Property Market

How is the Wellington property market going?

Dive into Wellington's property market trends with key insights on house prices, growth areas, and investment opportunities for 2026.

Property Market

18 min read

Author: Ed McKnight

Resident Economist, with a GradDipEcon and over five years at Opes Partners, is a trusted contributor to NZ Property Investor, Informed Investor, Stuff, Business Desk, and OneRoof.

Reviewed by: Laine Moger

Journalist and Property Educator, holds a Bachelor of Communication (Honours) from Massey University.

Out of all the suburbs in Auckland you could invest in, South Auckland is one of our top picks.

One of the key drivers is there are a lot of households in the area that rent. So, there is a clear opportunity for private landlords. Properties also tend to be more affordable, which means they tick both boxes.

But the title South Auckland can be loaded.

The suburbs in this area such as Mangere, Manukau, Manurewa, Otara – often carry long-standing negative connotations with crime, social housing and gang violence.

So you might be thinking: “Is South Auckland a good investment?”

In this article, you’ll learn all about South Auckland – where it is and what sort of investments are available – and whether it’s the right place for your next investment portfolio.

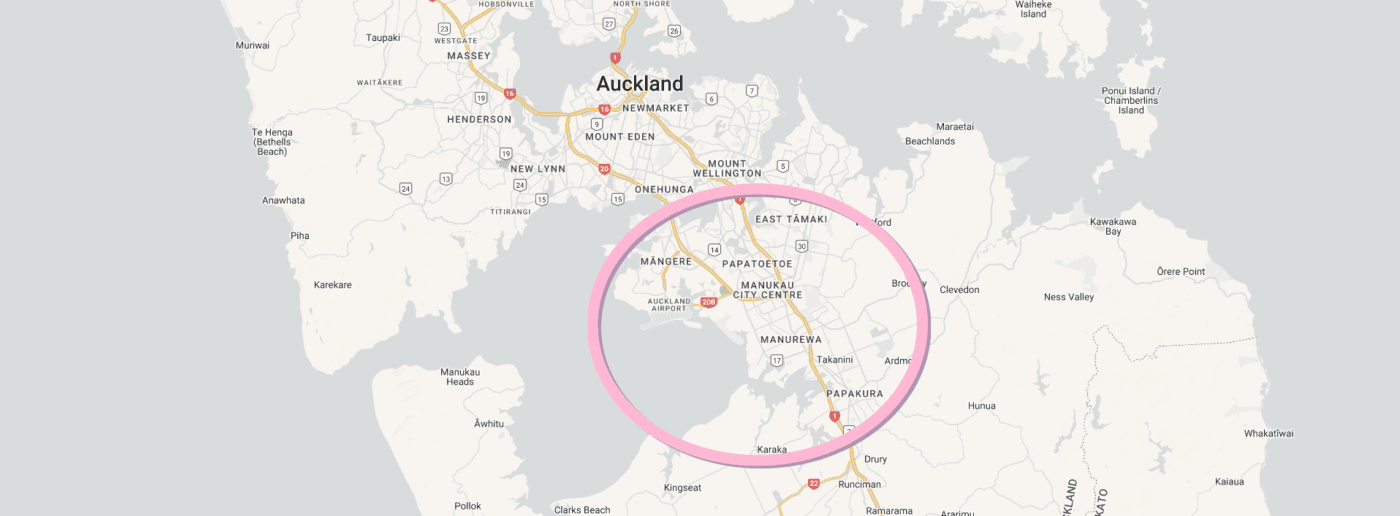

The area of “South Auckland” is not officially defined. It’s not like it has its own council area (any more). It’s just something people have come to label and generally agree on.

For the purposes of this article, when we say South Auckland we mean anything south of Mt Wellington, and all the way down to Papakura. Broadly speaking, South Auckland stretches from the bottom of the Auckland isthmus at Ōtāhuhu down.

The names you’ve most likely heard of are: Otara, Mangere, Manurewa and Manukau.

Further south becomes Franklin District, which is home to towns like Karaka and Waiuku, which is where the Auckland border stops.

