Property Investment

What is a Wealth Plan?

Discover how Opes' Wealth Plan helps you reach financial freedom and turn your goals into reality.

Opes

4 min read

Author: Andrew Nicol

Managing Director, 20+ Years' Experience Investing In Property, Author & Host

Reviewed by: Ed McKnight

Resident Economist, with a GradDipEcon and over five years at Opes Partners, is a trusted contributor to NZ Property Investor, Informed Investor, Stuff, Business Desk, and OneRoof.

Here at Opes, we find New Build properties for investors to buy.

As part of this, we pre-negotiate the price and have 'no-haggle' pricing. That means we’ve pre-negotiated the price so that it’s easy to invest and make decisions.

But that leads to a great question: "Well, how do I know that the prices you've negotiated are actually a good deal? Especially since you get paid a commission if I buy a property through you!"

That's such an important question. Because investing in property is a large financial decision. It could be one of the largest you ever make.

So, I don't just want to tell you a property is well-priced. I want to prove it to you.

As part of this, I've changed the structure of my business and have started the "Opes Best Price Policy".

This is so there are clear rules our properties have to meet before you see them.

Earlier in 2024, we implemented the Opes Best Price policy. This is where we negotiate a price with a developer.

Then, they put in writing that they will not sell the property at a lower price to anyone else.

It means you don’t have to worry about: “Maybe if I go to the developer directly, I can get a cheaper price.”

It means that if you look at a property with our team, you know that you’ve got the best price in the market for this specific property.

It's the best price the seller is willing to accept at the time you invest.

Of course, over time, the property market can move. Prices go up or down. So, if we have a property available and property prices decline, the price can change.

But, our prices will always be the lowest in the market for the properties we recommend.

But that's not enough. We have also recently implemented 3 other 'lines of defense'.

This is to give you confidence that our properties are good deals.

Before we agree on a price with the developer, we require them to get a valuation. And importantly, they must use one of our preferred valuers. That means they're experts in off-the-plan valuations.

Remember, if you talk to a different valuer, they will give you a different value for a property. It's subjective. That's why we force developers to use our preferred valuers. This way they can't game the system.

(So be prepared. When you get a valuation through the bank, the valuer will give a slightly different number to the one we have).

The properties must then be priced at or below that valuation. It depends on what's happening in the market.

Recently, the property market has been a buyer's market. Buyers have had the upper hand. So, we've been able to negotiate prices below their valuation.

