New Builds

New builds - The ultimate guide for every property investor

Explore the essentials of investing in new builds. Our guide covers key strategies, benefits, and tips to navigate the market and maximise your investment.

New Builds

13 min read

Author: Laine Moger

Journalist and Property Educator, holds a Bachelor of Communication (Honours) from Massey University.

Reviewed by: Ed McKnight

Resident Economist, with a GradDipEcon and over five years at Opes Partners, is a trusted contributor to NZ Property Investor, Informed Investor, Stuff, Business Desk, and OneRoof.

There are a lot of positives to buying New Builds – but it’s not all plain sailing.

Things do go wrong.

That doesn’t mean New Builds are a bad investment. But you need to know what could go wrong so that you’re not blindsided when the (un)expected happens.

After working with 97 developers and recommending over 1,000 New Builds to investors, we here at Opes Partners have seen it all.

In this article, you'll learn the top 8 problems New Build investors face.

(Trigger-warning for those already anxious investors).

You’ll learn about the bad things that can happen as well as what you can do to protect yourself.

Do you have a question or comment about the risks of purchasing a New Build? Feel free to leave your thoughts in the comment section at the end of this article.

First up, developers can cancel your contract. Yes, even after you’ve gone unconditional and construction has started.

For you investors who think a “fixed price” contract is always a done deal, you need to know about this one.

If you’re investing in a turn-key property, a developer may have the right to cancel your contract. That's where they can sometimes increase the price of your build.

They could do this using a sunset or finance clause.

They might do this and then ask you to sign another contract for the same property at a higher price. You don’t have to say “yes”, but it can mean losing out on a deal.

If you’re doing a progressive payments build, it's even easier for the developer to increase the price. This can happen if the cost of building materials goes up.

Here are the two options available to you to stop the developer from increasing the price.

Working with a property lawyer is the most important way to minimise your risk. More specifically, someone who specialises in build contracts.

Why? Because they know how the fine print works and what to look for. They can also help you negotiate parts of your contract before you go unconditional.

For instance, let’s say you are negotiating a turnkey contract, you might:

• Ask for the sunset clause to be only available for you (the buyer) to use, and not the developer

• Ask for a clause where the developer can’t use the sunset date to increase the price.

Be aware, these might not be accepted by the developer. But at least with a property lawyer, you are completely aware of the risks you are taking on.

Developers can increase the price of most new builds. But it's easier for them to do this for some types of properties over others.

Under a progressive payments build you buy (or already own a piece of land. You then hire the developer to build you a house.

Because you are hiring them to provide a service, it’s easier for the price to go up.

But if you go for a turnkey contract, then you are committing to buy a finished product from a developer at a set price.

The price can be lifted in some circumstances, but it’s a lot harder for the developer to do.

Secure a comfortable retirement with 3 easy steps

Book your free sessionDevelopers aren’t regulated the way banks or financial advisors are.

Yes, they have legal obligations to the Building Act and the RMA regulations. But there are no special rules for selling off-the-plan properties.

This means a developer with no finance and zero experience could start selling properties for a 200-unit project.

So, there is a risk that you sign up to buy a property off a developer who then goes broke.

In that case, you may have paid a deposit, but then your property never gets built.