Again, for this article we aren’t talking about Franklin District, which tends to be wealthier and more expensive.

South Auckland is home to Auckland Airport, MIT (Manukau Institute of Technology), Rainbow’s End and Manukau City.

Yes, the South Auckland suburbs are (generally speaking) in the lower socio-economic bracket.

However, areas such as Mangere Bridge are seeing significant development (for housing and infrastructure), which is bolstering rents and property value. So the area is becoming more gentrified.

Similarly, Auckland Council picks Manukau as the largest and most established suburb outside the main city centre.

The South Auckland area is expecting a population boom in the next 30 years, and a lot of money has been pumped into its public transport network to ensure accessibility to the city, the inland port at Wiri, and Auckland International Airport.

All these things contribute to its strong employment and a thriving local economy.

Secure a comfortable retirement with 3 easy steps

Book your free sessionFrom our analysis, South Auckland stacks up as an area worth considering. Although – like every area – it won’t be the right fit for everyone (more on this below).

It may come as a surprise to some, but South Auckland is 1 of our 2 investing “hot spots” in the country’s largest city.

Here are three key reasons:

South Auckland’s population is outstripping the New Zealand average. And the population is expected to increase further over the next 25 years.

The current population is 366,000 people. By 2048, this is expected to grow to 437,100.

That means the area will have 20% more households, who require 20% more houses, and for investors that means an extra 20% more potential tenants.

This additional population will create extra housing demand, which will support higher rents and can help nudge house prices higher.

As you can see from the map below, house prices in South Auckland’s suburbs have grown quickly compared to the rest of the city.

For example, Mangere Bridge, Mangere and Mangere East were all in the top 20% fastest growing suburbs. Whereas more expensive suburbs like Takapuna and Milford (on the North Shore), were in the bottom 30% of suburbs when it comes to house price appreciation.

Property prices in South Auckland are in the more affordable bracket, compared to other parts of the city.

Based on the data, property prices in South Auckland (the old Manukau City council area) are currently undervalued by 2%.

This suggests that house prices are likely to increase at a similar rate compared to the rest of the country over the medium term (about 3-7 years).

On top of that, property prices in South Auckland are more affordable than the rest of the city.

Rental yields are significantly higher in South Auckland compared to the rest of the city.

The dark red in the map below shows the suburbs where rents are highest. Almost all of the highest yielding suburbs are in South Auckland.

Bear in mind that the actual gross yields shown in the map are likely to be understated. This is because the map compares the median rent with the median priced house in the suburb.

However, rental properties tend to be cheaper than the average house. Even though the data is imperfect, the important part is the trend, rather than the exact gross yield displayed for each individual suburb.

And the trend is that South Auckland has higher rental yields on average.

The type of properties that suit long-term passive property investors are 2, 3 and 4 bedroom townhouses.

This is because passive property investors tend to focus on New Builds. And New Build standalone houses in South Auckland are scarce – they’re not often built because they are expensive.

Townhouses present a relatively more affordable option.

Having said that, more active investors – who want to renovate properties – will focus on standalone houses and do them up.

Ilse Wolfe (property coach at Opes Accelerate) says her Cashflow Hacked properties in South Auckland are her highest performers. So, there is potential for active investors in South Auckland too, not just those in the New Build space.

Prices in South Auckland start at around $700,000 to $750,000 for an entry level, 2-bed townhouse.

But generally speaking, 3 bedroom properties will sit in the $800K region.

