New Builds

New builds - The ultimate guide for every property investor

Explore the essentials of investing in new builds. Our guide covers key strategies, benefits, and tips to navigate the market and maximise your investment.

New Builds

12 min read

Author: Laine Moger

Journalist and Property Educator, holds a Bachelor of Communication (Honours) from Massey University.

Reviewed by: Ed McKnight

Resident Economist, with a GradDipEcon and over five years at Opes Partners, is a trusted contributor to NZ Property Investor, Informed Investor, Stuff, Business Desk, and OneRoof.

Sunset Clauses get a lot of heat in the media. You’ve probably read at least one article about a young couple losing out on their first home dreams – made possible by a sunset clause.

But what are sunset clauses? How are they used? And are they always the big bad wolves they’ve been made out to be? A sunset clause allows either party to cancel a contract if construction isn't finished by a set date. While necessary for protection against delays, they can be misused by developers to cancel and raise prices.

In this article you’ll learn what a Sunset Clause is, why they can be necessary, and how you can negotiate them to protect yourself from a developer raising the price on you.

Do you have a question or comment about sunset clauses? Feel free to leave your thoughts in the comment section at the end of the page.

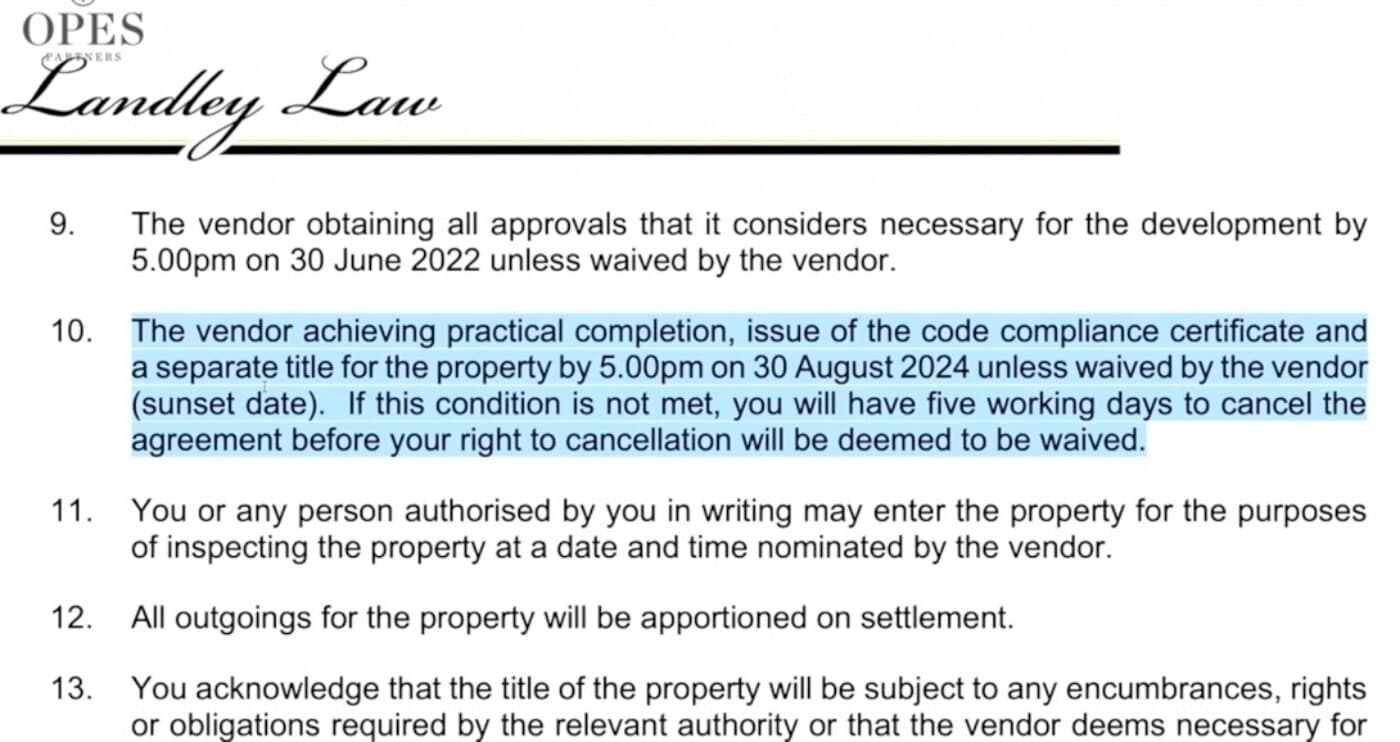

A Sunset Clause is part of a contract (sale and purchase agreement) for a New Build property. The clause allows that contract to be cancelled if the property isn’t completed by a certain date.