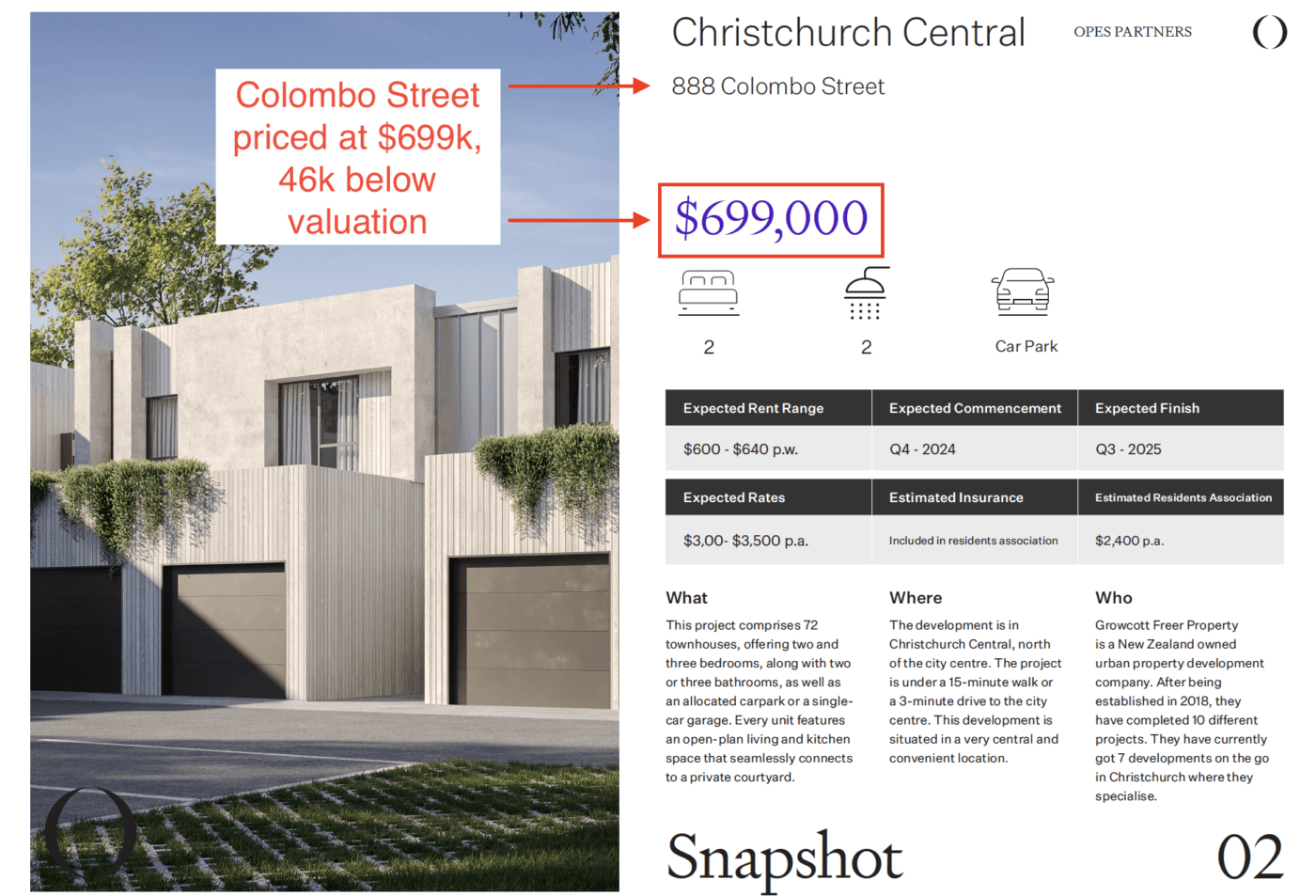

Here's an example. Recently, we helped an investor buy Unit 42 at 888 Colombo Street in Christchurch. This property was valued at $745,000.

But, one of our investors bought the unit for $699,000. That's a $46,000 discount compared to the valuation.

This won’t always be the case. But, we will never recommend a property at a price above its valuation.