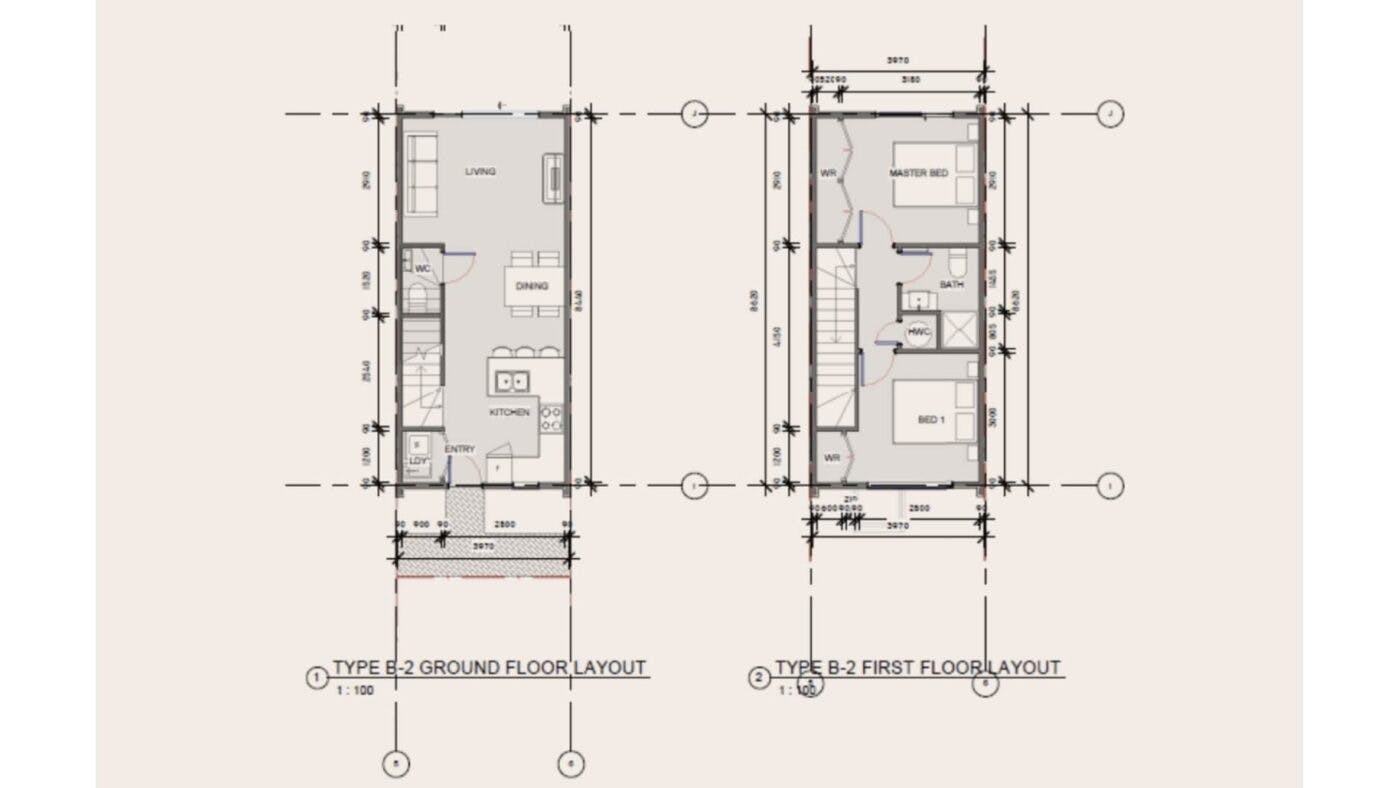

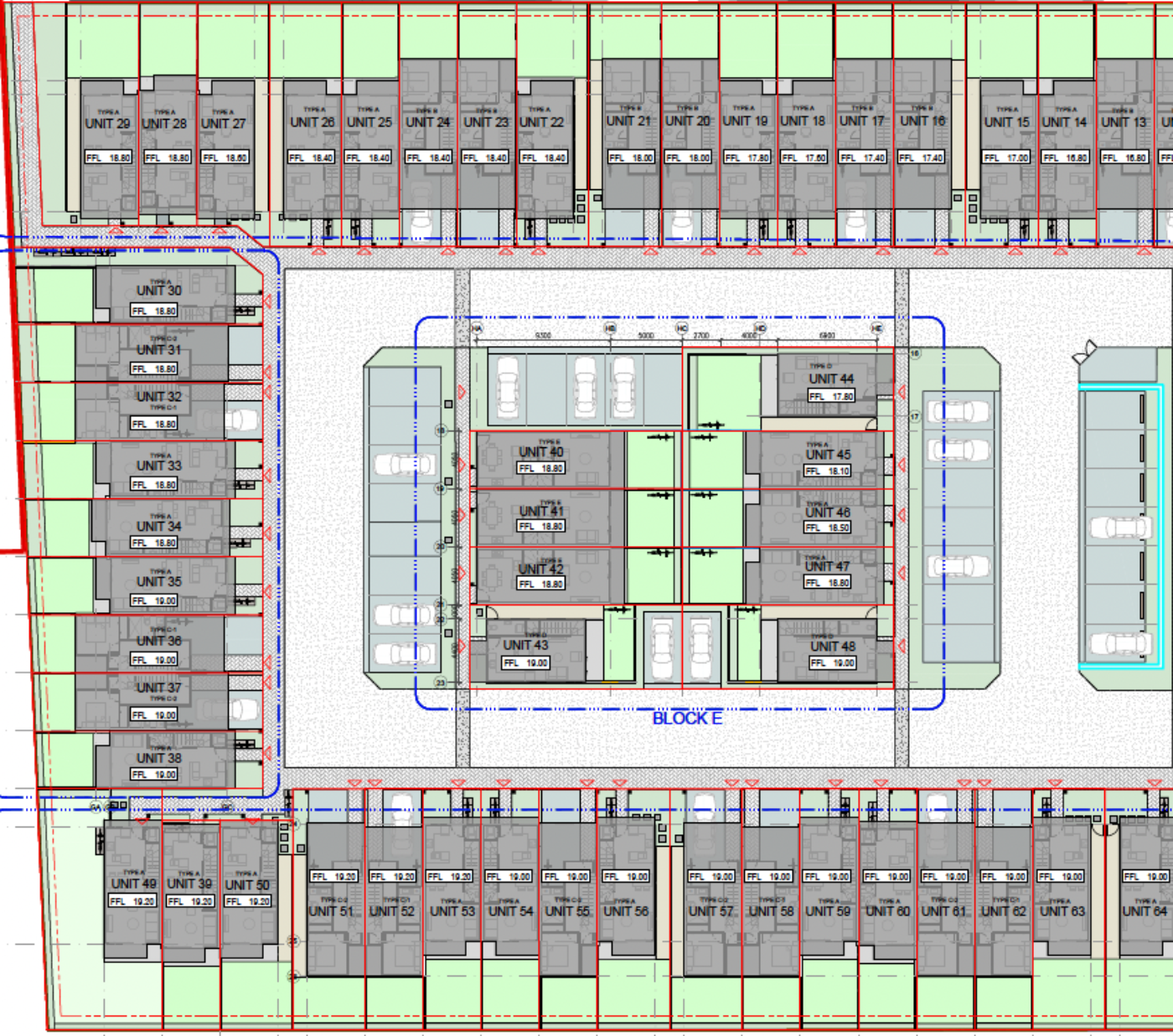

Here are 3 real examples of properties that Opes is currently recommending in South Auckland (at the time of writing).

These 2-bedroom townhouses start at $699,000. Properties are expected to rent for $615-$655.

The entry level townhouses have a gross yield of 4.6%, and come with 1.5 bathrooms and a car park.

This development of 66 is a mix of 3 and 4 bedroom townhouses. Prices begin at $899,000 and finish at $929,000.

Properties are expected to rent for between $780-$800 per week.

Mana Moana is a 80-strong development situated at 36 Lyncroft Street, Māngere.

Properties are a mix of 2, 3 and 4-bedroom terraced townhouses. All come with car parking.

The developer for this project is CETA Homes.

2-bed properties began at $755k, and are expected to rent for between $610-$630 per week.

Rents have been steadily increasing in South Auckland for the past 12 months.

However, due to the large amount of stock coming to market and seasonal changes, these prices have temporarily stabilised at the time of writing.

A colleague at Opes Property Management (Opes’ sister company), says she will review rents in the new year when the market changes.

Anecdotally, they say once tenants settle into their property they are usually very humble people and extremely easy to “tenant”.

While there a stigma of how South Auckland tenants behave, she says this is an outdated stereotype.