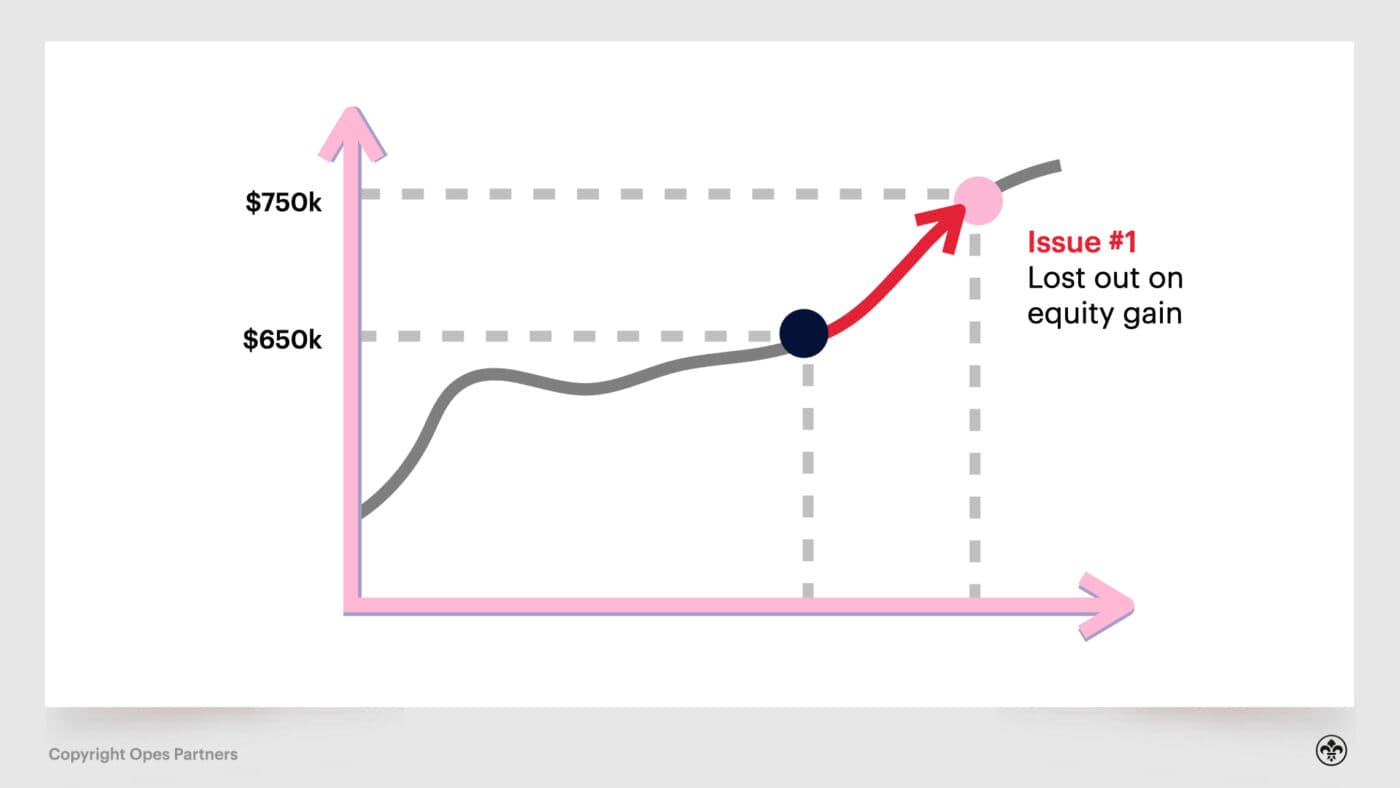

Sure, you’ll get your deposit back (if it’s held in a lawyer’s trust account). But if house prices have gone up by the time the developer goes belly-up, you’ve then lost out.

The key message is that you need to know the developer has the money to complete the development.

As part of your due diligence, you’ll investigate the developer. You’ll use this time to make sure they’re reliable and can finance the project they are pitching.

If your developer has good funding from a reputable lender like a bank, it’s a positive sign.

Be scrupulous about your research. Being “not bankrupt” is not a sufficient “green light”. You need to know if this developer could cope if there was a 20% increase in the overall cost of the build.

You should look for someone who has:

If you want a recommendation, here is our list of the top 5 developers you’ve never heard of.

But, this is also why many investors opt to use a property investment company like Opes Partners.

One of the big concerns for investors is build delays. They ask themselves “What happens if construction takes longer than expected?”

While this is a common concern, it’s probably one of the smaller worries an investor should have. After all, what’s the issue?

As long as the developer isn’t delaying construction to trigger a sunset clause, there’s no real issue.

Your price stays the same (for turnkey properties). When the property finishes you generally pay the same price.

We often joke that ideally, a build would take 15 years.

This is because you get all the benefits of the property increasing in value ... without having tenants or having to take on a full mortgage.

There’s not a lot you can do, save picking up a hammer and getting stuck in on a construction site (we’re kidding … don’t do that).

But you can opt to buy a property that is already finished or part-way through construction.

Some New Builds take 18+ months to complete.

But for others you may be able to buy it when the property is <3 months from completion.

This will decrease the risk of build delays.

