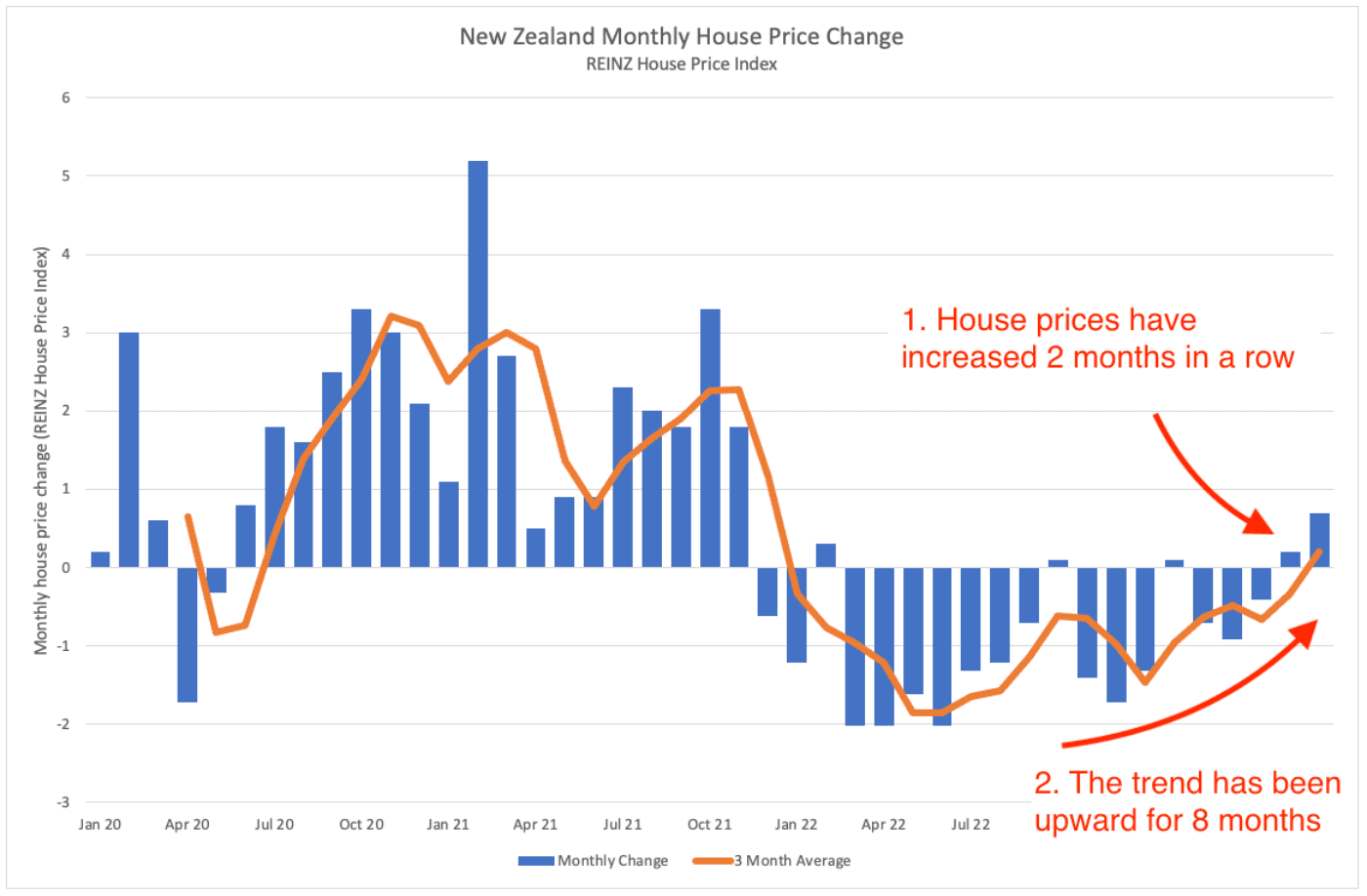

On average, New Zealand property prices have bottomed out. They are on the increase.

But that doesn’t mean that your specific area is on the up.

Here’s a good example. We’ve just updated our Average House Price page.

You can use this to see the average property price of every council area in New Zealand.

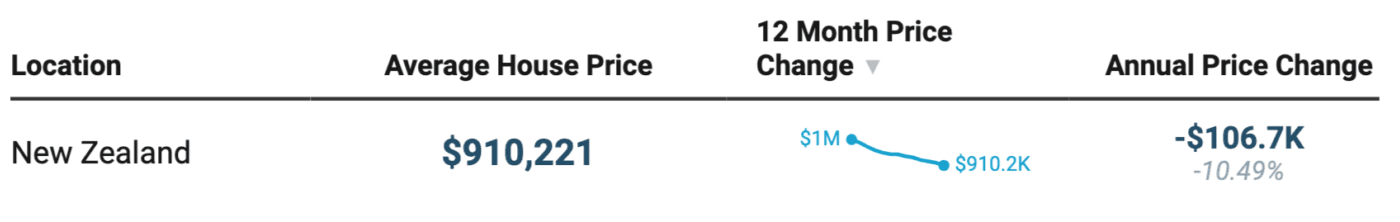

Even though house prices are down 10.5% across the country (year on year).