“Social issues aren’t being seen in suburbs like Papakura and Manukau because they usually attract young professionals, or small families, from the area,” she says.

Looking to the long term, they says better quality houses coming to market will have a positive effect on the overall rental future of these suburbs, similar to what happened in Christchurch after the earthquakes.

Established houses are replaced with newer (slightly smaller) houses, that are warmer and cheaper to maintain. It raises the overall standard and this becomes the new norm: a more preferred style of cheaper, warmer living.

There can be some hiccups with getting adequate references for potential tenants, generally because of a lack of rental history. However, there is strong demand in the city.

South Auckland has a lot of potential for property investors.

When forecasting the returns of an investment property, here at Opes we assume that a property in Auckland will increase by 6% per year. That compares to a 5% annual capital growth rate for the rest of the country.

That means Auckland properties often provide a higher return on investment when run through our calculators.

That makes investing in South Auckland a good fit for investors who need to grow their wealth in order to sort their retirement.

However, house prices in this area are slightly more expensive than say Christchurch (generally another $100K or so).

Because of that South Auckland will be a good fit for those investors who have the equity and purchasing power to break into the Auckland market.

On the other hand, if you already own lots of properties in Auckland you might like to look elsewhere for your next investment.

By this we mean if you have your own home and/or a few investment properties in the city already, it might be an idea to diversify your portfolio and include other areas of the country.

This is because you’re quite exposed to Auckland already with your salary, your house, your investments, so put some of your eggs in other baskets.

Also, because South Auckland is more expensive than other areas, it might not be the right fit for an emerging investor. Perhaps it would be a better idea to set your sights on a more affordable investment elsewhere, and circle back to South Auckland when your equity improves.

We’ll also say, if you really can’t sleep at night because you’re worried about some of the stereotypes about South Auckland, don’t do it. It won’t be worth the risk to your stress levels.

But at the same time, don’t let your nerves get in the way of a good deal.

Kāinga Ora is the new Housing NZ and it is pumping a tonne of investment into social housing builds nationwide, and accounts for about 10% of the rental market.

And some investors worry about buying a property next to (or near) a Kainga Ora house. The reason is they worry there may be anti-social behaviour from Kainga Ora tenants, which might make it harder to rent the property.

It’s easy to link low socio-economic areas to Kainga Ora builds.

But the truth is it’s more than likely you already live on the same street as a Kainga Ora property and you don’t know it.

For instance, there are 67,000 rentals owned by Kāinga Ora, just under 10% of the 690,000 rentals on the open market. And since about 40% of houses in Auckland are rentals, about 1 in 25 houses will be owned (or rented) by Kainga Ora.

So if your street has more than 25 letterboxes on it, there’s a good chance one of those is a Kainga Ora house.

The truth is some Kainga Ora tenants do have social problems and show anti-social behaviour. But that is true of all tenants and some owner-occupiers too.

However, it’s not fair to to paint all Kainga Ora tenants with the same brush. Yes, some former (and current) gang members may be Kainga Ora tenants. But Kainga Ora also serves people who might be disabled, or in a wheelchair, or unfortunately down on their luck. Not all of these people will throw raucous 24/7 parties.

In our view and experience, buying near or next to a Kainga Ora house does not matter. What matters is the deal in front of you. If it’s a good deal it doesn’t matter whether Kainga Ora owns a house down the street.

The bottom line, don’t let your preconceived perceptions or notions get in the way of a good investment.

Our data shows there has been a slow, continuous spread of development from Auckland’s City Centre, moving through and into South Auckland.

This is improving the area and making it more attractive.

For instance, Onehunga has historically not been the greatest area. But today, the suburb is seeing a lot of people doing up villas, constructing New Build terraced housing, and as a result the area is improving.

And this is what we are seeing happening in Mangere, coming down what we call the “corridor of availability” or the isthmus down from Onehunga, through Otahuhu and beyond.

As a long-term property investors, the question you should ask yourself is: “What is the area going to be like in 20 years’ time when I sell my property?” rather than asking “What is the area like today?”

This section is for the data nerds. Here are the key points you need to know to better understand the South Auckland property market and its economy.

