Property Investment

What happens at the end of the Nest Egg strategy

How do property investors turn equity into income? This guide explains what happens at the end of the Nest Egg strategy, step by step.

Property Investment

6 min read

Author: Andrew Nicol

Managing Director, 20+ Years' Experience Investing In Property, Author & Host

Reviewed by: Laine Moger

Journalist and Property Educator, holds a Bachelor of Communication (Honours) from Massey University.

Here at Opes Partners we find New Build properties for investors. Those properties come in different shapes and sizes.

And we don’t list the properties we currently have on our website (like real estate agents do).

That’s because when you use Opes Partners you’ll work with a financial adviser.

They create a financial plan for you, then find properties that fit your plan.

This leads many investors to wonder:

So, in this article you’ll learn the types of properties we recommend.

Though, as you’re reading this, don’t focus on the individual properties or the pretty photos. Focus on the numbers behind them.

Successful property investment isn’t about the property; it’s more about the investment.

Opes Partners tends to recommend four types of properties:

But we only recommend each property type in areas that suit it.

A 2-bedroom townhouse won’t be popular with tenants in a place like Rolleston or Pokeno. Everyone lives in standalone houses in these areas.

On the other hand, a standalone house won’t be the right fit in Central Auckland. A house would be too expensive to be a good investment property.

Now let’s go into each property type in more detail. This includes:

Target purchase price: $519,000 up to $1 million

We recommend townhouses in Auckland and Christchurch. Depending on the deal, we may also recommend properties in Lower Hutt and Hamilton.

These townhouses typically have 2-4 bedrooms. That’s because properties with only 1 bedroom don’t tend to increase in value as fast.

Townhouses are growth properties. That means they are likely to increase in value faster. But the trade-off is they are likely to have a worse rental yield.

Here are the prices of properties we tend to recommend. The price is always balanced against the rental income a property investor can expect to get:

They tend to have a gross yield of 4%-5%.

At the moment, property prices are a bit cheaper. So the properties we currently recommend have gross yields at the higher end of this range.

As part of creating your investment plan, we forecast how fast house prices will increase.

We forecast that townhouses outside Auckland will increase by 5% per year. Inside Auckland, we expect townhouses to increase by 6% per year.

These forecast rates are conservative. They are lower than how fast house prices have increased in the past. This is to be cautious when running the numbers on your investment property.

But not everyone should buy a townhouse as an investment property. Like all investments, they come with pros and cons –

You may also want to see examples of townhouses we’ve recommended in the past. Here are a few examples:

If you want to read more about whether townhouses are a good investment, here is some of our best research:

Target purchase price: $695,000 – $850,000

We also recommend standalone properties. These tend to be in Canterbury. That’s because Canterbury house prices are more affordable, so buying a standalone house isn’t too expensive.

The best places to invest in standalone houses are Kaiapoi, Belfast, Rolleston and Halswell in today’s market.

These houses usually have 3-4 bedrooms. That means they have enough space for a family to live in.

Standalone homes are a growth property. That means they are likely to increase in value faster. But the trade-off is they are likely to have a worse rental yield.

We target a rental yield between 4%-5%. And forecast that standalone houses in Canterbury will increase by 5% per year.

Here are the prices of properties you typically expect to see when you work with Opes Partners. Again, the price is always balanced against the rental income a property investor can expect to get:

But not everyone should buy a standalone house as an investment property. Of course, they also come with pros and cons –

You may also want to see examples of standalone houses we’ve recommended in the past. There are two examples in the following article.

This also shows how much money the investors have made:

If you want to read more about whether standalone houses are a good investment, here is some of our best research:

Target purchase price: $899,000 up to $1.1 million

If you work with Opes, we might also recommend a dual-key apartment. This will usually either be in Auckland or Wellington. That's because that's where most apartments in New Zealand are.

Here are the prices of properties you can expect to see:

Dual-key apartments are a yield property. This means they earn a good rental income, but don’t go up in value as fast.

You can expect to see dual-key apartments with a rental yield between 5%-6%.

And we forecast that the property will go up by 4.5% per year (on average) if purchasing in Auckland. This drops to 3.5% outside Auckland.

But not everyone should buy a dual-key apartment as an investment property. Here are the pros and cons –

You may also want to see examples of dual-key apartments we’ve recommended in the past. There is one example in the following article.

This also shows how much money the investor made:

If you want to read more about whether dual-key apartments are a good investment, here is some of our best research:

Sometimes we also recommend properties outside the three main staples. These could be room-by-room rentals or dual-key townhouses.

Usually, these properties are in Lower Hutt, Christchurch or Hamilton. That’s where we’ve seen them in the past. But these are a very specific type of property so they aren’t always available.