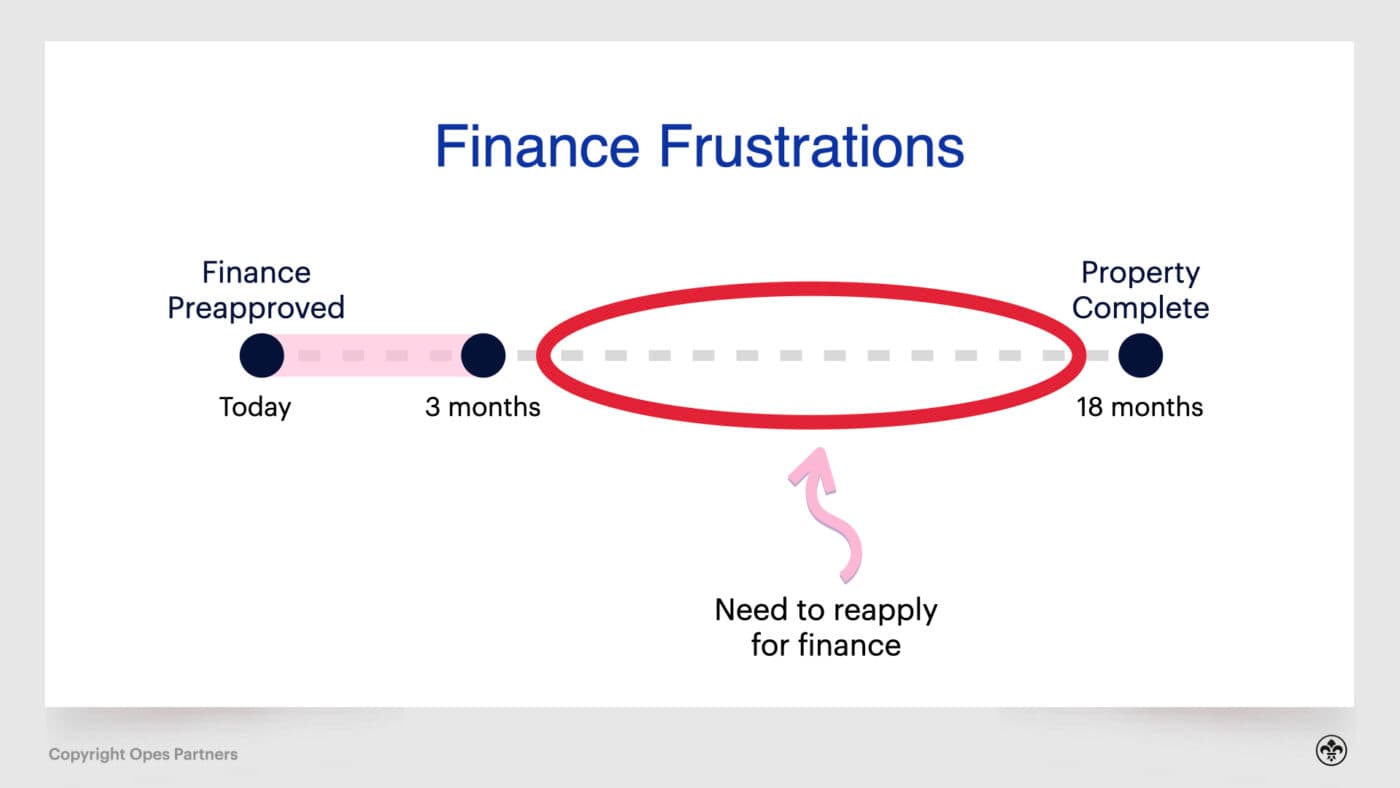

Sometimes investors will buy a property off-the-plans and get a pre-approval.

But that bank approval may only last 6 months. What happens if your New Builds takes 12 months to be built?

After the first 6 months you have to reapply to the bank to get the money.

So there is a risk (in some situations) that once it comes time to pay the money, the bank won’t lend to you.

That usually happens when interest rates go up, and banks change their lending rules.

The first step is to work with a good mortgage broker.

First, they will give you an indication of whether you can manage this risk. In other words, they’ll tell you whether you are likely to get re-approved in the future.

But you can also help yourself by keeping your financial situation the same during the build.

The bank would say yes to many investors, but New Builds buys shoot themselves in the foot when they:

- Take out extra credit cards during the build

- have a(nother) child during the build (without talking to the mortgage broker

- buy a holiday home;

- buy a car on finance.

At this point, the bank may not think you can afford the property and the extra commitments you’ve taken on.

A good mortgage broker should check in with you regularly.

They’ll be making sure nothing has changed and you are still on track to get the lending when the time comes.

The alternative is to buy a property where the construction timeline is shorter.

If there are only 6 months left in the build you might feel better going ahead with the investment.

Once you pay for the property, and pay for the mortgage, you want to find a tenant. Fast.

After all, most investors can’t afford to pay two mortgages.

But as you roll towards settlement, you may find your property competing with others. Especially, if there were a lot of properties in the same development.

Let's say, you buy a property in a development of 9. There are potentially 8 other properties trying to find a tenant at the same time. That’s usually not a problem.

But if you buy in a development of 100 … it can be a real headache. All of a sudden there are potentially 99 other investors looking for a tenant at the same time.

The good news is rentals are often in high demand. So, this doesn’t always happen.

Larger developments are also usually built in stages.

So while there may be 100 properties in the development, perhaps only 30 look for a tenant at the same time. This limits the number of fellow investors you’re competing against.

