In January a one in 200-year storm ravaged Auckland City.

Widespread flooding damaged homes, shut motorways, and caused significant landslides.

Two weeks later, Cyclone Gabrielle caused widespread devastation across the regions. It was described as the worst storm to hit New Zealand in a century,

With these extreme weather events fresh in our minds, many investors now worry about flood risk.

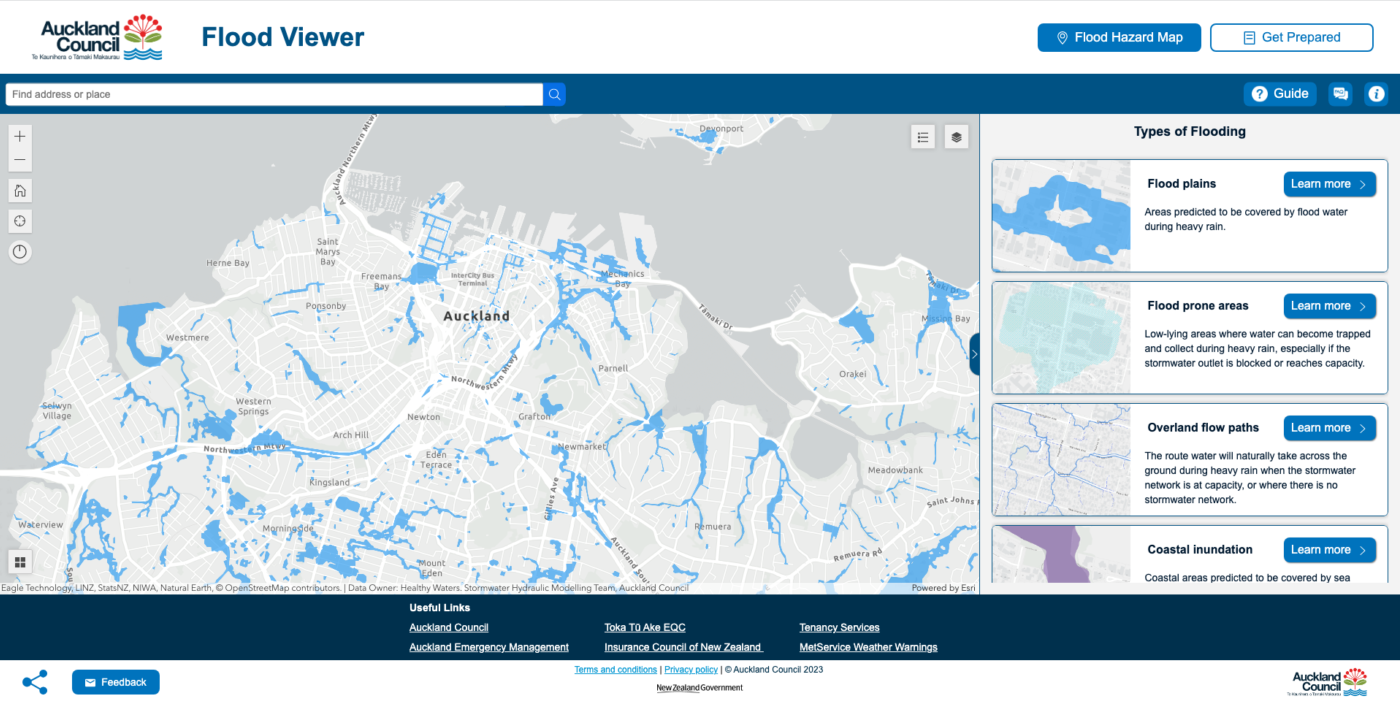

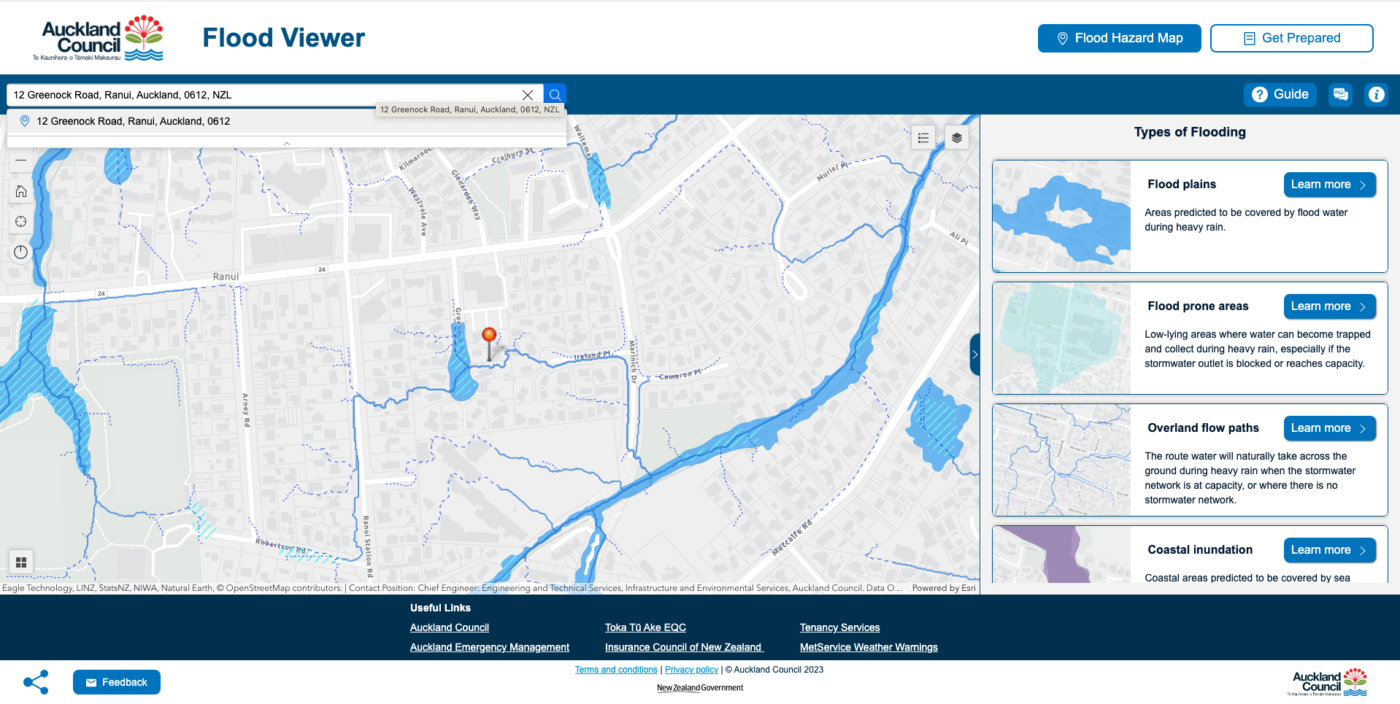

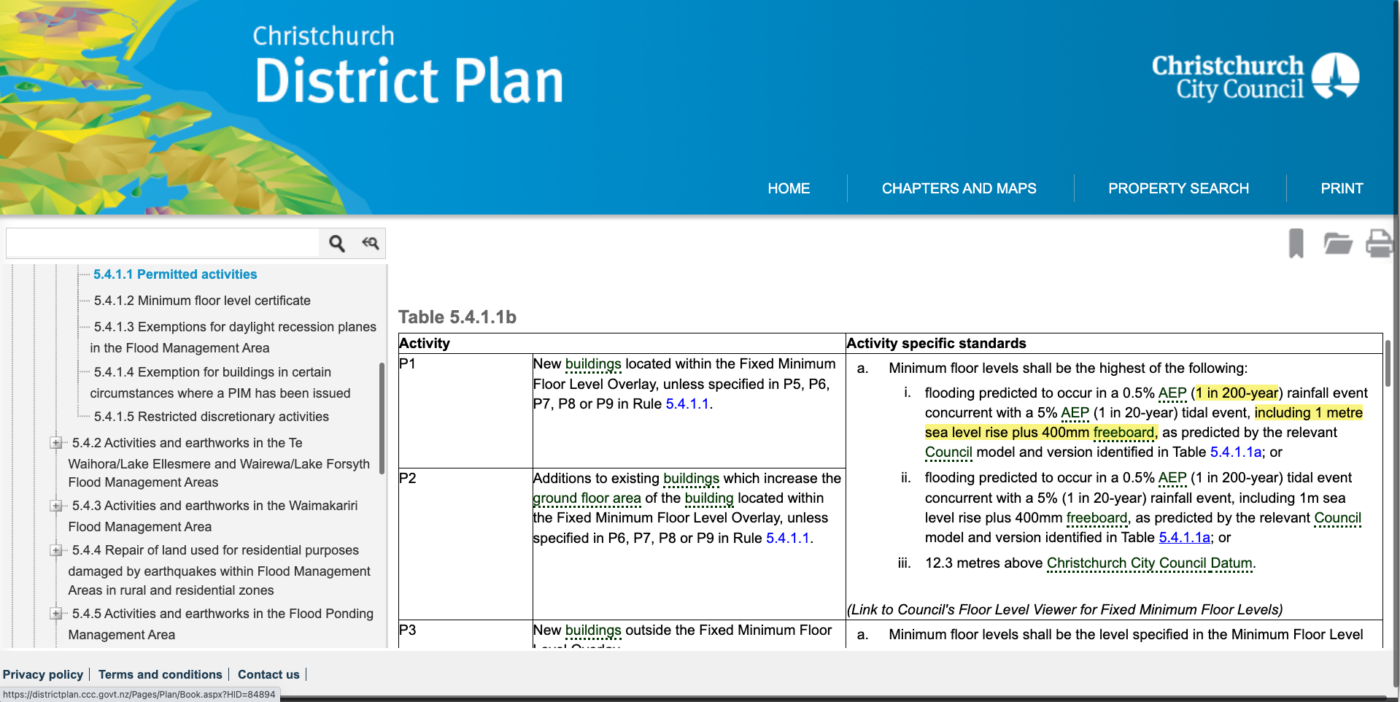

In this article, you’ll learn what tools are available to help you work out where the flood plains are. You’ll also learn what risk this poses to your property, and how to reduce flood risk when property hunting.

If you have any questions or thoughts, please leave them in the comments section below.