Put simply: if the property’s construction runs way over schedule, then the contract has a legal get-out-of-jail free card where the contract can be cancelled.

This date is usually the expected completion date + 12 months.

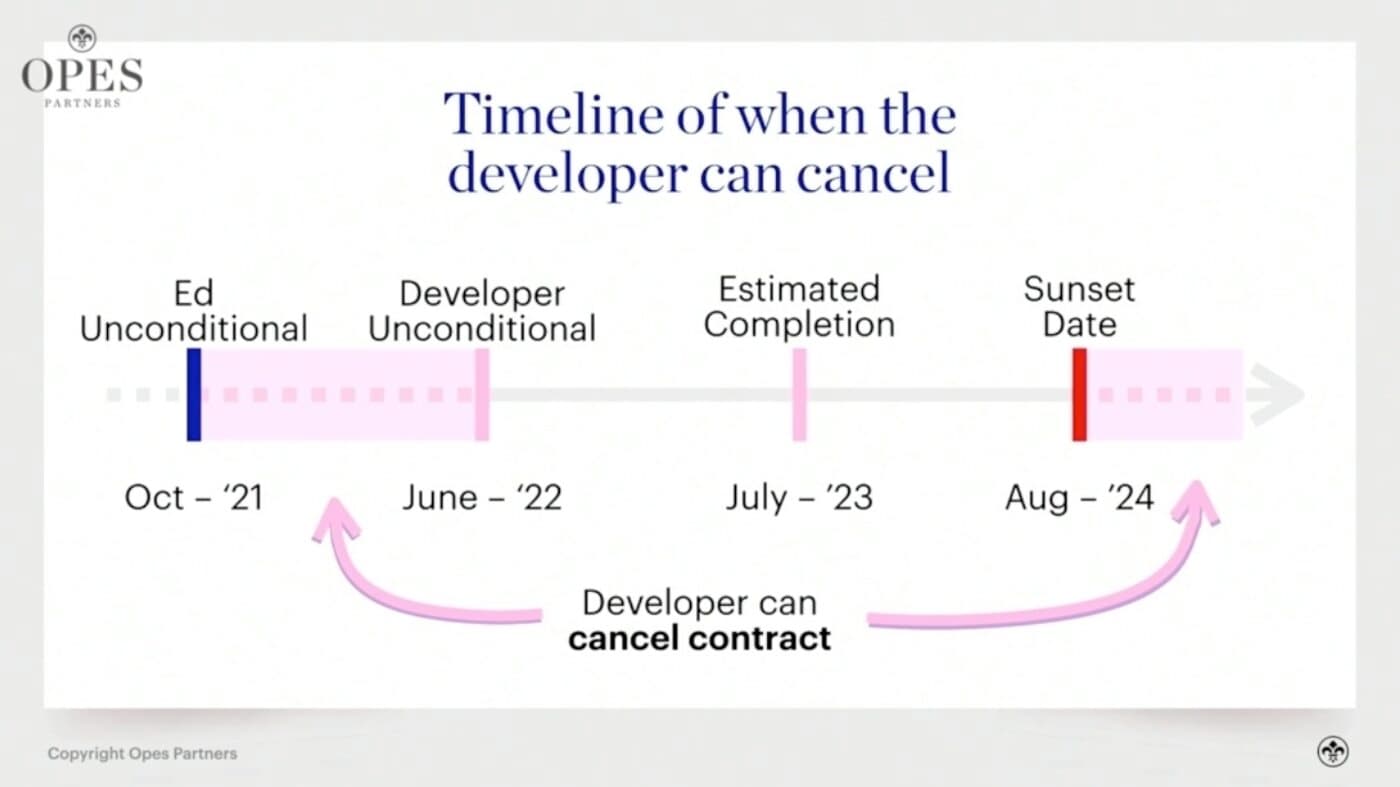

For instance, let’s take a look at a development on Coronation Road,Auckland, which some of our investors at Opes Partners bought into.