Another key consideration is buying in a development where owner-occupiers can buy.

Let’s say you buy a property in a development that has 30 properties finishing at the same time. If half are owned by owner-occupiers, then you’re only competing with 14 other investors. That’s more manageable.

There are also two other things you can do.

First, you can choose a unit that has something unique about it.

For instance, you might purchase one that has two car parks. This will be more desirable than those in the development that only have one.

If buying a townhouse you could buy a property on the end of a block. That way the tenant only has a neighbour on one side rather than on both.

These small things give the tenant a reason to rent your property vs others in the project.

Another option is to add extra features like a washing machine, fridge and dryer.

Ideally, you would pay for a property on a Friday and the tenants move in on Saturday.

That sometimes happens if you start advertising the property 2-3 weeks before settlement.

But it doesn’t always happen. It depends on whether the developer is willing to give the property manager early access.

That's why many property investors will budget for up to 4 weeks of vacancy when they first settle on a property. That's true both for new builds and existing properties.

With a New Build, you generally can’t walk through the property before buying it. That comes with a risk.

You run the risk that the developer doesn’t build what they say they will.

What if the materials and appliances end up being a different brand? What if the bathroom mirror hasn’t been installed quite right? What if the paintwork is shoddy and the hot water cylinder doesn't work?

Working with a good developer will protect you from this risk to an extent. … but sometimes things still go wrong.

The best thing you can do is hire a building inspector. They will thoroughly check the property before you pay the money for the property.

They’ll do so much more than just rock up to your property, check it's built, and calling it a day.

They will be able to check the entire property and catch anything that is not quite right.

This costs money – generally about $700 – $1,000.

But you’re paying $550,000 – $1.1 million for an investment property. It’s worth checking to make sure it is right.

Once they’ve gone through the property they will put notes and painter's tape all over the place.

This is to tell the developer what they need to fix.

They will also send a full builders report to the developer. This will show what needs to be fixed before settlement.

Finally, there is one of the biggest concerns of all.

What happens if you sign up to buy a property for $800k, but the value of the property drops while it is being built? This has happened to many investors over the last 18 months.

But it has also happened before. In fact, in 2008 this happened to Opes Partners Managing Director Andrew Nicol.

He signed up to buy a property in Rangiora, Canterbury in 2007. He agreed to pay $390,000. But by the time the property was built, it was only worth $370,000. He bought at the peak of the market.

What’s the issue with this? It’s not that the property was a bad investment. After all, today the property is worth $780,000.

The issue is that he had to come up with more money as a deposit.

Usually, the bank would lend him 80% of the value of the property. When the property was worth $390k, they'd lend him $312,000 and he'd put in $78,000 as a deposit.

But once the property had gone down in value, they’d only lend him 80% of $370,000. That’s $296,000.

Because Andrew still had to pay the developer the full $390k, he now had to put in a deposit of $94k, rather than $78k.

That’s an extra $16k he had to find.

Now, in the end, it worked out for him, and the property has made him over 24x that amount over the last 14 years. So for him, the risk worked out.

If the market drops the only thing you can do is hold your nerve. Generally, it’s best not to panic-sell because you will “crystallise your losses”.

A better strategy is to continue holding the property so that its price can recover.

The real question is how you come up with the extra money. The answer will be different for different people. But could include:

1. Using your own house as the deposit

2. Taking out a personal loan

3. Using any savings you have.

4. Using one of these ways to get out of a new build contract

Phew, we hear you – that’s really a lot of things that can go wrong.

And you may be thinking: “If Opes recommends New Build investment properties … why are they telling me all these issues and risks?”

It’s because when you buy a New Build you are going to spend a lot of money. It’s also likely that you’ll take on a lot of debt.

But it’s important to us that you not only understand the different risks – but what to do about them.

That means that you’ll have the confidence to make an informed decision.

Because then when things do go wrong, you’ll have the game plan for how to fix them.

This article is about helping you become a more informed investor.

Journalist and Property Educator, holds a Bachelor of Communication (Honours) from Massey University.

Laine Moger, a seasoned Journalist and Property Educator holds a Bachelor of Communications (Honours) from Massey University and a Diploma of Journalism from the London School of Journalism. She has been an integral part of the Opes team for four years, crafting content for our website, newsletter, and external columns, as well as contributing to Informed Investor and NZ Property Investor.

This article is for your general information. It’s not financial advice. See here for details about our Financial Advice Provider Disclosure. So Opes isn’t telling you what to do with your own money.

We’ve made every effort to make sure the information is accurate. But we occasionally get the odd fact wrong. Make sure you do your own research or talk to a financial adviser before making any investment decisions.

You might like to use us or another financial adviser