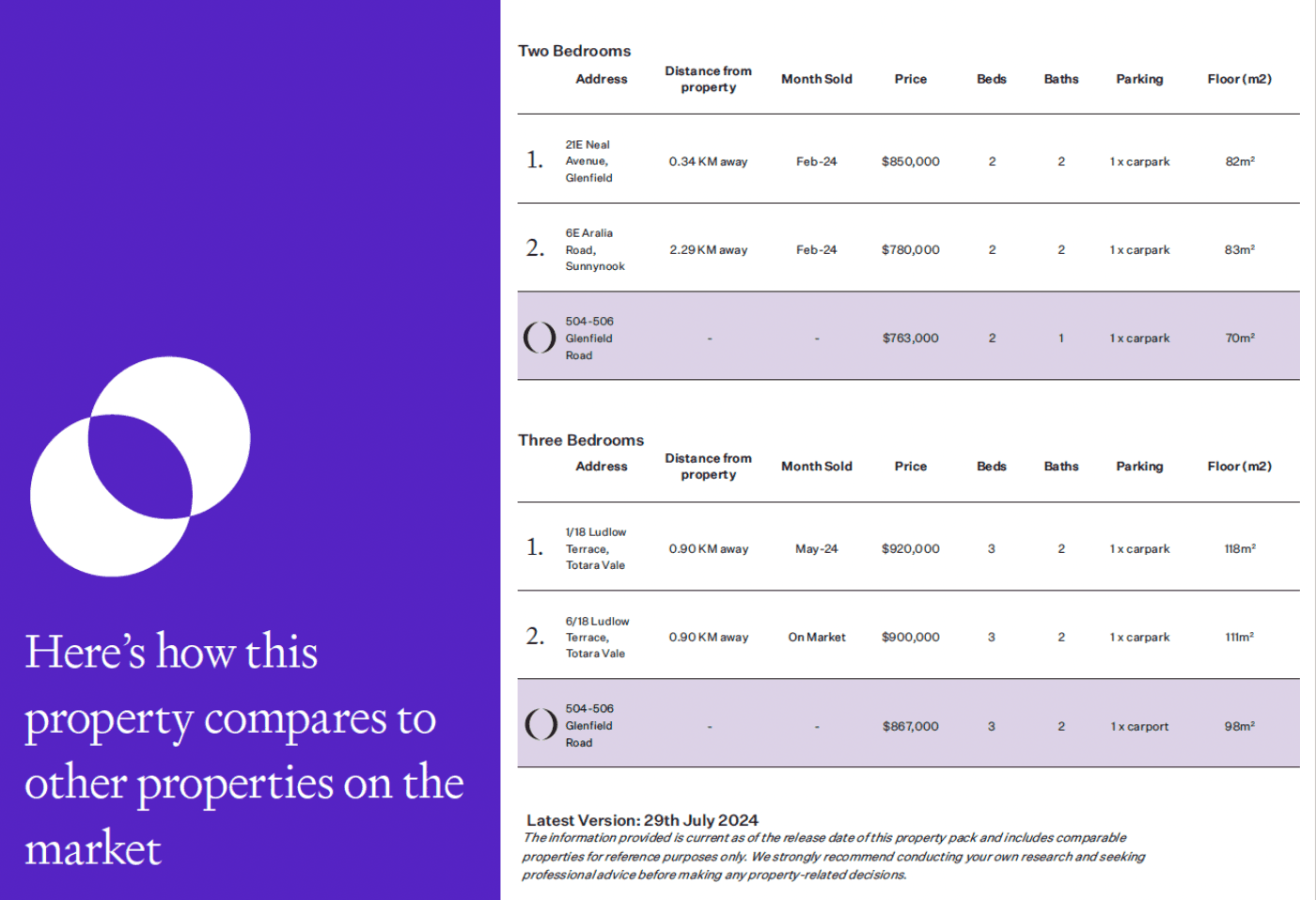

Every investor who buys a property through Opes gets a property information pack.

As part of our standard process, every property pack has a comparison table. This shows how our properties compare to similar ones on the market.

Our properties might not always be the cheapest. But, we aim to prove that they are the best value.

Here is a recent example from 504-506 Glenfield Road, Bayview.

Soon, our property packs will also have a Rent Ready checklist for all properties. This is coming in September 2024. It will show how every property meets our minimum standards.

So, when you come to see us at Opes Partners, you should ask (if we haven’t given it to you): “Can I see the property comparison?”

Here at Opes, one of the questions we often get is, “Aren’t you biassed?”

It's such a good question. On the one hand, we are giving you (the investor) financial advice. But then, we get paid by the developer.

So, how can we work for you and the developer at the same time?

To handle this, I've split my team into two separate companies – Opes Partners and Opes Property.

Opes Partners works for you, the investor. We have a team of financial advisers, and we are legally obligated to work in your best interests.

Then we have Opes Property. They are real estate agents who work for the developer.

So when you are talking to us, you know who represents the investor and who represents the developer.

The good news is that we (at Opes) own Opes Property. So I can put clear requirements on the team to make sure they find the right types of properties. Part of that is the Opes Best Price Policy.

Here at Opes, our goal is to help you make the best investment decision for you.

Sometimes, that means telling investors we aren’t the right fit. The truth is, a New Build property might not be the right fit for you.

A New Build investment strategy (The Build and Hold strategy) doesn’t suit every single investor in the country – and that’s OK.

The key point is that you understand how we price the properties. That way, you can make an informed investment decision.

Managing Director, 20+ Years' Experience Investing In Property, Author & Host

Andrew Nicol, Managing Director at Opes Partners, is a seasoned financial adviser and property investment expert with 20+ years of experience. With 40 investment properties, he hosts the Property Academy Podcast, co-authored 'Wealth Plan' with Ed Mcknight, and has helped 1,894 Kiwis achieve financial security through property investment.

This article is for your general information. It’s not financial advice. See here for details about our Financial Advice Provider Disclosure. So Opes isn’t telling you what to do with your own money.

We’ve made every effort to make sure the information is accurate. But we occasionally get the odd fact wrong. Make sure you do your own research or talk to a financial adviser before making any investment decisions.

You might like to use us or another financial adviser