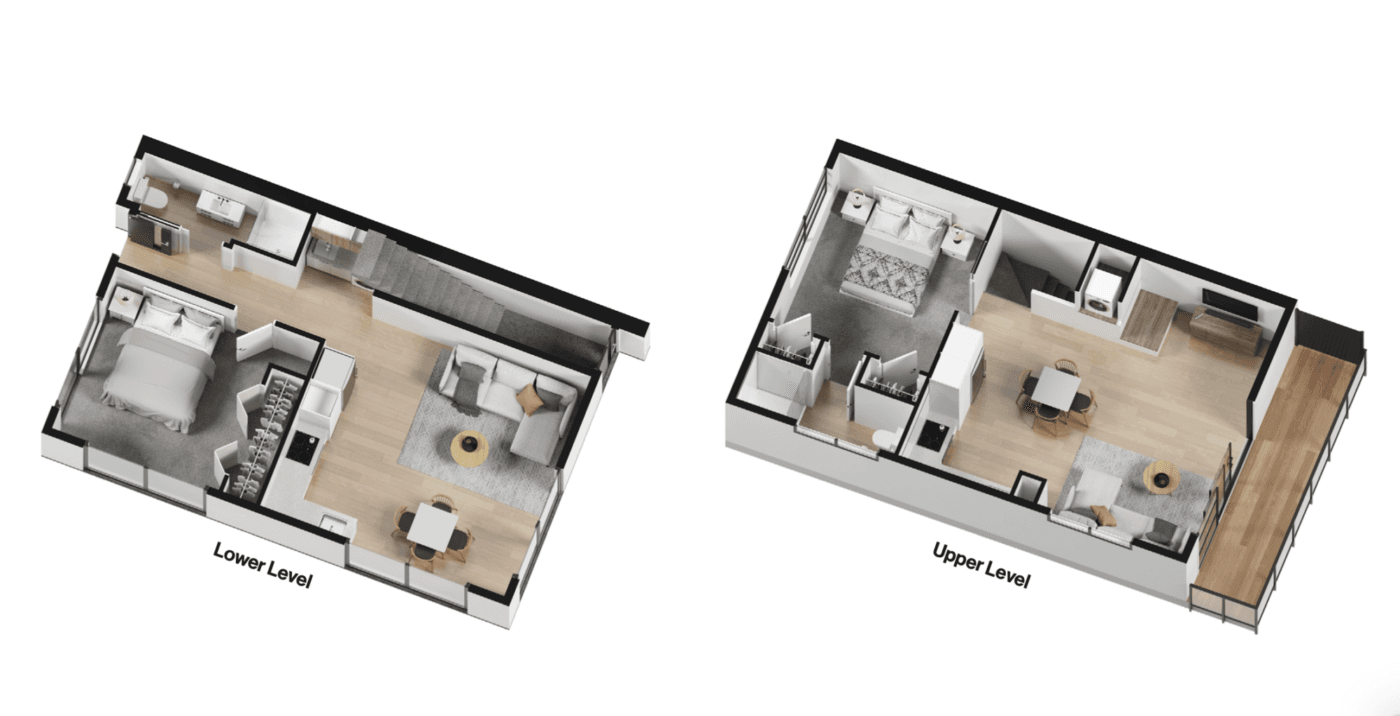

Here is an example of a dual-key townhouse. This property has one 1-bedroom apartment on the top floor and another on the bottom.

These properties are similar to a townhouse but with a yield element. This makes them attractive to investors.

We target a rental yield between 5% and 5.5% for these types of properties. The forecast capital growth rate is 4.25% outside Auckland, but 5.25% within Auckland.

Property investors can either buy a New Build or existing property. And while we here at Opes focus on New Builds, that doesn’t mean buying a new one is right for you.

Here are the main differences between New Builds and existing properties:

Because we focus on New Builds, we tend to be a better fit for passive investors. These investors want to grow their wealth, but aren’t interested in renovating.

But that does mean we’re not the right fit for active investors. These types of investors want to actively renovate properties.

Your next step is to book a portfolio planning session. This is where a financial adviser will create you a financial plan.

Book your free sessionManaging Director, 20+ Years' Experience Investing In Property, Author & Host

Andrew Nicol, Managing Director at Opes Partners, is a seasoned financial adviser and property investment expert with 20+ years of experience. With 40 investment properties, he hosts the Property Academy Podcast, co-authored 'Wealth Plan' with Ed Mcknight, and has helped 1,894 Kiwis achieve financial security through property investment.

This article is for your general information. It’s not financial advice. See here for details about our Financial Advice Provider Disclosure. So Opes isn’t telling you what to do with your own money.

We’ve made every effort to make sure the information is accurate. But we occasionally get the odd fact wrong. Make sure you do your own research or talk to a financial adviser before making any investment decisions.

You might like to use us or another financial adviser