The estimated completion date is July 2023, and the Sunset Clause is set for August 2024.

This means if the construction is not finished by August 2024, the contract can be cancelled. In this case either the developer or the purchaser can cancel. So really, you want the property to be finished before mid-2024.

Sunset Clauses can appear in all types of contracts (not just property). But when it comes to property, they are primarily only found in contracts for New Builds.

But not all Sunset Clauses are worded the same.

For instance, you can have either a:

The ideal situation is that you negotiate a one-way Sunset Clause where only you (as the purchaser) can use it.

That means you can cancel the contract if the build goes over … but the developer can’t. In practice, this isn’t always possible.

On the other end of the scale, there is a one-way clause when only the vendor can exercise a Sunset Clause. Now, this would probably be considered the “worst” one, but it also isn’t that uncommon to see in New Build contracts.

Somewhere in the middle ground is a two-way clause which distributes the power evenly between both parties.

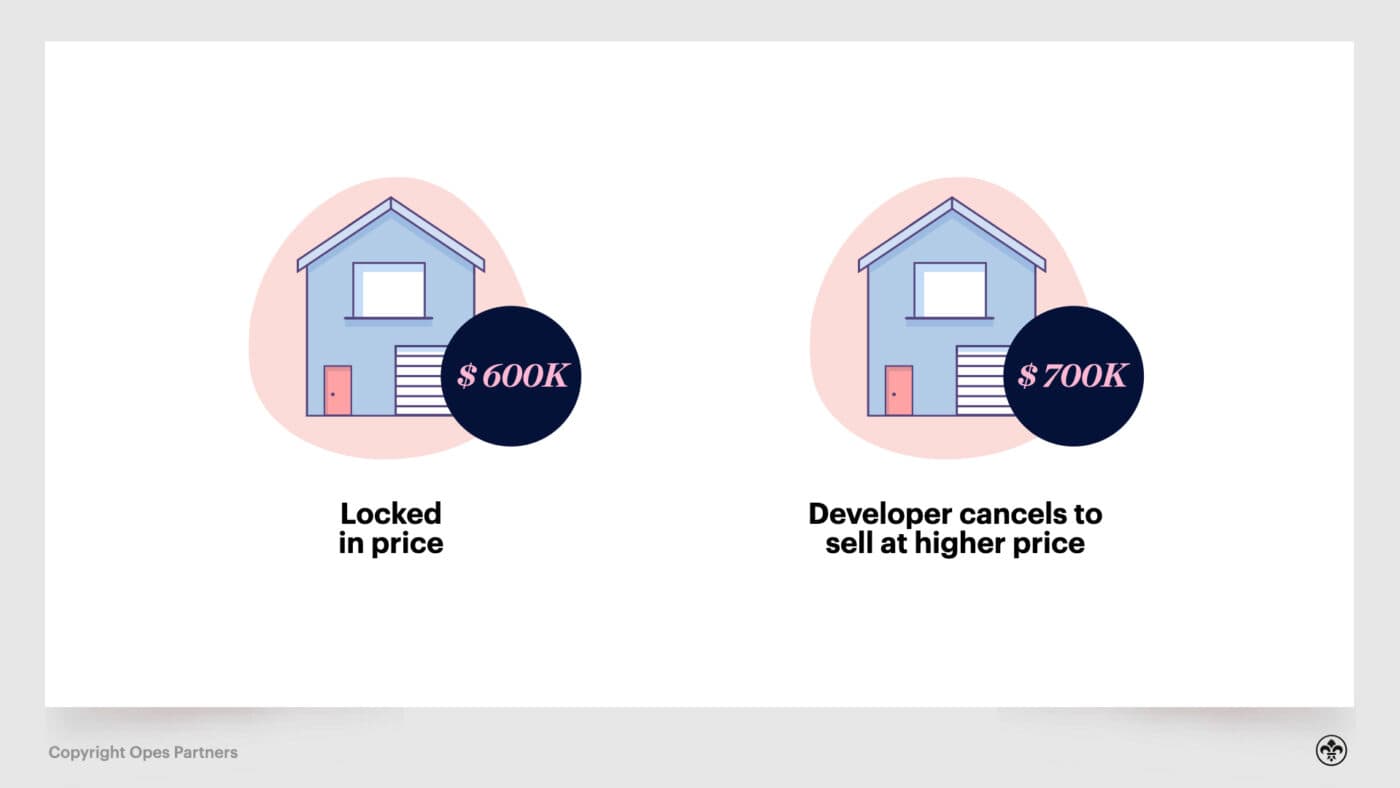

Picture this: you sign a contract with a developer to buy a property for a fixed price.

It’s going to take them 12 months to build the property, but 24 months later it’s still not built.

Then you get a call from the developer who says, “I’m cancelling this contract. The price is now an extra $150,000, if you still want it, otherwise I’ll sell it to someone else.”

Ouch.

It’s important to note, should this worst-case scenario play out, you will (at the very least) get your deposit back. But you lose out on money you would have otherwise gained.

For instance, one benefit to investing in New Builds is that the value of the property tends to rise during construction. That’s because: a) the market may increase in value, and b) a property that has been fully built is worth more than when it was just lines on a piece of paper.

That tends to benefit investors because you “lock in” the price at the time you sign, and then by the time you settle and pay for the property its value may have increased.

But you as an investor don’t get to reap that benefit until settlement – the day you pay and become the owner of that property.

This is the major risk associated with Sunset Clauses.

But, it should be noted this is only a significant risk where:

So, there is less risk someone who has signed a contract in the last 6 months will run into trouble with a Sunset Clause. The market hasn’t increased, and it’s less likely the developer will sell to someone else at a higher price.

In fact, we might be seeing the opposite in today’s market, whereby purchasers want to get out of the Sunset Clause because interest rates have risen. So the clause can be a benefit or a curse depending on what’s happening in the market.