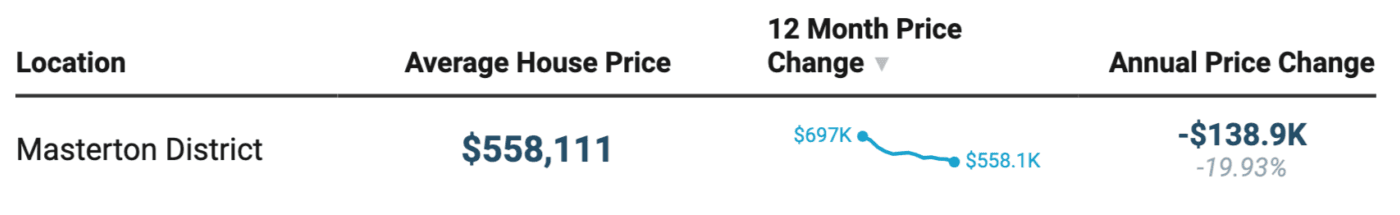

Masterton property prices are down almost 20% over the last 12 months.

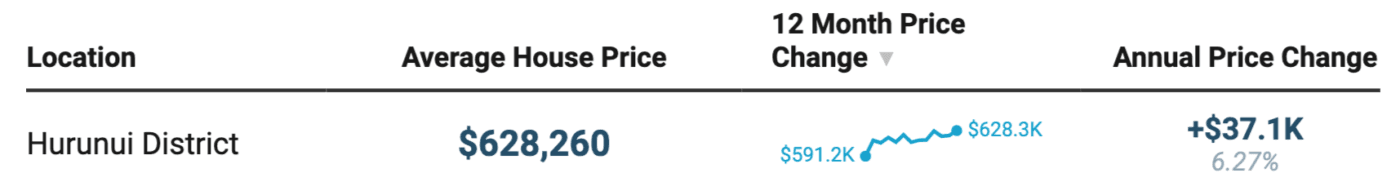

And Hurunui house prices (in the South Island) are up 6% year on year.

While NZ property prices might go in one direction (in this case, down) … parts of NZ can go in the other direction (in the case of Hurunui, they’ve gone up).

The same is true when it comes to the bottom of the market. NZ as a whole is on the up. But some parts are still falling.

Both statements can both be true.

Matt also sent me:

“ Morning. In precisely ZERO other industries would any group of co-opted organisations attempt to delude themselves like this.”

“A tiny blip up from the bottom indicates that “the downturn is over, we’ve hit the bottom, prices are on the increase!” etc etc” … “considering that property in NZ is the most over priced in the western world, and the least affordable it’s ever been – I doubt it.”

[I’ve condensed this down because it was long.]

Matt’s right. Property prices are up only 1.1% compared to where I think the bottom was.

It is a ‘blip’.

But here’s the thing. You can only see the bottom of the market once it’s over.

Back in 2008, property prices bottomed out in December 2008.

But if you were an investor trying to buy a property 2 months later, here is what you would have seen:

Property prices were up only 0.8%.

Too early to call the bottom of the property market.

But 12 months later, prices were up 5.5%.

Here’s what you would have seen at that point.

By the time the bottom of the market was clear ... it was also too late to take advantage.

So, how do you make the call to invest or not?

Property investors have to make decisions based on incomplete information.

The future is always uncertain. It hasn’t happened yet.

So today, we can’t point to a graph to say, “That was it. June 2023 was the bottom of the market.”

But we can still look at the facts to make a judgment call.

That’s according to Tony Alexander’s Real Estate agent survey, which came out 2 weeks ago.

Every month, my team here at Opes Partners helps 40 – 60 Kiwi couples buy investment properties.

We’re seeing these numbers increase. Developers I talk to also say they are starting to get busy.

The evidence is mounting that the downturn is over.

Can we definitely point to a graph and say the downturn is over? No.

But by the point we can, it’s too late.

Managing Director, 20+ Years' Experience Investing In Property, Author & Host

Andrew Nicol, Managing Director at Opes Partners, is a seasoned financial adviser and property investment expert with 20+ years of experience. With 40 investment properties, he hosts the Property Academy Podcast, co-authored 'Wealth Plan' with Ed Mcknight, and has helped 1,894 Kiwis achieve financial security through property investment.

This article is for your general information. It’s not financial advice. See here for details about our Financial Advice Provider Disclosure. So Opes isn’t telling you what to do with your own money.

We’ve made every effort to make sure the information is accurate. But we occasionally get the odd fact wrong. Make sure you do your own research or talk to a financial adviser before making any investment decisions.

You might like to use us or another financial adviser