Based on the data, property prices in South Auckland (the old Manukau City council area) are currently undervalued by 2%.

This is a big change from 6 years ago, where prices in the area were overvalued by 13.7% in June 2016.

Since then property prices across New Zealand have caught up substantially, and we no longer consider South Auckland to be overvalued. Their property prices look like good value compared to the rest of the country.

House prices in South Auckland (Manukau City) have increased very quickly over the last 30 years.

Today house prices are 8.28x what they were at the start of 1992 (1992-2022). That means that – on average – house prices in the area grew 7.2% per year.

Over the same period, New Zealand house prices grew 7.02% per year. That means property prices in South Auckland grew slightly faster than the rest of the country over the last 30 years.

Population growth in South Auckland is outstripping the New Zealand average.

Today, South Auckland’s population is 1.57x what it was 25 years ago. New Zealand’s population is only 1.37x its 1996 size.

So for every 1,000 people in the area, South Auckland added 18 people per year. The rest of New Zealand added 13 extra people per year per 1,000 people.

And over the next 25 years the population is expected to increase further. The current population is 366,000 people; by 2048 this is expected to grow to 437,100.

That means an extra 71,100 people will call South Auckland home.

For every 5 people currently living in South Auckland, there will be 1 more (about a 20% increase).

That means the area will have 20% more households, who require 20% more houses, and for investors that means an extra 20% more potential tenants.

Auckland rents have increased at a slightly slower rate compared to the rest of the country.

New Zealand’s rents are 2.63x higher than they were in January 2000, whereas in Auckland, rents are 2.33x what they were.

So rents across the country grew by 4.5% per year (on average). Rents in Auckland grew 3.9% per year.

iHowever, it should be noted that Auckland’s housing stock has changed over the last 2 decades. There are more townhouses being built and fewer standalone houses.

So perhaps Auckland rents are more sluggish because residents are trading down to cheaper housing – which rent out more cheaply.

Rental yields are significantly higher in South Auckland compared with the rest of the city.

The dark red in the below map shows the suburbs where rents are highest. Almost all of the highest yielding suburbs are in South Auckland.

Bear in mind that the actual gross yields shown in the map are likely to be understated. This is because the map compares the median rent with the median priced house in the suburb.

However, rental properties tend to be cheaper than the average house. Even though the data is imperfect, the important part is the trend, rather than the exact gross yield displayed for each individual suburb.

And the trend is that South Auckland has higher rental yields on average.

South Auckland property prices are more affordable than the rest of the city.

The map below shows which areas are cheapest and which are more expensive. The darker blue suburbs are relatively affordable; dark red suburbs are comparatively expensive.

Almost all of the more affordable suburbs are based in South Auckland.

That means investors can purchase more cheaply in this part of the city compared to the rest of the country.

South Auckland’s economy has grown at a faster rate than the rest of the country over the last 21 years.

Today, the economy is 1.8x larger than it was in 2000, slightly ahead of the rest of the country sitting at 1.7x.

A lot of this has been fueled by the development of infrastructure over that time, for example at Auckland Airport.

Unemployment in Auckland has kept roughly on par with the nationwide average.

This means there are a similar number of people looking for employment in Auckland as there are across the country at large.

Resident Economist, with a GradDipEcon and over five years at Opes Partners, is a trusted contributor to NZ Property Investor, Informed Investor, Stuff, Business Desk, and OneRoof.

Ed, our Resident Economist, is equipped with a GradDipEcon, a GradCertStratMgmt, BMus, and over five years of experience as Opes Partners' economist. His expertise in economics has led him to contribute articles to reputable publications like NZ Property Investor, Informed Investor, OneRoof, Stuff, and Business Desk. You might have also seen him share his insights on television programs such as The Project and Breakfast.

This article is for your general information. It’s not financial advice. See here for details about our Financial Advice Provider Disclosure. So Opes isn’t telling you what to do with your own money.

We’ve made every effort to make sure the information is accurate. But we occasionally get the odd fact wrong. Make sure you do your own research or talk to a financial adviser before making any investment decisions.

You might like to use us or another financial adviser