Sunset Clauses became an issue during the Covid-19 pandemic. That happened for two reasons:

This meant if construction went past the Sunset Clause, the developer could cancel and re-sell at a significantly higher price.

This also gave some developers an incentive to deliberately slow down the build to get more money.

So, investors missed out on owning the property, and the capital gains they would have had if they had settled, not forgetting how big a blow it could be to first home buyers who didn’t have the extra money to keep their (now) more expensive property.

Hold on, is that legal?

Yes, developers are legally within their rights to do this. It’s within the contract.

But there may be a blurry line here of what’s legal and what’s moral.

Legal? Yes. Moral? You decide. The real question is how you protect yourself, and what you can actually do.

If you do see a Sunset Clause within your New Build contract, that does not instantly mean the developer is trying to pull a fast one on you.

There are genuine reasons a developer might need a Sunset Clause.

For instance, let’s say a developer starts construction and they then discover a Maori pa (or other remains) underneath the land.

It’s likely that construction will be heavily delayed. In this instance, the developers will sometimes want a catch-all clause (like the Sunset Clause) to get out of the contract.

However, a developer won’t use the Sunset Clause to get out of a contract willy-nilly.

Remember, a developer incurs significant cost bringing a property to market. They have to buy the land, pay real estate fees, architecture fees, surveyor fees and more.

If you’ve signed a contract to buy a property from them, they want to deliver the house. And there is a huge incentive for them to build and settle the property.

So they won’t cancel the contract lightly. But, they may ask for a Sunset Clause to manage the risk of something happening that significantly delays construction.

There are ways you can negotiate a Sunset Clause to protect yourself.

It’s really important to note that all negotiations need to go through your lawyer. They’ll then negotiate with the developer’s lawyers, rather than you doing so directly.

You don’t call up the developer's lawyer and start demanding changes to your Sunset Clause. It doesn’t work like that.

Here are 3 ways you can negotiate a Sunset Clause to your benefit:

The gold standard is to negotiate the Sunset Clause so only you can use it.

This means you can cancel the contract if construction runs over the Sunset Clause, but your developer can’t.

In this scenario you would word it, with your lawyer, to say something along the lines of: “This clause can only be exercised by the purchaser, and not the vendor”.

While this is the ideal situation, it’s not always possible.

Why? Well, the developer can say “no”.

This isn’t necessarily a red flag. Just because your developer doesn’t agree to it doesn’t automatically mean they have plans to cancel on you.

Rather, it’s because they want to have some protection too.

For example, what if they start digging to lay the foundation and discover a body. That halts the project for several months, or indefinitely. The developer can then use this clause to cancel and halt construction if a major unforeseen event happens.

So, while you can ask for this (and you should), be prepared that you might not automatically get a “yes”.

As an alternative, you could adapt the Sunset Clause to say something along the lines of: “This clause cannot be used to resell the property at a higher price”.

This means the developer can still cancel if they find a body (or some other worst-case scenario), but they can’t then sell the property to someone else for more money.

It’s a fair enough ask, right? You’re basically saying: “I don’t want to give my deposit to fund your lending, only for you to turn around and ask for a higher price”.

If your developer refuses to negotiate a Sunset Clause like the above, all is not lost. Finally, you can ask to extend the sunset date period.

For instance, if the project is expected to take 12 months, you could ask for the Sunset Clause to be 24 months out from the estimated completion date.

This means that something would have to go seriously wrong in construction for the developer to have the ability to use the Sunset Clause.

This happened with a listener of our daily show – The Property Academy Podcast.

The purchaser signed a contract for a townhouse development, which had 6 townhouses.

As part of the negotiation the purchaser added an extra 12 months to the Sunset Clause.

When the project took longer than expected, every single one of this purchaser’s neighbours had their contracts cancelled. The developer then said they had to accept a $159,000 price increase, or he would cancel the contract.

Some of those purchasers couldn’t get the extra money and so lost the property. Others had to cough up the extra cash. That happened to everyone except the person who listened to this episode of the Property Academy Podcast, who had pushed out the Sunset Clause.

He settled the property at the original price and made a substantial capital gain.

Why? Because his lawyer had negotiated a 12-month extension to the Sunset Clause.

Some people hear in the media that ‘sunset clauses are bad’ and then decide to remove the clause completely. That can be a mistake.

While a lot of people might argue to just chuck the clause out the window, there might be instances where you really want to have a “get-out-of-jail free” card.

Think about it. Do you want to be locked into buying a property that drags on for 1, 2, or 50 years?

Because if you don’t have a Sunset Clause it’s a never-ending contract.

And there might just come a time when you want the opportunity to say “enough is enough”, get your deposit back and invest somewhere else.

All in all, there can be positives to a Sunset Clause – for developers and purchasers.

Remember, the biggest risk is not the clause itself, but when the developer uses it to cancel and sell at a higher price.

This is why negotiating your Sunset Clause can mitigate a lot of that risk. Particularly when you can get your clause to be worded in a way that says: “This clause can’t be used for the sole purpose of reselling at a higher price.”

However, it’s important to know from the outset, you’ll never end up with a contract worded exactly how you want it to be.

The contract has to be fair for both you and the developer and that means you both share in the risks.

So, if you ask for a lot of changes that will benefit you, the developer will sometimes say “no”.

And that’s OK. Ultimately, you need to weigh the risks and the rewards.

As the saying goes: Don’t let the perfect be the enemy of the good.

If the property is a great deal, you might pursue it even if there is some risk in the contract.

But similarly, if you’re going to lie awake worrying about the wording on your Sunset Clause, then it may be a good idea to look elsewhere.

Write your questions or thoughts in the comments section below.

Journalist and Property Educator, holds a Bachelor of Communication (Honours) from Massey University.

Laine Moger, a seasoned Journalist and Property Educator holds a Bachelor of Communications (Honours) from Massey University and a Diploma of Journalism from the London School of Journalism. She has been an integral part of the Opes team for four years, crafting content for our website, newsletter, and external columns, as well as contributing to Informed Investor and NZ Property Investor.

This article is for your general information. It’s not financial advice. See here for details about our Financial Advice Provider Disclosure. So Opes isn’t telling you what to do with your own money.

We’ve made every effort to make sure the information is accurate. But we occasionally get the odd fact wrong. Make sure you do your own research or talk to a financial adviser before making any investment decisions.

You might like to use us or another financial adviser